Legal Horse Bill of Sale Document for Texas State

Misconceptions

The Texas Horse Bill of Sale form is an important document for anyone involved in buying or selling horses in Texas. However, several misconceptions surround this form that can lead to confusion. Here are six common misunderstandings:

- It is not legally required. Many people believe that a bill of sale is unnecessary for horse transactions. While it is not mandated by law, having a written document protects both the buyer and seller by providing proof of the sale.

- It only benefits the seller. Some think that the bill of sale primarily serves the seller's interests. In reality, it benefits both parties by documenting the transaction details, including the horse's condition and any warranties.

- It must be notarized. There is a misconception that the bill of sale must be notarized to be valid. While notarization can add an extra layer of authenticity, it is not a legal requirement in Texas.

- It is the same as a receipt. A receipt and a bill of sale are often confused. A receipt simply acknowledges payment, while a bill of sale includes comprehensive details about the horse and the terms of the sale.

- All horse sales require a specific form. Some believe there is a standardized form that must be used. While a specific template can be helpful, any written agreement that includes the necessary information can serve as a bill of sale.

- It does not need to include the horse's health information. Many overlook the importance of including health details in the bill of sale. Providing this information helps protect both parties and can be crucial for future veterinary care.

Understanding these misconceptions can help ensure a smoother transaction process when buying or selling a horse in Texas. Always consider consulting with a knowledgeable professional to navigate the specifics of your situation.

Documents used along the form

The Texas Horse Bill of Sale form is an important document that facilitates the transfer of ownership of a horse. However, there are several other forms and documents that are commonly used in conjunction with it. Each of these documents serves a specific purpose and can help ensure a smooth transaction. Below is a list of these documents.

- Equine Liability Release Form: This document protects the seller from liability in case of accidents or injuries that may occur during the buyer's ownership of the horse. It outlines the risks associated with horse ownership and requires the buyer to acknowledge these risks.

- Divorce Settlement Agreement: For clear understanding of your divorce terms, refer to the detailed Divorce Settlement Agreement guidance to ensure all legal aspects are covered.

- Health Certificate: A health certificate is issued by a veterinarian and confirms that the horse is free from contagious diseases. This document is often required for interstate travel and can provide peace of mind to the buyer.

- Brand Inspection Certificate: In Texas, this certificate verifies the ownership of a horse by confirming the brand or identification markings on the animal. It helps prevent theft and ensures that the horse is legally owned by the seller.

- Registration Papers: If the horse is registered with a breed association, these papers prove the horse's lineage and breed. They are important for buyers who are interested in showing or breeding the horse.

- Purchase Agreement: This document outlines the terms of the sale, including the purchase price, payment method, and any contingencies. It serves as a formal agreement between the buyer and seller and can help prevent misunderstandings.

- Transfer of Ownership Form: This form is often required by breed registries to officially transfer ownership from the seller to the buyer. It ensures that the horse's registration reflects the new owner's information.

Using these documents along with the Texas Horse Bill of Sale can help both buyers and sellers navigate the complexities of horse transactions. Each document plays a vital role in protecting the interests of all parties involved and ensuring a clear and legal transfer of ownership.

Other State-specific Horse Bill of Sale Forms

Simple Horse Bill of Sale - In certain situations, the form can include representations or warranties about the horse's health and soundness.

Understanding the Child Support Texas form is crucial for both Obligor and Obligee, as it provides clarity on financial responsibilities and legal obligations. For those looking for assistance, resources are available to help navigate the form. You can find a helpful guide at https://texasformspdf.com/fillable-child-support-texas-online, ensuring that every detail is correctly addressed to avoid future complications.

Key Details about Texas Horse Bill of Sale

What is a Texas Horse Bill of Sale?

