Free Tax POA dr 835 PDF Form

Misconceptions

The Tax POA (Power of Attorney) DR 835 form is an important document for taxpayers, but several misconceptions can lead to confusion. Here are four common misunderstandings about this form:

- Misconception 1: The Tax POA DR 835 form is only for individuals.

- Misconception 2: Completing the form guarantees the acceptance of the representative.

- Misconception 3: A Tax POA DR 835 form is permanent.

- Misconception 4: The form can be used for any tax matter.

Many people believe that this form is exclusively for individuals. In reality, both individuals and businesses can utilize the Tax POA DR 835 form to authorize someone to represent them before the IRS.

Some think that simply filling out the form means the IRS will automatically accept the designated representative. However, the IRS must review and approve the form before any representation can take place.

It's a common belief that once the form is submitted, it remains in effect indefinitely. In fact, the authority granted can be revoked at any time by the taxpayer, and it also expires if the taxpayer passes away.

Some individuals assume that the Tax POA DR 835 form covers all tax-related issues. However, it is essential to note that it is specifically designed for certain tax matters, and other forms may be required for different situations.

Documents used along the form

When dealing with tax matters, especially in the United States, various forms and documents accompany the Tax Power of Attorney (POA) DR 835 form. Each of these documents serves a specific purpose, ensuring that the necessary information is conveyed to the tax authorities effectively. Understanding these forms can help streamline the process and avoid potential pitfalls.

- Form 2848 - Power of Attorney and Declaration of Representative: This form is commonly used to authorize an individual to represent a taxpayer before the IRS. It allows the representative to handle tax matters on behalf of the taxpayer.

- Fr44 Florida form: This official document certifies that a motorist has the required vehicle liability insurance coverage under Florida law. For further details, open the document.

- Form 4506 - Request for Copy of Tax Return: Taxpayers use this form to request copies of their past tax returns from the IRS. It can be crucial for verifying income or preparing for audits.

- Form 8821 - Tax Information Authorization: This form grants permission to an individual or organization to receive confidential tax information. Unlike a POA, it does not allow the representative to represent the taxpayer before the IRS.

- Form 1040 - U.S. Individual Income Tax Return: This is the standard form used by individuals to file their annual income tax returns. It provides a comprehensive overview of a taxpayer's income, deductions, and tax liability.

- Form 1065 - U.S. Return of Partnership Income: Partnerships use this form to report their income, deductions, gains, and losses. It’s essential for partnerships to accurately report their financial activities.

- Form 1120 - U.S. Corporation Income Tax Return: Corporations file this form to report their income, gains, losses, and tax liability. It is a key document for corporate tax compliance.

- Form 941 - Employer's Quarterly Federal Tax Return: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It’s crucial for maintaining compliance with payroll tax obligations.

- Form 1099 - Miscellaneous Income: This form is used to report various types of income other than wages, salaries, and tips. It’s essential for independent contractors and freelancers to receive this form for their tax records.

Understanding these forms and their purposes can significantly ease the tax filing process and ensure compliance with IRS regulations. Each document plays a vital role in representing your interests and ensuring that your tax matters are handled correctly.

Check out Popular Documents

How to Fill Out a Payroll Check - Can indicate pay scale information for transparency.

For more detailed guidance on completing IRS Form 2553, you can refer to resources available at PDF Documents Hub, which provides essential information that can help streamline the process and ensure compliance.

Schedule C Form 1040 - Honesty and accuracy are paramount when reporting on Schedule C to avoid penalties.

Roof Certification Template - Homeowners are encouraged to keep this document accessible and organized.

