Free Stock Transfer Ledger PDF Form

Misconceptions

The Stock Transfer Ledger form is a critical document for corporations managing their stock issuance and transfers. However, several misconceptions exist regarding its purpose and use. Below are six common misconceptions:

- It is only for large corporations. Many believe that only large corporations need a Stock Transfer Ledger. In reality, any corporation that issues stock, regardless of size, should maintain this document to track ownership and transfers.

- It is not legally required. Some assume that maintaining a Stock Transfer Ledger is optional. However, it is often a legal requirement for corporations to keep accurate records of stock ownership and transfers to comply with state regulations.

- Only the original stockholders are recorded. There is a misconception that only initial stockholders are documented. The ledger actually records all stockholders, including those who acquire shares through transfer, ensuring a complete history of ownership.

- It is only necessary during stock transfers. Many think the ledger is only relevant at the time of a transfer. In fact, it should be updated regularly to reflect any changes in stock ownership, including new issuances and cancellations.

- It does not need to be updated frequently. Some believe that the ledger can be updated infrequently. However, timely updates are essential to maintain accurate records, especially after any stock transactions.

- It is the same as a stock certificate. There is confusion between the Stock Transfer Ledger and stock certificates. The ledger is a record of ownership and transfers, while stock certificates serve as physical proof of ownership for stockholders.

Understanding these misconceptions can help ensure proper management of stock records and compliance with legal requirements.

Documents used along the form

The Stock Transfer Ledger form is an essential document for tracking the issuance and transfer of shares within a corporation. Several other forms and documents complement the Stock Transfer Ledger to ensure accurate record-keeping and compliance with regulations. Below is a list of commonly used documents.

- Stock Certificate: This document serves as proof of ownership of shares in a corporation. It includes details such as the stockholder's name, the number of shares owned, and the corporation's name.

- Shareholder Agreement: This agreement outlines the rights and responsibilities of shareholders. It may include provisions regarding the transfer of shares and the management of the corporation.

- Board Resolution: A formal document that records decisions made by the board of directors. It may authorize the issuance or transfer of shares and must be kept on file for corporate records.

- Stock Power Form: This form allows a stockholder to transfer ownership of shares to another party. It typically requires the signature of the current owner and details about the shares being transferred.

- Form 1099-DIV: This tax form reports dividends and distributions to shareholders. It is issued by the corporation to shareholders and must be filed with the IRS.

- Ownership Transfer Certificate: This document is crucial for legally documenting the transfer of ownership of personal property. Refer to the Ownership Transfer Certificate for detailed guidance on completing this form effectively.

- Corporate Bylaws: These rules govern the internal management of the corporation. They may include provisions regarding the issuance and transfer of shares.

- Annual Report: A document that provides an overview of the corporation’s financial performance and operations over the past year. It may include information relevant to shareholders.

- Transfer Agent Records: These records are maintained by a transfer agent and include information about stockholder accounts, share transfers, and dividend payments.

These documents work together to provide a comprehensive framework for managing stock ownership and transfers within a corporation. Proper documentation helps maintain transparency and ensures compliance with legal requirements.

Check out Popular Documents

Gf Number on T-47 - The form aids in documenting the property's history for new buyers.

Florida 4 Point Inspection Form - Provide details on any visible significant damage to structures or systems noted during the inspection.

To ensure a seamless transaction, you can access our new guide on the Washington Trailer Bill of Sale form requirements, which outlines the necessary steps and details to complete this legal document effectively.

Lien Waiver - The waiver provides legal protection for both contractors and property owners during and after the execution of the contract.

Key Details about Stock Transfer Ledger

What is the purpose of the Stock Transfer Ledger form?

The Stock Transfer Ledger form serves as a record-keeping tool for corporations to track the issuance and transfer of stock shares. It provides a comprehensive overview of stockholder transactions, ensuring that all changes in ownership are documented accurately. This form helps maintain transparency and accountability within the corporation, which is essential for compliance with legal requirements.

Who should fill out the Stock Transfer Ledger form?

The form should be completed by authorized personnel within the corporation, typically someone in the finance or legal department. It may also be filled out by a designated stock transfer agent. The individual responsible for completing the form must ensure that all information is accurate and up-to-date, reflecting the current ownership of shares.

