Legal Employment Verification Document for Texas State

Misconceptions

Understanding the Texas Employment Verification form is crucial for both employers and employees. However, several misconceptions can lead to confusion. Below is a list of ten common misconceptions about this form, along with clarifications for each.

-

Only employers can complete the form.

This is not true. While employers are responsible for providing verification, employees may also need to provide information to assist in the process.

-

The form is only required for new hires.

Many believe the form is only necessary for new employees. In reality, it may also be required for current employees seeking verification for loans or other purposes.

-

Employment verification is optional.

In many situations, especially for loan applications or government benefits, employment verification is a mandatory requirement.

-

All employers in Texas must use the same form.

While many employers may use a standard form, there is no single mandated format for employment verification in Texas.

-

Employers can refuse to provide verification.

Employers are generally obligated to provide truthful employment verification, but they may refuse if the request does not comply with legal guidelines or company policy.

-

Verification can take an indefinite amount of time.

Most employers strive to complete verification requests promptly, often within a few days. Delays can occur, but they should not be excessive.

-

Only full-time employees need verification.

Part-time employees and independent contractors may also require verification for various purposes, such as securing a loan or rental agreement.

-

The form is only relevant for salary information.

While salary is a component, the form may also include details about job title, duration of employment, and work status.

-

Employers can disclose any information they want.

Employers must adhere to privacy laws and company policies, which often limit the information that can be disclosed in an employment verification.

-

Once submitted, the verification cannot be updated.

Employers can update the information if there are changes in employment status or other relevant details, ensuring accuracy.

Clarifying these misconceptions can help both employers and employees navigate the employment verification process more effectively.

Documents used along the form

When completing the Texas Employment Verification form, several other documents may also be required to provide additional context or support. These documents help clarify employment status, income, and other relevant information. Below is a list of commonly used forms and documents associated with employment verification.

- W-2 Form: This document summarizes an employee's annual wages and the taxes withheld. It is often used to verify income for employment-related purposes.

- Pay Stubs: Recent pay stubs provide proof of income and employment status. They detail earnings for a specific period and can show consistency in employment.

- Employment Offer Letter: This letter outlines the terms of employment, including job title, salary, and start date. It serves as proof of employment and can clarify job responsibilities.

- Tax Returns: Personal tax returns can provide a comprehensive view of an individual's income over the previous year. They are often requested for verification of self-employment or other income sources.

- Motorcycle Bill of Sale: For those looking to buy or sell a motorcycle, use the essential Motorcycle Bill of Sale form resource to ensure proper documentation of the transaction.

- Social Security Card: A Social Security card may be requested to confirm identity and eligibility to work in the United States.

- Identification Documents: Valid identification, such as a driver's license or passport, is often required to verify identity and ensure compliance with employment laws.

Gathering these documents can streamline the employment verification process. Having everything ready can help avoid delays and ensure that the verification is completed efficiently.

Other State-specific Employment Verification Forms

State of California Verification of Employment - It supports claims made in workers’ compensation cases.

The Free And Invoice PDF form not only simplifies the invoicing process for businesses and individuals, but it also allows users to access valuable resources such as the PDF Documents Hub for additional support in creating tailored invoices efficiently.

Work Verification Letter Template - Can be tailored for different requests, including part-time or full-time statuses.

