Legal Real Estate Purchase Agreement Template

State-specific Guides for Real Estate Purchase Agreement Templates

Real Estate Purchase Agreement Document Categories

Misconceptions

When it comes to real estate transactions, the Real Estate Purchase Agreement (REPA) is a crucial document. However, several misconceptions surround it. Here are seven common misunderstandings about this important form:

-

It’s just a simple form. Many people believe that the REPA is a straightforward document that can be filled out in minutes. In reality, it contains numerous details that require careful consideration and understanding. Each clause serves a specific purpose and can significantly impact the transaction.

-

Only buyers need to sign it. Some individuals think that only the buyer’s signature is necessary for the agreement to be valid. However, both the buyer and seller must sign the REPA for it to be legally binding. Each party’s agreement is essential to the transaction.

-

It guarantees the sale will go through. A common misconception is that signing the REPA ensures the sale will be completed. While the agreement is a step toward finalizing the sale, it does not guarantee that all conditions will be met. Various contingencies can still lead to the deal falling through.

-

It’s the same in every state. Many people assume that the REPA is uniform across the United States. However, real estate laws vary by state, and so do the forms. It’s essential to use the appropriate form for the state in which the property is located.

-

It can’t be modified. Some believe that once the REPA is drafted, it cannot be changed. In truth, the agreement can be negotiated and modified before both parties sign it. Open communication is key to ensuring that the terms reflect the interests of both the buyer and the seller.

-

It’s only for residential properties. A misconception exists that the REPA is exclusively for residential real estate transactions. In reality, it can also be used for commercial properties, land sales, and other types of real estate transactions, depending on the specific needs of the parties involved.

-

Legal advice isn’t necessary. Many individuals think they can navigate the REPA without professional guidance. While it is possible to complete the form independently, consulting with a real estate attorney or agent can provide valuable insights and help avoid potential pitfalls.

Understanding these misconceptions can empower buyers and sellers, making the real estate process smoother and more informed. Always approach the Real Estate Purchase Agreement with careful consideration and, when in doubt, seek professional advice.

Documents used along the form

When engaging in a real estate transaction, the Real Estate Purchase Agreement is a crucial document. However, it is often accompanied by other forms and documents that help clarify the terms of the sale, ensure compliance with legal requirements, and protect the interests of all parties involved. Below is a list of commonly used documents that complement the Real Estate Purchase Agreement.

- Disclosure Statement: This document outlines any known issues with the property, such as structural problems, pest infestations, or environmental hazards. Sellers are typically required to provide this information to potential buyers to ensure transparency and avoid future disputes.

- Title Report: A title report is generated by a title company and details the legal ownership of the property. It identifies any liens, easements, or encumbrances that may affect the buyer's ability to take full ownership. This report is essential for ensuring that the buyer receives clear title to the property.

- Escrow Agreement: This document establishes the terms under which a neutral third party, known as an escrow agent, will hold funds and documents until all conditions of the sale are met. The escrow agreement protects both the buyer and seller by ensuring that the transaction proceeds smoothly and securely.

- Arizona Annual Report: As businesses operate, compliance with state regulations is essential, and filing the arizonapdfs.com/arizona-annual-report-template/ ensures transparency regarding their activities and financial status.

- Financing Addendum: If the buyer is obtaining a mortgage or other financing to purchase the property, a financing addendum may be included. This document outlines the terms of the financing, including the loan amount, interest rate, and any contingencies related to securing the loan.

Each of these documents plays a vital role in the overall transaction process. Understanding their purpose and implications can lead to a smoother and more successful real estate experience for all parties involved.

Fill out More Forms

Mobile Home Clipart - Provides peace of mind in the buying and selling process.

A New York Lease Agreement is a legally binding contract between a landlord and a tenant, outlining the terms and conditions for renting a residential property. This document details the rights and responsibilities of both parties, ensuring clarity and protecting their interests throughout the lease term. For those looking to enter into a rental arrangement, filling out the form is essential; you can find a reliable template at PDF Documents Hub.

Consolation Tournament - Each match in the bracket tests the skills and strategies of teams.

Key Details about Real Estate Purchase Agreement

What is a Real Estate Purchase Agreement?

