Legal Quitclaim Deed Template

State-specific Guides for Quitclaim Deed Templates

Misconceptions

Many people have misunderstandings about the Quitclaim Deed. Here are five common misconceptions, along with clarifications.

- A Quitclaim Deed transfers ownership completely. This is not always true. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor actually owns the property or has the right to transfer it.

- Using a Quitclaim Deed eliminates all liability. This is misleading. While a Quitclaim Deed can transfer property interests, it does not absolve the grantor from any debts or obligations associated with the property, such as mortgages or liens.

- Quitclaim Deeds are only for family transfers. This is a misconception. While they are often used in family situations, Quitclaim Deeds can be used in various transactions, including sales, gifts, or transfers between business partners.

- A Quitclaim Deed is the same as a Warranty Deed. This is incorrect. A Warranty Deed offers guarantees about the title and ownership of the property, while a Quitclaim Deed provides no such assurances. The two serve different purposes.

- You don’t need to record a Quitclaim Deed. This is not advisable. While it’s not legally required to record a Quitclaim Deed, failing to do so can lead to disputes over ownership and may affect the ability to sell the property in the future.

Understanding these misconceptions can help you make informed decisions about property transfers.

Documents used along the form

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another. While it serves a specific purpose in property transactions, several other forms and documents often accompany it to ensure a smooth transfer and to address various legal and financial aspects. Below is a list of commonly used documents in conjunction with a Quitclaim Deed.

- Title Search Report: This document provides a detailed history of the property, including previous ownership, liens, and any other claims against the property. It helps the buyer ensure that the seller has the legal right to transfer ownership.

- Property Transfer Tax Form: Many states require this form to be filed when property is transferred. It documents the transaction for tax purposes and calculates any applicable transfer taxes that may need to be paid.

- Affidavit of Title: This sworn statement by the seller confirms their ownership of the property and affirms that there are no undisclosed liens or claims against it. It provides additional assurance to the buyer regarding the property's title.

- Settlement Statement: Also known as a Closing Disclosure, this document outlines all the financial details of the property transaction. It includes the purchase price, closing costs, and any other fees associated with the transfer.

- Affidavit of Gift: The Texas Affidavit of Gift form is crucial when gifting a vehicle in Texas, serving as proof of the transfer without any expectation of payment or return service. For more information and to complete the form, visit https://texasformspdf.com/fillable-affidavit-of-gift-online.

- Power of Attorney: In some cases, the seller may be unable to sign the Quitclaim Deed in person. A Power of Attorney allows another individual to act on their behalf, ensuring that the transfer can still take place smoothly.

Each of these documents plays a crucial role in the property transfer process. Together, they help protect the interests of both the buyer and the seller, ensuring that the transaction is legally sound and transparent. Understanding these forms can significantly enhance one’s ability to navigate real estate transactions effectively.

More Types of Quitclaim Deed Templates:

What Is a Gift Deed in Real Estate - This form not only represents a gift but also solidifies relationships through thoughtful acts.

When completing the sale of an all-terrain vehicle, it's important to have the proper documentation in place, such as the New York ATV Bill of Sale form. This essential legal document not only records the transaction but also provides both parties with proof of ownership transfer. For easy access to this form, you can visit PDF Documents Hub and complete the necessary details with confidence.

Corrective Deed California - Multiple parties may need to sign the Corrective Deed depending on the error.

Key Details about Quitclaim Deed

What is a Quitclaim Deed?

A Quitclaim Deed is a legal document that allows a person to transfer their interest in a property to another person. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the person transferring the property has any ownership rights. It simply conveys whatever interest the grantor may have in the property, if any.

When should I use a Quitclaim Deed?

Quitclaim Deeds are often used in specific situations, such as:

- Transferring property between family members.

- Removing a spouse from a property title after a divorce.

- Transferring property into a trust.

- Clearing up title issues or claims.

They are not typically used for sales or purchases, as they do not provide the buyer with any assurances about ownership.

How do I complete a Quitclaim Deed?

Completing a Quitclaim Deed involves several steps:

- Identify the parties involved: the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide a legal description of the property. This is often found on the property’s deed or tax records.

- Sign the deed in front of a notary public.

- File the completed Quitclaim Deed with the appropriate local government office, usually the county recorder’s office.

Do I need a lawyer to create a Quitclaim Deed?

While it's possible to create a Quitclaim Deed without a lawyer, consulting one can be beneficial. A lawyer can ensure that the deed is completed correctly and that all legal requirements are met. This can help prevent future disputes or issues regarding property ownership.

What are the risks of using a Quitclaim Deed?

Using a Quitclaim Deed carries certain risks. Since it does not guarantee ownership, the grantee may not receive clear title to the property. If the grantor does not actually own the property, the grantee could end up with nothing. Additionally, any liens or debts associated with the property may still affect the new owner.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked. The transfer of interest is considered final. However, if there are specific circumstances, such as fraud or undue influence, legal action may be taken to challenge the deed.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides guarantees about the grantor's ownership and the property’s title. It assures the grantee that the property is free from claims or liens. In contrast, a Quitclaim Deed offers no such guarantees, making it a less secure option for transferring property.

Similar forms

- Warranty Deed: This document guarantees that the grantor has a clear title to the property and has the right to sell it. Unlike a quitclaim deed, which offers no such guarantees, a warranty deed provides protection to the buyer against future claims on the property.

- Grant Deed: Similar to a warranty deed, a grant deed conveys ownership of property but does not include the same level of guarantees. It assures that the property has not been sold to anyone else and that there are no undisclosed encumbrances.

