Legal Articles of Incorporation Document for Texas State

Misconceptions

Understanding the Texas Articles of Incorporation form is essential for anyone looking to establish a corporation in Texas. However, several misconceptions can lead to confusion. Here are nine common misconceptions:

- Only large businesses need to file Articles of Incorporation. Many small businesses and startups also need to file this form to establish their legal entity.

- Filing Articles of Incorporation guarantees automatic approval. While filing is a necessary step, the state must review and approve the application before the corporation is officially recognized.

- All states have the same Articles of Incorporation requirements. Each state has its own specific requirements and forms, including Texas, which may differ significantly.

- Once filed, Articles of Incorporation cannot be changed. Amendments can be made after filing, allowing businesses to adapt their structure as needed.

- The Articles of Incorporation form is the only document needed to start a corporation. Other documents, such as bylaws and initial meeting minutes, are also essential for a complete corporate formation.

- Filing Articles of Incorporation is a one-time process. Corporations must comply with ongoing requirements, including annual reports and fees, to maintain their status.

- You must hire a lawyer to file Articles of Incorporation. While legal assistance can be beneficial, many individuals successfully file the form on their own.

- Articles of Incorporation can be filed anytime without consequences. Delays in filing can lead to penalties or complications in starting business operations.

- All corporations are taxed the same way. Different types of corporations, such as S corporations and C corporations, have different tax implications.

By clarifying these misconceptions, individuals can better navigate the process of incorporating their businesses in Texas.

Documents used along the form

When forming a corporation in Texas, the Articles of Incorporation are essential, but they are not the only documents you will need. Several other forms and documents often accompany this primary filing. Each of these plays a vital role in ensuring your corporation is set up correctly and operates smoothly.

- Bylaws: These are the internal rules that govern how your corporation will operate. Bylaws outline the responsibilities of directors and officers, how meetings will be conducted, and other important operational procedures. Having clear bylaws helps prevent conflicts and provides a roadmap for decision-making.

- Initial Report: While not required in Texas, many corporations choose to file an initial report shortly after incorporating. This document provides the state with updated information about your corporation, including the names of directors and officers. It helps ensure that your corporation's records are accurate and up-to-date.

- Durable Power of Attorney Form: To appoint an agent to manage your affairs, consider the comprehensive Durable Power of Attorney form options available in Colorado.

- Employer Identification Number (EIN): This is a unique number assigned by the IRS for tax purposes. Obtaining an EIN is essential for opening a business bank account, hiring employees, and filing taxes. It acts like a Social Security number for your corporation, ensuring proper identification for tax obligations.

- Business License: Depending on your industry and location, you may need various licenses or permits to operate legally. These can include local business licenses, health permits, or professional licenses. Checking with local government offices ensures compliance with all necessary regulations.

In summary, while the Texas Articles of Incorporation are crucial for establishing your corporation, other documents like bylaws, an initial report, an EIN, and necessary business licenses play significant roles in your corporation's successful operation. Ensuring you have all the required paperwork in place will help set a solid foundation for your business.

Other State-specific Articles of Incorporation Forms

How to Obtain an Llc - Amendments to the Articles may require restating or re-filing the form.

For those looking to navigate the complexities of mobile home ownership, the PDF Documents Hub offers valuable resources to simplify the process, ensuring that all necessary documentation is in order and the transaction is properly recorded.

Florida Incorporation - Requires accurate completion to avoid future legal issues.

New York Certificate of Incorporation - May include delegation of duties among executive officers.

