Legal Purchase Letter of Intent Template

Misconceptions

Understanding the Purchase Letter of Intent (LOI) is crucial for anyone involved in real estate transactions or business deals. However, several misconceptions can lead to confusion. Here are eight common misconceptions about the Purchase Letter of Intent form:

- The Purchase LOI is a legally binding contract. Many believe that once a Purchase LOI is signed, it obligates both parties to complete the transaction. In reality, an LOI typically outlines intentions and is often non-binding, unless explicitly stated otherwise.

- The Purchase LOI is unnecessary. Some think that a Purchase LOI is just an extra step that complicates the process. In fact, it serves as a valuable tool for clarifying intentions and laying the groundwork for a formal agreement.

- All Purchase LOIs are the same. People often assume that all LOIs follow a standard format. However, each LOI can be tailored to the specific needs and circumstances of the parties involved, leading to significant variations.

- Only buyers need to sign the Purchase LOI. It's a common belief that only the buyer's signature is necessary. In truth, both parties should sign the LOI to demonstrate mutual agreement on the terms outlined.

- The Purchase LOI must include every detail of the transaction. Some individuals think that an LOI must cover all aspects of the deal. While it should include key terms, it is not required to be exhaustive. This allows for flexibility in negotiations.

- A Purchase LOI guarantees financing. Many mistakenly believe that signing an LOI secures financing for the transaction. However, financing is a separate process and must be arranged independently of the LOI.

- The Purchase LOI is only for real estate transactions. While commonly used in real estate, Purchase LOIs can also apply to various business deals, including mergers and acquisitions, making them versatile in different contexts.

- Once signed, the terms in a Purchase LOI cannot be changed. Some think that the terms are set in stone once the LOI is signed. In reality, the LOI is a starting point for negotiations, and changes can be made as discussions progress.

By addressing these misconceptions, individuals can better navigate the complexities of Purchase Letters of Intent and make informed decisions in their transactions.

Documents used along the form

A Purchase Letter of Intent (LOI) is often the starting point for negotiations in a transaction, outlining the intentions of the buyer and seller. However, several other documents frequently accompany the LOI to ensure clarity and set expectations. Here’s a brief overview of these important forms and documents:

- Confidentiality Agreement: This document protects sensitive information shared between the parties during negotiations. It ensures that proprietary details remain confidential, fostering an environment of trust.

- Purchase Agreement: This is a comprehensive document that outlines the final terms of the sale. It includes details such as the purchase price, payment terms, and conditions of the sale, serving as the legally binding contract once both parties agree.

- Due Diligence Checklist: A tool used by the buyer to evaluate the seller’s business before finalizing the purchase. This checklist covers financial, legal, and operational aspects to ensure the buyer makes an informed decision.

- Escrow Agreement: This document outlines the terms under which a neutral third party holds funds or assets until all conditions of the sale are met. It protects both the buyer and seller during the transaction process.

- Financing Commitment Letter: A letter from a lender that confirms the buyer’s ability to secure financing for the purchase. This document is crucial for demonstrating financial readiness to the seller.

- Letter of Representation: A document from the seller affirming that they have the authority to sell the business and are disclosing all material facts. It reassures the buyer about the legitimacy of the transaction.

- Homeschool Letter of Intent: This essential document is filed with the local school district to formally declare a parent's intention to homeschool their child, ensuring compliance with state laws and regulations. For further guidance on this process, visit TopTemplates.info.

- Non-Binding Offer: Similar to an LOI, this document expresses the buyer’s interest in purchasing the business but is typically less formal. It outlines preliminary terms and is often used to gauge the seller's interest before more detailed negotiations begin.

Each of these documents plays a vital role in the purchasing process, helping to create a clear framework for negotiations and protecting the interests of both parties. Understanding these forms can empower buyers and sellers to navigate transactions more effectively, leading to smoother outcomes.

More Types of Purchase Letter of Intent Templates:

How to Write Letter of Intent for Job - Signals a positive outcome following the interview process.

For those navigating investment opportunities, an essential overview of the Investment Letter of Intent process can be invaluable. This preliminary document helps investors articulate their intentions and sets the groundwork for effective negotiations, thereby promoting clarity and mutual understanding among parties.

