Legal Deed Document for Texas State

Misconceptions

Understanding the Texas Deed form is crucial for anyone involved in real estate transactions in the Lone Star State. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- Misconception 1: A Texas Deed must be notarized to be valid.

- Misconception 2: A Texas Deed can only be used for transferring ownership of residential properties.

- Misconception 3: All Texas Deeds are the same and can be used interchangeably.

- Misconception 4: Once a Texas Deed is signed, it cannot be changed.

While notarization is highly recommended for a Texas Deed to be enforceable, it is not a strict requirement for the deed to be considered valid. However, without notarization, proving the authenticity of the document may become challenging.

This is false. Texas Deeds can be used to transfer ownership of various types of properties, including commercial, agricultural, and vacant land. Each deed serves the purpose of legally transferring property rights, regardless of the property type.

Not all deeds are created equal. Different types of deeds, such as warranty deeds, quitclaim deeds, and special warranty deeds, serve different purposes and provide varying levels of protection for the buyer. Understanding the distinctions is essential.

While it's true that a signed deed is a legal document, it can be amended or revoked under certain circumstances. If both parties agree, they can create a new deed that supersedes the previous one. Always consult a legal expert for guidance on this process.

Documents used along the form

When engaging in real estate transactions in Texas, several documents accompany the Texas Deed form to ensure a smooth transfer of property ownership. Each document serves a specific purpose and plays a crucial role in the overall process.

- Title Commitment: This document outlines the terms under which a title insurance company agrees to insure the title of the property. It provides information about the property's legal status, including any liens or encumbrances that may affect ownership.

- Property Disclosure Statement: Sellers typically provide this statement to inform potential buyers of any known issues with the property. It covers aspects such as structural problems, pest infestations, or environmental hazards, ensuring transparency in the transaction.

- Closing Statement: Also known as a HUD-1 statement, this document details all the financial aspects of the real estate transaction. It includes information on the purchase price, closing costs, and any credits or debits for both the buyer and seller.

- Last Will and Testament: This form is crucial for individuals who want to specify how their assets should be distributed after their passing. For those looking to create a will, you can access and download the document to ensure your wishes are formally recorded.

- Affidavit of Heirship: In cases where property is inherited, this document establishes the heirs' rights to the property. It helps clarify ownership and can be essential for transferring the title to the rightful heirs.

Understanding these documents can significantly enhance the experience of buying or selling property in Texas. Each plays a vital role in protecting the interests of all parties involved and ensuring compliance with state laws.

Other State-specific Deed Forms

Florida Home Deed - There are different types of deed forms, such as warranty deeds and quitclaim deeds.

The New York Room Rental Agreement form is essential for defining the arrangement between landlords and tenants, ensuring clarity regarding responsibilities and rights. To eliminate any potential misunderstandings, it is advisable to utilize comprehensive templates available online, such as the one found at nyforms.com/room-rental-agreement-template, which can help streamline the rental process.

Key Details about Texas Deed

What is a Texas Deed form?

