Legal Release of Promissory Note Template

Misconceptions

Misconceptions about the Release of Promissory Note form can lead to confusion for individuals and businesses alike. Below are eight common misconceptions, along with clarifications to enhance understanding.

- It is only used in real estate transactions. Many believe that the Release of Promissory Note form is exclusive to real estate. In reality, it can be applicable in various types of loans, including personal loans and business financing.

- Once a promissory note is released, the debt is automatically forgiven. Some assume that the release signifies that the borrower no longer owes anything. However, the release merely indicates that the lender has relinquished their claim to the debt; any forgiveness must be explicitly stated.

- The form is unnecessary if payments have been made. Many think that as long as payments are made, a release is not needed. However, obtaining a release is essential to formally document that the debt has been satisfied.

- All lenders provide a Release of Promissory Note form. It is a misconception that every lender automatically issues this form. Borrowers should request it to ensure proper documentation of the transaction.

- The release can be verbal. Some individuals believe that a verbal agreement suffices for a release. In fact, a written release is critical for legal protection and clarity.

- Only the borrower needs to sign the release. There is a belief that only the borrower’s signature is required. In truth, both the lender and borrower should sign the release to validate the transaction.

- The form is standard and does not require customization. Many assume that the Release of Promissory Note form is a one-size-fits-all document. However, it may need to be tailored to reflect the specifics of the transaction and the parties involved.

- Once the release is filed, it cannot be revoked. Some think that a release is permanent and cannot be undone. While challenging, it is possible to contest a release under certain circumstances, especially if there was fraud or misrepresentation involved.

Understanding these misconceptions can help individuals navigate the complexities of financial agreements more effectively. Clear communication and proper documentation are essential in these matters.

Documents used along the form

The Release of Promissory Note form is an important document used to formally acknowledge that a debt has been paid or settled. It serves as proof that the borrower has fulfilled their obligation to the lender. In addition to this form, there are several other documents that are often used in conjunction with it. Below is a list of these documents, along with brief descriptions of each.

- Promissory Note: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any penalties for late payments.

- Loan Agreement: This is a comprehensive contract that details the rights and responsibilities of both the borrower and lender. It may include terms regarding collateral, default, and dispute resolution.

- Payment Receipt: A receipt serves as proof of payment made by the borrower to the lender. It includes details such as the amount paid, date of payment, and method of payment.

- Debt Settlement Agreement: This document outlines the terms under which a debt is settled for less than the full amount owed. It specifies the agreed-upon payment and any conditions that must be met.

- Release of Lien: If the loan was secured by collateral, this document releases the lender's claim on the collateral once the debt is paid in full.

- Affidavit of Payment: This is a sworn statement by the borrower confirming that they have paid the debt in full. It may be used in legal proceedings to prove payment.

- Promissory Note Form: For additional resources, you can find an editable template at NJ PDF Forms, which provides a convenient option for drafting and customizing your own promissory note.

- Credit Report Update Request: After the debt is settled, this request can be sent to credit reporting agencies to ensure that the borrower’s credit report reflects the updated status of the debt.

Each of these documents plays a vital role in the process of managing loans and debts. They help ensure clarity and protection for both parties involved in the transaction. Understanding these documents can aid in navigating financial agreements more effectively.

More Types of Release of Promissory Note Templates:

Simple Promissory Note - Contract detailing loan amount, interest, and repayment method.

A New York Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time. This legal document serves as a critical tool in various financial transactions, providing clarity and security for both lenders and borrowers. Understanding its structure and requirements can help individuals navigate their financial obligations effectively. For those seeking a template, you can find a helpful resource at nytemplates.com/blank-promissory-note-template.

