Legal Deed in Lieu of Foreclosure Document for Texas State

Misconceptions

Understanding the Texas Deed in Lieu of Foreclosure can be challenging. Here are six common misconceptions that people often have about this process.

-

It eliminates all debts related to the property.

Many believe that signing a deed in lieu of foreclosure wipes out all financial obligations. In reality, it typically only addresses the mortgage debt. Other debts, such as second mortgages or liens, may still remain.

-

It is the same as a foreclosure.

While both processes involve the transfer of property, they are not identical. A deed in lieu is a voluntary agreement, whereas foreclosure is a legal process initiated by the lender.

-

It will not affect your credit score.

Some people think that a deed in lieu of foreclosure has no impact on credit. However, it can still negatively affect your credit score, though typically less than a foreclosure would.

-

All lenders accept a deed in lieu of foreclosure.

This is a misconception. Not all lenders will agree to this option. Each lender has its own policies and may prefer to pursue foreclosure instead.

-

It’s a quick and easy process.

While a deed in lieu can be faster than foreclosure, it still requires documentation and negotiation. The timeline can vary based on the lender's requirements and the specific circumstances.

-

It absolves you from future liability.

Some individuals think that once they sign the deed, they are completely free from any future claims. However, if the property sells for less than what is owed, lenders may pursue a deficiency judgment in some cases.

Being informed about these misconceptions can help you make better decisions regarding your property and financial situation.

Documents used along the form

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to transfer ownership of their property to the lender to avoid foreclosure. When utilizing this form, there are several other documents that often accompany it. Each of these documents serves a specific purpose in the process, ensuring that both parties are protected and that the transaction is legally sound.

- Loan Modification Agreement: This document outlines the new terms of the loan after modifications have been made. It may include changes to the interest rate, payment schedule, or principal balance, providing a structured way to manage the debt if the homeowner is attempting to negotiate terms before resorting to a deed in lieu.

- Notice of Default: This is a formal notification sent by the lender to the homeowner indicating that they have defaulted on their mortgage payments. It serves as a precursor to the foreclosure process and can be an important document to include in discussions about a deed in lieu.

- CDC U.S. Standard Certificate of Live Birth: For parents considering the importance of official documentation, the https://documentonline.org provides essential information on how to obtain this crucial certificate, ensuring accurate record-keeping for their newborn.

- Release of Liability: This document releases the homeowner from any further obligations related to the mortgage once the deed in lieu is executed. It is crucial for the homeowner to ensure they are not held liable for any remaining debt after the property is transferred.

- Property Condition Disclosure: This form provides information about the condition of the property being transferred. It helps the lender understand any potential issues with the property, ensuring transparency in the transaction.

Understanding these additional documents can help homeowners navigate the complexities of a deed in lieu of foreclosure. Each document plays a vital role in protecting the interests of both the homeowner and the lender, facilitating a smoother transition away from foreclosure while ensuring that all legal obligations are addressed.

Other State-specific Deed in Lieu of Foreclosure Forms

Florida Deed in Lieu of Foreclosure - Homeowners are advised to communicate openly with their lenders throughout the process.

When entering into a rental agreement in New York, it is crucial to utilize a comprehensive document like a New York Residential Lease Agreement to ensure all terms are clear and enforceable. For reference, you can find a useful template at https://nyforms.com/residential-lease-agreement-template, which helps outline crucial elements such as the rent amount, deposit requirements, and lease duration, safeguarding the interests of both landlords and tenants.

Will I Owe Money After a Deed in Lieu of Foreclosure - A Deed in Lieu can help streamline the process for bank-owned properties, assisting lenders in inventory reduction.

