Free Payroll Check PDF Form

Misconceptions

Understanding the Payroll Check form is essential for both employers and employees. However, several misconceptions can lead to confusion. Here are eight common misconceptions about the Payroll Check form:

- Payroll checks are only for salaried employees. Many believe that payroll checks are exclusively for those on a salary. In reality, both hourly and salaried employees receive payroll checks based on their hours worked or agreed-upon salary.

- Payroll checks are always issued weekly. Some assume that payroll checks must be issued on a weekly basis. However, the frequency of payroll checks can vary by company policy. Some organizations pay bi-weekly or monthly.

- Payroll checks include only base salary. It's a common misconception that payroll checks reflect only the base salary. In fact, they may also include overtime pay, bonuses, and deductions for taxes and benefits.

- Direct deposit is the same as a payroll check. Many people think that direct deposit and payroll checks are identical. While both serve the same purpose of compensating employees, direct deposit is an electronic transfer, while a payroll check is a physical document.

- Employers have complete control over payroll check amounts. Some believe that employers can arbitrarily decide how much to pay employees. In reality, payroll amounts are determined by employment agreements, hours worked, and applicable laws.

- Payroll checks are always accurate. It’s a common belief that payroll checks are error-free. Mistakes can happen, so it’s important for employees to review their checks for accuracy regularly.

- Only full-time employees receive payroll checks. Many think that part-time employees do not receive payroll checks. In truth, part-time employees are also entitled to receive payroll checks based on their hours worked.

- Payroll checks are not subject to tax deductions. Some individuals mistakenly believe that payroll checks are free from tax deductions. However, payroll checks typically have federal, state, and sometimes local taxes withheld, as well as deductions for benefits.

Clearing up these misconceptions can help ensure that both employers and employees have a clear understanding of the Payroll Check form and its implications.

Documents used along the form

When managing payroll, several forms and documents work alongside the Payroll Check form to ensure accurate processing and compliance with regulations. Understanding these documents can help streamline payroll operations and maintain clear records.

- W-4 Form: Employees complete this form to indicate their tax withholding preferences. It helps employers determine the correct amount of federal income tax to withhold from each paycheck.

- Boat Bill of Sale: This legal document is necessary for the transfer of ownership of a boat. It provides essential details about the sale and can be completed efficiently by using resources like PDF Documents Hub.

- W-2 Form: This document summarizes an employee's annual earnings and the taxes withheld. Employers must provide it to employees by January 31 each year for tax reporting purposes.

