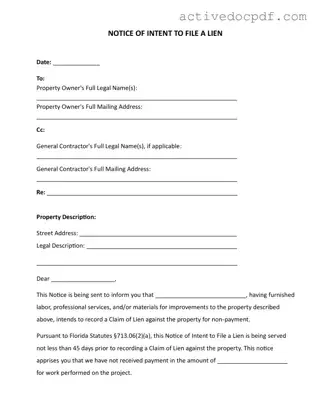

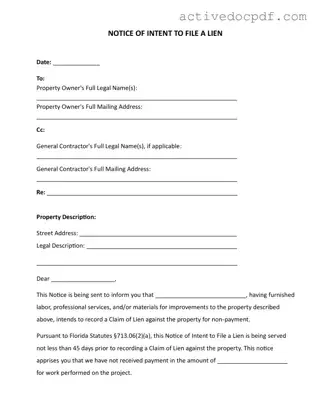

The Intent To Lien Florida form serves as a formal notice to property owners that a claim of lien will be filed due to non-payment for labor, services, or materials provided. This document notifies the property owner of their obligation...

An Investment Letter of Intent (LOI) is a preliminary document that outlines the intentions of parties involved in a potential investment. This form serves as a roadmap for negotiations, detailing key terms and conditions before a formal agreement is reached....

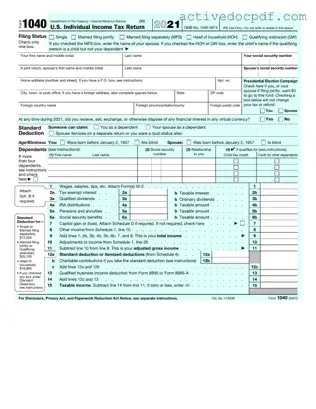

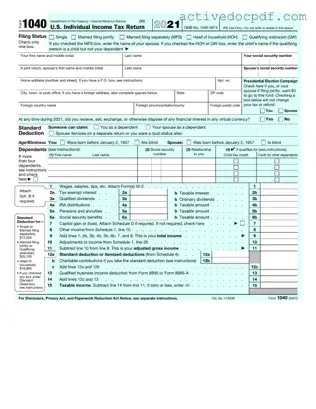

The IRS 1040 form is the standard individual income tax return used by U.S. taxpayers to report their annual earnings and calculate their tax obligations. This form plays a crucial role in the tax filing process, helping individuals determine whether...

The IRS 1099-MISC form is a tax document used to report various types of income received by individuals and businesses that are not classified as wages. This form is typically issued to independent contractors, freelancers, and other non-employees who have...

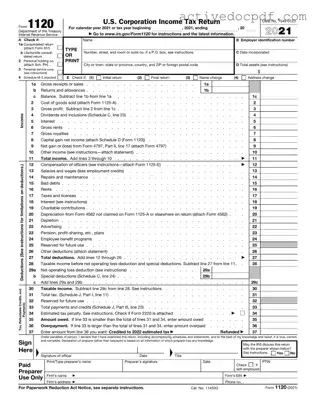

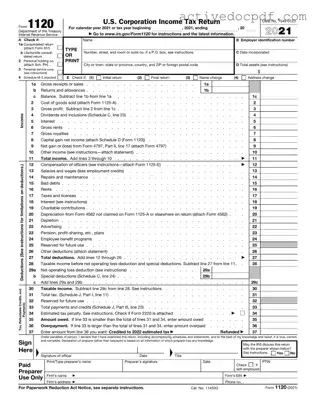

The IRS 1120 form is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for determining a corporation's tax liability and ensuring compliance with federal tax regulations....

The IRS 2553 form is a crucial document that allows eligible small businesses to elect S corporation status for tax purposes. This election can lead to significant tax benefits, including avoiding double taxation on corporate income. Understanding how to properly...

The IRS Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for ensuring compliance with federal tax regulations and helps businesses...

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business. This form helps individuals detail their earnings and expenses, ensuring they comply with tax regulations. Understanding how to...

The IRS Schedule C 1040 form is a tax document used by sole proprietors to report income and expenses from their business activities. This form allows individuals to calculate their net profit or loss, which is then transferred to their...

The IRS W-2 form is a crucial document that reports an employee's annual wages and the taxes withheld from their paycheck. Employers are required to provide this form to their employees by the end of January each year. Understanding the...

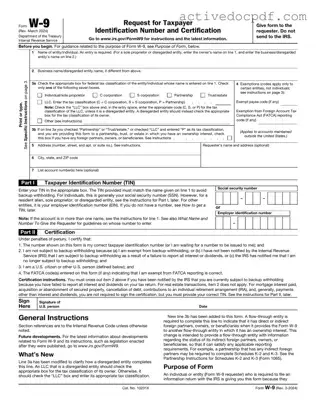

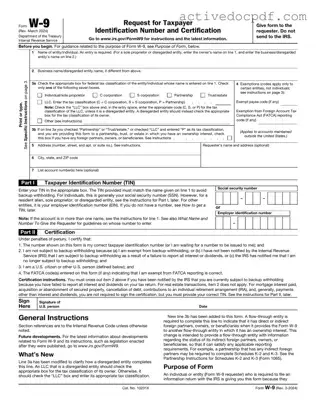

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to others. This form is essential for reporting income, ensuring that the correct taxes are withheld. Understanding how to fill out and...

The Jet Ski Bill of Sale form is a legal document that facilitates the transfer of ownership of a personal watercraft, specifically a jet ski, from one individual to another. This form serves as proof of the transaction and includes...