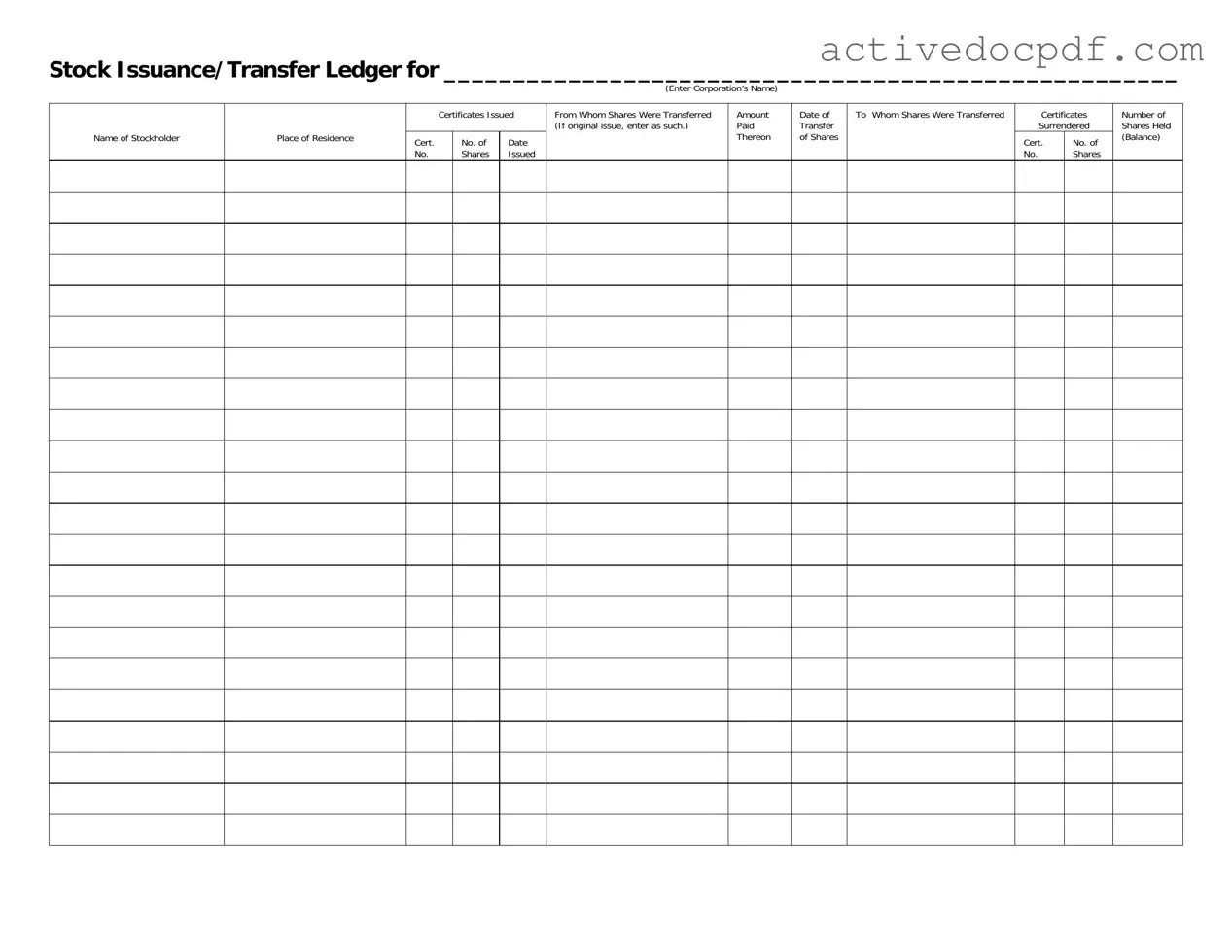

What information is required on the Stock Transfer Ledger form?

Several key pieces of information must be included on the form:

- Corporation's name

- Name of the stockholder

- Place of residence of the stockholder

- Certificates issued, including certificate numbers and dates

- Number of shares issued and transferred

- Amount paid for the shares

- Date of transfer

- Name of the person or entity to whom shares were transferred

- Certificates surrendered, including certificate numbers

- Number of shares held after the transfer

How does one determine the amount paid for shares?

