Legal Rental Application Template

State-specific Guides for Rental Application Templates

Misconceptions

When it comes to rental applications, many people have misconceptions that can lead to confusion and frustration. Here are five common misunderstandings about rental application forms:

-

All rental applications are the same.

This is not true. Different landlords and property management companies may have unique requirements and questions. Always read the application carefully to understand what is needed.

-

You only need to provide your income information.

While income is important, rental applications typically require much more. Expect to provide personal details, rental history, references, and sometimes even a credit check.

-

Submitting an application guarantees you the rental.

Submitting an application does not guarantee approval. Landlords consider various factors, including credit history, rental history, and the number of applicants.

-

Your application will be processed immediately.

Processing times can vary significantly. Factors such as the landlord’s workload and the number of applications received can affect how quickly you hear back.

-

All information provided is kept confidential.

While landlords should keep your information private, there are instances where they may need to share it, especially with credit bureaus or in legal situations. Always ask about their privacy policies.

Understanding these misconceptions can help you navigate the rental application process more effectively. Being informed allows you to prepare better and increases your chances of securing your desired rental property.

Documents used along the form

When applying for a rental property, a Rental Application form is just one piece of the puzzle. Several other documents often accompany this application to provide a comprehensive view of a potential tenant's qualifications. Here are four commonly used forms that can help landlords make informed decisions.

- Credit Report: This document provides a detailed account of an applicant's credit history, including their credit score, outstanding debts, and payment history. Landlords use it to assess the financial reliability of the applicant.

- Operating Agreement: Having an Operating Agreement in place is essential for LLCs, as it delineates the management structure and operational procedures clearly. You can easily draft one using templates available at PDF Documents Hub.

- Background Check: A background check reveals any criminal history or eviction records. This helps landlords ensure that they are renting to individuals who have a responsible history.

- Proof of Income: This may include pay stubs, tax returns, or bank statements. It serves to verify that the applicant has a stable income and can afford the rent.

- Rental History: This document outlines the applicant's previous rental experiences, including contact information for past landlords. It helps landlords gauge the applicant's reliability as a tenant.

By gathering these documents along with the Rental Application, landlords can make more informed decisions and create a safer rental environment for everyone involved.

More Types of Rental Application Templates:

Hunting Lease Agreement Pdf - Addresses the issue of illegal hunting or trespassing on the property.

The California Boat Bill of Sale form is essential for anyone looking to buy or sell a watercraft, as it provides a clear and legal record of the transaction. This document not only confirms the sale but also helps both parties understand their rights and responsibilities. To get started with your boat sale, make sure to download the necessary Boat Bill of Sale form for a smooth process.

How to Write an End of Tenancy Letter - Helps to ensure all parties are on the same page.

