Free Sample Tax Return Transcript PDF Form

Misconceptions

Understanding the Sample Tax Return Transcript form is essential for taxpayers, yet several misconceptions can lead to confusion. Here are six common misunderstandings:

- It shows real-time account activity. Many people believe that the transcript reflects ongoing changes to their tax account. In reality, it only displays the information as it was reported on the tax return and does not include subsequent adjustments or activities.

- It contains all tax-related information. Some assume that the transcript provides a complete picture of their tax situation. However, it primarily summarizes key data from the filed return, omitting details like supporting documents or additional correspondence with the IRS.

- It is the same as a tax return. A common misconception is that the transcript is equivalent to the actual tax return. While it summarizes the return, it does not replace the original document and may lack certain details that the full return contains.

- It can be used for loan applications. Many believe that the transcript can serve as a valid substitute for a tax return when applying for loans. Lenders often require the full tax return, as it includes necessary details that the transcript may not provide.

- It is only for individuals. Some think the transcript is exclusively for individual taxpayers. In fact, businesses and other entities can also request transcripts to verify their tax information.

- It is difficult to obtain. There is a belief that getting a transcript is a complicated process. In truth, taxpayers can easily request it online, by mail, or through their tax preparer, making it a straightforward task.

Clarifying these misconceptions can help taxpayers navigate their tax responsibilities more effectively and understand the purpose of the Sample Tax Return Transcript.

Documents used along the form

When filing taxes or dealing with tax-related matters, various forms and documents may be required alongside the Sample Tax Return Transcript. Each of these documents serves a specific purpose in providing information to the IRS or other relevant parties. Below is a list of commonly used forms that may accompany the Sample Tax Return Transcript.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers to report their annual income and calculate their tax liability.

- Form W-2: Employers use this form to report wages paid to employees and the taxes withheld from them during the year.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips, such as freelance work or interest income.

- Schedule C: Self-employed individuals use this form to report income and expenses from their business activities.

- Schedule A: Taxpayers use this form to itemize deductions, such as mortgage interest, property taxes, and charitable contributions.

- Articles of Incorporation: When establishing a corporation in California, it's essential to file the Incorporation Document to outline your business’s name, purpose, and initial directors, laying the groundwork for your legal entity.

- Form 8862: This form is used to claim the Earned Income Tax Credit (EITC) after it has been denied in a previous year.

- Form 4868: This is the application for an automatic extension of time to file an individual income tax return.

- Form 8888: Taxpayers use this form to allocate their tax refund to multiple accounts or to purchase U.S. savings bonds.

- Form 4506-T: This form allows taxpayers to request a transcript of their tax return from the IRS.

- Form 1040-X: This is the amended U.S. individual income tax return form used to correct errors on a previously filed return.

These forms and documents are essential for accurately reporting income, claiming deductions, and ensuring compliance with tax laws. Having them organized can help streamline the tax filing process and address any issues that may arise.

Check out Popular Documents

Example of No Trespass Letter - It is important to provide an accurate description of the property in question.

For those navigating rental agreements, understanding the necessary components of a well-structured Lease Agreement form can greatly enhance the renting experience. To learn more about the specific details required, visit the resource that provides a comprehensive overview of the Lease Agreement form essentials: comprehensive guide to Lease Agreement forms.

Uscis I864 - The I-864 form must be submitted to USCIS as part of the immigration application package.

Complaint for Divorce Form Michigan - The Defendant's name and contact information must also be provided.

Key Details about Sample Tax Return Transcript

What is a Sample Tax Return Transcript?

