Legal Owner Financing Contract Template

Misconceptions

Owner financing is a popular alternative to traditional mortgage loans, but there are several misconceptions surrounding the Owner Financing Contract form. Understanding these misconceptions can help buyers and sellers make informed decisions. Here’s a list of common misunderstandings:

- Owner financing is only for buyers with bad credit. Many people believe that owner financing is a last resort for those who cannot secure a traditional loan. In reality, it can be an attractive option for buyers with good credit as well, offering flexibility in terms and payments.

- All owner financing agreements are the same. Each owner financing contract can vary significantly based on the agreement between the buyer and seller. Terms such as interest rates, payment schedules, and the duration of the loan can differ widely.

- Owner financing eliminates the need for legal documentation. Some assume that because owner financing is a private arrangement, it does not require formal documentation. However, having a well-drafted contract is essential to protect both parties and ensure clarity.

- The seller has no rights once the property is sold. It is a common belief that once the seller agrees to owner financing, they relinquish all control over the property. In fact, sellers often retain certain rights, such as the ability to enforce terms if the buyer defaults.

- Owner financing is only for residential properties. Many think that this financing method applies solely to homes. However, it can also be used for commercial properties and land purchases.

- Buyers automatically gain equity in the property. While owner financing can lead to equity accumulation, it is not guaranteed. Buyers need to make timely payments and adhere to the terms of the contract to build equity.

- Interest rates in owner financing are always higher. Some believe that owner financing comes with steep interest rates. In reality, rates can be competitive, depending on the agreement between the buyer and seller.

- Owner financing is a quick and easy process. While it can be more straightforward than traditional financing, it still requires careful negotiation and documentation. Both parties must agree on terms and conditions, which can take time.

- Once signed, an owner financing contract cannot be modified. Many think that once the contract is in place, it is set in stone. However, both parties can agree to modify the terms if necessary, provided it is documented properly.

Understanding these misconceptions can help individuals navigate the owner financing process more effectively. It’s always advisable to seek guidance from a knowledgeable professional when entering into such agreements.

Documents used along the form

When entering into an owner financing agreement, several other forms and documents may be necessary to ensure clarity and protect the interests of all parties involved. Each of these documents plays a vital role in the transaction, helping to outline responsibilities, terms, and conditions.

- Promissory Note: This document outlines the borrower's promise to repay the loan. It includes details such as the loan amount, interest rate, payment schedule, and consequences of default.

- Deed of Trust: This document secures the loan by placing a lien on the property. It gives the lender the right to take possession of the property if the borrower fails to repay the loan.

- Purchase Agreement: This contract details the terms of the sale between the buyer and seller. It includes the sale price, closing date, and any contingencies that must be met before the sale is finalized.

- Disclosure Statement: This document provides essential information about the property, including its condition and any known issues. It ensures that the buyer is fully informed before completing the purchase.

- Title Search Report: This report verifies the property's ownership and checks for any liens or claims against it. It is crucial for ensuring that the seller has the right to sell the property.

- Closing Statement: This document summarizes all financial transactions related to the sale. It outlines the costs, fees, and credits involved in the closing process.

- Loan Application: This form gathers information about the buyer's financial situation. It helps the seller assess the buyer's ability to repay the loan.

- REAL ESTATE PURCHASE AGREEMENT: To safeguard your property transactions, consider our essential Real Estate Purchase Agreement guidelines for ensuring all terms are clearly defined.

- Amortization Schedule: This schedule shows the breakdown of each payment over the loan term. It details how much of each payment goes toward interest and how much goes toward the principal balance.

- Property Inspection Report: This report provides an evaluation of the property's condition. It identifies any repairs needed, which can influence the buyer's decision.

- Insurance Policy: This document proves that the property is insured. It protects both the buyer and seller from potential losses due to damage or liability.

Having these documents in place can help facilitate a smooth transaction and provide legal protection for both the buyer and seller. Understanding each document's purpose can lead to a more informed and confident decision-making process.

More Types of Owner Financing Contract Templates:

Real Estate Termination Agreement - May include clauses about the return of deposits or earnest money.

Before engaging in a real estate transaction, it is important to familiarize oneself with the necessary documentation, including the California Real Estate Purchase Agreement. This form ensures that both the buyer and seller understand their rights and obligations, helping to avoid misunderstandings. For those looking for comprehensive legal forms, refer to All California Forms to access a variety of essential templates and guidelines.

