Legal Golf Cart Bill of Sale Document for Texas State

Misconceptions

When it comes to the Texas Golf Cart Bill of Sale, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- The bill of sale is not necessary for golf cart transactions. Many believe that a bill of sale is optional. However, it serves as an important record of the transaction, protecting both the buyer and seller.

- Golf carts do not require any registration. Some people think golf carts are exempt from registration. In Texas, if a golf cart is used on public roads, it must be registered with the local authorities.

- Only new golf carts need a bill of sale. This is incorrect. Both new and used golf carts require a bill of sale to document the transfer of ownership.

- A verbal agreement is sufficient. Relying solely on a verbal agreement can lead to disputes. A written bill of sale provides clear evidence of the terms agreed upon.

- The bill of sale must be notarized. Notarization is not a requirement for a golf cart bill of sale in Texas. However, having it notarized can add an extra layer of security.

- All golf carts are the same. This misconception overlooks the fact that golf carts come in various types and models, which can affect their value and requirements.

- The seller is responsible for all taxes. Buyers should be aware that they may need to pay sales tax when purchasing a golf cart, not just the seller.

- There are no legal consequences for not using a bill of sale. Failing to use a bill of sale can lead to legal complications, especially if there is a dispute over ownership or payment.

- Anyone can sell a golf cart without restrictions. There are regulations regarding who can sell golf carts, especially in terms of safety and compliance with local laws.

Understanding these misconceptions can help ensure a smoother transaction when buying or selling a golf cart in Texas.

Documents used along the form

When purchasing or selling a golf cart in Texas, several forms and documents may be required to ensure a smooth transaction. These documents help establish ownership, provide proof of sale, and comply with state regulations. Below is a list of other forms that are often used alongside the Texas Golf Cart Bill of Sale.

- Title Transfer Application: This document is necessary for transferring ownership of the golf cart from the seller to the buyer. It typically requires information about the vehicle and both parties involved in the transaction.

- IRS W-9 Form: When conducting transactions, individuals may need to provide a completed PDF Documents Hub to ensure accurate reporting of income to the IRS.

- Vehicle Registration Application: After acquiring a golf cart, the new owner may need to register it with the Texas Department of Motor Vehicles (DMV). This form includes details about the golf cart and the owner.

- Odometer Disclosure Statement: This statement is often required when a vehicle is sold, indicating the mileage on the golf cart at the time of sale. It helps prevent fraud related to the odometer reading.

- Proof of Insurance: Buyers may need to provide proof of insurance coverage for the golf cart. This document verifies that the vehicle is insured, which is essential for legal operation on public roads.

- Sales Tax Receipt: In Texas, sales tax is applicable on the sale of vehicles, including golf carts. A receipt showing the payment of sales tax may be required for registration purposes.

- Affidavit of Heirship: If the golf cart is inherited, this document may be necessary to establish the new owner’s rights to the vehicle. It outlines the relationship between the deceased and the heir.

- Power of Attorney: If the seller cannot be present during the transaction, a power of attorney may be used to authorize another individual to sign documents on their behalf.

- Inspection Report: Some buyers may request an inspection report to assess the condition of the golf cart before purchase. This document provides details about any mechanical or cosmetic issues.

Having these documents prepared can facilitate the sale and ensure compliance with Texas laws. Buyers and sellers should ensure that all necessary forms are completed accurately to avoid any complications in the future.

Other State-specific Golf Cart Bill of Sale Forms

Does a Golf Cart Have a Title - Essential for state registration and legal ownership verification.

When entering into a rental agreement, it is crucial for both landlords and tenants to have a comprehensive understanding of the terms and obligations defined in the contract. For those looking for a straightforward template to help navigate this process, the nyforms.com/residential-lease-agreement-template/ offers an excellent resource that ensures all necessary elements are addressed, promoting a smooth leasing experience.