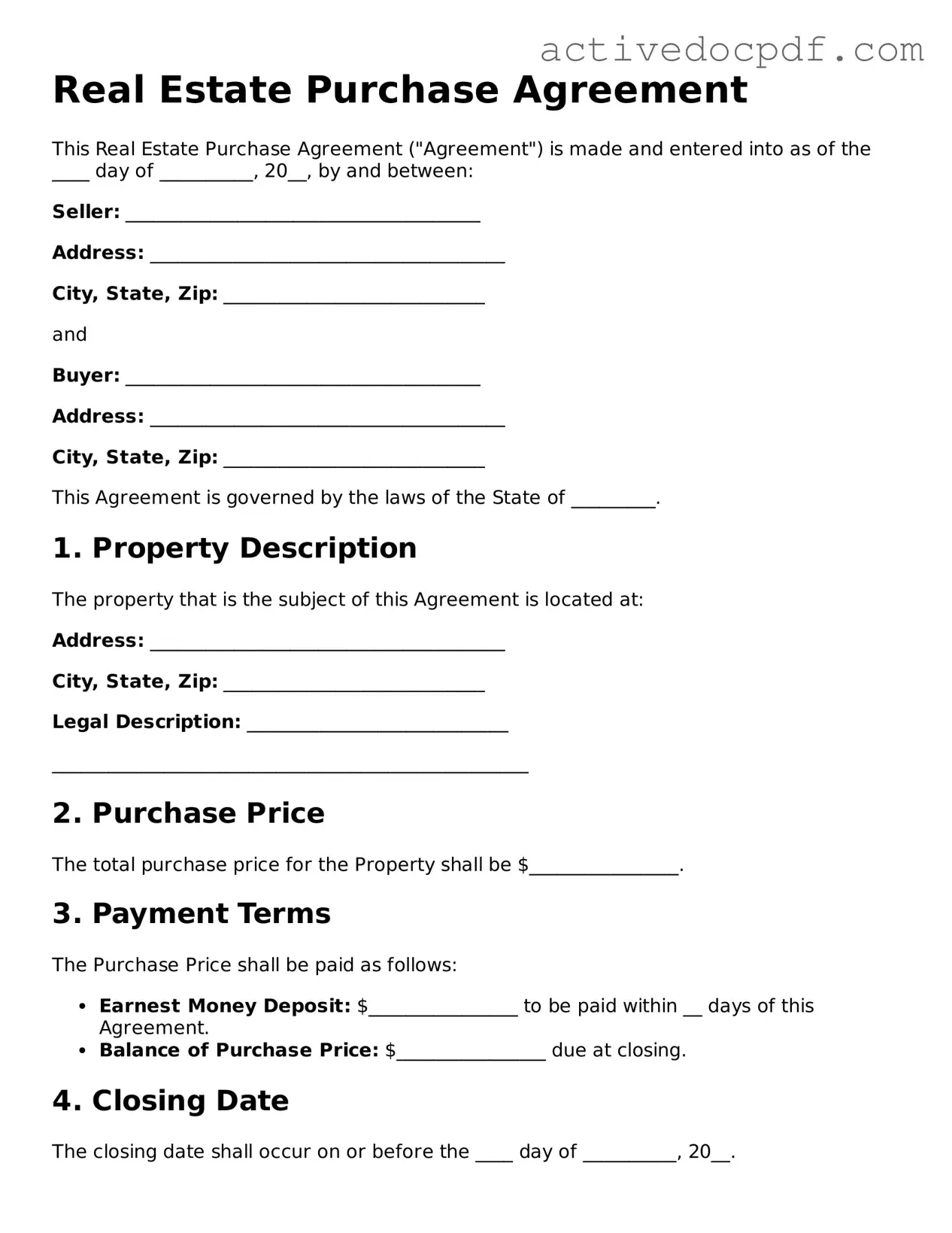

A Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement serves as a binding contract once both parties have signed it. It typically includes details such as the purchase price, closing date, and any contingencies that must be met before the sale can proceed.

What are the key components of a Real Estate Purchase Agreement?

Key components of a Real Estate Purchase Agreement often include:

- Parties Involved: Names and contact information of the buyer and seller.

- Property Description: A detailed description of the property being sold, including the address and any relevant legal descriptions.

- Purchase Price: The agreed-upon price for the property.

- Earnest Money: A deposit made by the buyer to demonstrate serious intent to purchase.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing or inspections.

- Closing Date: The date when the transaction will be finalized and ownership transferred.

Why is it important to have a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is crucial because it protects the interests of both the buyer and seller. It provides a clear outline of the expectations and obligations of each party, which can help prevent misunderstandings and disputes. Additionally, having a written agreement is often required by lenders when financing a home purchase.

Can a Real Estate Purchase Agreement be modified?

Yes, a Real Estate Purchase Agreement can be modified, but any changes must be agreed upon by both parties. Modifications should be documented in writing and signed by both the buyer and seller to ensure clarity and enforceability. This can include changes to the purchase price, closing date, or contingencies.

