Legal Gift Deed Document for Texas State

Misconceptions

When it comes to the Texas Gift Deed form, several misconceptions can lead to confusion for those looking to transfer property without compensation. Here are five common misunderstandings:

- Gift Deeds are only for family members. Many believe that a Gift Deed can only be used to transfer property between relatives. In reality, anyone can give a gift of property to another person, regardless of their relationship.

- A Gift Deed does not require any formalities. Some people think that because a Gift Deed is a simple transfer, it does not need to be executed formally. However, a valid Gift Deed must be in writing, signed by the donor, and typically requires notarization to be legally binding.

- There are no tax implications with a Gift Deed. It is a common belief that transferring property as a gift is completely tax-free. While there may not be immediate income tax consequences, the donor should be aware of potential gift tax liabilities and the impact on future capital gains taxes for the recipient.

- A Gift Deed can be revoked easily. Some assume that once a Gift Deed is executed, it can be easily undone. In truth, revoking a Gift Deed is not straightforward and often requires legal action, especially if the property has already been transferred.

- All property can be gifted using a Gift Deed. It is a misconception that any type of property can be transferred with a Gift Deed. Certain properties, such as those under a mortgage or subject to liens, may have restrictions or require additional steps to transfer.

Understanding these misconceptions can help individuals navigate the process of gifting property in Texas more effectively. Always consider seeking professional advice to ensure compliance with legal requirements and to address any specific concerns.

Documents used along the form

In the process of transferring property as a gift in Texas, several documents may accompany the Texas Gift Deed form. Each of these documents serves a unique purpose, ensuring that the transaction is legally sound and clearly documented. Below is a list of common forms and documents used in conjunction with the Texas Gift Deed.

- Affidavit of Gift: This document confirms that the property is being given as a gift without any expectation of payment or compensation. It may include details about the donor and the recipient, as well as a description of the property.

- Property Description: A detailed description of the property being gifted is essential. This document may include the legal description, address, and any relevant identifiers that clearly define the property boundaries.

- Transfer Tax Exemption Form: In some cases, a transfer tax exemption form may be necessary to indicate that the transfer of property is a gift and not a sale, thereby exempting it from certain taxes.

- Residential Lease Agreement: This crucial document outlines the specific terms between the landlord and tenant for renting a property, detailing elements such as rent, security deposits, and lease duration, as found at https://nyforms.com/residential-lease-agreement-template.

- Gift Tax Return (IRS Form 709): If the value of the gift exceeds a certain threshold, the donor may need to file a gift tax return with the IRS. This form reports the gift and ensures compliance with federal tax laws.

- Consent to Gift: If the property is jointly owned or subject to a mortgage, a consent form may be required from co-owners or lenders, allowing the transfer of the property as a gift.

- Title Insurance Policy: While not always required, obtaining a title insurance policy can protect the recipient from potential issues with the property’s title, such as liens or ownership disputes.

- Deed of Trust: If the property has an existing mortgage, a deed of trust may be necessary to outline the terms under which the property can be transferred, ensuring that the lender’s interests are protected.

- Notarized Signatures: Many of the documents associated with the gift deed may need to be notarized to verify the identities of the parties involved and to ensure that the documents are legally binding.

By understanding these accompanying documents, individuals can navigate the process of gifting property more effectively. Proper documentation helps to clarify intentions, protect rights, and ensure compliance with legal requirements, ultimately facilitating a smoother transaction.

Other State-specific Gift Deed Forms

Gift Deed California - A Gift Deed can enable smoother transactions during estate planning.

For more detailed information about the necessary requirements and guidelines for completing this important document, parents can refer to resources such as documentonline.org, which provides valuable insights into the CDC U.S. Standard Certificate of Live Birth form.