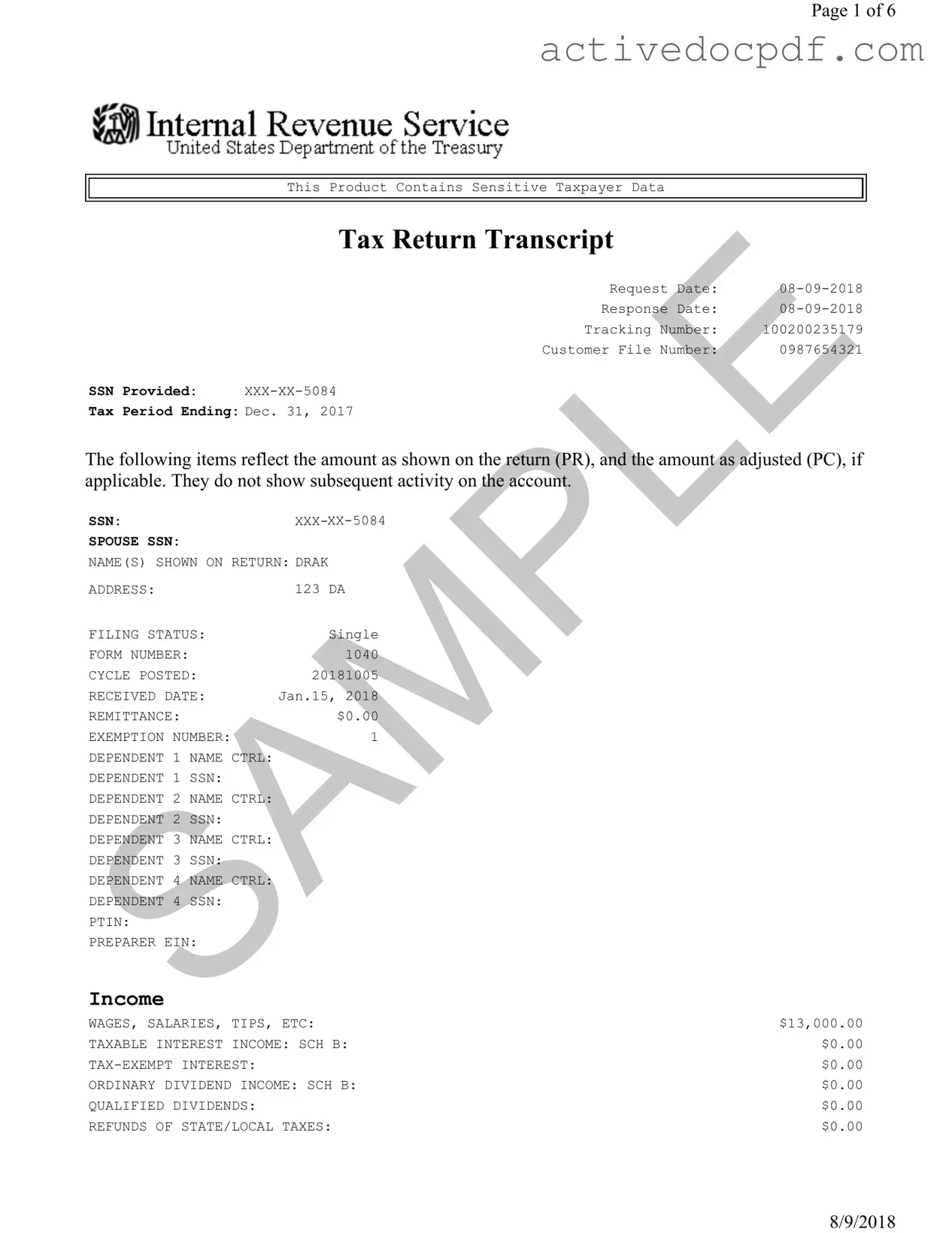

A Sample Tax Return Transcript is a document that summarizes key information from a taxpayer's tax return. It includes details such as income, deductions, and tax credits. This transcript is useful for individuals who need to verify their income or tax filing status for purposes like applying for loans or financial aid.

How can I obtain a Sample Tax Return Transcript?

You can request a Sample Tax Return Transcript through the IRS website, by mail, or by phone. To request online, you will need to create an account on the IRS website. Alternatively, you can fill out Form 4506-T and send it to the IRS to receive a transcript by mail. Make sure to provide your Social Security Number and other identifying information.

What information is included in the Sample Tax Return Transcript?

