Legal Real Estate Power of Attorney Template

Misconceptions

When it comes to the Real Estate Power of Attorney (POA) form, several misconceptions often arise. Understanding these can help clarify its purpose and proper use.

- A Power of Attorney is only for elderly individuals. This is not true. People of all ages can utilize a POA for various reasons, such as being out of town or needing assistance with complex transactions.

- A Real Estate Power of Attorney can only be used for buying and selling properties. This is a misconception. A POA can also grant authority for managing properties, handling leases, and dealing with repairs or renovations.

- Once a Power of Attorney is signed, it cannot be revoked. This is incorrect. A principal can revoke a POA at any time, as long as they are mentally competent. Proper procedures should be followed to ensure the revocation is legally recognized.

- The agent has unlimited power once appointed. This is misleading. The authority granted is specific to what is outlined in the POA document. The principal can limit the agent's powers as needed.

Being informed about these misconceptions can help individuals make better decisions when considering a Real Estate Power of Attorney.

Documents used along the form

When engaging in real estate transactions, several documents often accompany the Real Estate Power of Attorney form. These documents serve various purposes, ensuring that all legal and procedural requirements are met. Below is a list of commonly used forms and documents that may be relevant in conjunction with the Real Estate Power of Attorney.

- Property Deed: This document transfers ownership of real property from one party to another. It includes details about the property and the parties involved.

- Sales Agreement: A legally binding contract between the buyer and seller outlining the terms of the sale, including price and conditions for closing.

- Disclosure Statement: This form provides essential information about the property, including any known defects or issues that may affect its value.

- Title Insurance Policy: A document that protects the buyer and lender from potential disputes over property ownership and ensures clear title to the property.

- Closing Statement: A summary of the financial transactions involved in the sale, detailing costs, fees, and adjustments that occur at closing.

- Power of Attorney Form: This document is crucial for delegating authority to another individual to handle real estate matters. It can simplify transactions and ensure that your interests are protected, especially in situations where you may not be able to be present. For more information, you can visit https://documentonline.org/.

- Mortgage Agreement: A contract between the borrower and lender that outlines the terms of the loan used to purchase the property, including repayment terms and interest rates.

- Affidavit of Identity: A sworn statement confirming the identity of the parties involved in the transaction, often required to prevent fraud.

Each of these documents plays a critical role in the real estate process. Understanding their functions can help ensure a smoother transaction and safeguard the interests of all parties involved.

More Types of Real Estate Power of Attorney Templates:

California Durable Power of Attorney Form - This form is often used in advance planning for medical emergencies or serious health issues.

How to Revoke a Power of Attorney in California - This form helps clarify your intent to cancel prior legal agreements.

In addition to the Texas Power of Attorney form, individuals can explore various resources to better understand their options and ensure that they are making informed decisions about their legal and financial future. For instance, you can find detailed guidance and access to the necessary documents at https://texasformspdf.com/fillable-power-of-attorney-online/, which can simplify the process and provide clarity on the responsibilities involved.

Power of Attorney for Vehicle Transactions California - Allows for the delegating of vehicle registration changes to another person.

Key Details about Real Estate Power of Attorney

What is a Real Estate Power of Attorney?

A Real Estate Power of Attorney is a legal document that allows one person, known as the agent or attorney-in-fact, to act on behalf of another person, referred to as the principal, in real estate transactions. This document grants the agent the authority to make decisions regarding the buying, selling, or managing of real estate properties.

Why would someone need a Real Estate Power of Attorney?

There are several reasons why someone might choose to create a Real Estate Power of Attorney:

- Absence: If the principal is unable to be present for a real estate transaction due to travel, health issues, or other commitments.

- Convenience: It can simplify the process by allowing a trusted individual to handle transactions without needing the principal's direct involvement.

- Capacity: In cases where the principal may become incapacitated and unable to make decisions, this document ensures that their real estate matters are still managed effectively.

What powers does the agent have under this document?