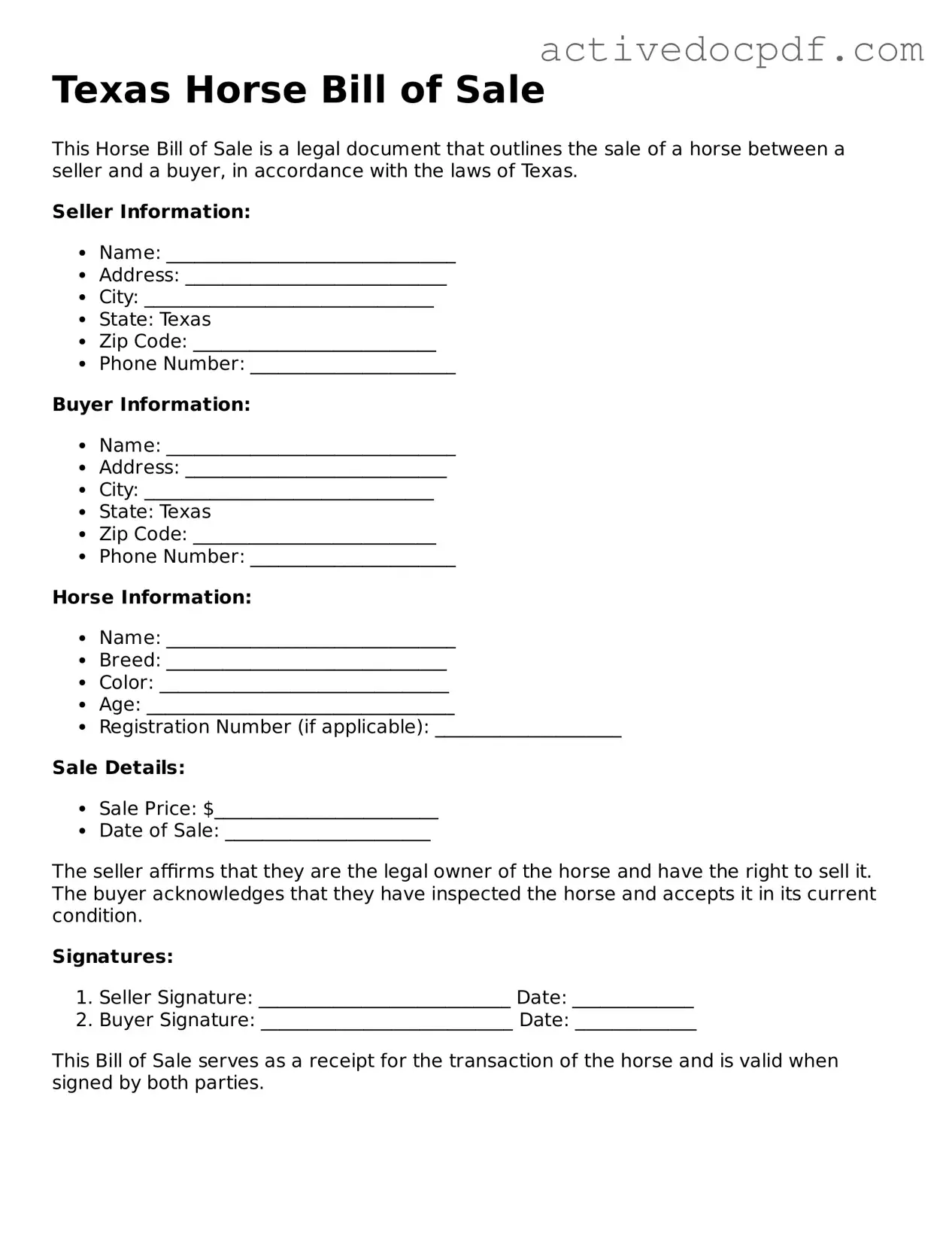

A Texas Horse Bill of Sale is a legal document that records the sale of a horse. It serves as proof of the transaction between the seller and the buyer. This document includes important details about the horse, such as its breed, age, and registration number, as well as the sale price and the names of both parties involved.

Why is a Horse Bill of Sale important?

This document is important for several reasons:

- It provides a record of ownership transfer.

- It protects both the buyer and seller in case of disputes.