Key Details about Texas Golf Cart Bill of Sale

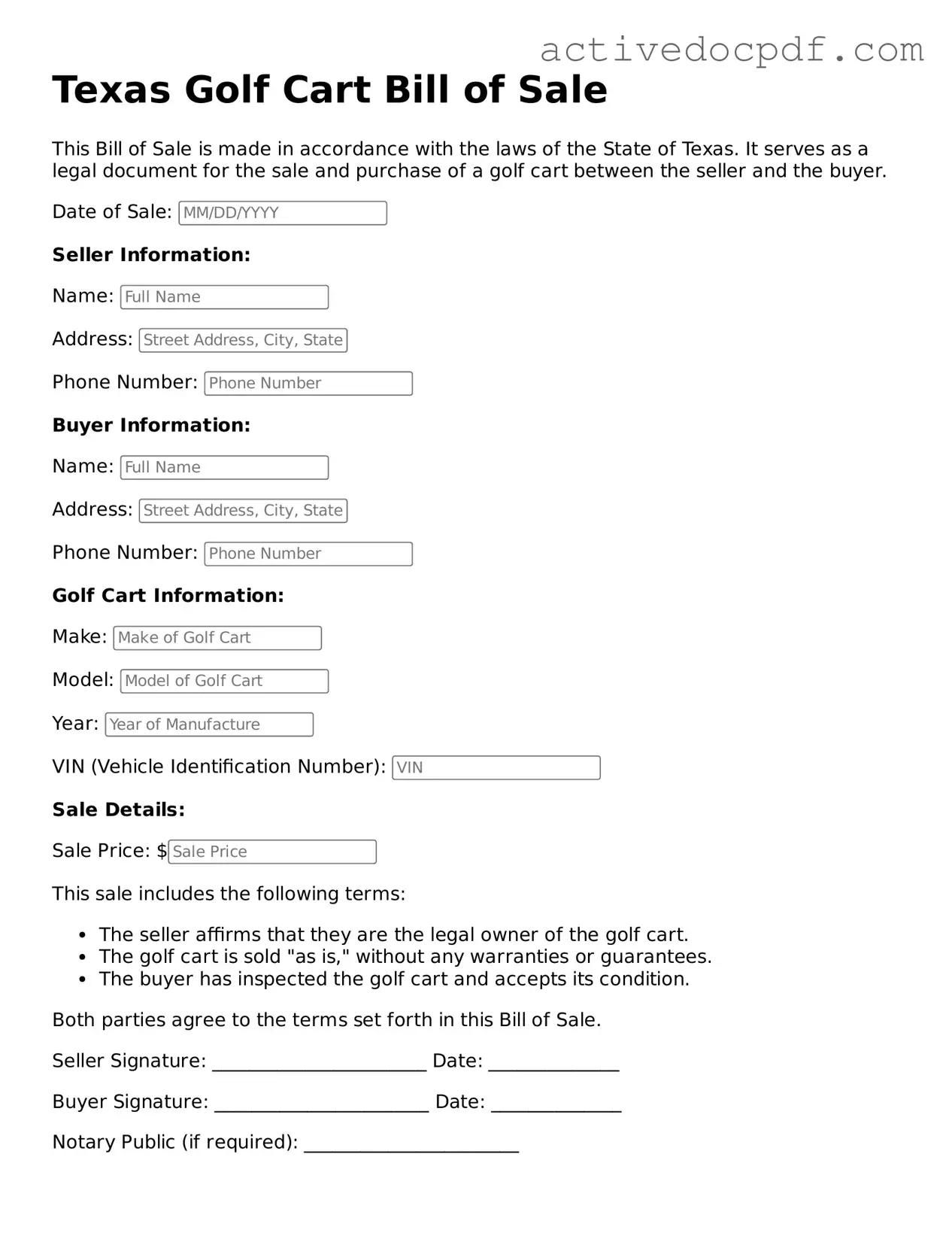

What is a Texas Golf Cart Bill of Sale?

A Texas Golf Cart Bill of Sale is a legal document that records the sale of a golf cart between a seller and a buyer. It serves as proof of the transaction and outlines the details of the sale, including the names of both parties, the date of the sale, and a description of the golf cart. This document can be important for both parties for future reference and potential registration purposes.

Is a Bill of Sale required for selling a golf cart in Texas?

