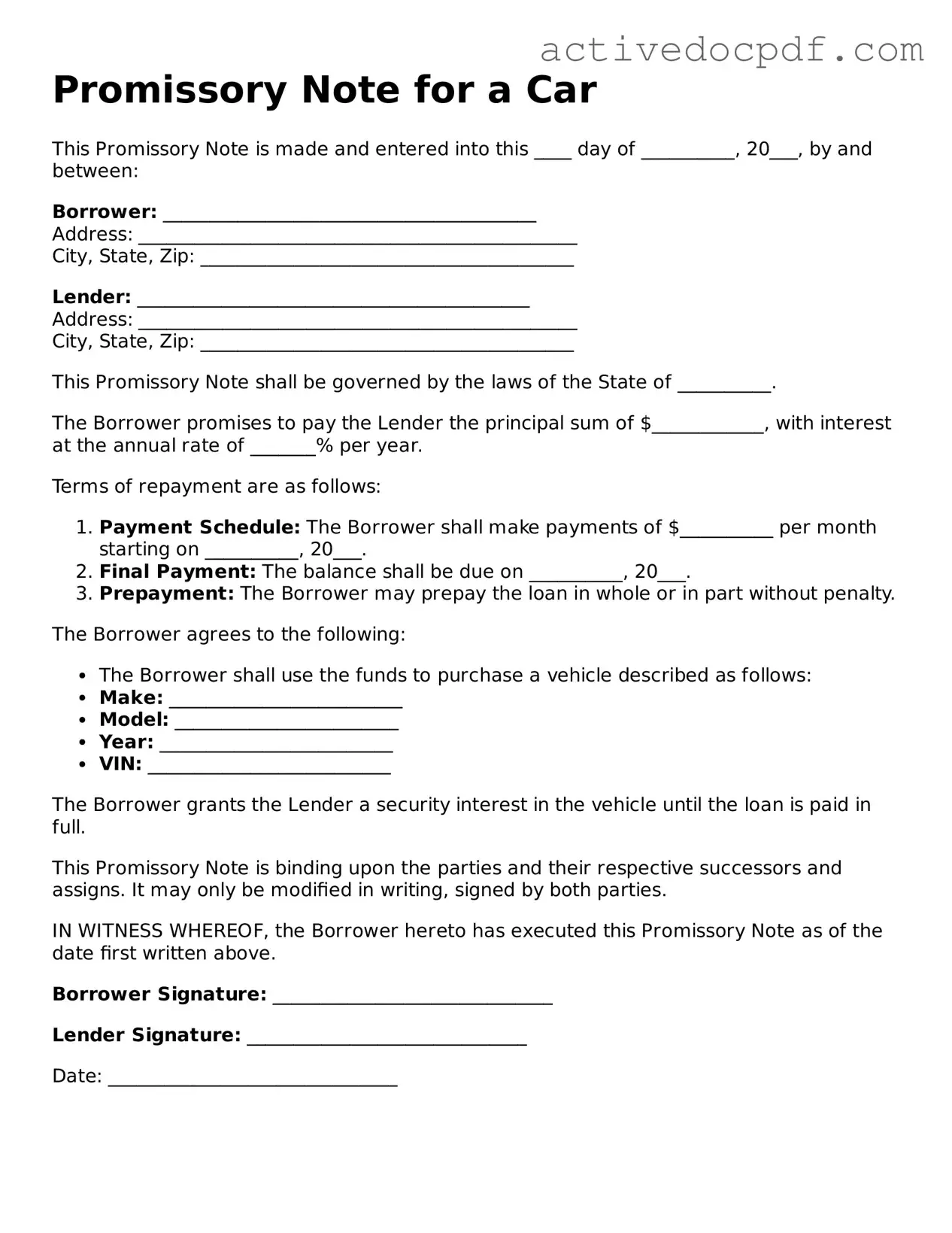

Legal Promissory Note for a Car Template

Misconceptions

When it comes to financing a vehicle, many people encounter the Promissory Note for a Car form. Unfortunately, several misconceptions can lead to confusion. Here are eight common misunderstandings about this important document:

- It is the same as a car loan agreement. While both documents relate to financing a vehicle, a promissory note is a promise to repay the loan, whereas a car loan agreement includes terms and conditions of the loan itself.

