Free P 45 It PDF Form

Misconceptions

- Misconception 1: The P45 form is only for employees who quit their jobs.

- Misconception 2: The P45 form is not necessary for tax purposes.

- Misconception 3: Employees do not need to keep their P45 forms.

- Misconception 4: The P45 is only relevant to the employee and not the employer.

- Misconception 5: A new employer can ignore the P45 if they have other documentation.

- Misconception 6: The P45 form can be filled out incorrectly without consequences.

- Misconception 7: The P45 is a one-time document and does not need to be updated.

This is incorrect. The P45 form is issued whenever an employee leaves a job, regardless of the reason. This includes resignations, layoffs, and even situations where an employee has passed away.

In fact, the P45 is crucial for tax calculations. It provides the new employer with the employee's tax code and earnings to date, ensuring that the correct amount of tax is deducted in subsequent employment.

Employees should retain their P45 forms. This document contains important information that may be required for tax returns or when claiming benefits.

This is misleading. Employers must also complete and submit the P45 to HM Revenue & Customs (HMRC) to report the employee's departure accurately.

New employers should not disregard the P45. It provides essential information that helps determine the correct tax code and ensures compliance with tax regulations.

Incorrectly filling out the P45 can lead to tax issues for both the employee and the employer. It is essential to ensure all details are accurate to avoid complications.

The P45 must be updated whenever an employee changes jobs. Each time an employee leaves a job, a new P45 is generated to reflect their latest employment status and tax information.

Documents used along the form

The P45 form is a crucial document for employees leaving a job in the UK. It provides essential information about their employment, including pay and tax details. Along with the P45, several other forms and documents may be necessary for various situations. Here are four commonly used forms that often accompany the P45.

- P60: This form summarizes an employee's total pay and deductions for the tax year. Employers issue it at the end of each tax year, providing a clear record of earnings and taxes paid. Employees use this information for tax returns and to verify their income.

- P50: This document is used to claim a tax refund after an employee has stopped working. If an individual has overpaid tax, they can request a refund using this form. It is particularly useful for those who have not started a new job immediately after leaving.

- P85: If an employee is leaving the UK to work abroad, they should complete this form. It informs HMRC of their departure and helps in managing tax obligations while overseas. This form is essential for those planning to return to the UK or who need to claim tax relief.

- California Dog Bill of Sale: This form is essential for transferring ownership of a dog between parties, ensuring that both buyer and seller understand the terms of sale and the dog's information. For more details, you can visit documentonline.org.

- Jobseeker's Allowance (JSA) Claim Form: If an employee is unemployed after leaving their job, they may need to fill out this form to claim JSA. It collects information about their previous employment and financial situation, helping determine eligibility for benefits.

Understanding these forms can simplify the transition after leaving a job. Each document serves a specific purpose, ensuring that employees manage their tax and financial responsibilities effectively. Keeping these forms organized will aid in a smoother process during employment changes.

Check out Popular Documents

Rx Pad - Clear legibility on the Prescription Pad is vital for ensuring accurate dispensing of medications.

For those looking to enhance their invoicing experience, the Free And Invoice PDF form provides an excellent solution, enabling users to generate customized invoices with ease. To explore more resources that can assist you in document creation, visit PDF Documents Hub for valuable tools and information.

Bad Business Bureau - Share your experience if you encountered rude or unhelpful staff at a business.

Key Details about P 45 It

-

What is a P45 form and why is it important?

The P45 form is an official document issued when an employee leaves a job in the UK. It contains essential information about the employee's earnings and tax deductions up to the point of leaving. This form is crucial for both the employee and the new employer, as it helps ensure that the correct amount of tax is deducted in future employment. Without it, an employee might face higher tax deductions due to emergency tax codes.

-

What should I do with my P45 once I receive it?

Upon receiving your P45, it is vital to keep it safe and secure, as copies are not available. You will need to provide Parts 2 and 3 of the P45 to your new employer to ensure accurate tax deductions. If you are not starting a new job immediately, you may need Part 1A for your tax records or to claim any tax refunds. Additionally, if you are claiming Jobseeker's Allowance or Employment and Support Allowance, bring your P45 to the Jobcentre Plus office.

-

What happens if I lose my P45?

If you lose your P45, it is advisable to contact your previous employer to request a replacement. They can provide you with the necessary details to help you complete your tax return or assist with any tax-related inquiries. In the absence of a P45, you may face issues with your new employer regarding tax codes, potentially leading to overpayment of taxes. Therefore, it is essential to obtain a replacement as soon as possible.

-

Can I still claim tax refunds without a P45?

Yes, you can still claim tax refunds even if you do not have a P45. In such cases, you may need to fill out a different form, such as the P50, which is designed for individuals who have stopped working and wish to claim back any overpaid taxes. You can obtain this form from your local HMRC office or their website. However, having a P45 simplifies the process and provides the necessary information to expedite your claim.

Similar forms

- P60 - This document summarizes an employee's total pay and tax deductions for the year. Like the P45, it provides essential information for tax purposes, especially when filing a tax return.

- P11D - This form reports benefits and expenses for employees. Similar to the P45, it helps ensure that all income and benefits are accounted for when determining tax obligations.

- P50 - Used to claim a tax refund after leaving a job, the P50 allows individuals to recover overpaid taxes. It shares the purpose of the P45 in managing tax affairs after employment ends.

- P85 - This form is for individuals leaving the UK to inform HMRC of their departure. Like the P45, it is crucial for tax adjustments related to employment status changes.

- P14 - This document was used to report an employee's annual pay and tax deductions to HMRC. It served a similar function as the P45 in providing necessary tax information.