Key Details about Purchase Letter of Intent

What is a Purchase Letter of Intent?

A Purchase Letter of Intent (LOI) is a document that outlines the preliminary agreement between a buyer and a seller. It indicates the buyer's interest in purchasing a property or business and sets the stage for further negotiations. While it is not a legally binding contract, it shows serious intent and helps both parties understand the basic terms of the potential sale.

What should be included in a Purchase Letter of Intent?

Typically, a Purchase Letter of Intent should include the following key elements:

- Parties Involved: Names and contact information of the buyer and seller.

- Description of the Property or Business: Clear details about what is being purchased.

- Proposed Purchase Price: An estimated price that the buyer is willing to pay.

- Timeline: Key dates for negotiations, due diligence, and closing.

- Confidentiality Clause: A statement about keeping the information private.

Is a Purchase Letter of Intent legally binding?

No, a Purchase Letter of Intent is generally not legally binding. It serves as a starting point for negotiations and expresses the intent to move forward. However, some sections, like confidentiality or exclusivity clauses, may be enforceable. It’s important to clarify which parts are binding and which are not.

How does a Purchase Letter of Intent benefit both parties?

A Purchase Letter of Intent benefits both the buyer and the seller in several ways:

- It establishes a clear understanding of the terms before a formal agreement is drafted.

- It saves time by outlining the key points for negotiation.

- It shows the seller that the buyer is serious, which can help in negotiations.

- It allows both parties to address any concerns early in the process.

What happens after a Purchase Letter of Intent is signed?

Once a Purchase Letter of Intent is signed, the next steps typically involve:

- Due Diligence: The buyer will conduct research and inspections to confirm the property's value and condition.

- Negotiation of Terms: Both parties will negotiate the final terms of the purchase agreement.

- Drafting a Purchase Agreement: A formal contract will be created based on the agreed terms.

- Closing the Deal: Final steps will be taken to complete the sale, including payment and transfer of ownership.

Similar forms

- Purchase Agreement: This document outlines the terms and conditions of the sale, including price and payment terms. It is more detailed than a letter of intent and serves as a binding contract once signed.

- Letter of Intent Template: For those looking to draft an LOI, resources such as Templates Online can provide valuable guidance and samples to ensure all necessary components are included.

- Memorandum of Understanding (MOU): Similar to a letter of intent, an MOU expresses the intentions of both parties but is often less formal and may not be legally binding.

- Non-Disclosure Agreement (NDA): This document protects sensitive information shared during negotiations. Like a letter of intent, it establishes trust between parties but focuses on confidentiality.

- Term Sheet: A term sheet outlines the key terms of a deal in a summary format. It is similar to a letter of intent in that it provides a framework for negotiations but is often used in financial transactions.

- Sales Proposal: A sales proposal details the offerings and pricing from a seller to a potential buyer. While it aims to persuade, a letter of intent indicates a serious interest in moving forward.

- Letter of Interest: This document expresses a party's desire to engage in negotiations. Like a letter of intent, it signals intent but may lack the specificity regarding terms and conditions.

- Closing Statement: This document summarizes the final terms of a sale and is used at the closing of a transaction. It is similar in that it finalizes the agreement but comes into play after the intent has been established.

