Free Profit And Loss PDF Form

Misconceptions

Understanding the Profit and Loss form can be tricky. Here are five common misconceptions that people often have:

-

It only shows income.

Many believe that the Profit and Loss form only details income. In reality, it also lists expenses, allowing you to see how much profit or loss your business has made over a specific period.

-

It's the same as a balance sheet.

Some people think the Profit and Loss form is the same as a balance sheet. However, they serve different purposes. The balance sheet shows what a business owns and owes at a specific point in time, while the Profit and Loss form summarizes income and expenses over a period.

-

It only matters for large businesses.

There's a misconception that only large companies need to worry about Profit and Loss forms. In fact, small businesses and sole proprietors also benefit from tracking their income and expenses to understand their financial health.

-

It’s only for tax purposes.

While the Profit and Loss form is useful for tax filings, it serves a broader purpose. It helps business owners make informed decisions, assess performance, and plan for the future.

-

All expenses are deductible.

Some individuals think that all expenses listed on the form are automatically deductible. However, not all expenses qualify for tax deductions, and it’s important to understand which ones do.

Documents used along the form

The Profit and Loss form is an essential document for assessing a business's financial performance over a specific period. However, it is often used in conjunction with various other forms and documents that provide a comprehensive view of a company's financial health. Below is a list of common documents that may accompany the Profit and Loss form.

- Balance Sheet: This document summarizes a company's assets, liabilities, and equity at a specific point in time, providing insights into its financial stability.

- Cash Flow Statement: This statement outlines the cash inflows and outflows during a given period, helping to assess liquidity and operational efficiency.

- Statement of Retained Earnings: This report details the changes in retained earnings over a period, reflecting profits retained in the business rather than distributed as dividends.

- Budget Report: A budget report compares actual financial performance against planned budgets, assisting in identifying variances and guiding future financial decisions.

- Horse Bill of Sale: For those transferring ownership of horses, utilize the official Horse Bill of Sale documentation to ensure a smooth and legal transaction.

- Tax Returns: These documents provide a summary of income, expenses, and taxes owed, ensuring compliance with tax regulations and reflecting overall financial performance.

- Invoices: Invoices are detailed bills sent to customers, documenting sales transactions and serving as proof of revenue generation.

- Sales Reports: These reports track sales performance over time, highlighting trends and patterns that inform business strategies.

- Expense Reports: These documents itemize business expenses, providing clarity on spending and helping in budget management.

- Accounts Receivable Aging Report: This report categorizes outstanding invoices based on how long they have been due, assisting in cash flow management.

- Financial Projections: These forecasts estimate future revenues and expenses, aiding in strategic planning and investment decisions.

Each of these documents plays a crucial role in providing a well-rounded understanding of a business's financial situation. Utilizing them alongside the Profit and Loss form can enhance decision-making and strategic planning for the future.

Check out Popular Documents

Ncoer Signing Order - Failing to complete any section accurately could result in delays or negative impacts on the rated NCO's record.

When buying or selling a motorcycle in Illinois, having the appropriate documentation is essential, and a vital part of that process is the Motorcycle Bill of Sale form, which ensures both parties are protected during the transfer of ownership.

Contract for Leased Owner Operators - The contract also anticipates unforeseen changes in regulations affecting transportation, without penalizing the Owner Operator unfairly.

Key Details about Profit And Loss

What is a Profit and Loss form?