- Quitclaim Deed: A Quitclaim Deed is a legal instrument that transfers ownership rights without warranties, often utilized among family members or to resolve title issues. For more information on how to create one, visit https://nyforms.com/quitclaim-deed-template.

- P60U - This is an annual summary for employees who have left employment. It resembles the P45 by summarizing pay and tax for the period worked.

- P46 - This form is used when an employee starts a new job without a P45. It collects information to determine the correct tax code, similar to how the P45 provides tax details upon leaving.

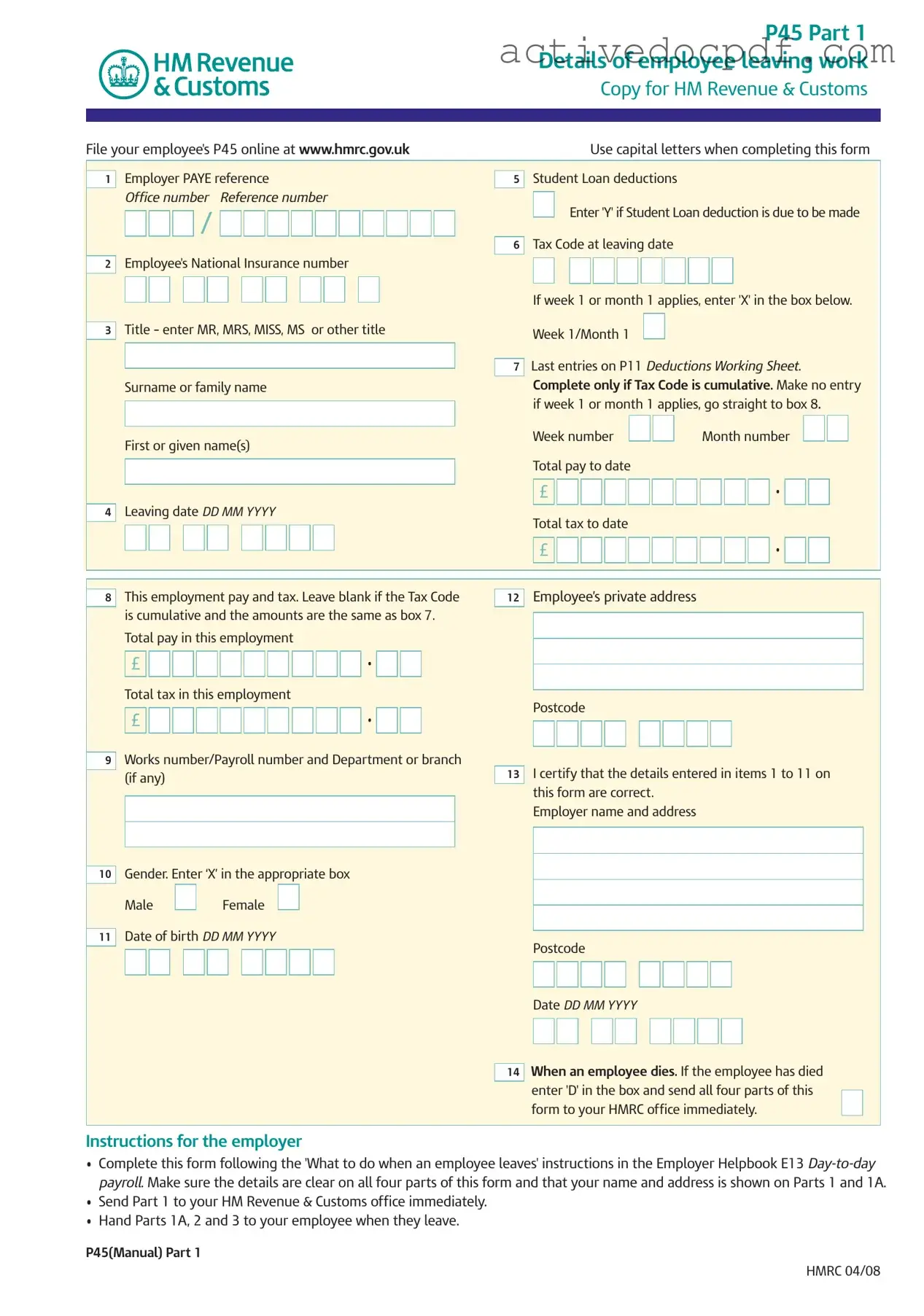

Guide to Filling Out P 45 It

Completing the P45 It form requires accurate information regarding the employee's departure from their job. This document is essential for tax purposes and should be filled out carefully. The following steps outline how to properly complete the form.

- Begin with Part 1 of the P45 form.

- Enter the employer's PAYE reference in the designated box.

- Fill in the office number and reference number as required.

- Provide the employee's National Insurance number.

- Indicate the employee's title (MR, MRS, MISS, MS, or other) in the appropriate section.

- Specify if week 1 or month 1 applies by entering 'X' in the corresponding box.

- Enter the employee's surname or family name.

- Record the first or given name(s) of the employee.

- Fill in the leaving date using the format DD MM YYYY.

- Provide the total pay to date and total tax to date in the specified boxes.

- Include the employee's private address and postcode.

- Indicate the employee's gender by marking 'X' in the appropriate box.

- Fill in the employee's date of birth in the format DD MM YYYY.

- Certify that the details entered are correct by signing and dating the form.

- Send Part 1 to HM Revenue & Customs immediately.

- Hand Parts 1A, 2, and 3 to the employee upon their departure.

After completing the P45 form, ensure that all parts are distributed correctly. The employee should keep Part 1A safe for future reference, while Parts 2 and 3 should be provided to the new employer. Proper handling of this form is crucial for accurate tax processing.