Guide to Filling Out Purchase Letter of Intent

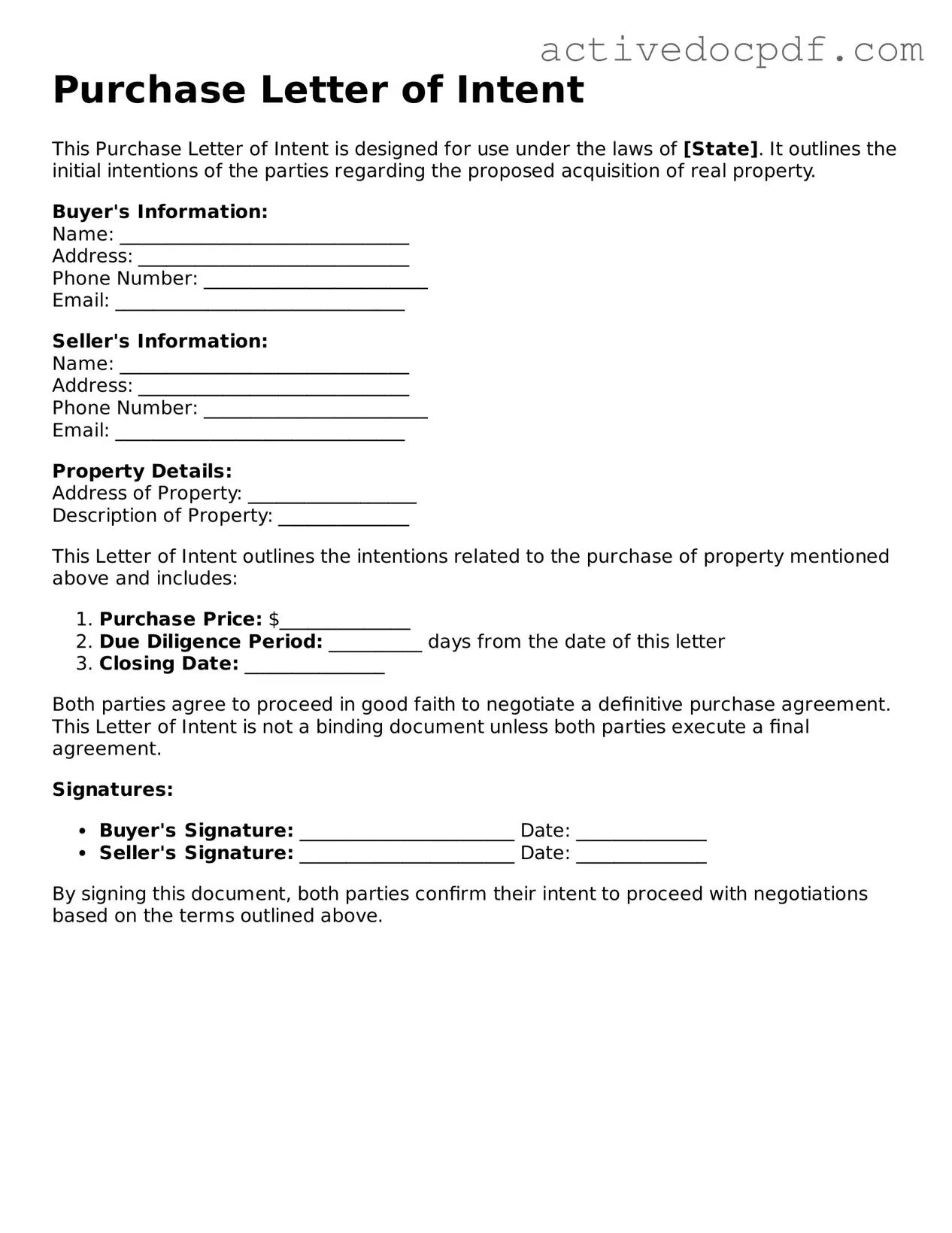

After completing the Purchase Letter of Intent form, you will be ready to present your intentions regarding a property purchase. This document serves as a preliminary agreement between you and the seller, outlining the key terms before entering into a formal contract. Follow these steps to ensure accuracy and clarity when filling out the form.

- Begin with your contact information: Fill in your full name, address, phone number, and email address at the top of the form.

- Provide the seller's information: Enter the seller's name, address, phone number, and email address in the designated section.

- Describe the property: Clearly state the address and any relevant details about the property you wish to purchase.

- Specify the purchase price: Indicate the amount you are offering for the property.

- Outline the terms: Include any conditions or contingencies that must be met for the sale to proceed, such as financing or inspections.

- Set a timeline: Provide a proposed timeline for the transaction, including important dates like the closing date.

- Include earnest money details: Mention the amount of earnest money you are willing to deposit and the conditions for its return.

- Sign and date the form: Ensure you sign and date the document to confirm your intent.

Once you have completed the form, review it for any errors or missing information. This attention to detail will help facilitate a smoother negotiation process with the seller.