Legal Durable Power of Attorney Document for Texas State

Misconceptions

The Texas Durable Power of Attorney (DPOA) form is a crucial document that allows individuals to appoint someone to make decisions on their behalf. However, several misconceptions can lead to confusion about its purpose and effectiveness. Here are four common misconceptions:

- Misconception 1: A Durable Power of Attorney is only necessary for the elderly.

- Misconception 2: A Durable Power of Attorney grants unlimited power to the agent.

- Misconception 3: A Durable Power of Attorney becomes invalid upon the principal's death.

- Misconception 4: A Durable Power of Attorney is the same as a Living Will.

This is not true. While many people associate DPOAs with aging individuals, anyone can benefit from having this document. Unexpected events, such as accidents or sudden illnesses, can render anyone unable to make decisions. A DPOA ensures that your wishes are respected regardless of age.

While a DPOA does provide significant authority to the appointed agent, it does not mean they can act without limits. The powers granted can be tailored to specific needs and can be revoked at any time, as long as the principal is still competent. Understanding the scope of authority is crucial.

This is a common misunderstanding. A DPOA does indeed become invalid when the principal passes away. However, it is important to note that the agent's authority ends at that moment, and the will or estate plan then governs the distribution of assets.

These two documents serve different purposes. A DPOA allows someone to make financial and legal decisions on your behalf, while a Living Will outlines your preferences for medical treatment in the event that you cannot communicate your wishes. It is essential to have both documents to cover different aspects of decision-making.

Documents used along the form

When creating a Texas Durable Power of Attorney, several other forms and documents can enhance its effectiveness and ensure that your wishes are clearly communicated. Here’s a list of commonly used documents that often accompany the Durable Power of Attorney.

- Advance Healthcare Directive: This document outlines your preferences for medical treatment and appoints someone to make healthcare decisions on your behalf if you become unable to do so.

- Living Will: A living will specifies your wishes regarding life-sustaining treatments in situations where you are terminally ill or in a persistent vegetative state.

- HIPAA Release Form: This form allows designated individuals to access your medical records and information, ensuring they can make informed decisions about your healthcare.

- Will: A will details how your assets will be distributed after your death and can appoint guardians for minor children.

- Motorcycle Bill of Sale: Essential for transferring ownership of a motorcycle, this document details the buyer and seller's information, motorcycle specifics, and sale price. Ensure a smooth transaction by utilizing resources like PDF Documents Hub.

- Trust Agreement: A trust can manage your assets during your lifetime and after your death, providing more control over how your assets are handled.

- Financial Power of Attorney: Similar to the Durable Power of Attorney, this document specifically focuses on financial matters and can be used for more immediate financial needs.

- Property Deed: If you own real estate, a property deed may be necessary to transfer ownership or clarify property interests.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, like life insurance policies or retirement accounts, outside of your will.

Having these documents in place can provide clarity and peace of mind, ensuring that your wishes are respected and that your loved ones are prepared to act on your behalf when needed. It's essential to review and update these documents regularly to reflect any changes in your circumstances or preferences.

Other State-specific Durable Power of Attorney Forms

Free Durable Power of Attorney Form Florida - By establishing a Durable Power of Attorney, you create a clear pathway for your future care.

The Missouri Bill of Sale form serves as a legal document that records the transfer of ownership of personal property from one individual to another. This form is essential for ensuring that both parties have a clear understanding of the transaction and its terms. To facilitate your sale, consider filling out the Bill of Sale form by clicking the button below.

California Durable Power of Attorney - You can specify the powers granted to your agent, tailoring the authority to your needs.

Key Details about Texas Durable Power of Attorney

What is a Texas Durable Power of Attorney?

