Legal Bill of Sale Document for Texas State

Misconceptions

Understanding the Texas Bill of Sale form is essential for anyone involved in buying or selling personal property. However, several misconceptions often cloud the clarity of this important document. Here are six common misconceptions:

-

The Texas Bill of Sale is only necessary for vehicles. Many people believe that this form is required solely for the sale of cars or trucks. In reality, a Bill of Sale can be used for various types of personal property, including boats, motorcycles, and even furniture.

-

A Bill of Sale is a legally binding contract. While a Bill of Sale serves as a receipt for the transaction, it does not necessarily create a legally binding contract in the same way that a formal contract does. It primarily documents the exchange of property and can be used as evidence in disputes.

-

All Bill of Sale forms are the same. Some may assume that a generic Bill of Sale will suffice for any transaction. However, Texas has specific requirements and details that should be included in the form to ensure it meets state laws and adequately protects both parties.

-

A Bill of Sale must be notarized. Many people think that notarization is a requirement for a Bill of Sale to be valid. In Texas, notarization is not mandatory, although it can add an extra layer of authenticity and may be required by certain buyers or sellers.

-

The seller is responsible for all liabilities after the sale. Some sellers fear that they will remain liable for the item sold, even after the transaction is complete. Once the Bill of Sale is signed and the property is transferred, the seller generally relinquishes responsibility for that item.

-

You cannot use a Bill of Sale for gifts. It is a common belief that a Bill of Sale is only applicable for sales. However, a Bill of Sale can also document the transfer of property as a gift, ensuring that the recipient has proof of ownership.

Being aware of these misconceptions can help individuals navigate the process of buying or selling property in Texas with greater confidence and understanding.

Documents used along the form

When engaging in a transaction that involves the transfer of ownership, particularly in Texas, several important documents accompany the Bill of Sale. These documents serve various purposes, ensuring that both parties are protected and that the transaction is properly recorded. Below are some common forms and documents that may be used alongside the Texas Bill of Sale.

- Title Transfer Document: This document is essential for transferring ownership of a vehicle. It serves as proof that the seller has relinquished their rights to the vehicle and that the buyer is now the rightful owner.

- Vehicle Registration Application: After purchasing a vehicle, the new owner must register it with the state. This application provides necessary details about the vehicle and the new owner, enabling the state to update its records.

- Odometer Disclosure Statement: Required by federal law for vehicle sales, this statement verifies the mileage on the vehicle at the time of sale. It helps prevent odometer fraud and ensures transparency between the buyer and seller.

- Dog Bill of Sale: This legal document facilitates the transfer of ownership of a dog from one party to another, ensuring transparency and clarity in the transaction. For more information, you can refer to the Dog Bill of Sale form.

- Warranty Deed: In real estate transactions, a warranty deed provides a guarantee that the seller has the legal right to sell the property and that the title is free of any encumbrances. This document protects the buyer’s interests.

- Purchase Agreement: This document outlines the terms of the sale, including the purchase price, payment method, and any conditions agreed upon by both parties. It serves as a binding contract that details the responsibilities of each party.

- Affidavit of Heirship: In cases where property is inherited, this document helps establish the rightful heirs of a deceased person's estate. It can be crucial for transferring ownership without going through probate.

Each of these documents plays a vital role in ensuring a smooth transaction and protecting the interests of both buyers and sellers. Understanding their purpose can facilitate a more efficient and secure process when transferring ownership in Texas.

Other State-specific Bill of Sale Forms

How to Transfer Ownership of a Car to a Family Member in Ny - Using a Bill of Sale can increase the confidence of buyers in the transaction.

For individuals seeking clarity in their transactions, a comprehensive General Bill of Sale template can serve as a vital resource. This document not only ensures a smooth transfer of ownership but also outlines essential details related to the sale. For more information on creating a proper document, consider our essential General Bill of Sale form guide.

Do You Need a Bill of Sale in Florida - Using a Bill of Sale can promote transparency in private transactions.

Key Details about Texas Bill of Sale

What is a Texas Bill of Sale form?

A Texas Bill of Sale form is a legal document that serves as proof of the transfer of ownership of personal property from one party to another. This form is commonly used for the sale of vehicles, boats, trailers, and other personal items. It outlines essential details about the transaction, including the names of the buyer and seller, a description of the item being sold, and the sale price.