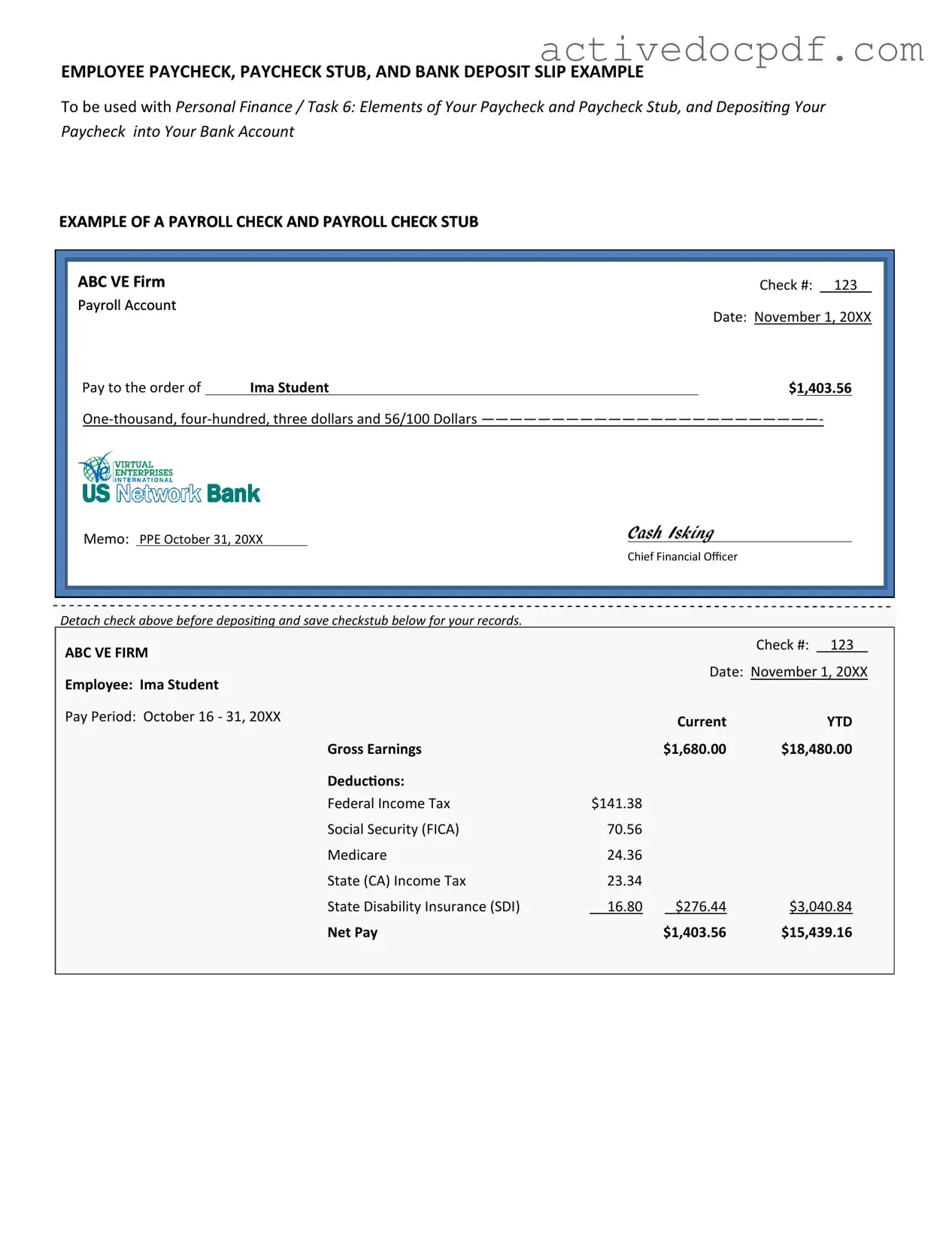

- Pay Stub: Accompanying each paycheck, a pay stub details the employee's earnings, deductions, and net pay. It serves as a record of payment and helps employees understand their compensation.

- Direct Deposit Authorization Form: Employees use this form to authorize their employer to deposit their pay directly into their bank accounts. It simplifies payment processing and enhances convenience for employees.

- Time Sheets: These records track the hours worked by employees. They are essential for calculating pay accurately, especially for hourly workers.

- Employee Handbook: This document outlines company policies, including payroll practices, benefits, and employee rights. It serves as a reference for employees regarding workplace expectations.

- Payroll Register: This is a comprehensive report that summarizes all payroll transactions for a specific period. It includes details such as gross pay, deductions, and net pay for each employee.

- State Tax Withholding Forms: Different states may require specific forms for state tax withholding. These documents ensure compliance with state tax laws and help determine the appropriate withholdings.

By familiarizing yourself with these documents, you can enhance your payroll management process and ensure compliance with tax regulations and company policies. Each form plays a crucial role in maintaining accurate records and facilitating smooth payroll operations.

Check out Popular Documents

Facial Consent Form - This form highlights the value of informed consent in aesthetics.

The Florida Motor Vehicle Power of Attorney form is a legal document that allows someone to appoint another person to handle matters related to their vehicle on their behalf. This can include tasks such as registration, titling, and selling. It's an essential tool for anyone who needs someone else to manage their vehicle affairs, especially when they're unable to do so themselves. To get started, you can access the document easily online.