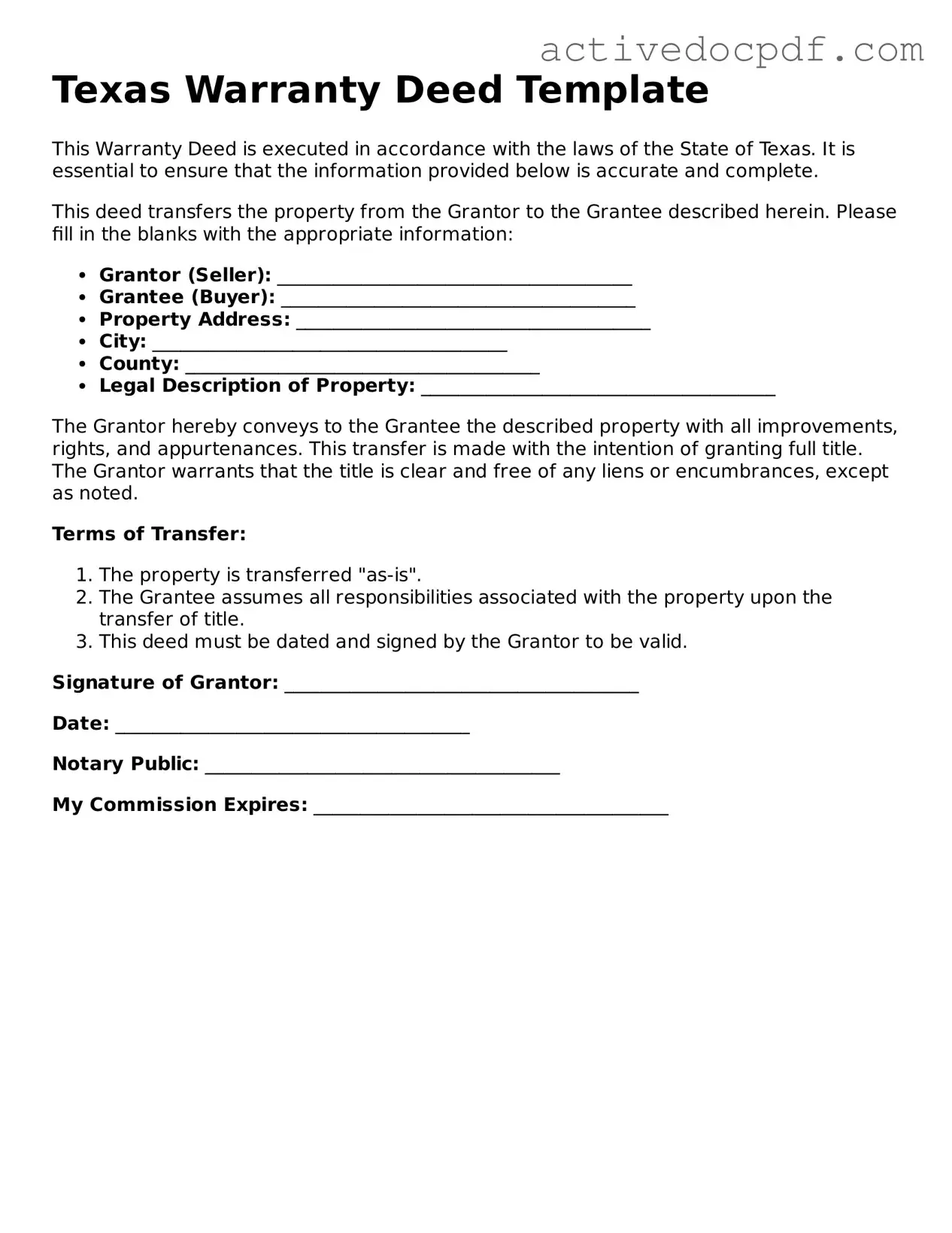

A Texas Deed form is a legal document used to transfer ownership of real property from one party to another in the state of Texas. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions or covenants related to the transfer. The deed must be signed and notarized to be legally binding.

What types of deeds are available in Texas?

Texas recognizes several types of deeds, each serving different purposes. The most common types include:

- General Warranty Deed: Provides the highest level of protection to the buyer, guaranteeing that the seller holds clear title to the property.

- Special Warranty Deed: Offers a limited warranty, covering only the time the seller owned the property.

- Quitclaim Deed: Transfers whatever interest the seller has in the property without any warranties.

- Deed of Trust: Used in Texas to secure a loan, this deed involves three parties: the borrower, the lender, and a trustee.

How do I complete a Texas Deed form?

Completing a Texas Deed form involves several key steps:

- Identify the parties involved in the transaction, including the grantor (seller) and grantee (buyer).

- Provide a legal description of the property, which can usually be found on the previous deed or in public records.

- Include any necessary terms or conditions related to the transfer.

- Sign the deed in the presence of a notary public.