The transcript includes various details from your tax return, such as:

- Your filing status

- Income amounts from wages, business income, and other sources

- Deductions and credits claimed

- Adjusted Gross Income (AGI)

- Tax liabilities and payments

This information helps you understand your tax situation and can assist in future filings or applications.

Why might I need a Sample Tax Return Transcript?

A Sample Tax Return Transcript can be required for several reasons, including:

- Applying for a mortgage or loan

- Filing for financial aid for education

- Verifying income for government assistance programs

Having this document can simplify the process of proving your income and tax history.

Is the Sample Tax Return Transcript the same as my full tax return?

No, a Sample Tax Return Transcript is not the same as your full tax return. It is a summary that does not include all the details found in your complete tax return. If you need more specific information, you may need to refer to your actual tax return documents.

How long does it take to receive a Sample Tax Return Transcript?

If you request your transcript online, you may receive it immediately. However, if you request it by mail, it can take up to 10 business days for the IRS to process your request and send it to you. Be sure to plan ahead if you need the transcript by a specific date.

Are there any fees associated with obtaining a Sample Tax Return Transcript?

No, there are no fees for obtaining a Sample Tax Return Transcript from the IRS. This service is provided at no cost to taxpayers. Just ensure that you have the necessary information to make your request.

Similar forms

- Tax Return Transcript: This document provides a summary of your tax return information as filed with the IRS. It includes details about income, deductions, and credits, similar to the Sample Tax Return Transcript.

- W-2 Form: This form reports wages paid to employees and the taxes withheld. It is often used to verify income and tax withholdings, much like the income details found in the Sample Tax Return Transcript.

- 1099 Form: Issued for various types of income other than wages, salaries, or tips, this form is used to report income that may also appear in the Sample Tax Return Transcript.

- Form 1040: This is the standard individual income tax return form. It contains detailed information about income, deductions, and credits, similar to the information summarized in the Sample Tax Return Transcript.

- Operating Agreement: This essential document delineates the management structure and operational procedures for an LLC, mitigating conflicts among members. To create your Operating Agreement seamlessly, you can utilize resources like PDF Documents Hub.

- Schedule C: Used by self-employed individuals to report income and expenses from a business, this schedule provides detailed financial information that can be reflected in the Sample Tax Return Transcript.

- IRS Account Transcript: This document shows your tax account activity, including payments and adjustments. It provides a broader view of your tax situation, similar to what is summarized in the Sample Tax Return Transcript.

Guide to Filling Out Sample Tax Return Transcript

Completing the Sample Tax Return Transcript form is a crucial step in understanding your financial situation. This form contains sensitive taxpayer data, so it’s important to fill it out accurately and securely. Follow the steps below to ensure you provide the necessary information correctly.

- Gather Your Information: Collect all relevant documents, including your Social Security Number (SSN), spouse’s SSN (if applicable), and any income statements.

- Fill in Your Personal Details: Start by entering your name, address, and filing status. Ensure that the information matches what is on your tax return.

- Enter Your Tax Period: Specify the tax period ending date, which is typically December 31 of the tax year you are reporting.

- Input Income Details: Fill in the income sections, including wages, salaries, tips, and any other relevant income sources.

- Adjustments to Income: If applicable, enter any adjustments to your income, such as self-employment tax deductions or educator expenses.

- Calculate Your Adjusted Gross Income: This is done by subtracting your adjustments from your total income.

- Complete Tax and Credits Section: Fill in the necessary tax credits and deductions, including any standard deductions you qualify for.

- Detail Other Taxes: If you have additional taxes, such as self-employment tax, be sure to include them in this section.

- Record Payments: Document any federal income tax withheld, estimated tax payments, and any other credits that apply.

- Determine Amount Owed or Refund: Calculate whether you owe taxes or if you are due a refund based on the information provided.

- Complete Third Party Designee Section: If you wish to authorize someone else to discuss your tax return with the IRS, fill in their details here.

After filling out the form, review it carefully for any errors or omissions. Ensure that all figures are accurate and that you have provided all required information. Once confirmed, you can proceed with the next steps in managing your tax obligations or seeking further assistance if needed.