When do I need a Bill of Sale in Texas?

While a Bill of Sale is not always legally required in Texas, it is highly recommended in several situations, including:

- When selling or buying a vehicle.

- For transactions involving boats or trailers.

- When dealing with high-value personal items, such as jewelry or electronics.

- To protect both parties by providing a record of the transaction.

What information should be included in a Texas Bill of Sale?

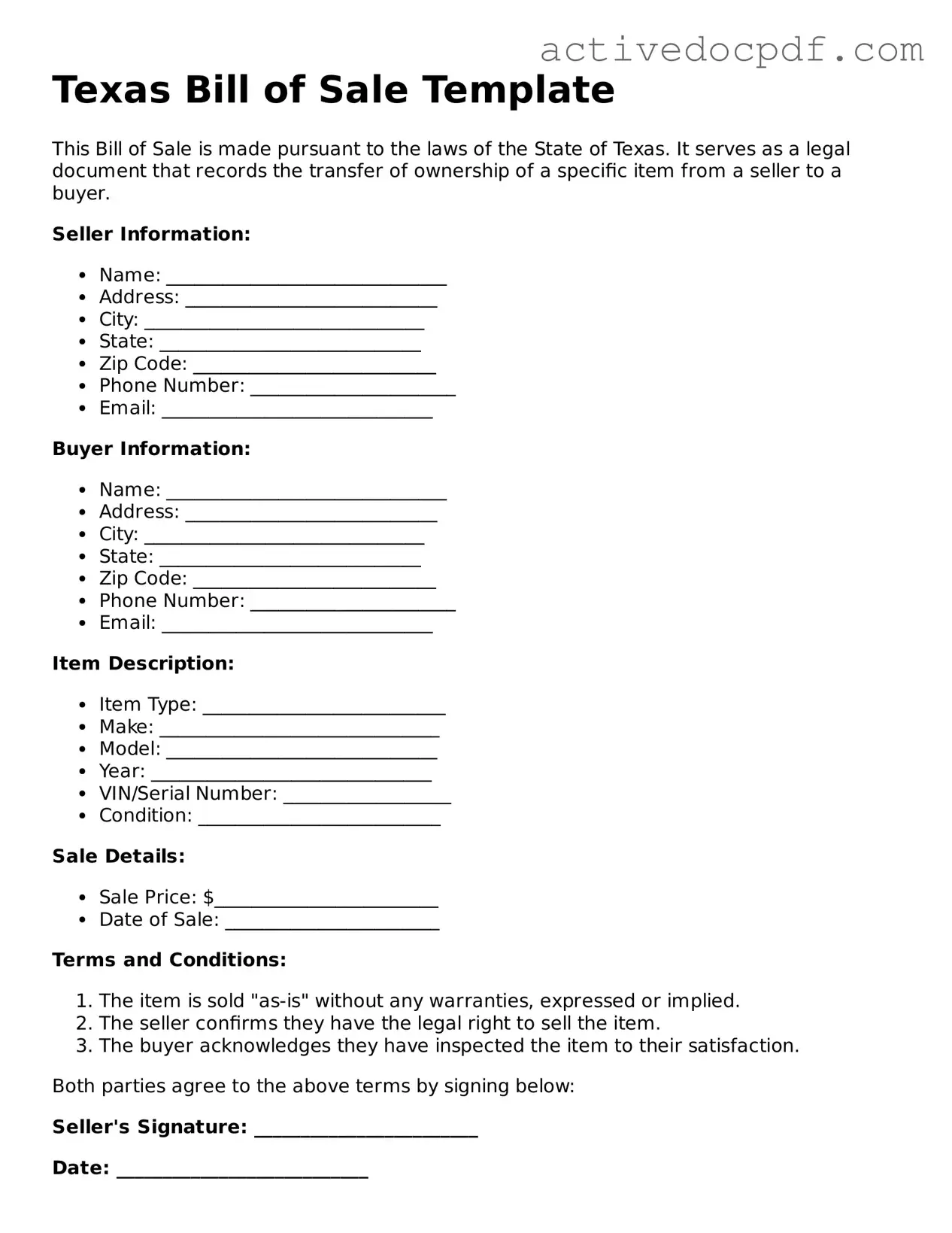

A comprehensive Texas Bill of Sale should include the following details:

- The full names and addresses of both the buyer and seller.