- It may be required for registration purposes with breed associations.

- It can help establish the horse's value for insurance or tax purposes.

What information should be included in the form?

A complete Texas Horse Bill of Sale should include the following information:

- The names and addresses of both the buyer and seller.

- A detailed description of the horse, including breed, age, color, and any identifying marks.

- The sale price.

- The date of the sale.

- Signatures of both parties.

Is a Horse Bill of Sale required by law in Texas?

No, a Horse Bill of Sale is not legally required in Texas. However, it is highly recommended to protect both parties involved in the transaction. Having a written record can prevent misunderstandings and provide clarity regarding the sale.

Can I use a generic Bill of Sale for a horse?

While a generic Bill of Sale can be used, it is advisable to use a specific Horse Bill of Sale. A specialized form will ensure that all relevant details about the horse and the transaction are included, reducing the chance of missing important information.

How should the Bill of Sale be signed?

Both the buyer and seller should sign the Bill of Sale. It is best to have the signatures witnessed or notarized, though this is not a requirement. Having a witness or notary can add an extra layer of credibility to the document.

What if the horse has health issues or is sold “as-is”?

If the horse has known health issues, it is important to disclose this information in the Bill of Sale. If the horse is being sold “as-is,” this should also be clearly stated in the document. This protects the seller from future claims regarding the horse’s condition after the sale.

Can the Bill of Sale be used for tax purposes?

Yes, a Horse Bill of Sale can be used for tax purposes. It serves as proof of the sale price and can help establish the horse's value for tax assessments or deductions. Keeping a copy of the Bill of Sale is advisable for record-keeping and tax filing purposes.

Where can I obtain a Texas Horse Bill of Sale form?

Texas Horse Bill of Sale forms can be obtained from various sources, including online legal document providers, local equestrian organizations, or by consulting with an attorney. Many websites offer templates that can be customized to fit specific needs.

Similar forms

- Vehicle Bill of Sale: Similar to the Horse Bill of Sale, this document transfers ownership of a vehicle from one party to another. It includes details such as the buyer, seller, vehicle identification number, and sale price.

- Boat Bill of Sale: This document serves to finalize the sale of a boat. Like the Horse Bill of Sale, it records essential information about the buyer and seller, as well as specifics about the boat being sold.

- Real Estate Purchase Agreement: This agreement outlines the terms of a real estate transaction. It details the property, buyer, and seller, similar to how a Horse Bill of Sale details the horse and the parties involved in the sale.

- Pet Bill of Sale: When selling a pet, this document provides proof of ownership transfer. It captures the same basic information found in a Horse Bill of Sale, including the pet's description and the parties' details.

- Boat Bill of Sale: The Boat Bill of Sale is a critical document for transferring ownership of a boat, ensuring that the buyer and seller have a clear record of the transaction. Just like the Horse Bill of Sale, it includes vital information such as the parties involved, the boat's description, and the sale price, securing the rights of both sides. For further details, visit PDF Documents Hub.

- Equipment Bill of Sale: This form is used for the sale of various types of equipment. It shares similarities with the Horse Bill of Sale by documenting the sale terms, including the buyer, seller, and equipment specifics.

Guide to Filling Out Texas Horse Bill of Sale

After gathering the necessary information, you can proceed to fill out the Texas Horse Bill of Sale form. This document will help you record the sale of a horse and provide proof of ownership transfer.

- Begin by entering the date of the sale at the top of the form.

- Provide the seller's full name and address. Make sure to include city, state, and ZIP code.

- Next, fill in the buyer's full name and address, including city, state, and ZIP code.

- Describe the horse being sold. Include details such as the horse's name, breed, age, color, and any identifying marks or registration numbers.

- State the sale price of the horse clearly in the designated space.

- If applicable, indicate any warranties or guarantees regarding the horse's health or condition.

- Both the seller and buyer should sign and date the form at the bottom. This confirms the agreement between both parties.

Once the form is complete, keep a copy for your records and provide a copy to the other party involved in the sale.