The powers granted to the agent can vary based on the principal's wishes. Common powers include:

- Buying or selling real estate.

- Signing contracts and documents related to real estate transactions.

- Managing rental properties, including collecting rent and handling maintenance issues.

- Making decisions regarding mortgages or refinancing.

How is a Real Estate Power of Attorney created?

To create a Real Estate Power of Attorney, the principal must typically follow these steps:

- Choose a trusted individual to act as the agent.

- Draft the document, specifying the powers granted and any limitations.

- Sign the document in accordance with state laws, which may require witnesses or notarization.

Can the agent make decisions that are against the principal's wishes?

No, the agent is legally obligated to act in the best interest of the principal. They must adhere to the instructions laid out in the Real Estate Power of Attorney. If the agent acts outside these guidelines, they may be held accountable for any resulting damages.

Is a Real Estate Power of Attorney revocable?

Yes, the principal can revoke a Real Estate Power of Attorney at any time, as long as they are mentally competent. To do so, the principal should create a written revocation document and notify the agent and any relevant third parties, such as financial institutions or real estate agencies.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, the Real Estate Power of Attorney remains effective, allowing the agent to continue making decisions on their behalf. This is one of the key benefits of having this document in place. However, if the principal has not created a durable power of attorney, the agent's authority may end if the principal loses mental capacity.

Are there any risks associated with granting someone a Real Estate Power of Attorney?

Yes, there are potential risks. Choosing an untrustworthy agent could lead to misuse of power. It's crucial to select someone who is reliable and has the principal's best interests at heart. Additionally, the principal should clearly outline the powers granted to avoid any misunderstandings.

Similar forms

- General Power of Attorney: This document grants broad authority to an agent to act on behalf of a principal in various matters, including real estate transactions.

- Limited Power of Attorney: Similar to the Real Estate Power of Attorney, this document restricts the agent's authority to specific tasks or a particular timeframe.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated, ensuring that real estate decisions can still be made.

- Healthcare Power of Attorney: While focused on medical decisions, this document allows an agent to make health-related choices, similar to how a real estate agent makes property decisions.

- Financial Power of Attorney: This document enables an agent to manage financial affairs, which can include property management and real estate transactions.

- Living Will: Though primarily for healthcare decisions, it can indirectly affect real estate by outlining preferences for asset distribution in the event of incapacity.

- California Power of Attorney Form: This essential legal document ensures your decisions are honored, enabling you to Fill PDF Forms with ease, thus granting authority to an agent during times of incapacity.

- Trust Agreement: A trust can hold real estate assets, and the trustee acts similarly to an agent, managing the property according to the trust terms.

- Quitclaim Deed: This document transfers interest in real estate without warranties, allowing a principal to delegate property rights to an agent.

- Real Estate Listing Agreement: This agreement authorizes a real estate agent to market and sell property on behalf of the owner, paralleling the authority granted in a power of attorney.