Key Details about Release of Promissory Note

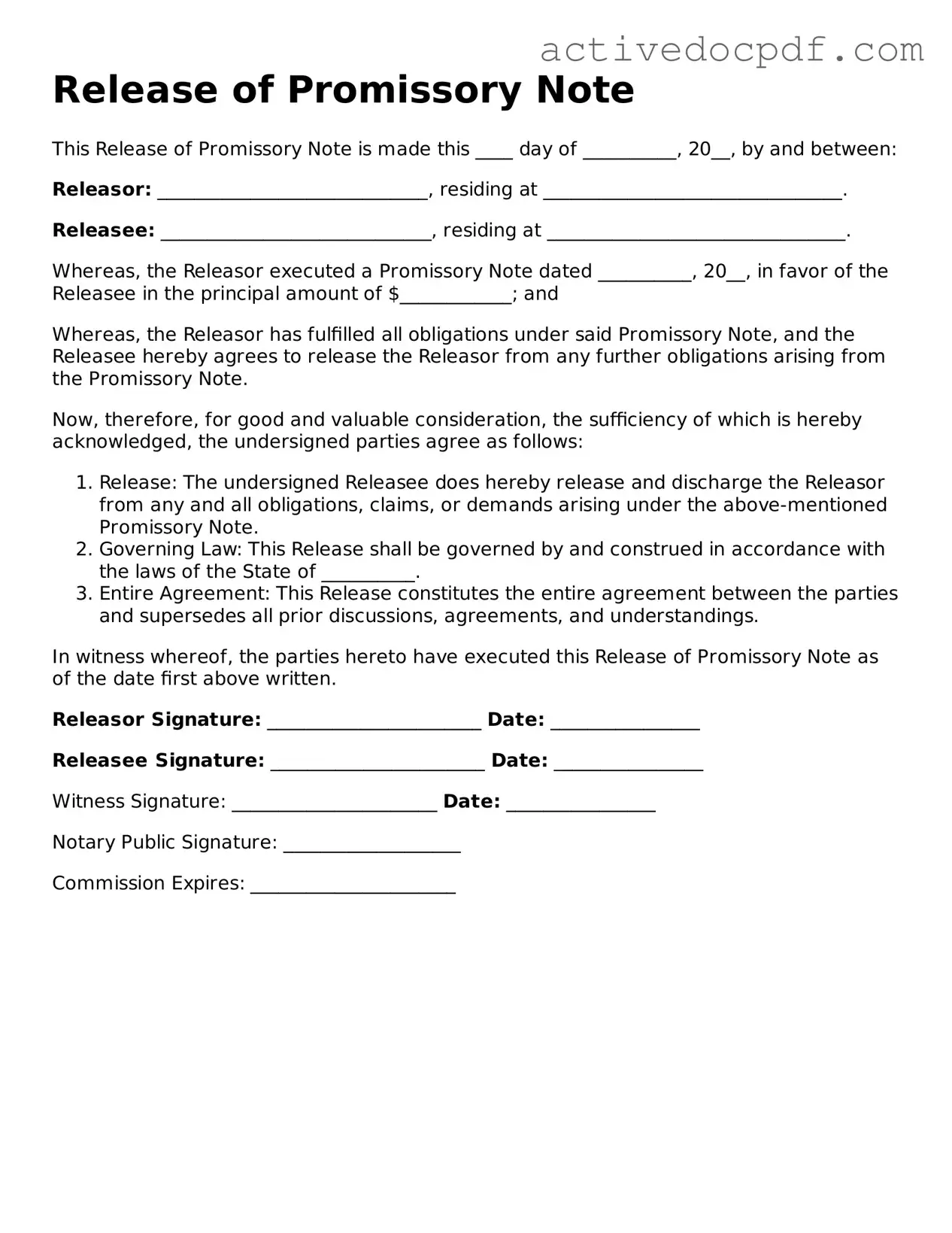

What is a Release of Promissory Note form?

A Release of Promissory Note form is a document used to formally acknowledge that a borrower has fulfilled their obligations under a promissory note. Once the borrower has repaid the loan in full, this form serves as proof that the lender releases any claims to the debt.

When should I use this form?

You should use the Release of Promissory Note form once the borrower has paid off the loan. This is important to prevent any future claims against the borrower regarding the debt. It provides clarity and peace of mind for both parties involved.

Who needs to sign the form?

The form should be signed by both the lender and the borrower. The lender confirms that the debt has been satisfied, while the borrower acknowledges the release of the obligation. In some cases, a witness or notary may also be required to ensure the document's validity.

What information is included in the form?

The form typically includes:

- The names and addresses of both the lender and the borrower

- The original loan amount and the date of the promissory note

- A statement confirming that the loan has been paid in full

- The date of the release

- Signatures of both parties

Is this form legally binding?

Yes, once signed, the Release of Promissory Note form is legally binding. It acts as a formal agreement between the lender and borrower, ensuring that the lender cannot make any further claims on the debt. It is advisable to keep a copy for your records.

Can I create my own Release of Promissory Note form?

While you can create your own form, it is recommended to use a standard template or consult with a legal professional. This ensures that all necessary information is included and that the document complies with state laws.

What if I lose the form after it’s signed?

If you lose the signed form, you can request a duplicate from the other party. It’s a good idea to keep multiple copies in a safe place. If necessary, you may also consider drafting a new release and having both parties sign it again.

Are there any fees associated with filing this form?

Generally, there are no fees for simply completing and signing the Release of Promissory Note form. However, if you choose to have the document notarized or filed with a government agency, there may be associated costs. Always check local regulations for any specific requirements.

What should I do if I have more questions?

If you have additional questions or need assistance, consider reaching out to a legal professional. They can provide guidance tailored to your specific situation and ensure you understand the implications of the release.

Similar forms

- Release of Lien: This document removes a lien from a property, similar to how a Release of Promissory Note clears the borrower’s obligation. Both documents signify the end of a financial obligation and provide assurance to the involved parties.

- Debt Settlement Agreement: This agreement outlines the terms under which a debtor settles a debt for less than the full amount owed. Like the Release of Promissory Note, it formalizes the conclusion of a financial obligation and prevents future claims on the settled debt.

- Mutual Release Agreement: This document releases both parties from any further claims against each other. It parallels the Release of Promissory Note in that it concludes obligations and liabilities, ensuring that neither party can pursue further legal action related to the original agreement.

- Waiver of Claims: This document allows a party to waive any future claims against another party. It functions similarly to the Release of Promissory Note by formally ending the potential for future disputes regarding the obligations outlined in the original agreement.

- Promissory Note: This essential document outlines the terms of a loan between a borrower and a lender, ensuring that the borrower's obligation to repay is clear and enforceable. To learn more about related forms, you can visit All Alabama Forms.

- Termination Agreement: This document terminates a contract between parties, effectively ending their obligations to each other. Like the Release of Promissory Note, it provides a clear conclusion to a financial relationship and protects both parties from future claims.

Guide to Filling Out Release of Promissory Note

After you have completed the Release of Promissory Note form, the next steps involve ensuring that all parties involved receive a copy of the document. This ensures that everyone is aware of the release and can keep it for their records. It's important to follow the instructions carefully to avoid any errors.

- Begin by entering the date at the top of the form. This should be the date you are filling out the document.

- Next, write the name of the lender or the party who originally issued the promissory note.

- Then, include the name of the borrower or the party who received the funds.

- In the designated space, provide the amount of the promissory note that is being released.

- Clearly state the reason for the release. This could be due to full payment, settlement, or another reason.

- Both parties should sign and date the form. Ensure that the signatures are legible.

- Finally, make copies of the signed document for all parties involved. Keep the original in a safe place.