Once completed, the deed should be filed with the county clerk's office where the property is located to ensure public record of the transfer.

Do I need an attorney to create a Texas Deed?

While it is not legally required to have an attorney to create a Texas Deed, consulting one can be beneficial. An attorney can provide guidance on the specific requirements and help ensure that the deed is properly executed and recorded. This can prevent potential disputes or issues with the title in the future.

What happens after the Texas Deed is recorded?

After the Texas Deed is recorded, it becomes part of the public record. This action serves several purposes:

- It provides legal notice to third parties regarding the ownership of the property.

- It protects the grantee's rights to the property against claims from other parties.

- It establishes a clear chain of title, which is essential for future transactions involving the property.

It is advisable for the grantee to obtain a copy of the recorded deed for their records.

Can a Texas Deed be revoked or changed?

A Texas Deed cannot be unilaterally revoked once it has been executed and recorded. However, the parties involved can create a new deed to transfer the property again. If changes are necessary, such as correcting an error in the original deed, a new deed can be drafted to reflect the correct information. This new deed must also be signed and recorded to be effective.

Similar forms

The Deed form serves a specific purpose in legal transactions, particularly in the transfer of property or rights. However, there are several other documents that share similarities with a Deed form. Each of these documents may be used in various legal contexts, but they often have overlapping functions. Below is a list of ten documents that are similar to the Deed form:

- Contract: A contract is a legally binding agreement between two or more parties. Like a Deed, it requires mutual consent and outlines specific obligations.

- Lease Agreement: A lease agreement allows one party to use another's property for a specified time in exchange for payment. Both documents formalize the terms of property use.

- Bill of Sale: A bill of sale transfers ownership of personal property from one person to another. Similar to a Deed, it serves as proof of ownership.

- Power of Attorney: This document grants one person the authority to act on behalf of another. It is similar to a Deed in that it formalizes the transfer of rights.

- Trust Agreement: A trust agreement establishes a fiduciary relationship where one party holds property for the benefit of another. Both documents create legally binding arrangements regarding property management.

- Emotional Support Animal Letter: This document validates the need for an emotional support animal and can be vital in housing and travel scenarios. For more information, visit documentonline.org.

- Quitclaim Deed: A quitclaim deed transfers interest in a property without guaranteeing that the title is clear. It is a specific type of Deed that simplifies the transfer process.

- Warranty Deed: A warranty deed provides a guarantee that the grantor holds clear title to the property. Like a Deed, it is used in property transactions to ensure security for the buyer.

- Affidavit: An affidavit is a written statement confirmed by oath, often used to provide evidence in legal matters. It can support the claims made in a Deed.

- Settlement Statement: This document outlines the financial details of a real estate transaction. It complements a Deed by detailing the financial aspects of the property transfer.

- Mortgage Agreement: A mortgage agreement secures a loan with the property as collateral. It is similar to a Deed in that it involves property rights and obligations.

Each of these documents plays a crucial role in legal transactions, much like the Deed form. Understanding their similarities can help clarify their respective functions in property and rights management.

Guide to Filling Out Texas Deed

Filling out a Texas Deed form is an important step in transferring property ownership. Once you have completed the form, you will need to file it with the appropriate county office to make the transfer official. Here are the steps to ensure you fill out the form correctly.

- Begin by clearly writing the date at the top of the form.

- Identify the grantor, or the person transferring the property. Provide their full name and address.

- Next, identify the grantee, or the person receiving the property. Include their full name and address as well.

- Describe the property being transferred. Include the legal description, which can often be found on the previous deed or property tax statement.

- State the consideration, or the amount paid for the property, if applicable. If the transfer is a gift, you can note that as well.

- Include any additional terms or conditions of the transfer, if necessary.

- Both the grantor and grantee must sign the document. Ensure that the signatures are dated.

- Have the deed notarized. A notary public will verify the identities of the signers and witness the signing.

- Make copies of the completed deed for your records before filing.

- Finally, file the original deed with the county clerk's office in the county where the property is located.