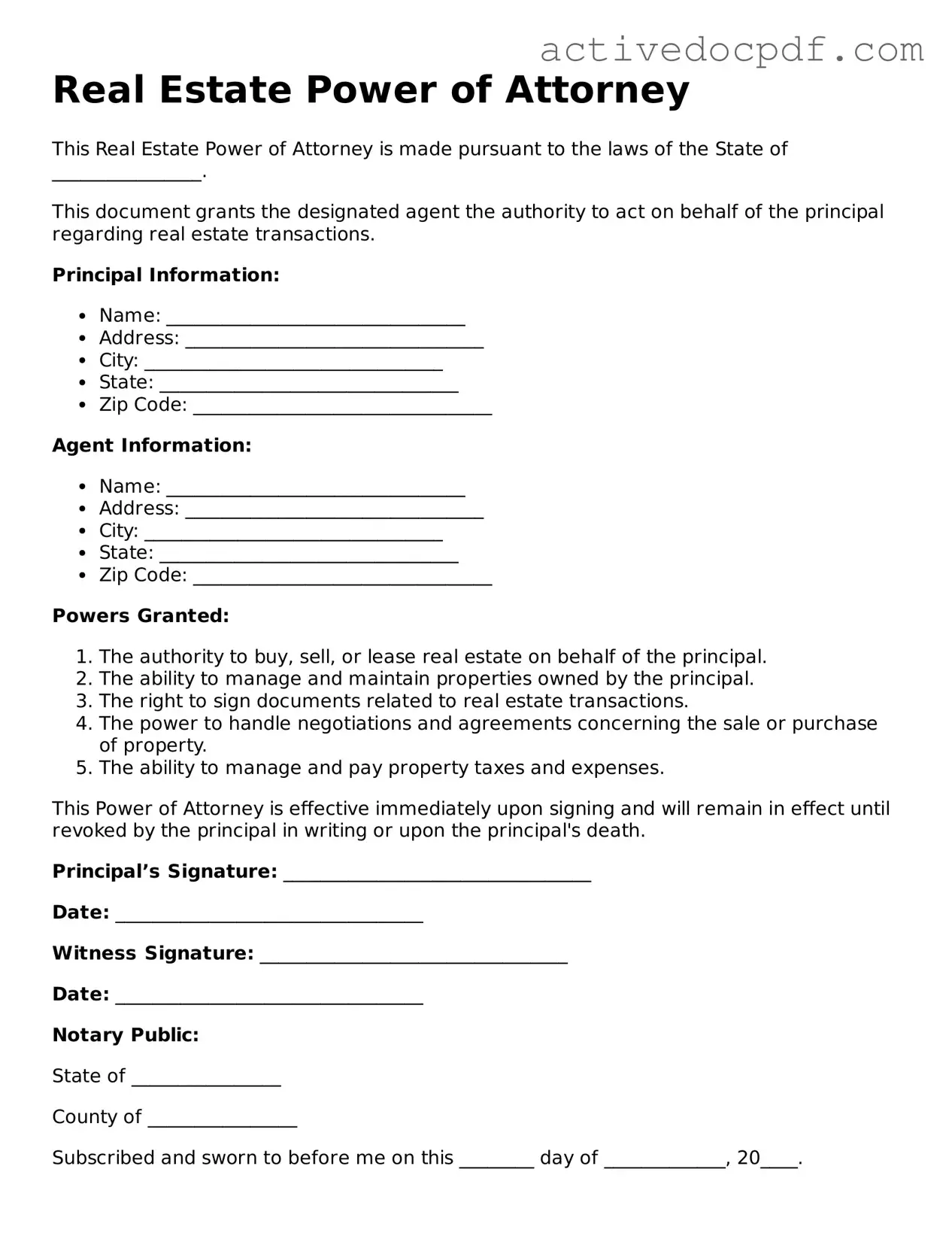

Guide to Filling Out Real Estate Power of Attorney

Filling out a Real Estate Power of Attorney form is an important step in designating someone to act on your behalf regarding real estate transactions. Once you have the form ready, you can proceed with filling it out accurately to ensure that your wishes are clearly communicated.

- Obtain the Form: Start by downloading or requesting a copy of the Real Estate Power of Attorney form from a reliable source.

- Identify the Principal: In the first section, write your full legal name and address as the person granting the power.

- Designate the Agent: Clearly state the name and address of the individual you are appointing as your agent. This person will act on your behalf.

- Define Powers Granted: Specify the powers you are granting. This could include buying, selling, or managing property. Be as detailed as necessary.

- Include Effective Dates: Indicate when the power of attorney will take effect and whether it will remain in effect until revoked or for a specific duration.

- Sign the Document: Sign the form in the designated area. Make sure your signature matches the name you provided at the beginning.

- Notarization: Have the document notarized. This step is crucial for ensuring that the form is legally binding.

- Distribute Copies: Once completed, provide copies of the signed and notarized document to your agent and keep a copy for your records.

By following these steps, you can confidently complete the Real Estate Power of Attorney form. This ensures that your real estate matters will be handled according to your wishes, even when you cannot be present.