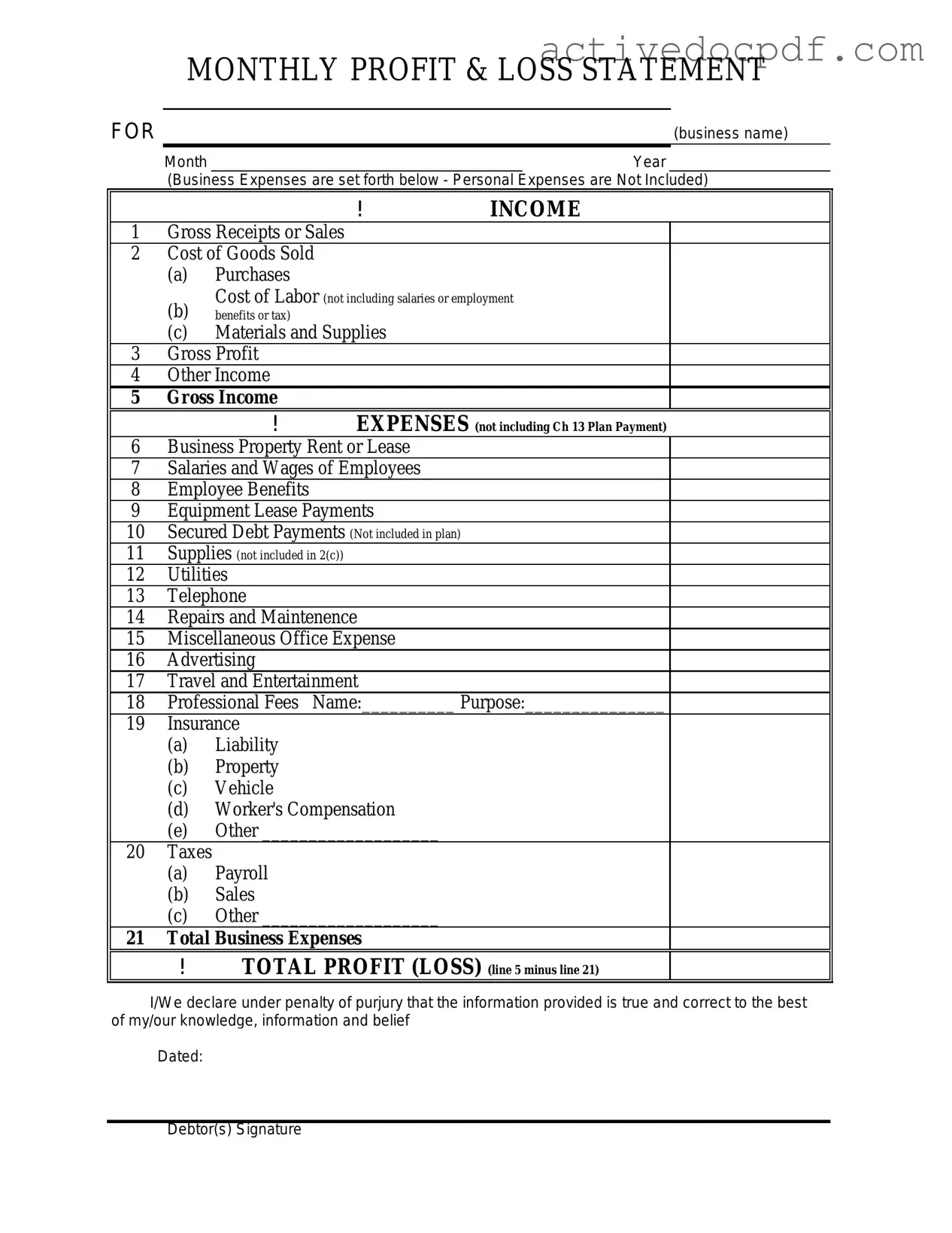

A Profit and Loss form, often referred to as an income statement, summarizes the revenues, costs, and expenses incurred during a specific period. This document provides a clear picture of a company's financial performance, showing whether it has made a profit or a loss during that time frame.

Why is the Profit and Loss form important?

The Profit and Loss form is crucial for several reasons:

- It helps business owners and stakeholders assess profitability.

- It provides insights into revenue trends and expense management.

- It aids in financial planning and forecasting for future periods.

- It is often required by lenders and investors when evaluating a business's financial health.

What information is included in a Profit and Loss form?

A typical Profit and Loss form includes the following sections:

- Revenue: Total income generated from sales or services.

- Cost of Goods Sold (COGS): Direct costs associated with producing goods or services sold.

- Gross Profit: Revenue minus COGS.

- Operating Expenses: Costs incurred in the normal course of business, such as rent, utilities, and salaries.

- Net Profit or Loss: The final figure after subtracting total expenses from total revenue.

How often should a Profit and Loss form be prepared?

Businesses typically prepare Profit and Loss forms on a monthly, quarterly, or annual basis. The frequency may depend on the size of the business, industry practices, and specific management needs. Regular preparation helps track financial performance and make timely adjustments as necessary.

Can the Profit and Loss form be used for tax purposes?

Yes, the Profit and Loss form can be used for tax purposes. It provides a summary of income and expenses, which is essential for calculating taxable income. However, it is important to ensure that the form aligns with the accounting methods used for tax reporting to avoid discrepancies.

How can I improve my Profit and Loss results?

Improving Profit and Loss results can be approached in several ways:

- Increase revenue through marketing strategies, upselling, and expanding product lines.

- Reduce costs by evaluating suppliers, renegotiating contracts, and streamlining operations.

- Monitor expenses regularly to identify areas for savings.

- Implement financial controls to prevent unnecessary spending.

Similar forms

- Income Statement: The Income Statement provides a summary of revenues and expenses over a specific period. Like the Profit and Loss form, it shows whether a business made a profit or incurred a loss.

- Operating Agreement: The PDF Documents Hub offers essential resources for creating an Operating Agreement, ensuring clarity in management roles and compliance with New York laws, akin to the structure of financial documents like the Profit and Loss form.

- Cash Flow Statement: This document outlines the cash inflows and outflows from operating, investing, and financing activities. While the Profit and Loss form focuses on profitability, the Cash Flow Statement emphasizes cash management.

- Balance Sheet: The Balance Sheet gives a snapshot of a company's assets, liabilities, and equity at a specific point in time. It complements the Profit and Loss form by providing context on financial stability and resources.

- Statement of Changes in Equity: This statement details the changes in a company’s equity over a period. Similar to the Profit and Loss form, it reflects how profits are retained or distributed among shareholders.

Guide to Filling Out Profit And Loss

Completing the Profit and Loss form is an important step in tracking your business's financial performance. This form will help you organize your income and expenses clearly. Follow these steps carefully to ensure all necessary information is included.

- Begin by entering your business name at the top of the form.

- Fill in the reporting period for which you are calculating profit and loss. This could be monthly, quarterly, or annually.

- List all sources of income. Include sales revenue, service income, and any other earnings. Make sure to provide the total amount for each source.

- Calculate your total income by adding all sources of income together. Write this amount in the designated section.

- Next, list all your expenses. Common expenses include rent, utilities, salaries, and supplies. Be thorough and include every expense.

- Add up all your expenses to find the total expenses amount. Write this total in the appropriate area of the form.

- To determine your profit or loss, subtract the total expenses from the total income. Write this figure in the profit or loss section.

- Review all entries for accuracy. Make sure all numbers are correct and all sections are filled out completely.

- Finally, sign and date the form at the bottom to certify that the information is true and accurate.

Once you have completed the form, keep a copy for your records. This information will be useful for tax purposes and for assessing the financial health of your business.