Legal Promissory Note Template

State-specific Guides for Promissory Note Templates

Promissory Note Document Categories

Misconceptions

Understanding promissory notes is crucial for anyone involved in lending or borrowing money. However, several misconceptions often cloud this important financial instrument. Here are ten common misconceptions about promissory notes, along with clarifications to help you navigate this area more effectively.

-

All promissory notes are the same.

This is false. Promissory notes can vary widely in terms of terms, conditions, and legal enforceability. Each note should be tailored to the specific agreement between the parties involved.

-

Promissory notes do not need to be in writing.

While verbal agreements can exist, a written promissory note is essential for clarity and legal enforceability. Written documents provide evidence of the terms agreed upon.

-

Only banks can issue promissory notes.

This is incorrect. Individuals, businesses, and organizations can all create and issue promissory notes. Anyone can lend or borrow money using this form.

-

Promissory notes are only for large loans.

Not true. Promissory notes can be used for loans of any size. They are useful for both small personal loans and larger business transactions.

-

Once signed, a promissory note cannot be changed.

This misconception overlooks the possibility of amendments. Both parties can agree to modify the terms of the note, but such changes should be documented in writing.

-

Interest rates on promissory notes are always fixed.

This is misleading. Interest rates can be fixed or variable, depending on the terms agreed upon by the parties. It's important to clarify this in the note.

-

Promissory notes do not require a witness or notary.

While not always necessary, having a witness or notary can provide additional legal protection and validation to the agreement.

-

Defaulting on a promissory note has no consequences.

This is a serious misconception. Defaulting can lead to legal action, damage to credit scores, and other financial repercussions. It is crucial to understand the obligations involved.

-

Promissory notes are not legally binding.

This is incorrect. When properly executed, promissory notes are legally binding contracts. They can be enforced in a court of law if necessary.

-

All promissory notes must be notarized to be valid.

While notarization can add an extra layer of authenticity, it is not always a requirement for a promissory note to be valid. The key is that both parties agree to the terms.

By dispelling these misconceptions, individuals can better understand the significance of promissory notes and their role in financial agreements. Knowledge empowers borrowers and lenders alike to engage in transactions with confidence.

Documents used along the form

A promissory note is a crucial document in financial transactions, serving as a written promise to pay a specified amount of money to a designated party. However, it often accompanies several other forms and documents that help clarify the terms of the agreement and protect the interests of all parties involved. Below is a list of commonly used documents alongside a promissory note.

- Loan Agreement: This document outlines the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive guide for both the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this agreement details the specific assets that back the loan. It provides legal protection for the lender in case of default.

- Disclosure Statement: This document informs the borrower of all relevant loan terms, including fees and costs. It ensures transparency and helps borrowers make informed decisions.

- Guarantee Agreement: In cases where a third party agrees to repay the loan if the borrower defaults, this document outlines the guarantor's responsibilities and obligations.

- Amortization Schedule: This table breaks down each payment into principal and interest components over the life of the loan. It helps borrowers understand their payment obligations over time.

- ATV Bill of Sale: This document verifies the sale and transfer of ownership of an all-terrain vehicle, ensuring that all required details are documented clearly. For more information, visit PDF Documents Hub.

- Payment Receipt: After each payment, a receipt is issued to confirm the transaction. This document serves as proof of payment for both parties.

- Default Notice: If a borrower fails to meet their payment obligations, this document formally notifies them of the default and outlines potential consequences. It serves as a crucial step before any legal action is taken.

These documents work together to create a clear framework for the loan transaction, ensuring that all parties understand their rights and obligations. By utilizing these forms, individuals can navigate the complexities of borrowing and lending with greater confidence and security.

Fill out More Forms

How to Write a Bill of Sale for a Boat - Boat Bills of Sale can help facilitate loans or financing, as lenders often require proof of ownership.

Completing the Texas Affidavit of Gift form is crucial to ensure a smooth transfer of ownership when gifting a vehicle, as this document not only provides legal proof of the transaction but also clearly indicates that the vehicle is given without any strings attached. To fill out the form correctly, you can access it online at texasformspdf.com/fillable-affidavit-of-gift-online.

Mortgage Interest Form for Taxes - Delinquency notice alerts you of any overdue payments and the potential consequences.

California Correction Deed - This form can be crucial for ensuring compliance with legal standards.

Key Details about Promissory Note

What is a Promissory Note?

A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a defined future date or on demand. It serves as a legal document that outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any penalties for late payment.