Key Details about Texas Articles of Incorporation

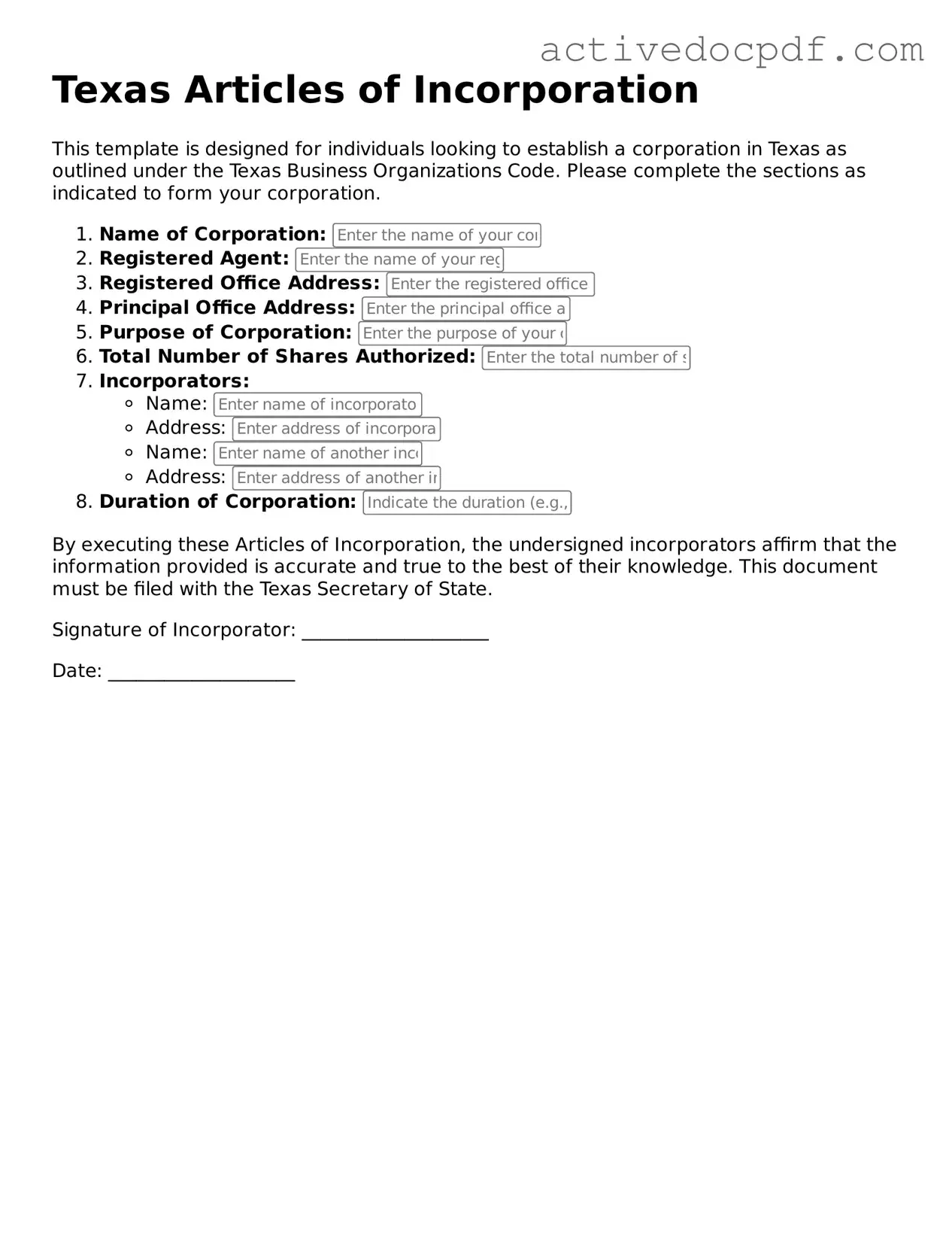

What is the Texas Articles of Incorporation form?

The Texas Articles of Incorporation form is a legal document that establishes a corporation in the state of Texas. This form outlines essential information about the corporation, including its name, purpose, registered agent, and duration. Filing this form is a crucial first step in creating a corporation, as it officially registers the business with the state.

What information do I need to provide when completing the form?

When filling out the Texas Articles of Incorporation form, you will need to provide several key pieces of information:

- The name of the corporation, which must be unique and comply with Texas naming requirements.

- The purpose of the corporation, which can be a general business purpose or a specific one.

