Legal Single-Member Operating Agreement Template

Misconceptions

Understanding the Single-Member Operating Agreement is essential for anyone operating a single-member LLC. Here are ten common misconceptions about this important document:

- It is not necessary for single-member LLCs. Many believe that a single-member operating agreement is optional. However, having one can help clarify ownership and management structure.

- It is a public document. Some think that operating agreements must be filed with the state. In reality, they are private documents that do not need to be publicly disclosed.

- It must be filed with the state. This is incorrect. The operating agreement is an internal document and does not require state filing.

- It has to be complicated. Many assume that an operating agreement must be complex. In fact, it can be simple and still effectively outline the necessary details.

- It cannot be changed. Some believe that once an operating agreement is created, it cannot be amended. This is false; it can be updated as needed.

- It only covers financial matters. While financial details are important, the agreement also addresses management roles, decision-making processes, and other operational aspects.

- It is the same as a business plan. An operating agreement is not a business plan. The former focuses on internal operations, while the latter outlines business strategy and goals.

- All states have the same requirements. People often think that operating agreements are uniform across states. However, requirements can vary significantly by state.

- It is only for legal protection. While it does provide legal protection, the agreement also serves as a roadmap for business operations and decision-making.

- Only lawyers can draft it. Many believe that only legal professionals can create an operating agreement. However, anyone can draft one, though legal advice can be beneficial.

Clearing up these misconceptions can help ensure that single-member LLC owners understand the value and importance of an operating agreement.

Documents used along the form

The Single-Member Operating Agreement is an essential document for individuals who own a single-member limited liability company (LLC). It outlines the management structure and operational guidelines for the business. Several other documents often accompany this agreement to ensure comprehensive business management and compliance. Below is a list of related forms and documents that may be beneficial.

- Articles of Organization: This document is filed with the state to officially create the LLC. It includes basic information such as the company name, address, and registered agent.

- Operating Agreement: This document is integral to outline the management structure and operational procedures of the LLC, ensuring clarity in ownership responsibilities and helping to prevent misunderstandings. For more resources, visit PDF Documents Hub.

- Employer Identification Number (EIN): An EIN is obtained from the IRS and is necessary for tax purposes. It allows the LLC to hire employees and open a business bank account.

- Membership Certificate: This certificate serves as proof of ownership for the single member. It may be used for record-keeping and to verify ownership in various transactions.

- Bylaws: Although not always required, bylaws outline the rules and procedures for the operation of the LLC. They can help clarify roles and responsibilities.

- Business License: Depending on the business type and location, a license may be required to operate legally. This document ensures compliance with local regulations.

- Operating Procedures: This document details the day-to-day operations of the business. It can include policies on finances, employee management, and customer service.

- Annual Report: Many states require LLCs to file an annual report. This document updates the state on the business's status and any changes to its structure or operations.

Having these documents in place can help streamline operations and ensure compliance with state and federal regulations. Proper documentation supports the smooth functioning of the LLC and protects the owner's interests.

More Types of Single-Member Operating Agreement Templates:

How to Set Up an Operating Agreement for Llc - A vital tool for any business with multiple stakeholders involved.

In addition to the essential details outlined in the California Operating Agreement form, which serves as a blueprint for your LLC’s functionality and member responsibilities, you can further enhance your understanding and compliance by accessing additional resources available at https://califroniatemplates.com/fillable-operating-agreement.

Key Details about Single-Member Operating Agreement

What is a Single-Member Operating Agreement?

A Single-Member Operating Agreement is a legal document that outlines the management structure and operating procedures for a limited liability company (LLC) with one owner. This agreement helps define the relationship between the owner and the business, even if there is only one member involved.

Why is a Single-Member Operating Agreement important?

This agreement is important for several reasons:

- It provides clarity on how the business will operate.

- It helps protect the owner's personal assets by reinforcing the limited liability status of the LLC.

- It can assist in avoiding disputes by clearly outlining the owner's rights and responsibilities.

- It may be required by banks or investors when opening a business account or seeking financing.

What should be included in a Single-Member Operating Agreement?

A comprehensive Single-Member Operating Agreement typically includes the following sections:

- Business name and address

- Purpose of the LLC

- Management structure

- Owner's rights and responsibilities

- Financial arrangements, including profit distribution

- Procedures for amending the agreement

Do I need a lawyer to create a Single-Member Operating Agreement?

While it is not legally required to have a lawyer draft this agreement, consulting with one can be beneficial. A lawyer can ensure that the document complies with state laws and meets your specific business needs. However, many templates are available online for those who prefer to create the agreement independently.

How does a Single-Member Operating Agreement affect taxes?

The Single-Member Operating Agreement itself does not directly affect taxes. However, it establishes the LLC as a separate entity, which can provide tax benefits. Single-member LLCs are typically treated as pass-through entities for tax purposes, meaning profits and losses are reported on the owner's personal tax return.

Can I change my Single-Member Operating Agreement after it is created?

Yes, you can change your Single-Member Operating Agreement after it is created. The process for making amendments should be outlined in the agreement itself. Typically, the owner can simply draft a new version of the agreement or modify the existing one, ensuring that all changes are documented and dated.

Similar forms

- Multi-Member Operating Agreement: This document is similar because it outlines the management structure and operational procedures for a business with multiple owners. Both agreements define roles and responsibilities, but the multi-member version includes provisions for multiple members, while the single-member version focuses solely on one owner.

- Bylaws: Bylaws serve as the internal rules for a corporation. Like a Single-Member Operating Agreement, they provide guidelines on how the business should be run. However, bylaws typically apply to corporations, while the operating agreement is specific to LLCs.