Key Details about Rental Application

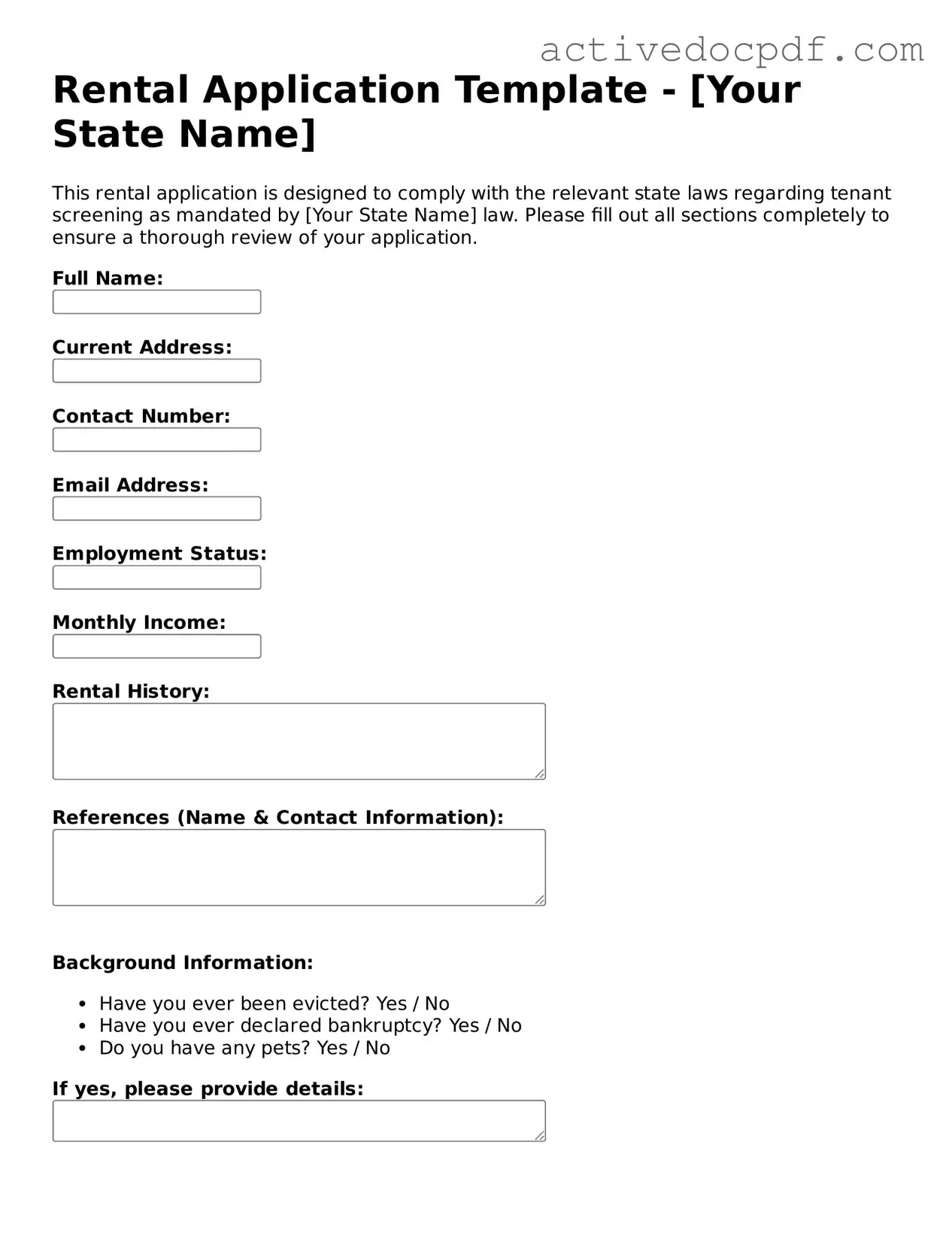

What is a Rental Application form?

A Rental Application form is a document that potential tenants fill out to apply for a rental property. This form helps landlords or property managers gather essential information about applicants, including their rental history, employment status, and personal references. By reviewing this information, landlords can make informed decisions about who to rent their property to.

What information do I need to provide on the Rental Application?

When completing a Rental Application, you will typically need to provide the following information:

- Personal Information: Your full name, contact information, and Social Security number.

- Rental History: Details about your previous addresses, including landlord contact information and the duration of your stay.

- Employment Information: Your current employer's name, your position, and income details.

- References: Personal or professional references who can vouch for your character and reliability.

- Financial Information: Information about your credit history, bank accounts, and any other relevant financial details.

Why is my credit history important for the Rental Application?

Your credit history plays a crucial role in the rental application process. Landlords use it to assess your financial responsibility and reliability as a tenant. A good credit score can demonstrate that you pay your bills on time and manage your finances well. Conversely, a poor credit score may raise concerns for landlords about your ability to pay rent consistently. It's a good idea to check your credit report before applying to ensure there are no surprises.

How long does the rental application process take?

The rental application process can vary depending on several factors, such as the landlord's or property manager's policies, the number of applications they receive, and how quickly they can verify the information provided. Generally, it can take anywhere from a few days to a week. To speed up the process, ensure that you provide complete and accurate information and respond promptly to any requests for additional documentation.

What happens after I submit my Rental Application?

Once you submit your Rental Application, the landlord or property manager will review it. They may conduct background and credit checks, contact your references, and verify your employment and rental history. After completing this process, they will typically inform you of their decision. If approved, you will receive further instructions regarding the lease agreement and any required deposits. If denied, you may request information about the reasons for the denial.

Similar forms

Lease Agreement: This document outlines the terms and conditions under which a tenant may occupy a rental property. Like the rental application, it requires personal information and financial details to assess the tenant's suitability.

Background Check Authorization: Similar to a rental application, this document grants permission to landlords to conduct background checks, including criminal history and credit reports, to evaluate potential tenants.

Employment Verification Form: This form collects information about a tenant's employment status and income, much like the rental application, which seeks to confirm the applicant's financial stability.

Credit Application: A credit application assesses an applicant's creditworthiness. It shares similarities with the rental application in that both require financial information to determine the risk involved in renting to the applicant.

Tenant Screening Report: This report compiles various data points about an applicant, including credit history and rental history, paralleling the information requested in a rental application.

- ATV Bill of Sale: A crucial document for buying or selling an all-terrain vehicle in California, ensuring transparency in the transaction. For more details, refer to the Bill of Sale for a Quad.

Guarantor Application: When a tenant requires a guarantor, this document is filled out to assess the guarantor’s financial stability. It mirrors the rental application by gathering similar financial information.

Pet Application: If a property allows pets, this application collects information about the pet and the owner's ability to care for it. It functions similarly to the rental application by evaluating the applicant's responsibility.

Rental History Verification: This document confirms a tenant's previous rental experiences. It complements the rental application by providing additional context about the applicant's past behavior as a tenant.

Move-in Checklist: Although primarily used after acceptance, this checklist details the condition of the property at move-in. It relates to the rental application by emphasizing the importance of maintaining property standards.

Guide to Filling Out Rental Application

Once you have the Rental Application form, you will need to complete it accurately to ensure a smooth process. Follow these steps to fill out the form correctly.

- Start with your personal information. Fill in your full name, current address, phone number, and email address.

- Provide details about your employment. Include your employer's name, your job title, and your monthly income.

- List your rental history. Include previous addresses, the names of landlords, and the duration of each tenancy.

- Disclose any additional sources of income, if applicable. This may include alimony, child support, or other financial support.

- Complete the section on references. Include names and contact information for personal or professional references.

- Answer any questions regarding your credit history and background. Be honest and provide any necessary explanations.

- Review the form for accuracy. Make sure all information is correct and complete.

- Sign and date the application. This indicates that the information provided is true to the best of your knowledge.

After completing the form, you may need to submit it along with any required documentation, such as proof of income or identification. Be sure to check the specific requirements of the landlord or property management company.