Legal Affidavit of Death Document for Texas State

Misconceptions

The Texas Affidavit of Death form is a legal document that serves a specific purpose in the state of Texas. However, several misconceptions surround its use and implications. Understanding these misconceptions can clarify the process for those involved in estate management or legal matters following a death.

- The Affidavit of Death is only for estates that require probate. This is not true. While the affidavit is often used in probate situations, it can also be utilized in cases where the deceased's estate does not require formal probate proceedings. The affidavit can help transfer property or clarify ownership without going through the full probate process.

- Anyone can complete the Affidavit of Death. This misconception can lead to complications. While the form may seem straightforward, it must be completed by someone with first-hand knowledge of the death. This typically means a close family member or a legal representative. Incorrectly filled forms can lead to disputes or delays.

- The Affidavit of Death is the same as a death certificate. Although both documents are related to the deceased, they serve different purposes. A death certificate is an official record issued by the state, providing proof of death. In contrast, the Affidavit of Death is a sworn statement that may be used in legal contexts, particularly for transferring property.

- Filing the Affidavit of Death is optional in all cases. This is misleading. In certain situations, especially when dealing with property transfers or financial accounts, filing the affidavit may be necessary to establish clear ownership. Failing to do so can complicate matters for heirs or beneficiaries.

Documents used along the form

When dealing with the Texas Affidavit of Death form, several other documents may be necessary to ensure the proper handling of estate matters and the transfer of property. These documents serve various purposes and help clarify the legal status of the deceased's affairs. Below are four commonly used forms that often accompany the Affidavit of Death.

- Death Certificate: This official document serves as proof of death. It is typically issued by the state and includes vital information such as the deceased's name, date of birth, and date of death. The death certificate is often required for legal proceedings and to settle the estate.

- Horse Bill of Sale: In Florida, documenting the sale of a horse is crucial for legal recognition, and the document is available here to facilitate this process.

- Will: A will outlines the deceased's wishes regarding the distribution of their assets. If a will exists, it must be submitted to probate court. This document ensures that the deceased's property is distributed according to their wishes, and it may also appoint an executor to manage the estate.

- Affidavit of Heirship: This document is used to establish the heirs of the deceased when there is no will. It provides a sworn statement regarding the family relationships and can help facilitate the transfer of property without going through probate.

- Letters Testamentary: If the deceased left a will, this document is issued by the probate court to the executor named in the will. It grants the executor the authority to manage the estate, pay debts, and distribute assets according to the will's terms.

Each of these documents plays a critical role in the process of managing a deceased person's estate. Understanding their functions can help streamline the legal proceedings and ensure that all necessary steps are taken in accordance with Texas law.

Other State-specific Affidavit of Death Forms

Affidavit of Death of Joint Tenant - Documenting the death formally helps prevent fraudulent claims against the estate.

A comprehensive understanding of the nuances of renting a property is essential for both landlords and tenants. By establishing clear rules and responsibilities, a Lease Agreement helps to ensure a smooth rental experience. For those looking to solidify their rental terms, filling out a Lease Contract is a prudent step to take, providing legal security to both parties involved.

Key Details about Texas Affidavit of Death

What is a Texas Affidavit of Death?

A Texas Affidavit of Death is a legal document that serves to officially declare an individual's death. It is often used to settle the deceased person's estate, transfer property, or update records. This affidavit provides necessary information about the deceased, including their full name, date of death, and other relevant details. It must be signed by a person who can verify the death, typically a family member or a close associate.

Who can file an Affidavit of Death in Texas?

Any individual who has personal knowledge of the deceased's death can file an Affidavit of Death. This includes:

- Immediate family members, such as spouses, children, or parents.

- Close relatives, like siblings or grandparents.

- Anyone who was present at the time of death or has relevant information.

It is important that the person filing the affidavit is willing to attest to the facts stated within it.

What information is required on the Affidavit of Death?

The Affidavit of Death must include specific information to be valid. Key details include:

- The full name of the deceased.

- The date of death.

- The place of death.

- The relationship of the affiant (the person filing the affidavit) to the deceased.

- A statement affirming the affiant's knowledge of the death.

Providing accurate information is crucial, as any discrepancies could lead to complications in legal proceedings.

Where do I file the Affidavit of Death?

The Affidavit of Death should be filed in the county where the deceased person lived at the time of death. This is typically done at the county clerk's office. After filing, the affidavit becomes part of the public record. It is advisable to keep copies for personal records and to provide copies to relevant parties, such as banks or insurance companies, as needed.

Similar forms

- Death Certificate: This official document is issued by a government authority and confirms the fact of a person's death, including details such as the date and cause of death. It serves as a primary legal proof of death.

- Will: A legal document that outlines a person's wishes regarding the distribution of their assets after death. It is often used in conjunction with an affidavit of death to settle an estate.

- Trust Documents: These documents establish a trust, which can manage assets for beneficiaries after a person's death. They may require an affidavit of death to activate certain provisions.

- IRS W-9 Form: This form is essential for providing your Taxpayer Identification Number (TIN) to ensure accurate reporting of income to the IRS. To learn more, visit PDF Documents Hub for guidance on filling it out.

- Probate Petition: This is a request filed with a court to begin the legal process of administering a deceased person's estate. An affidavit of death may accompany this petition to confirm the death.

- Letters Testamentary: Issued by a probate court, these letters grant the executor authority to manage the deceased's estate. An affidavit of death is often necessary to obtain these letters.