Key Details about Texas Employment Verification

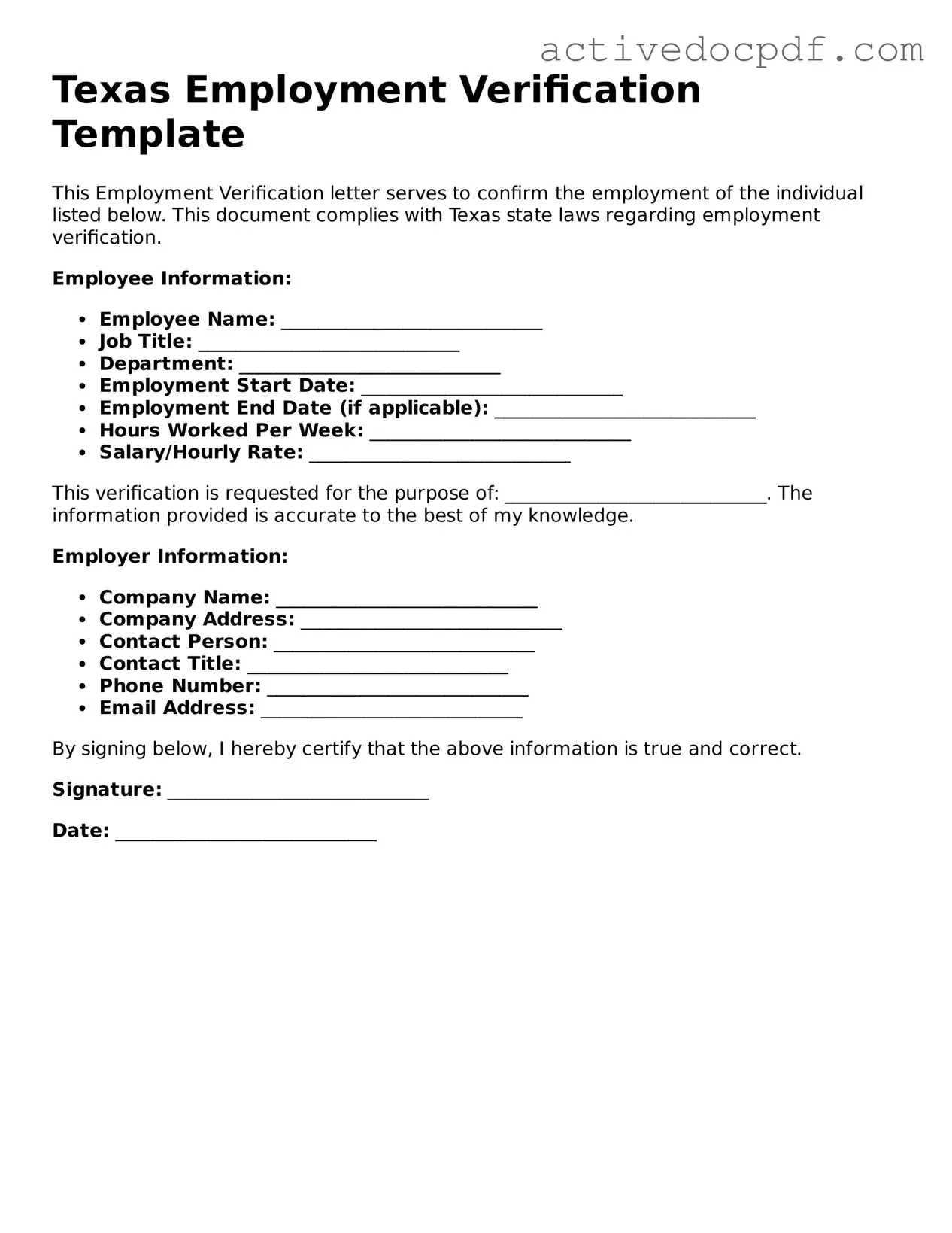

What is the Texas Employment Verification form?

The Texas Employment Verification form is a document used to confirm an individual's employment status, job title, and duration of employment with a particular employer in Texas. This form is often required for various purposes, including loan applications, rental agreements, and government assistance programs.

Who needs to complete the Texas Employment Verification form?

Typically, employers are responsible for completing the Texas Employment Verification form. Employees may request this form for personal use, such as when applying for a mortgage or rental property. It is essential for employers to provide accurate and timely information to facilitate the verification process.

What information is included in the Texas Employment Verification form?

The form generally includes the following details:

- Employee's full name

- Job title

- Start date of employment

- End date of employment (if applicable)

- Current employment status (active, terminated, etc.)

- Employer's contact information

How can I request a Texas Employment Verification form?

To request the form, employees should contact their human resources department or their direct supervisor. Employers may also have a standardized process for handling such requests, which could include submitting a written request or filling out an internal form.

Is there a fee associated with obtaining the Texas Employment Verification form?