Key Details about Owner Financing Contract

What is an Owner Financing Contract?

An Owner Financing Contract is an agreement between a seller and a buyer where the seller provides financing to the buyer to purchase a property. Instead of the buyer obtaining a traditional mortgage from a bank or lender, the seller allows the buyer to make payments directly to them over time. This arrangement can benefit both parties by simplifying the process and potentially offering more flexible terms.

Who benefits from using an Owner Financing Contract?

Both buyers and sellers can benefit from this type of contract. Buyers may find it easier to qualify for financing, especially if they have less-than-perfect credit or insufficient funds for a large down payment. Sellers can attract more potential buyers and may sell their property faster. Additionally, sellers can earn interest on the financing, which can provide a steady income stream.

What are the key terms typically included in an Owner Financing Contract?

Key terms in an Owner Financing Contract usually include:

- Purchase Price: The total amount the buyer agrees to pay for the property.

- Down Payment: The initial amount paid by the buyer upfront.

- Interest Rate: The rate at which interest will be charged on the remaining balance.

- Payment Schedule: Details on how often payments will be made (monthly, quarterly, etc.) and the duration of the loan.

- Default Terms: Conditions that specify what happens if the buyer fails to make payments.

Are there any risks associated with Owner Financing?

Yes, there are risks for both parties. Buyers may face the risk of the seller not holding the title until the loan is paid off, which can complicate ownership. Sellers, on the other hand, risk the possibility of the buyer defaulting on payments. It is crucial for both parties to conduct thorough due diligence and consider consulting with a legal professional to understand the implications fully.

How can I ensure my Owner Financing Contract is legally sound?

To ensure that your Owner Financing Contract is legally sound, consider the following steps:

- Consult with a real estate attorney to review the contract.

- Ensure that all terms are clearly defined and agreed upon by both parties.

- Include contingencies to protect both the buyer and the seller.

- Make sure to comply with local and state laws regarding real estate transactions.

- Keep a copy of the signed contract for your records.

Similar forms

The Owner Financing Contract is a valuable tool for real estate transactions, particularly for buyers and sellers looking for flexible financing options. Several other documents serve similar purposes in real estate and financial agreements. Here are nine documents that share similarities with the Owner Financing Contract:

- Purchase Agreement: This document outlines the terms of the sale between the buyer and seller, including price, contingencies, and closing details.

- Real Estate Purchase Agreement: This legally binding document is crucial in real estate transactions in Texas, outlining essential terms and conditions between buyer and seller. For further details, visit https://documentonline.org/.

- Lease Option Agreement: This allows a tenant to lease a property with the option to buy it later, combining rental and purchase elements.

- Seller Financing Addendum: This is added to a standard purchase agreement to specify seller financing terms, including interest rates and payment schedules.

- Promissory Note: This is a written promise from the buyer to repay the loan amount, detailing the loan terms, interest, and repayment schedule.

- Deed of Trust: This document secures the loan by transferring the property title to a trustee until the loan is paid off, protecting the lender’s interest.

- Mortgage Agreement: Similar to a deed of trust, this document outlines the loan terms and secures the property as collateral for the loan.

- Real Estate Option Agreement: This gives the buyer the right, but not the obligation, to purchase a property at a predetermined price within a specified timeframe.

- Installment Sale Agreement: This allows the buyer to make payments over time, similar to owner financing, but typically involves a formal sales contract.

- Buy-Sell Agreement: Often used in partnerships, this document outlines the terms under which an owner can sell their interest in a property, including financing options.

Each of these documents plays a crucial role in facilitating real estate transactions, especially when traditional financing may not be available or suitable.