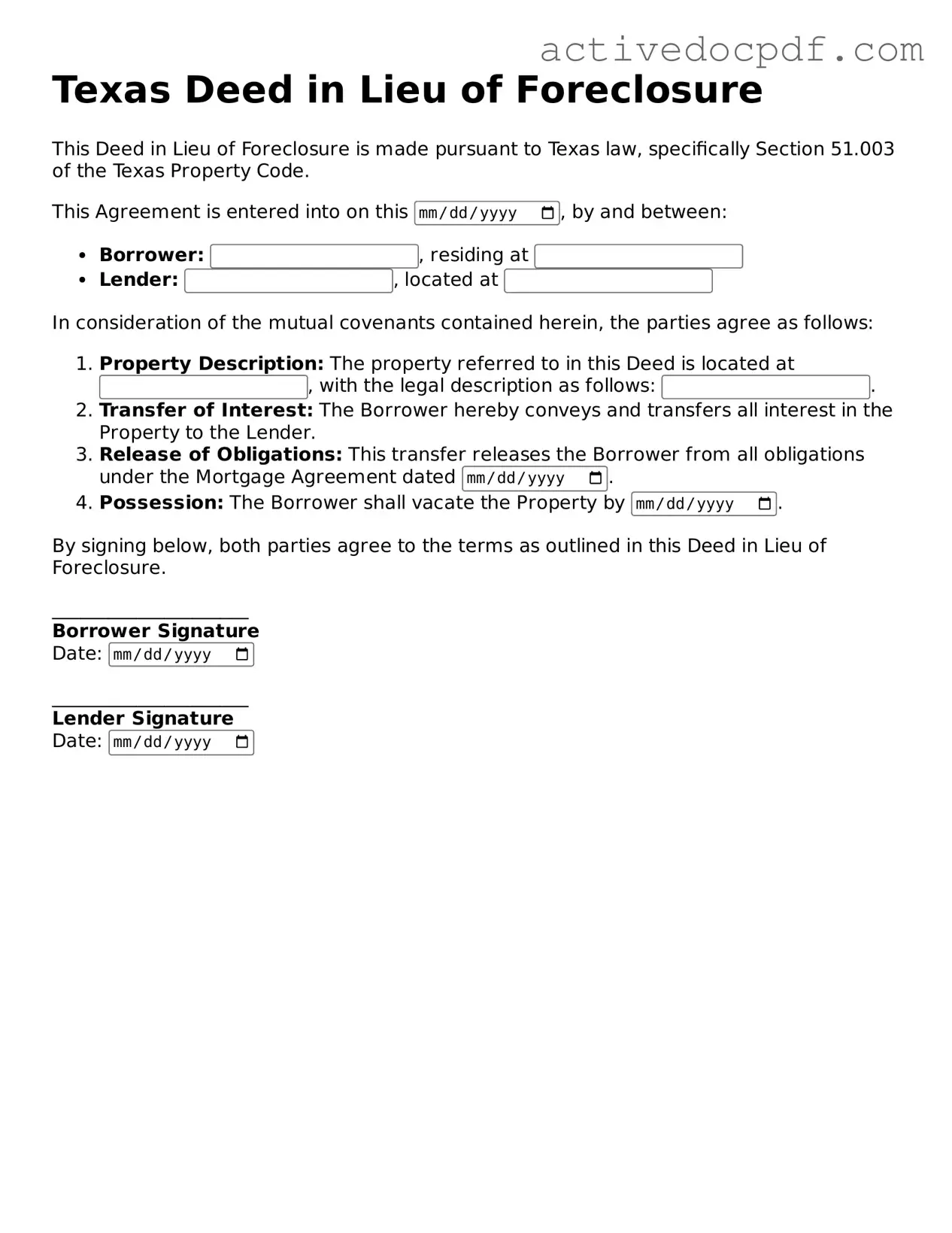

Key Details about Texas Deed in Lieu of Foreclosure

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal agreement where a homeowner voluntarily transfers their property to the lender to avoid foreclosure. This option can help both the homeowner and the lender by simplifying the process and reducing costs associated with foreclosure.

Who is eligible for a Deed in Lieu of Foreclosure?

Typically, homeowners facing financial difficulties and at risk of foreclosure may be eligible. However, lenders usually require that:

- The homeowner is unable to make mortgage payments.

- The property is not subject to any other liens.

- The homeowner has tried to sell the property without success.

What are the benefits of a Deed in Lieu of Foreclosure?

There are several advantages to this option:

- It can help preserve the homeowner’s credit score compared to a foreclosure.

- The process is usually quicker and less costly than foreclosure.

- Homeowners may be able to negotiate a cash incentive to help with relocation.

What are the risks involved?