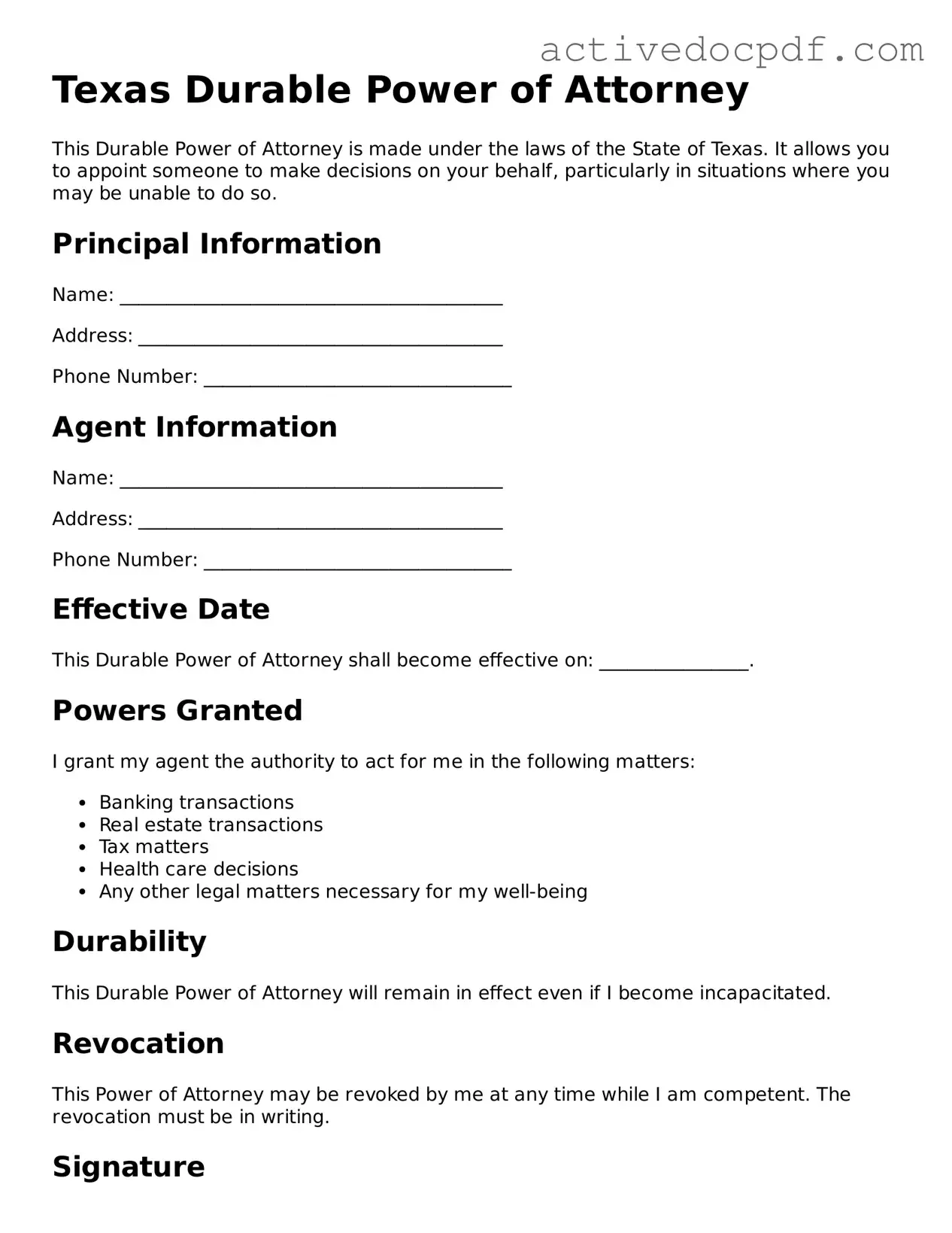

A Texas Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint another person, called the agent or attorney-in-fact, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated, ensuring that their financial and legal affairs can be managed without interruption.

What types of decisions can an agent make under this document?

The agent can make a wide range of decisions, including:

- Managing financial accounts

- Paying bills

- Buying or selling property

- Handling tax matters

- Making healthcare decisions if specified

However, the principal can limit the agent's authority by specifying which powers are granted in the document.

How does one create a Durable Power of Attorney in Texas?

To create a Durable Power of Attorney in Texas, the principal must:

- Obtain the appropriate form, which can be found online or through legal resources.

- Clearly outline the powers being granted to the agent.

- Sign the document in the presence of a notary public.

It is advisable to consult with an attorney to ensure that the document meets all legal requirements and adequately reflects the principal's wishes.

Can I revoke a Durable Power of Attorney?