- Arizona Annual Report: As a crucial document that businesses must file with the Arizona Corporation Commission, it details essential company information and ensures compliance with state regulations. To learn more, visit arizonapdfs.com/arizona-annual-report-template/.

- Deed of Trust: This document involves three parties: the borrower, the lender, and a trustee. It secures a loan by placing a lien on the property, much like a quitclaim deed transfers interest in property, but it serves a different purpose related to financing.

- Bill of Sale: While a bill of sale is primarily used for personal property rather than real estate, it serves a similar function in transferring ownership. Both documents facilitate the transfer of interest, although they apply to different types of assets.

- Lease Agreement: This document outlines the terms under which one party can use another party's property. Like a quitclaim deed, it involves the transfer of rights, but it does not convey ownership; instead, it grants temporary use.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters, including property transactions. While it doesn’t transfer ownership like a quitclaim deed, it can empower someone to execute a quitclaim deed on behalf of the property owner.

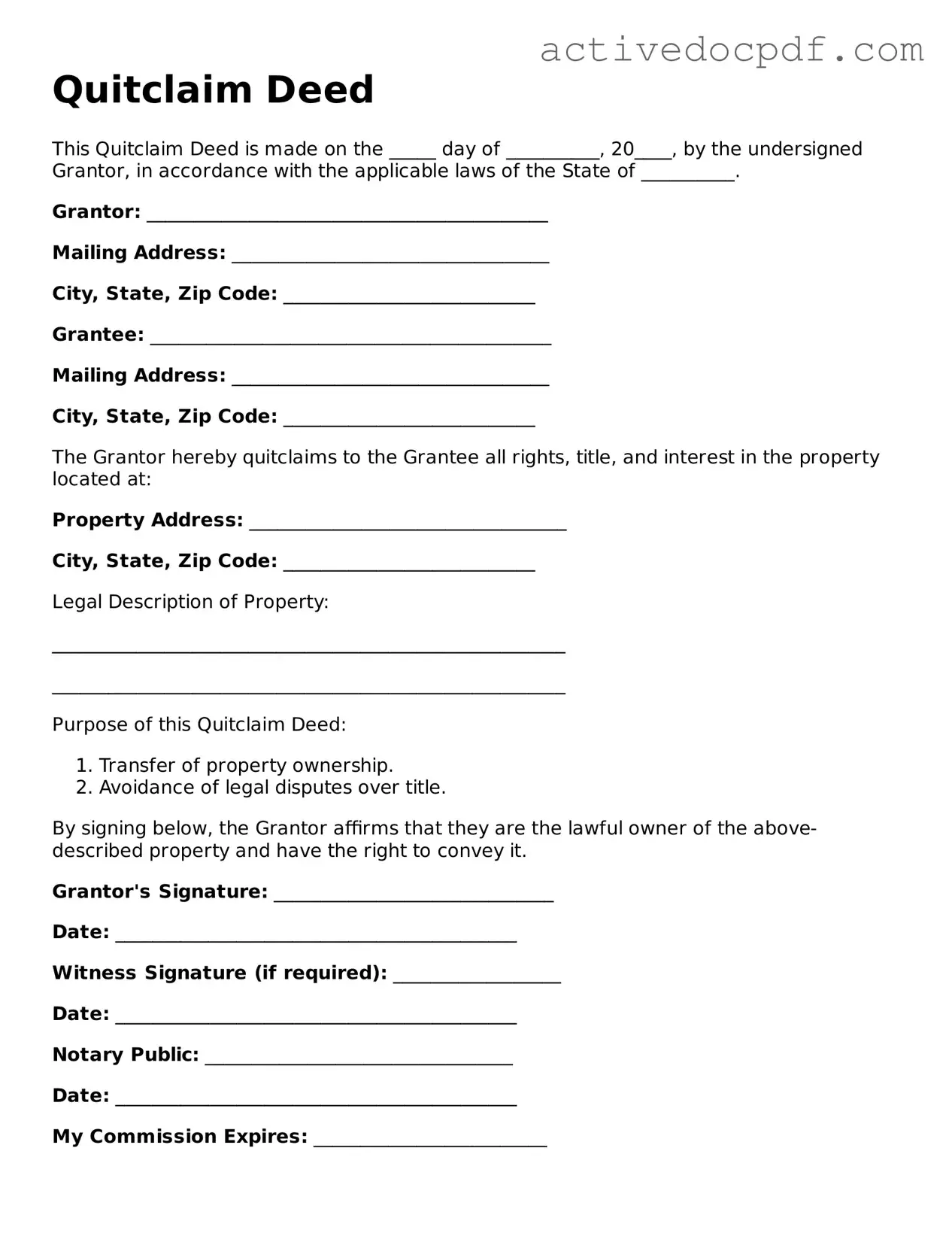

Guide to Filling Out Quitclaim Deed

After you have gathered the necessary information and documents, you can proceed to fill out the Quitclaim Deed form. This form is essential for transferring property ownership. Make sure to provide accurate details to ensure a smooth process.

- Obtain the Quitclaim Deed form: You can find this form online or at your local county clerk's office.

- Identify the parties: Clearly state the names of the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Provide property details: Include the legal description of the property. This information can typically be found on the property’s deed or tax records.

- Include the date: Write the date on which the transfer is taking place.

- Sign the form: The grantor must sign the form in the presence of a notary public. This step is crucial for the deed to be legally binding.

- Notarization: Have the notary public complete their section, confirming the identity of the grantor and witnessing the signature.

- File the deed: Submit the completed Quitclaim Deed form to the appropriate county office for recording. There may be a small fee associated with this process.

Once the Quitclaim Deed is filed, the transfer of property ownership will be recorded, making it official. It’s advisable to keep a copy of the recorded deed for your records.