While there are benefits, there are also risks to consider:

- The homeowner may still face tax implications on any forgiven debt.

- The lender may not agree to a Deed in Lieu if there are other liens on the property.

- It could affect future borrowing opportunities.

How does the process work?

The process generally involves these steps:

- The homeowner contacts the lender to discuss options.

- Both parties negotiate the terms of the Deed in Lieu.

- The homeowner signs the deed, transferring ownership to the lender.

- The lender processes the deed and releases the homeowner from the mortgage obligation.

Do I need a lawyer to complete a Deed in Lieu of Foreclosure?

While it’s not legally required to have a lawyer, it’s often a good idea. A lawyer can help ensure that the terms are fair and that the homeowner understands all implications of the agreement.

Can I still live in my home after signing a Deed in Lieu?

No, once the Deed in Lieu is signed, the homeowner no longer owns the property. The lender takes possession, and the homeowner must vacate the premises. However, there may be options for the homeowner to negotiate a move-out timeline.

How does a Deed in Lieu of Foreclosure affect my credit?

A Deed in Lieu is generally less damaging to your credit than a foreclosure. However, it will still be noted on your credit report and may affect your ability to obtain new credit for a period of time.

What should I do if I am considering a Deed in Lieu of Foreclosure?

If you are considering this option, start by contacting your lender to discuss your situation. It’s also wise to consult with a housing counselor or financial advisor to explore all available options and make an informed decision.

Similar forms

- Short Sale Agreement: This document allows a homeowner to sell their property for less than the amount owed on the mortgage. Like a deed in lieu of foreclosure, it provides a way to avoid foreclosure and can help the homeowner mitigate financial losses.

- IRS W-9 Form: This essential tax form enables individuals and businesses to provide their Taxpayer Identification Number (TIN) to others, ensuring accurate income reporting to the IRS. For more information, visit PDF Documents Hub.

- Loan Modification Agreement: A loan modification alters the terms of an existing mortgage to make it more affordable. Similar to a deed in lieu of foreclosure, it aims to help homeowners retain their property and avoid the negative consequences of foreclosure.

- Forebearance Agreement: This document temporarily suspends mortgage payments or reduces the amount owed. Both a forbearance agreement and a deed in lieu of foreclosure serve to prevent foreclosure, although the former allows the homeowner to keep the property while managing their payments.

- Mortgage Release: A mortgage release occurs when a lender agrees to release a borrower from their mortgage obligation. This is similar to a deed in lieu of foreclosure because it resolves the debt but typically requires the property to be sold or transferred back to the lender.

- Bankruptcy Filing: Filing for bankruptcy can halt foreclosure proceedings and provide a way to reorganize debts. While a deed in lieu of foreclosure involves voluntarily transferring the property, bankruptcy offers legal protection and a structured plan to address debts.

- Property Settlement Agreement: This document outlines the division of property and debts during a divorce or separation. Like a deed in lieu of foreclosure, it can involve the transfer of property ownership to resolve financial obligations and avoid foreclosure.

Guide to Filling Out Texas Deed in Lieu of Foreclosure

After completing the Texas Deed in Lieu of Foreclosure form, the next steps involve submitting the document to the appropriate parties. Ensure that all information is accurate and that all required signatures are present before proceeding. This form will facilitate the transfer of property ownership in a manner that can help resolve outstanding mortgage obligations.

- Obtain the Texas Deed in Lieu of Foreclosure form. This can typically be found online or through a legal document service.

- Fill in the name of the Grantor, which is the current property owner. This should be the individual or entity that holds the title to the property.

- Enter the name of the Grantee, which is usually the lender or mortgage company receiving the property.

- Provide a complete legal description of the property. This information can be found on the property deed or tax records.

- Include the address of the property. Ensure that this matches the legal description provided.

- State the date of the transfer. This is the date on which the deed will take effect.

- Sign the document in the presence of a notary public. The Grantor must sign the form to validate the transfer.

- Have the notary public complete their section, confirming the identity of the Grantor and witnessing the signature.

- Make copies of the completed form for personal records and for the Grantee.

- Submit the original signed document to the Grantee, typically the lender.

- File the deed with the county clerk’s office where the property is located, if required. Check local regulations for specific filing requirements.