- Operating Agreement Form: To ensure a well-structured business and protect member interests, consider filling out the Texas Operating Agreement form available at texasformspdf.com/fillable-operating-agreement-online/.

- Partnership Agreement: This document governs the relationship between partners in a business. Similar to the Single-Member Operating Agreement, it outlines the roles, responsibilities, and profit-sharing arrangements. The key difference is that a partnership agreement involves two or more individuals, while the operating agreement is for a single owner.

- Business Plan: A business plan outlines the goals and strategies of a business. While it is broader in scope, it shares similarities with a Single-Member Operating Agreement by detailing how the business will operate and grow. Both documents are essential for guiding business decisions.

- Articles of Organization: This document is necessary for forming an LLC. It is similar to the Single-Member Operating Agreement in that both are essential for establishing the legal framework of the business. The Articles of Organization create the LLC, while the operating agreement governs its operations.

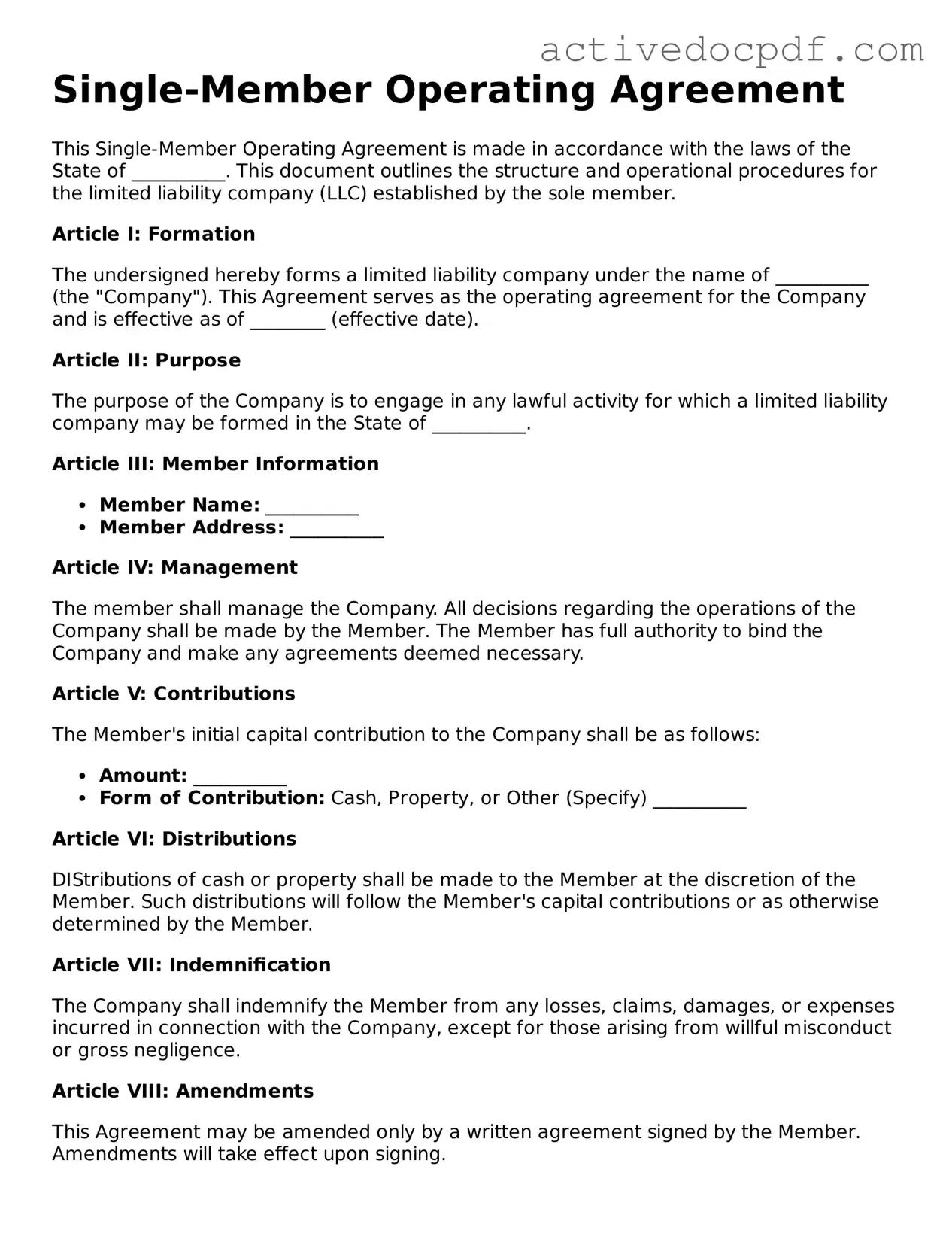

Guide to Filling Out Single-Member Operating Agreement

Completing the Single-Member Operating Agreement form is a crucial step in establishing the framework for your business. This document will help clarify the management structure and operational guidelines for your single-member entity. Follow the steps below to ensure that you fill out the form accurately and effectively.

- Begin with the title section. Write "Single-Member Operating Agreement" at the top of the form.

- Enter your name as the sole member of the LLC in the designated space.

- Provide the name of your business. This should match the name registered with the state.

- Include the principal office address of your business. Make sure this is a physical address, not a P.O. Box.

- State the date on which the agreement is being executed.

- Outline the purpose of the business. This can be a brief description of the nature of your business activities.

- Specify the management structure. Indicate whether you will manage the LLC yourself or appoint someone else.

- Detail the financial arrangements. Include information on how profits and losses will be allocated.

- Sign and date the agreement at the bottom. Ensure that your signature is clear and legible.

Once you have completed these steps, review the document for accuracy. It's advisable to keep a copy for your records and consider consulting a legal professional to ensure compliance with state laws.