Key Details about Tax POA dr 835

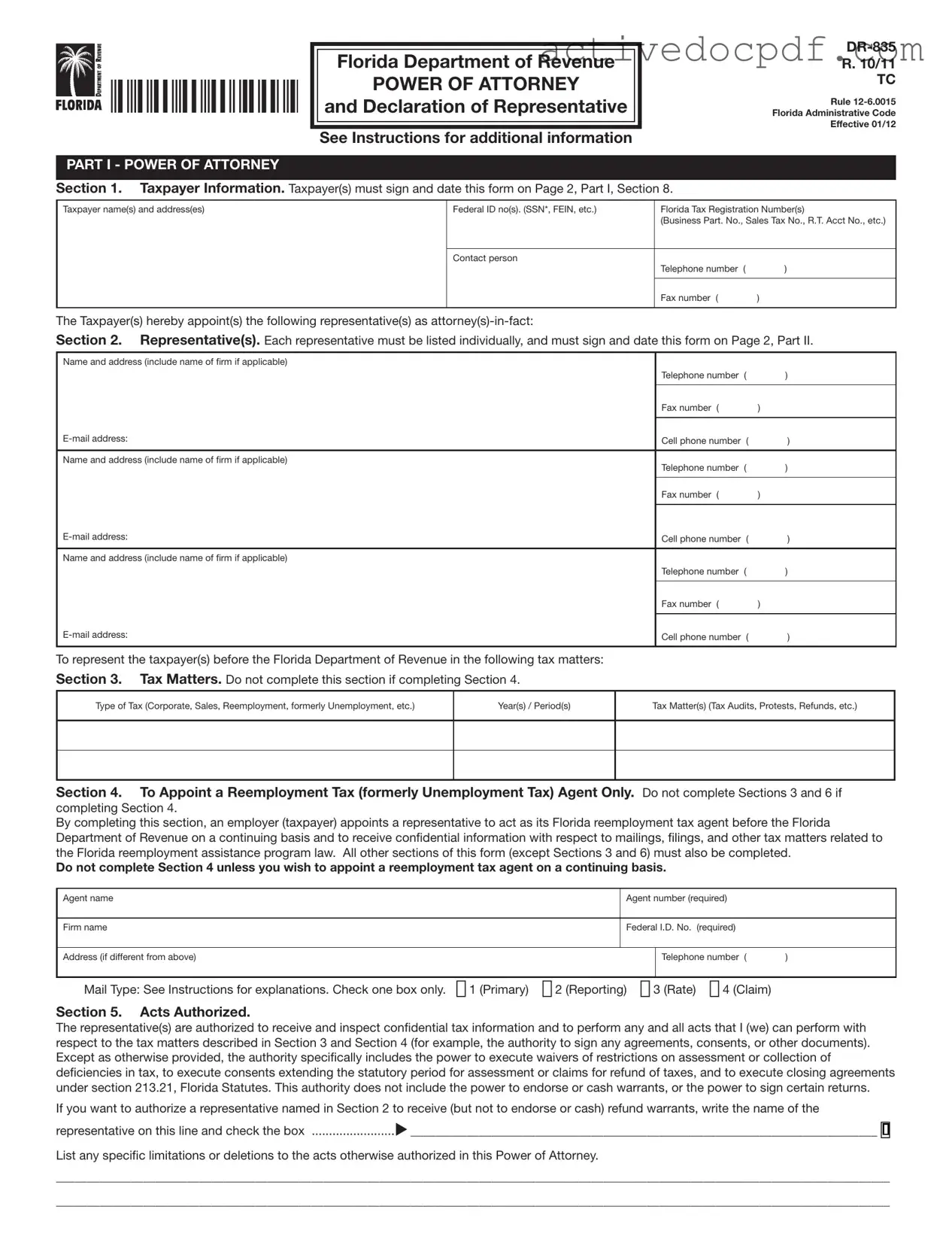

What is the Tax POA DR 835 form?

The Tax POA DR 835 form is a Power of Attorney form used in the state of Colorado. It allows taxpayers to authorize another individual, often a tax professional, to represent them before the Colorado Department of Revenue. This representation can include handling tax matters, accessing tax records, and communicating with tax authorities on behalf of the taxpayer.

Who needs to fill out the Tax POA DR 835 form?

Any individual or business that wants to grant someone else the authority to handle their tax affairs in Colorado should consider filling out this form. This includes situations where you might need help with tax returns, audits, or other tax-related issues.

How do I complete the Tax POA DR 835 form?

Completing the Tax POA DR 835 form is straightforward. Here are the steps to follow:

- Download the form from the Colorado Department of Revenue's website.

- Fill in your personal information, including your name, address, and Social Security number or tax identification number.

- Provide the representative's details, including their name and contact information.

- Specify the types of tax matters you are authorizing them to handle.

- Sign and date the form to make it official.

Where do I submit the Tax POA DR 835 form?