Who uses a Promissory Note?

Promissory notes are commonly used by individuals, businesses, and financial institutions. They may be utilized in various situations, such as:

- Personal loans between friends or family members

- Business loans for startups or existing companies

- Real estate transactions

- Student loans

What are the key components of a Promissory Note?

A well-drafted promissory note typically includes the following elements:

- The names and addresses of the borrower and lender

- The principal amount borrowed

- The interest rate, if applicable

- The repayment schedule and due dates

- Any late fees or penalties for missed payments

- Signatures of both parties

Is a Promissory Note legally binding?

Yes, a promissory note is a legally binding document as long as it meets certain criteria. It must be signed by the borrower and lender, and it should clearly outline the terms of the agreement. If either party fails to uphold their end of the agreement, the other party may have legal grounds to seek enforcement or recovery of the owed amount.

Can a Promissory Note be modified?

Yes, a promissory note can be modified if both the borrower and lender agree to the changes. It is advisable to document any modifications in writing and have both parties sign the revised note. This helps prevent misunderstandings and provides a clear record of the new terms.

What happens if a borrower defaults on a Promissory Note?

If a borrower defaults, meaning they fail to make payments as agreed, the lender has several options. They may:

- Contact the borrower to discuss the situation

- Charge late fees as specified in the note

- Seek legal action to recover the owed amount

- Report the default to credit bureaus, affecting the borrower's credit score

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a promissory note, consulting with one can be beneficial. A lawyer can ensure that the document complies with state laws and adequately protects both parties’ interests. For simple loans, templates are often available online, but customization may be necessary to fit specific needs.

Where can I find a Promissory Note template?

Promissory note templates can be found in various places, including:

- Legal websites that provide free or paid templates

- Office supply stores that sell legal forms

- Online document creation tools

When using a template, ensure it is suitable for your specific situation and jurisdiction.

Similar forms

A Promissory Note is a financial document that outlines a borrower's promise to repay a loan under specific terms. Several other documents serve similar purposes in different contexts. Here are nine documents that share similarities with a Promissory Note:

- Loan Agreement: This document details the terms of a loan, including the amount borrowed, interest rate, and repayment schedule, much like a Promissory Note.

- Mortgage: A mortgage is a type of loan specifically for purchasing real estate. It includes a promise to repay, similar to a Promissory Note, but is secured by the property itself.

- Installment Agreement: This agreement allows a borrower to pay back a loan in installments over time, reflecting the repayment structure found in a Promissory Note.

- Credit Agreement: This document outlines the terms under which a borrower can access credit, including repayment obligations, similar to the commitments made in a Promissory Note.

- FedEx Bill of Lading: The FedEx Bill of Lading is vital for shipping logistics, as it details the agreement between the shipper and the carrier. This document, much like a Promissory Note, clarifies the terms and conditions essential for a successful shipment process. More information can be found at https://documentonline.org/.

- Personal Guarantee: A personal guarantee involves an individual promising to repay a debt if the primary borrower defaults, echoing the promise aspect of a Promissory Note.

- Lease Agreement: In some cases, a lease agreement includes a promise to make payments over time for the use of property, similar to the repayment obligations in a Promissory Note.

- Bill of Exchange: This financial document involves a written order to pay a specific sum to a third party, sharing the transactional nature of a Promissory Note.

- Secured Note: A secured note is backed by collateral, providing additional assurance to the lender, much like a Promissory Note but with added security.

- Loan Modification Agreement: This document alters the terms of an existing loan, often including new repayment terms, similar to how a Promissory Note outlines repayment obligations.

Understanding these documents can help clarify the obligations and rights involved in borrowing and lending scenarios. Each serves a unique purpose while sharing fundamental characteristics with a Promissory Note.