Blank Pdf Invoice - Engage clients with well-defined, visually appealing PDF invoices.

Key Details about Payroll Check

What is the Payroll Check form?

The Payroll Check form is a document used by employers to process payments to employees for their work. This form details the amount owed to the employee, including any deductions for taxes, benefits, or other withholdings. It serves as a record for both the employer and the employee, ensuring transparency in compensation.

How do I fill out the Payroll Check form?

Filling out the Payroll Check form requires careful attention to detail. Follow these steps:

- Enter the employee's full name and address.

- List the pay period for which the payment is being made.

- Specify the gross pay amount before any deductions.

- Detail any deductions, such as taxes or benefits, and calculate the net pay.

- Sign and date the form to validate it.

Ensure that all information is accurate to avoid payment issues.

What should I do if I make a mistake on the Payroll Check form?

If a mistake occurs, it's crucial to address it promptly. Here’s what you can do:

- Cross out the error neatly and write the correct information next to it.

- Initial the correction to indicate that it was made intentionally.

- If the error is significant, consider starting a new form to maintain clarity.

Always keep a copy of the corrected form for your records.

When should I submit the Payroll Check form?

Timely submission of the Payroll Check form is essential. Generally, it should be submitted:

- At the end of each pay period to ensure employees receive their payments on time.

- Before the payroll processing deadline set by your organization.

Late submissions can lead to delayed payments, which may affect employee satisfaction.

Who can I contact if I have questions about the Payroll Check form?

If questions arise regarding the Payroll Check form, reach out to your HR department or payroll administrator. They are equipped to assist you with:

- Clarifying any aspects of the form.

- Providing guidance on payroll policies.

- Resolving any issues related to payments.

Don't hesitate to seek help; it's better to ask than to risk errors in payroll processing.

Similar forms

- Pay Stub: A pay stub provides a detailed breakdown of an employee's earnings and deductions for a specific pay period. Like the Payroll Check form, it is issued during the payroll process and helps employees understand their compensation.

- FedEx Release Form: This essential document allows customers to authorize FedEx to leave a package at a designated location when they are not home, ensuring delivery continuity similar to how the Payroll Check form maintains payment accuracy. More details can be found at documentonline.org/.

- W-2 Form: The W-2 form summarizes an employee's annual wages and the taxes withheld from their paycheck. Similar to the Payroll Check form, it is essential for tax reporting and reflects the total income earned over the year.

- Direct Deposit Authorization Form: This document allows employees to authorize their employer to deposit their pay directly into their bank account. It relates closely to the Payroll Check form as it facilitates the payment process without issuing a physical check.

- Employee Time Sheet: An employee time sheet records the hours worked by an employee during a pay period. It serves as the basis for calculating pay, similar to how the Payroll Check form finalizes the payment based on that information.

- Payroll Register: A payroll register is a summary report of all payroll transactions for a specific period. It includes details about each employee's pay, much like the Payroll Check form, which reflects individual payments made to employees.

Guide to Filling Out Payroll Check

Filling out the Payroll Check form is an essential task that ensures employees are compensated accurately and on time. Following these steps will help you complete the form efficiently, allowing for a smooth payroll process.

- Begin by entering the date at the top of the form. This is typically the date you are issuing the check.

- Next, fill in the employee's name. Make sure to use their full legal name as it appears in your records.

- In the employee ID section, input the unique identifier assigned to the employee. This helps in tracking their payroll history.

- Specify the pay period for which the employee is being paid. This could be weekly, bi-weekly, or monthly.

- Enter the gross pay, which is the total amount earned before any deductions.

- Next, list any deductions, such as taxes or benefits. These should be clearly outlined to ensure transparency.

- Calculate the net pay, which is the amount the employee will receive after deductions. This should be clearly marked.

- Finally, sign the form in the designated area to authorize the payment. Your signature confirms the check is valid.

Once you have filled out the form completely, it’s ready for processing. Make sure to keep a copy for your records, and provide the employee with their check in a timely manner.