Legal Power of Attorney Template

State-specific Guides for Power of Attorney Templates

Power of Attorney Document Categories

Misconceptions

Many people have misunderstandings about the Power of Attorney (POA) form. Here are five common misconceptions:

-

All Power of Attorney forms are the same.

In reality, there are different types of POA forms, such as durable, springing, and medical. Each serves a unique purpose and may have different legal implications.

-

Once a Power of Attorney is signed, it cannot be revoked.

This is not true. A principal can revoke a POA at any time, as long as they are mentally competent. It’s important to follow the proper procedures for revocation.

-

A Power of Attorney gives unlimited power to the agent.

This misconception overlooks the fact that the principal can specify what powers the agent has. The authority can be broad or limited, depending on the principal's wishes.

-

Power of Attorney is only for financial matters.

While many people associate POA with financial decisions, it can also cover health care decisions. A medical POA allows someone to make health-related choices on behalf of the principal.

-

Power of Attorney is only needed for elderly individuals.

This is a common belief, but anyone can benefit from having a POA. Unexpected situations, such as accidents or illnesses, can happen to anyone, making it essential for all adults to consider.

Documents used along the form

A Power of Attorney (POA) form allows one person to act on behalf of another in legal or financial matters. When preparing a POA, it is often helpful to consider additional forms and documents that may be necessary to ensure comprehensive coverage of your needs. Below is a list of commonly used documents that accompany a Power of Attorney.

- Durable Power of Attorney: This form allows the appointed agent to continue making decisions on behalf of the principal even if the principal becomes incapacitated. It provides a safeguard for ongoing management of affairs.

- Lease Agreement Form: To facilitate your renting arrangements, refer to the essential Lease Agreement form resources for comprehensive guidance on rental terms and conditions.

- Advance Healthcare Directive: Also known as a living will, this document outlines a person's wishes regarding medical treatment and healthcare decisions in the event they are unable to communicate those wishes themselves.

- HIPAA Release Form: This form authorizes designated individuals to access a person's medical records and information. It ensures that the appointed agent can make informed decisions about healthcare and treatment options.

- Financial Power of Attorney: This specific type of POA focuses solely on financial matters. It grants the agent authority to manage financial transactions, pay bills, and handle other monetary issues on behalf of the principal.

These documents can enhance the effectiveness of a Power of Attorney by addressing various aspects of personal and financial management. It is important to consider each one carefully based on individual circumstances and needs.

Fill out More Forms

Parking Spot Lease - It may require identification details for the vehicles being parked.

In addition to its importance in establishing the internal rules, the Operating Agreement also enhances the credibility of your LLC when dealing with external parties. To ensure you have all the necessary documentation, you can find useful resources at PDF Documents Hub, making the process of creating your agreement even more seamless and efficient.

Articles of Corporation - Sets clear expectations for corporate governance.

Key Details about Power of Attorney

- General Power of Attorney: Grants broad powers to the agent to handle a variety of matters.

- Limited Power of Attorney: Restricts the agent's authority to specific tasks or time periods.

- Durable Power of Attorney: Remains in effect even if the principal becomes incapacitated.

- Springing Power of Attorney: Activates only under certain conditions, such as the principal's incapacitation.

- Choose your agent carefully. This person should be trustworthy and capable of handling your affairs.

- Decide what powers you want to grant. Be specific about the authority you are giving.

- Complete the Power of Attorney form. You can find templates online or consult with a legal professional.

- Sign the document in accordance with your state's laws, which may require witnesses or notarization.

What is a Power of Attorney (POA)?

A Power of Attorney is a legal document that allows one person to act on behalf of another person in legal or financial matters. The person who grants this authority is called the principal, while the person who receives the authority is known as the agent or attorney-in-fact.

What are the different types of Power of Attorney?

There are several types of Power of Attorney, including:

Who should consider getting a Power of Attorney?

Anyone who wants to ensure their financial and legal matters are managed according to their wishes in case they become unable to do so should consider a Power of Attorney. This includes individuals with chronic illnesses, those planning for retirement, and anyone who travels frequently or has complex financial situations.

How do I create a Power of Attorney?

Creating a Power of Attorney typically involves the following steps:

Can I revoke a Power of Attorney?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To revoke it, you should create a written notice of revocation and inform your agent and any institutions or individuals that may have relied on the original document.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, a Durable Power of Attorney remains effective, allowing the agent to continue making decisions on behalf of the principal. If a standard Power of Attorney was used, it would no longer be valid, and decisions would need to be made through guardianship or conservatorship proceedings.

Is a Power of Attorney valid in all states?

While a Power of Attorney is recognized in all states, the specific laws and requirements can vary. It's essential to ensure that the document complies with the laws of the state where it will be used. Consulting with a legal professional can help ensure validity and compliance.

Similar forms

- Living Will: Similar to a Power of Attorney, a living will outlines your healthcare preferences in case you become unable to communicate. It specifies the types of medical treatments you do or do not want.

- Healthcare Proxy: This document appoints someone to make medical decisions on your behalf if you are incapacitated. Like a Power of Attorney, it grants authority to act in your best interest.

- Durable Power of Attorney: This is a specific type of Power of Attorney that remains effective even if you become incapacitated. It ensures your financial matters are managed continuously.

- Financial Power of Attorney: Focused solely on financial decisions, this document allows someone to handle your financial affairs, similar to a general Power of Attorney but limited to finances.

- Trust Agreement: A trust can manage your assets and designate someone to oversee them. Like a Power of Attorney, it allows for the management of your affairs but often provides more control over how assets are distributed.

- Will: A will outlines how your assets should be distributed after your death. While a Power of Attorney is effective during your lifetime, a will takes effect posthumously.