What happens if one party breaches the agreement?

If one party breaches the Real Estate Purchase Agreement, the other party may have several options. These can include:

- Seeking specific performance, which means asking the court to enforce the agreement.

- Claiming damages, which involves seeking financial compensation for losses incurred due to the breach.

- Terminating the agreement, if the breach is significant enough to justify ending the contract.

Is it necessary to have a lawyer review the Real Estate Purchase Agreement?

While it is not legally required to have a lawyer review the agreement, it is highly advisable. A lawyer can help ensure that the terms are fair and that all necessary legal protections are in place. They can also assist in identifying any potential issues that may arise during the transaction.

How long is a Real Estate Purchase Agreement valid?

The validity of a Real Estate Purchase Agreement depends on the terms outlined within the document itself. Typically, the agreement remains in effect until the transaction is completed, or until the specified closing date. If contingencies are included, the agreement may remain valid until those conditions are met or waived.

What should buyers do after signing the Real Estate Purchase Agreement?

After signing the Real Estate Purchase Agreement, buyers should take several important steps, including:

- Making the earnest money deposit as specified in the agreement.

- Scheduling any necessary inspections or appraisals.

- Securing financing if applicable.

- Reviewing any contingencies and ensuring they are addressed in a timely manner.

- Preparing for the closing process by gathering required documentation.

Similar forms

- Lease Agreement: This document outlines the terms under which a tenant can occupy a property. Like a Real Estate Purchase Agreement, it details the parties involved, property description, and payment terms.

- Option to Purchase Agreement: This allows a tenant the option to buy the property at a later date. Similar to a purchase agreement, it specifies the purchase price and conditions under which the sale can occur.

- Sales Contract: A sales contract for personal property includes terms for the sale of items other than real estate. It shares similarities in outlining the buyer, seller, and transaction details.

- Listing Agreement: This document is used between a property owner and a real estate agent. It outlines the agent’s responsibilities and the terms of sale, akin to the buyer-seller relationship in a purchase agreement.

- Escrow Agreement: This involves a third party holding funds or documents until conditions are met. It parallels the purchase agreement in ensuring that both parties fulfill their obligations before the transaction is completed.

- Durable Power of Attorney: Much like the documents in real estate transactions, a Durable Power of Attorney grants authority to another individual to make critical decisions on your behalf, ensuring you are protected even in incapacitation. For more information, you can visit https://texasformspdf.com/fillable-durable-power-of-attorney-online/.

- Joint Venture Agreement: When two or more parties collaborate to purchase real estate, this document outlines their roles and contributions, similar to the cooperative nature of a purchase agreement.

- Seller Financing Agreement: In cases where the seller provides financing to the buyer, this agreement details the terms of the loan. It resembles a purchase agreement in that it includes purchase price and payment terms.

- Title Transfer Document: This document is used to officially transfer ownership of the property. It is similar to a purchase agreement in that it confirms the change of ownership and related terms.

- Real Estate Option Agreement: This grants a buyer the right to purchase a property within a specified time frame. It includes terms similar to those found in a purchase agreement, such as price and conditions.

- Disclosure Agreement: This document requires sellers to disclose certain information about the property. It complements the purchase agreement by ensuring buyers are fully informed before finalizing the sale.

Guide to Filling Out Real Estate Purchase Agreement

After you have gathered the necessary information and documents, you're ready to fill out the Real Estate Purchase Agreement form. This document is essential for outlining the terms of the property sale, and completing it accurately is crucial for both buyers and sellers.

- Begin by entering the date at the top of the form. This marks when the agreement is being created.

- Next, provide the full names and contact information of both the buyer and the seller. Make sure to include addresses, phone numbers, and email addresses.

- Identify the property being sold. Include the full address, legal description, and any other identifying details to avoid confusion.

- Specify the purchase price. Clearly state the amount the buyer agrees to pay for the property.

- Outline the terms of payment. Indicate whether the payment will be made in cash, through financing, or other means.

- Detail any contingencies. If the sale depends on certain conditions being met, such as financing approval or a satisfactory inspection, list these here.

- Include the closing date. This is the date when the sale will be finalized and ownership transferred.

- Signatures are required. Both the buyer and seller must sign and date the agreement to make it legally binding.

- Consider having a witness or notary present. While not always necessary, having a third party can add an extra layer of validation to the agreement.

Once you have completed the form, review it carefully to ensure all information is accurate. After that, you can proceed with the next steps in the real estate transaction process, which may include negotiations, inspections, and finalizing financing.