- A detailed description of the item being sold, including make, model, year, and VIN (for vehicles).

- The sale price of the item.

- The date of the transaction.

- Signatures of both parties to confirm the agreement.

Is a Bill of Sale required for vehicle registration in Texas?

Yes, if you are purchasing a vehicle in Texas, you will need a Bill of Sale to register the vehicle with the Texas Department of Motor Vehicles (DMV). This document helps establish proof of ownership and is often required alongside other paperwork, such as the title and proof of insurance.

Can I create my own Bill of Sale in Texas?

Absolutely. You can create your own Bill of Sale in Texas, as long as it includes all necessary information and is signed by both parties. There are also templates available online that can help guide you in drafting a legally sound document. Just ensure that it meets the requirements outlined by Texas law.

Do I need to have the Bill of Sale notarized?

In Texas, notarization of a Bill of Sale is not required for most transactions. However, having the document notarized can provide an extra layer of protection and legitimacy, especially for high-value items. It may also be beneficial if a dispute arises in the future.

What should I do with the Bill of Sale after the transaction?

After completing the transaction, both the buyer and seller should keep a copy of the Bill of Sale for their records. This document serves as proof of the sale and can be important for tax purposes or in case of future disputes. Additionally, if the item is a vehicle, the buyer should submit the Bill of Sale to the DMV when registering the vehicle.

Similar forms

- Purchase Agreement: This document outlines the terms of a sale between a buyer and seller, detailing the items sold, payment terms, and any conditions of the sale.

- Lease Agreement: Similar to a Bill of Sale, this document outlines the terms under which one party rents property from another. It specifies the duration, payment terms, and responsibilities of both parties.

- Trailer Bill of Sale: This essential document ensures the proper transfer of ownership for a trailer, protecting both buyer and seller. For more details, visit PDF Documents Hub.

- Gift Deed: A Gift Deed transfers ownership of property without any exchange of money. It serves a similar purpose as a Bill of Sale but is used when property is given as a gift.

- Title Transfer Document: This document is used to officially transfer ownership of a vehicle or real estate. Like a Bill of Sale, it provides proof of ownership change.

- Sales Receipt: A Sales Receipt serves as proof of purchase and includes details about the transaction, similar to a Bill of Sale, but is often less formal.

- Promissory Note: This document outlines a promise to pay a specified amount of money, often used in sales transactions where payment is made over time, similar to how a Bill of Sale may specify payment terms.

- Warranty Deed: A Warranty Deed guarantees that the seller has the right to sell the property and that it is free from any claims. This document is similar to a Bill of Sale in that it provides assurance of ownership.

- Contract for Deed: This document allows a buyer to make payments over time while gaining ownership of a property. It shares similarities with a Bill of Sale regarding payment structure and ownership transfer.

- Service Agreement: While primarily used for services rather than goods, this document outlines the terms of a service transaction, much like a Bill of Sale outlines the terms of a sale.

- Inventory List: This document details items owned or sold, providing a record similar to a Bill of Sale, which also serves as a record of the transaction.

Guide to Filling Out Texas Bill of Sale

Completing the Texas Bill of Sale form is a straightforward process that allows you to document the sale of an item, typically a vehicle or personal property. After filling out the form, both the buyer and seller will have a clear record of the transaction, which can be helpful for future reference or legal purposes.

- Obtain the Form: Start by downloading the Texas Bill of Sale form from a reliable source or obtain a physical copy from a local office.

- Fill in the Date: Write the date of the transaction at the top of the form. This helps establish when the sale occurred.

- Provide Seller Information: Enter the seller's full name and address. This identifies who is selling the item.

- Provide Buyer Information: Enter the buyer's full name and address. This identifies who is purchasing the item.

- Describe the Item: Clearly describe the item being sold. Include details such as make, model, year, color, and any identification numbers (like VIN for vehicles).

- State the Sale Price: Indicate the agreed-upon price for the item. This should be a clear and specific amount.

- Signatures: Both the seller and buyer must sign the form. This confirms that both parties agree to the terms of the sale.

- Date the Signatures: Each party should date their signature to indicate when they signed the document.

Once completed, ensure that both parties keep a copy of the Bill of Sale for their records. This document serves as proof of the transaction and can be useful in the future.