-

California ATV Bill of Sale: The Bill of Sale for a Quad is essential for documenting the sale of an all-terrain vehicle, ensuring both the buyer and seller are protected in the transaction.

- Guardianship Documents: These documents appoint someone to care for a minor or incapacitated adult. They share similarities with a Power of Attorney in that they grant authority to make decisions on behalf of another.

- Advance Directive: This document combines elements of a living will and healthcare proxy. It details your medical preferences and appoints someone to make decisions if you cannot.

- Real Estate Power of Attorney: This specialized Power of Attorney allows someone to manage real estate transactions on your behalf, similar to a general Power of Attorney but focused on property matters.

- Business Power of Attorney: This document enables someone to make business-related decisions for you. It is akin to a general Power of Attorney but is tailored for business activities.

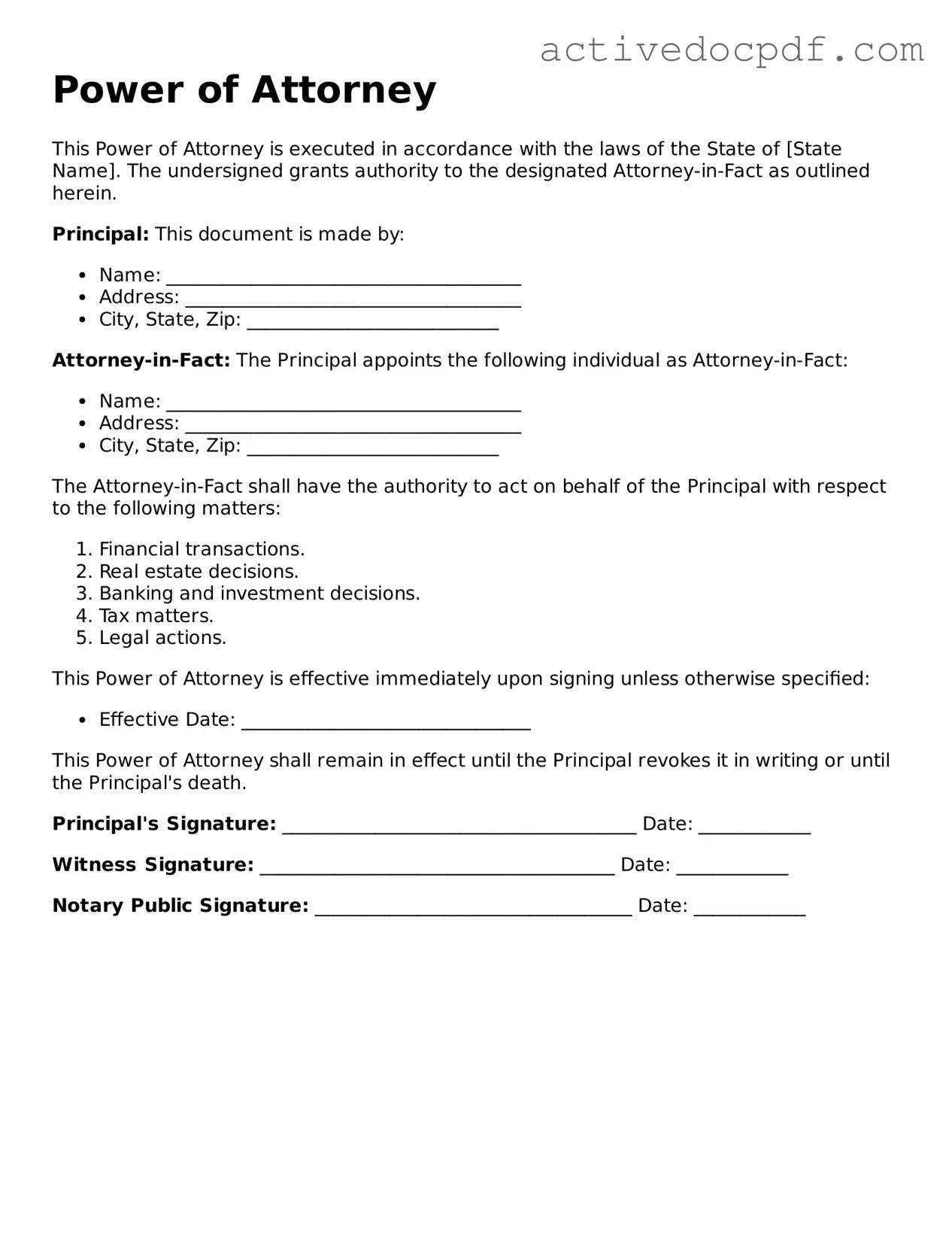

Guide to Filling Out Power of Attorney

After obtaining the Power of Attorney form, you will need to fill it out accurately to ensure that your wishes are clearly stated. This document will allow you to designate someone to act on your behalf in specific matters. Follow these steps carefully to complete the form.

- Read the Instructions: Before you start filling out the form, read any accompanying instructions to understand the requirements and implications.

- Identify the Principal: Write your full name and address in the designated section. This identifies you as the person granting the power.

- Choose the Agent: Enter the name and address of the person you are appointing as your agent. This person will have the authority to act on your behalf.

- Specify Powers: Clearly outline the specific powers you are granting to your agent. This could include financial decisions, healthcare decisions, or other specific matters.

- Set Effective Date: Indicate when the Power of Attorney will take effect. You can choose to make it effective immediately or upon a certain event.

- Include Revocation Clause: If applicable, mention how and when this Power of Attorney can be revoked.

- Sign the Document: Sign and date the form in the presence of a notary public or witnesses, if required by your state.

- Provide Copies: Make copies of the signed document for your agent, yourself, and any relevant parties.

Once you have completed these steps, your Power of Attorney form will be ready for use. Ensure that all parties involved are aware of the document and its contents.