Yes, a principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. To do so, the principal should create a written revocation document and notify the agent and any institutions or individuals that were relying on the original document.

What happens if the agent cannot serve or is unavailable?

If the appointed agent is unable to serve, the principal can designate an alternate agent in the Durable Power of Attorney document. If no alternate is named, the principal may need to create a new document or seek legal advice to appoint a new agent.

Is a Durable Power of Attorney the same as a Medical Power of Attorney?

No, a Durable Power of Attorney primarily deals with financial and legal matters, while a Medical Power of Attorney specifically grants authority to make healthcare decisions. It is important for individuals to have both documents if they wish to address both areas comprehensively.

What are the limitations of a Durable Power of Attorney?

While a Durable Power of Attorney is powerful, it does have limitations. For example, the agent cannot make decisions that are illegal or contrary to the principal's wishes as expressed in the document. Additionally, the agent's authority ends upon the principal's death.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not required to have a lawyer to create a Durable Power of Attorney, consulting with one is highly recommended. An attorney can provide guidance on the specific needs of the principal, help draft the document properly, and ensure that all legal requirements are met.

How long does a Durable Power of Attorney last?

A Durable Power of Attorney remains in effect until the principal revokes it, the principal passes away, or the agent resigns or is unable to serve. It is important for individuals to periodically review their documents to ensure they still meet their needs.

Can I use a Durable Power of Attorney from another state in Texas?

A Durable Power of Attorney created in another state may be recognized in Texas, provided it complies with Texas law. However, it is advisable to consult with a Texas attorney to ensure that the document is valid and will be honored by institutions in Texas.

Similar forms

- General Power of Attorney: Similar to a Durable Power of Attorney, this document grants authority to someone to act on your behalf in various matters. However, it becomes invalid if you become incapacitated.

- Health Care Proxy: This document allows you to appoint someone to make medical decisions for you if you are unable to do so. It focuses specifically on health care matters.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you cannot communicate. It complements a Durable Power of Attorney by providing guidance on health care decisions.

- Financial Power of Attorney: This document specifically grants authority to manage your financial affairs. It can be durable or non-durable, depending on your preferences.

- Advance Directive: An Advance Directive combines both a Living Will and a Health Care Proxy. It provides a comprehensive approach to medical decision-making and end-of-life care.

- Trust Agreement: A Trust Agreement allows you to place assets into a trust, managed by a trustee. While it serves different purposes, it can also designate someone to make decisions regarding your assets.

- Guardian Appointment: This document allows you to appoint a guardian for your minor children or dependents. It ensures that someone you trust will take care of them if you are unable to do so.

- Hold Harmless Agreement: Essential for protecting parties from liability, you can find the details in the comprehensive Hold Harmless Agreement resources needed for various activities.

- Will: A Will outlines your wishes regarding the distribution of your assets after death. While it does not grant authority during your lifetime, it is essential for estate planning.

Guide to Filling Out Texas Durable Power of Attorney

Filling out the Texas Durable Power of Attorney form is a straightforward process that allows you to designate someone to manage your financial affairs if you become unable to do so. Follow these steps carefully to ensure the document is completed accurately.

- Obtain the Form: Download the Texas Durable Power of Attorney form from a reliable source or acquire a physical copy from a legal office.

- Read the Instructions: Familiarize yourself with the form’s sections and any accompanying instructions to understand what information is required.

- Fill in Your Information: Enter your full name, address, and other identifying details in the designated sections at the top of the form.

- Select an Agent: Choose a trusted individual to act as your agent. Write their full name and contact information in the appropriate fields.

- Define Powers: Specify the powers you wish to grant to your agent. This may include managing bank accounts, selling property, or handling investments.

- Include Alternate Agents: If desired, list one or more alternate agents who can step in if your primary agent is unable or unwilling to serve.

- Sign and Date: Sign and date the form in the presence of a notary public to validate the document. Make sure to check any state-specific requirements for notarization.

- Distribute Copies: Provide copies of the signed document to your agent, alternate agents, and any financial institutions or entities that may need it.

Once the form is completed and distributed, it is important to keep a copy for your records. This ensures that you have access to the document whenever necessary and that your wishes are clear to all parties involved.