Key Details about Texas Gift Deed

-

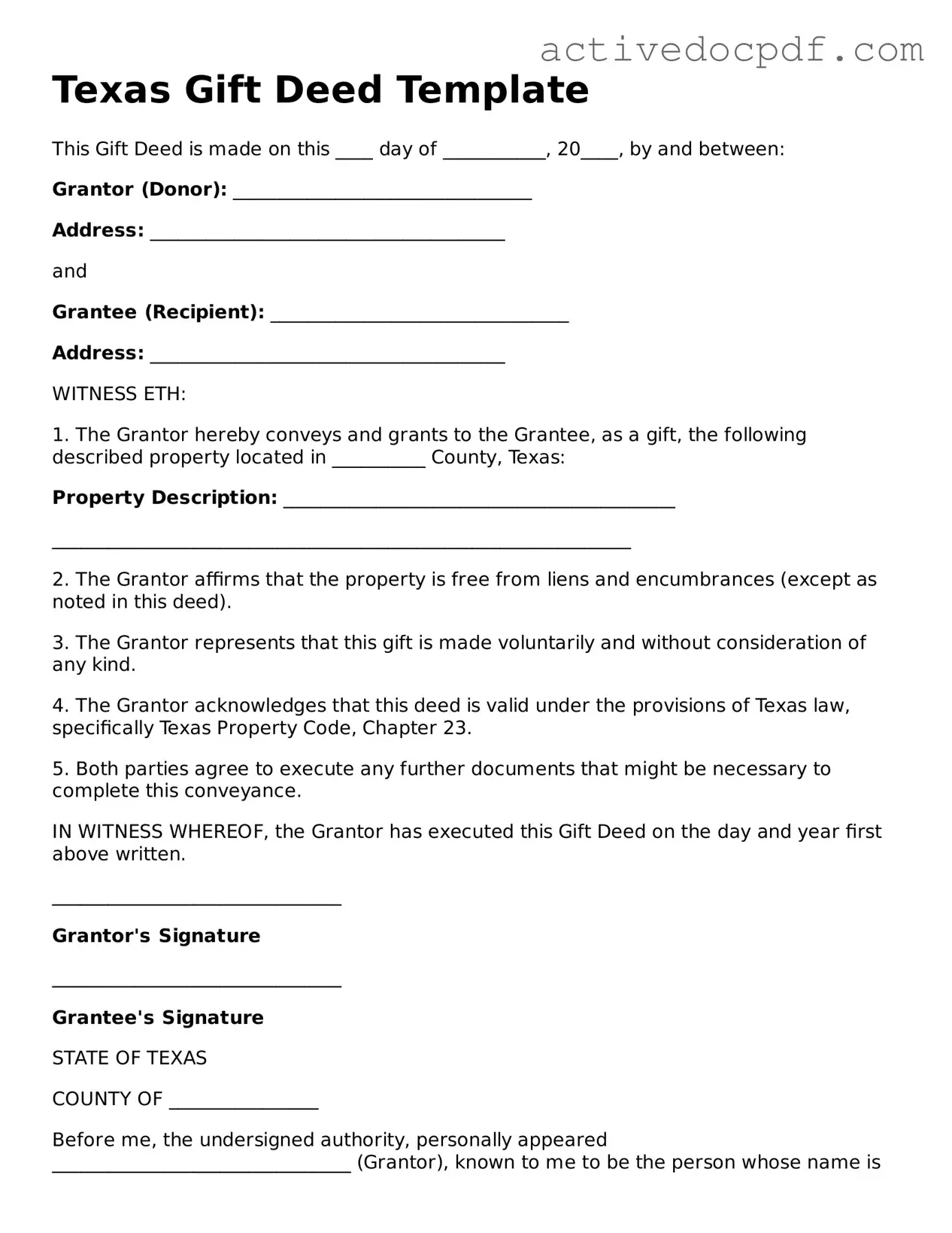

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This deed signifies that the property is being given as a gift, and it outlines the details of the transfer, including the names of the giver (grantor) and the receiver (grantee), as well as a description of the property.

-

Who can use a Gift Deed in Texas?

Any individual who owns property in Texas can use a Gift Deed to transfer ownership to another person. This can include family members, friends, or even charitable organizations. It is important that the grantor has the legal capacity to transfer the property and that they are doing so voluntarily.

-

What are the requirements for a valid Gift Deed in Texas?

To create a valid Gift Deed in Texas, the following requirements must be met:

- The grantor must be the legal owner of the property.

- The deed must be in writing and signed by the grantor.

- The grantee must be identified in the deed.

- The property must be adequately described.

- The deed must be notarized and recorded in the county where the property is located.

-

Is there a tax implication when using a Gift Deed?

While a Gift Deed itself does not incur property taxes, it may have implications for gift taxes. The IRS allows individuals to gift a certain amount each year without incurring taxes. If the value of the property exceeds this limit, the grantor may need to file a gift tax return. It is advisable to consult with a tax professional for specific guidance.

-

Can a Gift Deed be revoked or changed after it is executed?