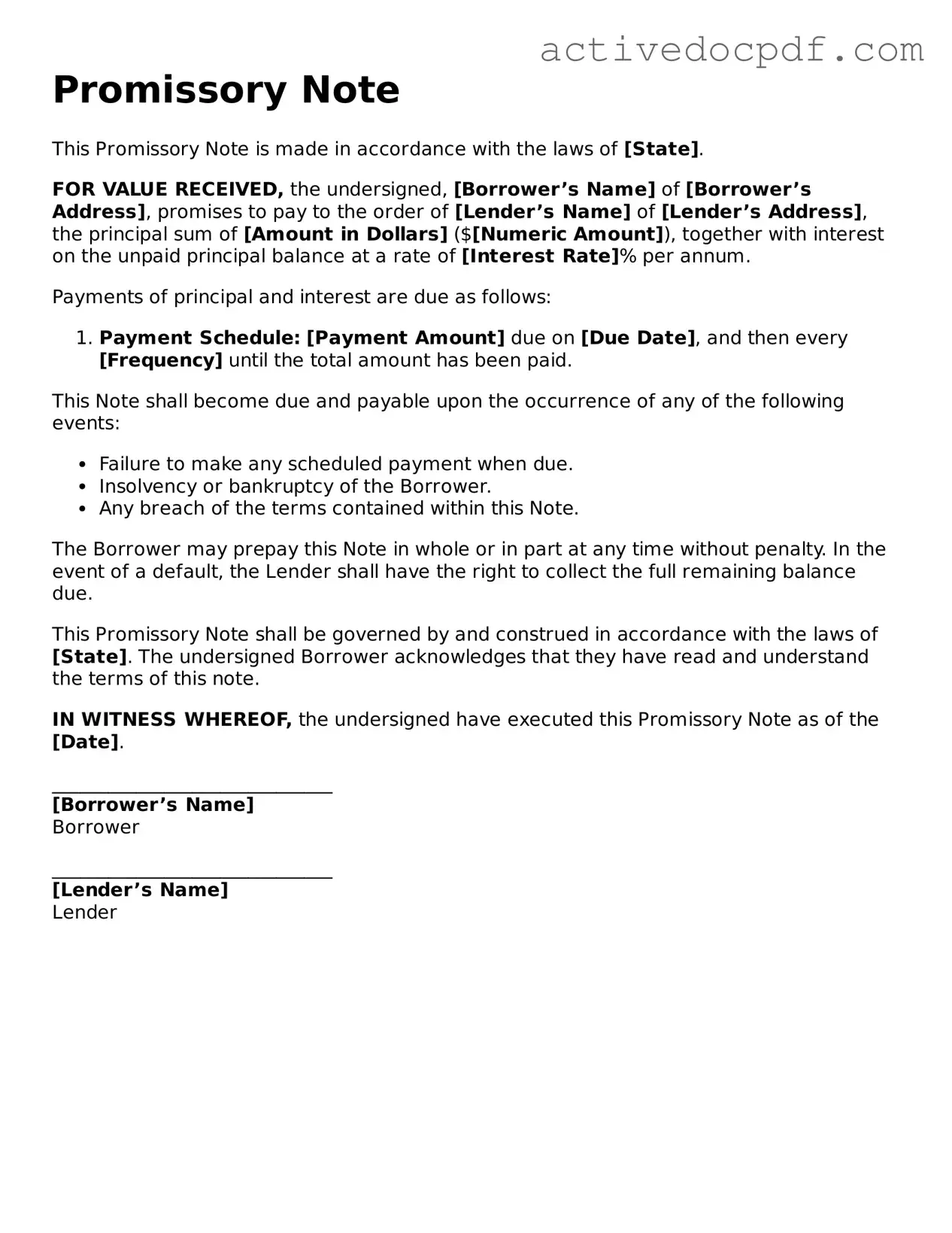

Guide to Filling Out Promissory Note

Once you have the Promissory Note form in front of you, it's time to fill it out carefully. This document is essential for establishing the terms of a loan agreement between a borrower and a lender. Ensuring that all details are accurate and clear will help avoid misunderstandings in the future.

- Title the Document: At the top of the form, write "Promissory Note." This clearly indicates the purpose of the document.

- Identify the Parties: Fill in the names and addresses of both the borrower and the lender. Make sure to include any relevant contact information.

- State the Loan Amount: Clearly write the total amount of money being borrowed. This should be in both numerical and written form for clarity.

- Specify the Interest Rate: Indicate the interest rate being charged on the loan. If the loan is interest-free, note that as well.

- Outline the Payment Terms: Describe how and when the borrower will repay the loan. Include the payment schedule, such as monthly or quarterly payments.

- Include Maturity Date: Specify the date by which the loan must be fully repaid. This is important for both parties to understand the timeline.

- Signatures: Both the borrower and the lender must sign the document. Include the date of signing next to each signature.

- Witness or Notary (if required): Depending on your state’s laws, you may need a witness or a notary public to sign the document as well.

After completing the form, ensure that both parties retain a copy for their records. This will serve as a reference in case of any future disputes or questions regarding the agreement.