- Life Insurance Claims: When a policyholder passes away, beneficiaries may need to submit a claim form along with an affidavit of death to receive benefits from the insurance company.

- Bank Account Closure Forms: Banks often require an affidavit of death to close the accounts of a deceased person, ensuring that funds are handled according to the deceased’s wishes.

- Social Security Administration Forms: To claim survivor benefits or report a death, family members often need to provide an affidavit of death to the Social Security Administration.

- Real Estate Transfer Documents: When a property owner dies, an affidavit of death may be needed to transfer ownership to heirs or beneficiaries as part of the estate settlement process.

- Funeral Home Contracts: These agreements may require an affidavit of death to ensure that the funeral services are properly arranged and paid for, reflecting the deceased's wishes.

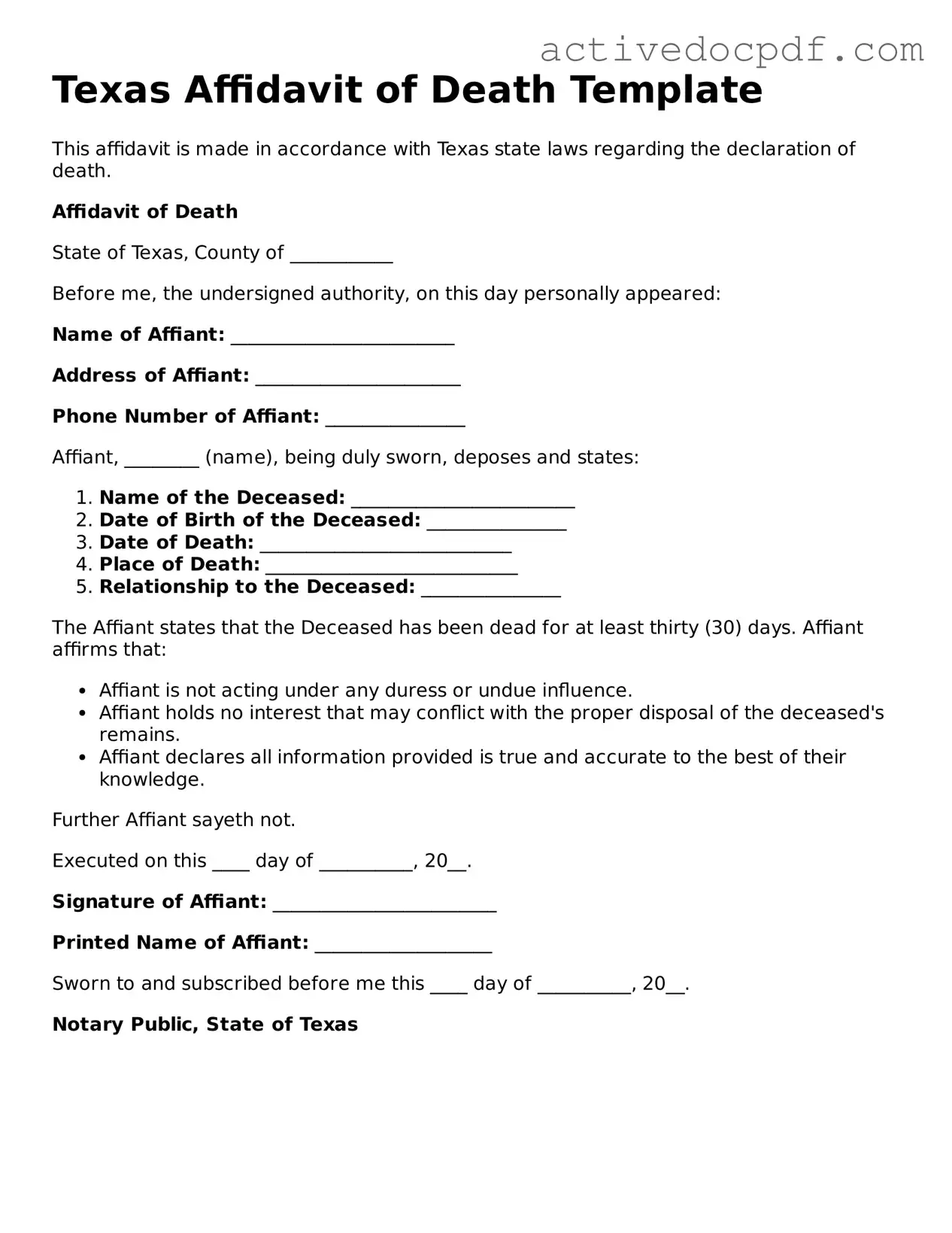

Guide to Filling Out Texas Affidavit of Death

After you have gathered the necessary information, you can proceed to fill out the Texas Affidavit of Death form. This document will require specific details about the deceased and the individual completing the affidavit. Follow these steps carefully to ensure accuracy.

- Begin by writing the full name of the deceased in the designated space.

- Provide the date of death. Ensure that this is the official date as recorded on the death certificate.

- Include the deceased's last known address. This should be the address where they resided at the time of death.

- Fill in the name and relationship of the affiant, the person completing the form. Clearly state how you are connected to the deceased.

- Sign and date the affidavit in the appropriate section. Your signature confirms the accuracy of the information provided.

- Have the affidavit notarized. This step is crucial for the document's validity. A notary public will verify your identity and witness your signature.

Once you have completed these steps, you will be ready to submit the affidavit as required. Ensure you keep a copy for your records.