- It only protects the lender. Although the lender's interests are prioritized, the promissory note also protects the borrower by outlining the repayment terms and conditions clearly.

- It is not legally binding. A properly executed promissory note is a legally enforceable contract. This means that if either party fails to uphold their end of the agreement, legal action can be taken.

- It can be verbal. A promissory note must be in writing to be enforceable. Verbal agreements lack the necessary documentation to support claims in case of a dispute.

- It doesn’t need to be notarized. While notarization is not always required, having the document notarized can provide additional legal protection and credibility.

- Only banks issue promissory notes. Any individual or entity that lends money can create a promissory note. This includes private lenders and family members.

- It is only for large loans. Promissory notes can be used for loans of any size, including smaller amounts for vehicle purchases. The key is that the borrower is promising to repay the loan.

- Once signed, it cannot be changed. Amendments can be made to a promissory note if both parties agree. It is essential to document any changes in writing to avoid future disputes.

Understanding these misconceptions can help you navigate the process of financing a car more effectively. Being informed ensures that you can make better decisions and protect your interests.

Documents used along the form

When financing a vehicle, several important documents accompany the Promissory Note for a Car. Understanding these forms can help ensure a smooth transaction and protect your interests. Here’s a brief overview of four key documents often used alongside the promissory note.

- Bill of Sale: This document serves as proof of the transaction between the buyer and the seller. It outlines the details of the vehicle, including the make, model, year, and VIN, and confirms that the buyer has purchased the vehicle from the seller.

- Title Transfer: The title transfer document officially changes the ownership of the vehicle from the seller to the buyer. It must be completed and submitted to the appropriate state agency to ensure the buyer is recognized as the new owner.

- Promissory Note: An essential legal document that formalizes the borrower's promise to repay the lender under specified terms. For additional related documents, refer to All Alabama Forms.

- Loan Agreement: This document outlines the terms of the loan, including the interest rate, payment schedule, and any fees associated with the loan. It provides clarity on the obligations of both the borrower and the lender.

- Insurance Verification: Proof of insurance is often required before finalizing the sale. This document shows that the buyer has obtained insurance coverage for the vehicle, which is essential for protecting both parties in case of an accident or damage.

Being informed about these documents can empower you during the car buying process. Ensure you have everything in order to avoid any complications down the road.

More Types of Promissory Note for a Car Templates:

Release and Satisfaction of Promissory Note - Use this document to provide formal confirmation that a debt represented by a promissory note has been fully repaid.

For those seeking to create a legally binding agreement, obtaining a North Carolina Promissory Note is crucial, as it outlines the repayment terms and conditions between the borrower and lender. Detailed information and templates for this essential document can be found at North Carolina PDF Forms, ensuring a comprehensive understanding for both parties involved in the transaction.

Key Details about Promissory Note for a Car

What is a Promissory Note for a Car?

A Promissory Note for a Car is a legal document that outlines the terms of a loan taken to purchase a vehicle. It serves as a written promise from the borrower to repay the lender a specific amount of money, typically including interest, over a defined period. This document is crucial for both parties as it provides clarity on the repayment terms and protects their interests.

What information is typically included in a Promissory Note for a Car?

A Promissory Note for a Car usually includes the following information:

- Borrower's name and contact information: Identifies who is borrowing the money.

- Lender's name and contact information: Identifies the person or institution providing the loan.

- Loan amount: Specifies how much money is being borrowed.

- Interest rate: Indicates the percentage of interest that will be charged on the loan.

- Repayment schedule: Outlines when payments are due and how much will be paid at each interval.

- Consequences of default: Details what happens if the borrower fails to make payments.