Once a Gift Deed is executed and recorded, it generally cannot be revoked or changed. The transfer of property is considered complete. However, if the grantor wishes to retain some rights to the property, they may want to consider other legal instruments, such as a life estate.

-

What happens if the grantor dies after executing a Gift Deed?

If the grantor dies after executing a Gift Deed, the property will remain with the grantee. The gift is considered complete at the time of transfer, and the property does not become part of the grantor's estate. However, it is wise for both parties to keep copies of the deed for their records.

-

Do I need an attorney to prepare a Gift Deed?

While it is not legally required to have an attorney prepare a Gift Deed, consulting one can provide peace of mind. An attorney can ensure that the deed complies with Texas laws and that all necessary details are included, reducing the risk of future disputes.

-

How do I record a Gift Deed in Texas?

To record a Gift Deed in Texas, the signed and notarized deed must be submitted to the county clerk's office in the county where the property is located. There may be a small fee for recording the deed. Once recorded, the deed becomes part of the public record.

-

Are there any special considerations for gifting property to minors?

When gifting property to minors, it is essential to consider that minors cannot legally hold title to property. A guardian or custodian must be appointed to manage the property until the minor reaches the age of majority. Legal advice should be sought to ensure compliance with state laws and to protect the interests of the minor.

-

Can a Gift Deed be used for personal property as well?

A Gift Deed is specifically designed for real property transfers. However, personal property can be gifted through other means, such as a bill of sale or a simple written agreement. It is advisable to document the transfer of personal property to avoid any potential disputes in the future.

Similar forms

A Gift Deed is a legal document that facilitates the transfer of property or assets from one individual to another without any exchange of money. Several other documents serve similar purposes in various contexts. Here are ten documents that share similarities with a Gift Deed:

- Will: A will outlines how an individual wishes to distribute their property upon death. Like a Gift Deed, it involves the transfer of ownership, although it takes effect posthumously.

- Trust Agreement: This document establishes a trust to manage assets for beneficiaries. Similar to a Gift Deed, it allows for the transfer of property, but typically involves ongoing management by a trustee.

- Quitclaim Deed: A quitclaim deed transfers any interest one party has in a property to another party without guaranteeing that interest is valid. It is often used to clear title issues, akin to how a Gift Deed transfers ownership.

- Sales Contract: A sales contract outlines the terms of a property sale. While a Gift Deed does not involve payment, both documents facilitate the transfer of ownership.

- Lease Agreement: A lease agreement allows one party to use property owned by another for a specified period. Although it typically involves rental payments, it shares the aspect of property rights transfer.

- Power of Attorney: This document grants one person the authority to act on behalf of another in legal matters. While not a direct transfer of property, it allows for decisions regarding property management, similar to the intent behind a Gift Deed.

- Assignment Agreement: An assignment agreement transfers rights or property from one party to another. This document functions similarly to a Gift Deed by transferring ownership, though it may involve consideration.

- Deed of Trust: A deed of trust secures a loan by transferring property rights to a trustee until the loan is repaid. While it involves a financial transaction, it also facilitates a transfer of property rights.

- IRS W-9 Form: The IRS W-9 form is essential for providing Taxpayer Identification Numbers to ensure accurate income reporting. For assistance in filling out this form, visit PDF Documents Hub.

- Settlement Agreement: This document resolves disputes and may involve the transfer of assets as part of the settlement. Like a Gift Deed, it can result in the transfer of ownership without a monetary exchange.

- Release of Liability: This document releases one party from legal claims related to a property. While it does not transfer ownership, it can affect property rights in a manner similar to a Gift Deed.

Guide to Filling Out Texas Gift Deed

Once the Texas Gift Deed form is completed, it should be printed and signed by the parties involved. After signing, the document must be filed with the appropriate county clerk's office to ensure it is recorded properly. This process helps to formalize the gift of property from one individual to another.

- Obtain the Texas Gift Deed form from a reliable source, such as a legal website or office supply store.

- Begin by entering the name and address of the grantor (the person giving the gift).

- Next, provide the name and address of the grantee (the person receiving the gift).

- Include a description of the property being gifted. This should be detailed enough to identify the property clearly.

- Specify the date of the gift in the designated area.

- Both the grantor and grantee should sign the form in the appropriate sections.

- Have the signatures notarized to validate the document.

- Make copies of the completed and notarized form for personal records.

- Submit the original form to the county clerk's office where the property is located for recording.