In most cases, there is no fee for obtaining the Texas Employment Verification form. However, some employers may charge a nominal fee for administrative costs, especially if the request requires significant time or resources to fulfill.

How long does it take to receive the completed Texas Employment Verification form?

The time frame for receiving the completed form can vary. Generally, employers aim to process requests within a few business days. However, during busy periods or if additional information is needed, it may take longer. It is advisable to allow ample time when making a request.

What should I do if my employer refuses to complete the Texas Employment Verification form?

If an employer refuses to complete the form, employees should first seek clarification on the reason for the refusal. It may be helpful to discuss the situation with a supervisor or human resources representative. If the issue persists, employees can consider seeking legal advice or assistance from the Texas Workforce Commission.

Can the Texas Employment Verification form be used for purposes outside of employment verification?

While the primary purpose of the Texas Employment Verification form is to confirm employment status, it may also be used for various other purposes, such as income verification for loans or benefits applications. However, it is essential to check with the requesting party to ensure that the form meets their specific requirements.

What should I do if I find an error on the Texas Employment Verification form?

If you discover an error on the form, contact your employer immediately to address the issue. Employers are responsible for correcting any inaccuracies. It is crucial to resolve these discrepancies quickly, as they can impact your ability to secure loans, housing, or other opportunities.

Are there any legal implications associated with the Texas Employment Verification form?

Yes, providing false information on the Texas Employment Verification form can have serious legal consequences for both the employer and the employee. Employers must ensure the accuracy of the information provided, as misleading statements can lead to liability issues. Employees should also be aware that submitting false information can result in penalties or loss of benefits.

Similar forms

- Pay Stubs: These documents provide evidence of an employee's earnings and hours worked. Like the Employment Verification form, they confirm employment status and income level.

- W-2 Forms: Issued by employers, W-2 forms report annual wages and tax withholdings. They serve a similar purpose in verifying employment and income for tax purposes.

- Offer Letters: An offer letter outlines the terms of employment, including position, salary, and start date. This document verifies that an individual has been offered a job, similar to how the Employment Verification form confirms current employment.

- Employment Contracts: These legally binding agreements detail the terms of employment. They can confirm employment status and specific conditions of employment, akin to the Employment Verification form.

- Power of Attorney: A Power of Attorney form allows an individual to designate someone to make decisions on their behalf, particularly in financial and legal matters. This is crucial when one is unable to manage their affairs, ensuring that their wishes are respected. For more details, visit https://nyforms.com/power-of-attorney-template.

- Reference Letters: Written by previous employers or colleagues, reference letters attest to an individual's work history and character. They provide a form of verification of past employment, similar to the Employment Verification form.

- Social Security Administration (SSA) Earnings Statement: This document summarizes an individual's earnings history as reported to the SSA. It can be used to verify employment and income over time, much like the Employment Verification form.

- Job Descriptions: A detailed job description outlines an employee's role and responsibilities. While not a direct verification tool, it can support claims of employment status and duties performed.

- Tax Returns: Personal tax returns can reflect income and employment history. They provide a broader context for verifying employment and earnings, similar to the Employment Verification form.

- Company ID or Badge: An employee identification card serves as proof of employment within a specific organization. While not a formal document, it visually confirms that an individual is employed at a company.

- Separation Notices: Issued when an employee leaves a job, these documents confirm the end of employment. They can provide context for employment verification, particularly for past roles.

Guide to Filling Out Texas Employment Verification

After obtaining the Texas Employment Verification form, you'll need to fill it out accurately to ensure your employment status is confirmed. Follow these steps carefully to complete the form properly.

- Start by entering your personal information. Include your full name, address, and contact details.

- Provide your employment details. List your job title, department, and the start date of your employment.

- Indicate your employment status. Specify whether you are currently employed, terminated, or on leave.

- Fill in your salary information. Include your current salary or hourly wage, along with any bonuses or additional compensation.

- Sign and date the form at the bottom to certify that the information provided is accurate.

- Submit the completed form to the designated department or individual as instructed.

Once you have submitted the form, it will be processed, and the relevant authorities will verify your employment status. Be sure to keep a copy for your records.