The amount paid for shares is typically determined by the price set by the corporation at the time of issuance or transfer. This price may vary based on several factors, including market conditions, the corporation's financial health, and any applicable agreements between parties involved. It is crucial to document this amount accurately on the form to reflect the true value of the transaction.

What happens if there is an error on the Stock Transfer Ledger form?

If an error is discovered on the form, it is important to correct it promptly. The corporation should document the correction clearly, indicating the original entry and the corrected information. This ensures that the ledger remains accurate and maintains its integrity. In some cases, it may be necessary to notify affected stockholders of the changes made.

Is it necessary to keep the Stock Transfer Ledger form updated?

Yes, maintaining an updated Stock Transfer Ledger is essential. An accurate ledger reflects the current ownership of shares and helps prevent disputes among stockholders. It is advisable to update the form immediately after any stock issuance or transfer occurs, ensuring that all transactions are recorded in real time.

How long should the Stock Transfer Ledger be retained?

Corporations should retain the Stock Transfer Ledger for as long as the corporation exists and for a reasonable period afterward, typically at least seven years. This retention period helps in case of audits, legal inquiries, or disputes that may arise regarding stock ownership. It is essential to follow any specific state regulations regarding record retention as well.

Can electronic records be used instead of a physical Stock Transfer Ledger form?

Yes, electronic records can be used as long as they comply with applicable laws and regulations. Many corporations opt for electronic systems to manage their stock transfer records, as these systems can offer enhanced security, easier access, and better organization. However, it is vital to ensure that electronic records are backed up and maintained properly to prevent data loss.

Similar forms

The Stock Transfer Ledger form shares similarities with several other documents used in corporate governance and record-keeping. Below is a list of eight such documents, each highlighting their connections to the Stock Transfer Ledger.

- Stock Certificate: This document represents ownership of shares in a corporation. It includes details such as the stockholder's name, number of shares owned, and certificate number, similar to the Stock Transfer Ledger's emphasis on stockholder information.

- Shareholder Register: This record maintains a list of all shareholders and their respective shares. Like the Stock Transfer Ledger, it tracks ownership and changes in share ownership over time.

- Dividend Payment Record: This document details the distribution of dividends to shareholders. It parallels the Stock Transfer Ledger in that both require accurate tracking of shares and ownership to ensure proper payments.

- Stock Option Agreement: This agreement outlines the terms under which stock options are granted to employees. It shares similarities with the Stock Transfer Ledger in documenting the transfer and ownership of shares, albeit in a different context.

- Corporate Bylaws: These rules govern the operations of a corporation. They often include provisions regarding stock transfers, aligning with the Stock Transfer Ledger's purpose of recording such transactions.

- Last Will and Testament: This important legal document allows individuals to outline the distribution of their assets and care for dependents after their passing, ensuring that their wishes are followed. To create your own, click here to download.

- Meeting Minutes: These documents record the discussions and decisions made during shareholder meetings. They often reference stock transfers and ownership, connecting them to the Stock Transfer Ledger's focus on share transactions.

- Transfer Agent Records: Transfer agents maintain records of stock ownership and transfers. Their function mirrors that of the Stock Transfer Ledger, as both serve to document changes in share ownership.

- Form 1099-DIV: This tax form reports dividends and distributions to shareholders. It relates to the Stock Transfer Ledger by requiring accurate share ownership records to ensure correct reporting and compliance.

Guide to Filling Out Stock Transfer Ledger

After completing the Stock Transfer Ledger form, it will be essential to ensure that all information is accurate and up to date. This document will help maintain a clear record of stock transfers within the corporation.

- Begin by entering the name of the corporation in the designated space at the top of the form.

- In the first section, list the name of the stockholder. This should reflect the individual or entity that currently holds the shares.

- Next, provide the place of residence for the stockholder. Include the city and state.

- Indicate the number of certificates issued to the stockholder in the appropriate field.

- For each certificate, enter the certificate number and the date it was issued.

- Document the number of shares issued from whom the shares were transferred. If this is the original issue, specify that clearly.

- Record the amount paid for the shares in the corresponding section.

- Next, fill in the date of the transfer of shares.

- Specify to whom the shares were transferred, including the name of the new stockholder.

- Indicate the certificates surrendered by entering the certificate number and the number of shares associated with those certificates.

- Finally, calculate and enter the number of shares held after the transfer, which will be the balance for the stockholder.