After completing the form, you should submit it to the Colorado Department of Revenue. This can typically be done by mailing it to the appropriate address listed on the form or by submitting it electronically, if applicable.

Is there a fee associated with the Tax POA DR 835 form?

No, there is no fee for submitting the Tax POA DR 835 form. It is a free service provided by the state to help taxpayers manage their tax affairs more effectively.

How long does it take for the Tax POA DR 835 form to be processed?

Processing times can vary. Generally, once the form is submitted, it may take a few weeks for the Colorado Department of Revenue to process it. However, if you have urgent matters, it's a good idea to follow up with them to ensure everything is in order.

Can I revoke the Power of Attorney granted by the Tax POA DR 835 form?

Yes, you can revoke the Power of Attorney at any time. To do this, you will need to submit a written notice of revocation to the Colorado Department of Revenue. It’s also a good practice to inform the representative that their authority has been revoked.

What happens if I don’t submit a Tax POA DR 835 form?

If you don’t submit the Tax POA DR 835 form, your representative will not have the legal authority to act on your behalf regarding tax matters. This means they won’t be able to access your tax information or communicate with tax authorities for you, which could complicate your tax situation.

Can I designate more than one representative on the Tax POA DR 835 form?

Yes, you can designate multiple representatives on the Tax POA DR 835 form. Just ensure that you provide all necessary information for each representative, including their names and contact details. However, keep in mind that this may complicate communication, so it’s often best to limit the number of representatives to those who are essential.

Similar forms

The Tax Power of Attorney (POA) form, specifically the DR 835, serves a unique purpose in allowing individuals to authorize someone else to act on their behalf regarding tax matters. However, several other documents share similar features and functions. Here are seven such documents:

- General Power of Attorney: This document grants broad authority to an agent to act on behalf of the principal in various matters, not limited to tax issues. It allows for decisions in financial, legal, and personal affairs.

- Limited Power of Attorney: Unlike the general version, this document restricts the agent’s powers to specific tasks or time frames. For instance, it may only cover tax filing for a particular year.

- Health Care Proxy: This form allows an individual to appoint someone to make medical decisions on their behalf. While it pertains to health care, the underlying principle of delegation is similar.

- Durable Power of Attorney: This document remains effective even if the principal becomes incapacitated. It ensures that someone can manage financial and legal matters, including taxes, without interruption.

- IRS Form 2848: Specifically designed for tax matters, this form allows taxpayers to appoint an individual to represent them before the IRS. It is closely aligned with the Tax POA in function.

Washington Non-disclosure Agreement Form: To protect sensitive information during business transactions, consider utilizing the Washington Non-disclosure Agreement form guide for comprehensive details on its execution.

- Financial Power of Attorney: This document focuses on financial decisions, allowing an agent to handle banking, investments, and tax-related matters, similar to the Tax POA.

- Trustee Appointment Document: In the context of a trust, this document empowers a trustee to manage trust assets, which may include handling tax obligations associated with the trust.

Each of these documents, while serving different specific purposes, shares the common theme of allowing one individual to act on behalf of another. Understanding these similarities can help individuals choose the right document for their needs.

Guide to Filling Out Tax POA dr 835

Completing the Tax POA DR 835 form is an essential step in designating someone to represent you in tax matters. Following these steps carefully will help ensure that the form is filled out correctly and submitted promptly.

- Obtain the form: Download the Tax POA DR 835 form from the appropriate state tax authority website or request a physical copy if necessary.

- Fill in your information: At the top of the form, provide your full name, address, and Social Security number or taxpayer identification number.

- Designate your representative: Enter the name, address, and phone number of the person you are authorizing to represent you. Make sure this individual is qualified to act on your behalf.

- Specify the tax matters: Clearly indicate the type of tax matters for which you are granting authority. This could include income tax, sales tax, or other relevant categories.

- Set the effective date: Include the date when this authorization becomes effective. This is important for clarity regarding the timeframe of representation.

- Sign and date the form: Your signature is required to validate the form. Be sure to date it as well.

- Submit the form: Send the completed form to the appropriate tax authority. Keep a copy for your records.

After completing these steps, monitor your communication channels for any updates from the tax authority. This will help ensure that your representative can act on your behalf without any delays.