How do I fill out a Promissory Note for a Car?

Filling out a Promissory Note for a Car involves a few straightforward steps:

- Gather necessary information about both the borrower and the lender.

- Clearly state the loan amount and the interest rate.

- Define the repayment schedule, including payment amounts and due dates.

- Include any additional terms or conditions that may apply.

- Both parties should sign and date the document to make it official.

What happens if the borrower defaults on the loan?

If the borrower defaults, meaning they fail to make the required payments, the lender has several options. These may include:

- Charging late fees as specified in the note.

- Taking legal action to recover the owed amount.

- Repossessing the vehicle, if applicable.

It's essential for borrowers to understand these consequences before signing the note.

Is a Promissory Note for a Car legally binding?

Yes, a Promissory Note for a Car is legally binding once both parties sign it. This means that the borrower is obligated to repay the loan according to the terms outlined in the document. If disputes arise, the note can be used in court to enforce the agreement. Therefore, it's important to read and understand all terms before signing.

Similar forms

- Loan Agreement: Like a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. Both documents establish a legal obligation to repay the borrowed funds.

- Maryland Promissory Note Form: To ensure that your loan agreement is legally recognized, utilize the detailed Maryland promissory note resources for comprehensive guidance on documentation.

- Lease Agreement: A lease agreement details the terms under which one party agrees to rent property from another. Similar to a promissory note, it includes payment terms and duration, but focuses on rental rather than ownership.

- Mortgage Note: A mortgage note is similar to a promissory note but specifically pertains to real estate. It outlines the borrower's promise to repay a loan used to purchase property, including terms and conditions.

- Installment Agreement: This document sets up a plan for paying off a debt in installments over time. Like a promissory note, it includes payment amounts and due dates, ensuring both parties understand the repayment process.

- Personal Loan Agreement: This is a contract between a borrower and a lender that specifies the loan amount, interest rate, and repayment terms. It functions similarly to a promissory note in that it formalizes the borrowing relationship.

- Credit Card Agreement: A credit card agreement outlines the terms of credit usage, including interest rates and payment terms. While it covers ongoing credit, it shares the fundamental principle of repayment with a promissory note.

- Business Loan Agreement: This document is used when a business borrows money. It includes terms similar to a promissory note, such as the amount borrowed and repayment schedule, but is tailored for business needs.

- Retail Installment Sales Contract: This contract is used when consumers purchase goods on credit. It outlines the payment terms and is similar to a promissory note as it establishes a repayment obligation for the buyer.

- Student Loan Agreement: A student loan agreement details the terms under which a student borrows money for education. Like a promissory note, it specifies repayment terms and obligations for the borrower.

Guide to Filling Out Promissory Note for a Car

Once you have the Promissory Note for a Car form in hand, the next steps involve carefully filling it out to ensure all necessary information is provided. This form is crucial for outlining the terms of the loan agreement between the borrower and the lender. Follow the steps below to complete the form accurately.

- Begin by entering the date at the top of the form. This should reflect the date you are filling out the document.

- Provide the full name of the borrower. Make sure to include any middle initials if applicable.

- Next, enter the borrower's address. Include the street address, city, state, and zip code.

- Fill in the lender's name. This is the individual or institution providing the loan.

- Input the lender's address, ensuring you include all relevant details like street, city, state, and zip code.

- Specify the total amount of the loan. This is the amount being borrowed to purchase the car.

- Indicate the interest rate for the loan. This can be a fixed or variable rate, depending on your agreement.

- Detail the repayment schedule. Include how often payments will be made (monthly, bi-weekly, etc.) and the duration of the loan.

- Include any late fees or penalties for missed payments. Clearly outline these terms to avoid confusion later.

- Provide a section for both parties to sign and date the form. This signifies agreement to the terms laid out in the note.

After completing the form, review it for accuracy. Both the borrower and the lender should keep a copy for their records. This ensures that everyone involved has a clear understanding of the loan terms.