- The registered agent's name and address, who will receive legal documents on behalf of the corporation.

- The duration of the corporation, which can be perpetual or for a specified period.

Additional information may include the number of shares the corporation is authorized to issue and the names and addresses of the initial directors.

How do I file the Texas Articles of Incorporation form?

To file the Texas Articles of Incorporation form, you can follow these steps:

- Complete the form with all required information.

- Choose a filing method: you can file online through the Texas Secretary of State's website or submit a paper form by mail.

- Pay the required filing fee, which varies depending on the type of corporation you are forming.

- Submit the form and wait for confirmation of your filing.

Once filed, the state will review your application. If everything is in order, you will receive a certificate of incorporation, confirming that your corporation is officially registered.

What happens after I file the Articles of Incorporation?

After filing the Articles of Incorporation, several important steps follow:

- You will receive a confirmation from the state, typically in the form of a certificate of incorporation.

- It is essential to create bylaws for your corporation, which will govern its internal operations.

- You should also apply for an Employer Identification Number (EIN) from the IRS, which is necessary for tax purposes.

- Consider opening a business bank account in the corporation's name to keep personal and business finances separate.

These steps help ensure that your corporation operates smoothly and complies with legal requirements.

Similar forms

- Bylaws: Like the Articles of Incorporation, bylaws outline the rules and procedures for managing a corporation. However, bylaws provide more detailed operational guidelines.

- Operating Agreement: This document is similar for limited liability companies (LLCs). It defines the management structure and responsibilities of members, similar to how Articles of Incorporation define a corporation's structure.

- Durable Power of Attorney: This form is vital in the event of incapacitation, allowing designated individuals to handle financial and legal matters on your behalf. For a convenient way to fill out the necessary document, visit https://texasformspdf.com/fillable-durable-power-of-attorney-online/.

- Certificate of Formation: Often used interchangeably with Articles of Incorporation, this document serves to officially establish a corporation in some states.

- Partnership Agreement: This document outlines the terms of a partnership, including roles and responsibilities, similar to how Articles of Incorporation define the roles within a corporation.

- Business License: While not a structural document, a business license is required to operate legally, much like Articles of Incorporation are required for a corporation to exist.

- Shareholder Agreement: This document governs the relationship between shareholders, similar to how Articles of Incorporation define the rights and responsibilities of shareholders in a corporation.

- Certificate of Good Standing: This document confirms that a corporation is legally registered and compliant with state regulations, similar to the purpose of Articles of Incorporation.

- Annual Report: Corporations must file this document to provide updated information about their status and operations, reflecting the information initially provided in the Articles of Incorporation.

- Nonprofit Charter: For nonprofit organizations, this document serves a similar purpose as Articles of Incorporation, establishing the organization’s existence and structure.

- Employer Identification Number (EIN): This document is necessary for tax purposes and is often obtained after filing Articles of Incorporation, serving a foundational role in business operations.

Guide to Filling Out Texas Articles of Incorporation

After completing the Texas Articles of Incorporation form, you will need to submit it to the Texas Secretary of State along with the required filing fee. This process officially establishes your corporation in the state of Texas.

- Obtain the Texas Articles of Incorporation form from the Texas Secretary of State's website or office.

- Fill in the name of your corporation. Ensure it complies with Texas naming requirements.

- Provide the duration of the corporation. Most corporations are set to exist perpetually unless otherwise stated.

- List the purpose of the corporation. Be clear and concise about the business activities.

- Enter the address of the corporation's registered office in Texas. This is where official documents will be sent.

- Designate a registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Include the names and addresses of the initial directors. Typically, a minimum of one director is required.

- State the number of shares the corporation is authorized to issue and their par value, if applicable.

- Provide the name and address of the incorporator, who is responsible for filing the document.

- Review the completed form for accuracy and completeness.

- Sign and date the form where indicated.

- Prepare the required filing fee, which can vary based on the type of corporation.

- Submit the completed form and fee to the Texas Secretary of State by mail or in person.