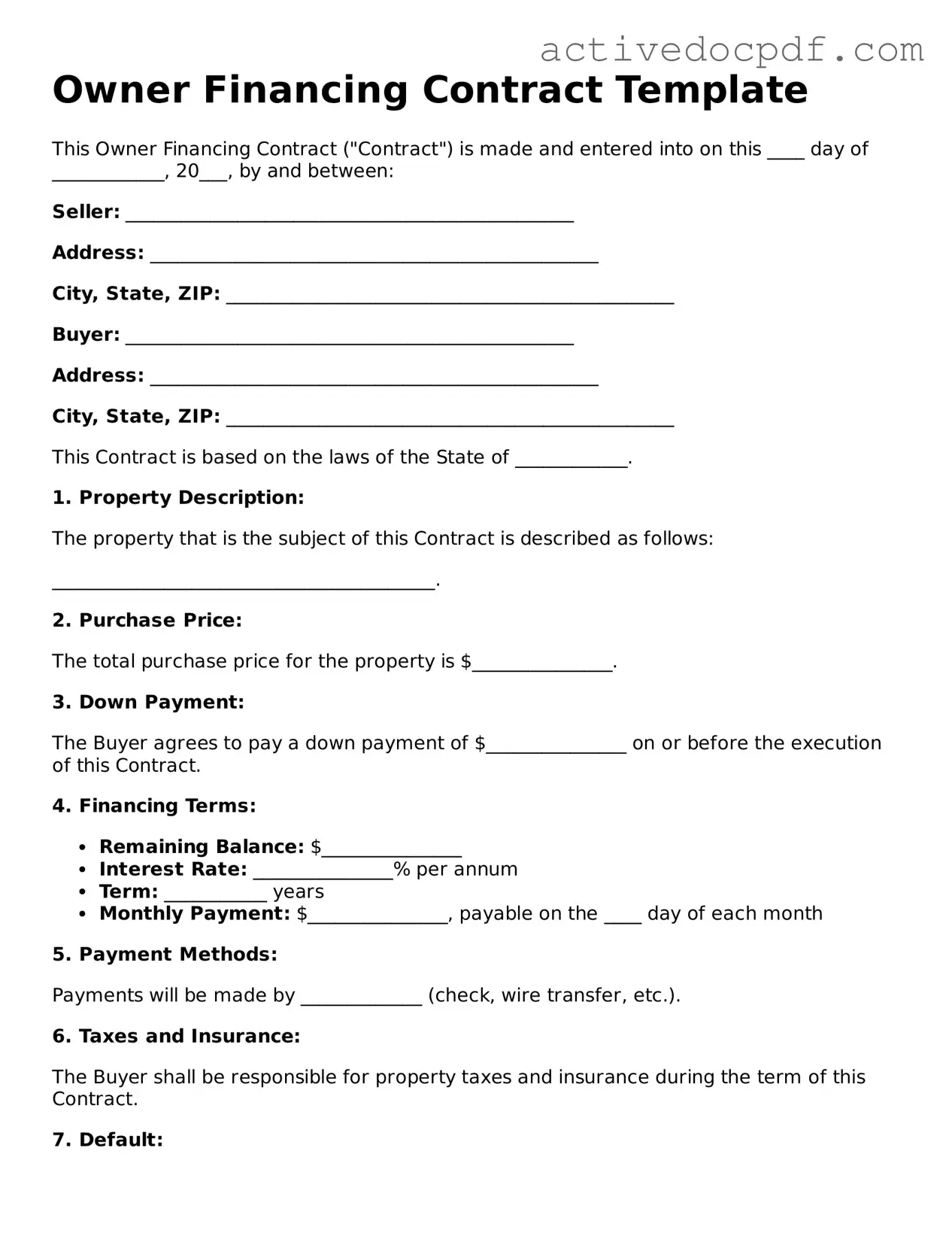

Guide to Filling Out Owner Financing Contract

Completing the Owner Financing Contract form is an important step in establishing the terms of a financing agreement between a buyer and a seller. This document outlines the responsibilities of both parties and ensures that everyone is on the same page regarding payment terms, interest rates, and other key details. Follow these steps carefully to fill out the form accurately.

- Read the Instructions: Before you begin filling out the form, take a moment to review any provided instructions. Understanding the requirements will help you avoid mistakes.

- Identify the Parties: Fill in the names and contact information of both the buyer and the seller. Make sure to include full legal names and addresses.

- Property Description: Clearly describe the property being financed. Include the address and any relevant details that define the property.

- Purchase Price: Enter the total purchase price of the property. This should reflect the agreed-upon amount between the buyer and seller.

- Down Payment: Specify the amount of the down payment. This is the initial payment made by the buyer before financing the remaining balance.

- Financing Terms: Outline the financing terms, including the interest rate, loan term, and payment schedule. Be clear about how often payments are due.

- Default Terms: Describe what happens if the buyer defaults on the loan. Include any penalties or actions the seller may take.

- Signatures: Both the buyer and seller must sign the contract. Ensure that each party dates their signature to confirm the agreement.

- Review the Completed Form: Go over the filled-out form to check for any errors or missing information. It’s important that everything is accurate before finalizing the document.