While a Bill of Sale is not legally required to sell a golf cart in Texas, it is highly recommended. Having this document provides protection for both the buyer and the seller. It can help prevent disputes regarding the sale and serves as a record of the transaction, which can be useful for future ownership verification or registration.

What information should be included in the Bill of Sale?

The Bill of Sale should include the following information:

- Full names and addresses of the buyer and seller

- Date of the sale

- Description of the golf cart (make, model, year, VIN, etc.)

- Sale price

- Signatures of both parties

Including these details helps ensure clarity and can prevent future misunderstandings.

Can I create my own Bill of Sale for a golf cart?

Yes, you can create your own Bill of Sale for a golf cart. It is important to ensure that all necessary information is included to make the document valid. Many templates are available online that can guide you in drafting a comprehensive Bill of Sale. However, using a standardized form can sometimes simplify the process and ensure that you do not overlook any important details.

What if the golf cart has a lien on it?

If the golf cart has a lien, it is crucial to address this before completing the sale. The seller should pay off the lien and obtain a lien release from the lender. This release should be attached to the Bill of Sale. Buyers should be cautious and verify that there are no outstanding liens to avoid complications in the future.

Do I need to register my golf cart after purchasing it?

In Texas, golf carts do not require registration if they are used exclusively on private property. However, if the golf cart will be operated on public roads, registration may be necessary. Additionally, the buyer should check local ordinances, as some areas may have specific requirements for golf cart registration and operation.

How do I handle taxes related to the sale of a golf cart?

Sales tax may apply to the purchase of a golf cart in Texas. The seller is typically responsible for collecting the sales tax from the buyer at the time of sale. The buyer then pays this tax when registering the golf cart, if applicable. It is advisable to check with local tax authorities for specific rates and requirements.

What should I do if I lose the Bill of Sale?

If you lose the Bill of Sale, it is advisable to contact the other party involved in the transaction to request a duplicate. If that is not possible, you may need to create a new Bill of Sale that includes the same details as the original. Having a written record is beneficial for both parties, especially for future reference.

Similar forms

- Vehicle Bill of Sale: Similar to the Golf Cart Bill of Sale, this document serves as proof of the transfer of ownership for any motor vehicle. It includes details like the buyer and seller's information, vehicle identification number (VIN), and sale price.

- CDC U.S. Standard Certificate of Live Birth: This important document is used to officially record the birth of a child in the United States, ensuring that details are consistently captured. For more information, visit https://documentonline.org.

- Boat Bill of Sale: This document functions similarly to the Golf Cart Bill of Sale but pertains to the sale of boats. It includes information about the vessel, such as its registration number, make, model, and the terms of sale.

- Motorcycle Bill of Sale: Like the Golf Cart Bill of Sale, this document is used when selling or buying a motorcycle. It outlines the details of the transaction, including the motorcycle's VIN and the agreed sale price.

- ATV Bill of Sale: This document is specifically for all-terrain vehicles. It captures the buyer and seller's information, vehicle details, and sale conditions, similar to what is found in a Golf Cart Bill of Sale.

- Trailer Bill of Sale: When buying or selling a trailer, this document serves the same purpose as the Golf Cart Bill of Sale. It includes essential details about the trailer, including its VIN and condition.

- Personal Property Bill of Sale: This document can be used for various items, not just vehicles. It details the transaction of personal property, ensuring both parties have a record of the sale.

- Real Estate Purchase Agreement: While more complex, this agreement is similar in that it documents the sale of a property. It outlines the terms and conditions of the sale, including the purchase price and property details.

Guide to Filling Out Texas Golf Cart Bill of Sale

After obtaining the Texas Golf Cart Bill of Sale form, you will need to complete it accurately to ensure a smooth transaction. This form serves as a record of the sale and provides essential information about the buyer, seller, and the golf cart itself. Follow the steps below to fill it out correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller in the designated section.

- Next, fill in the buyer's full name and address.

- Include the golf cart's make, model, year, and Vehicle Identification Number (VIN).

- Specify the purchase price of the golf cart clearly.

- Indicate whether the sale includes any additional items, such as accessories or equipment.

- Both the seller and buyer should sign and date the form to validate the transaction.

- Make a copy of the completed form for both parties for their records.