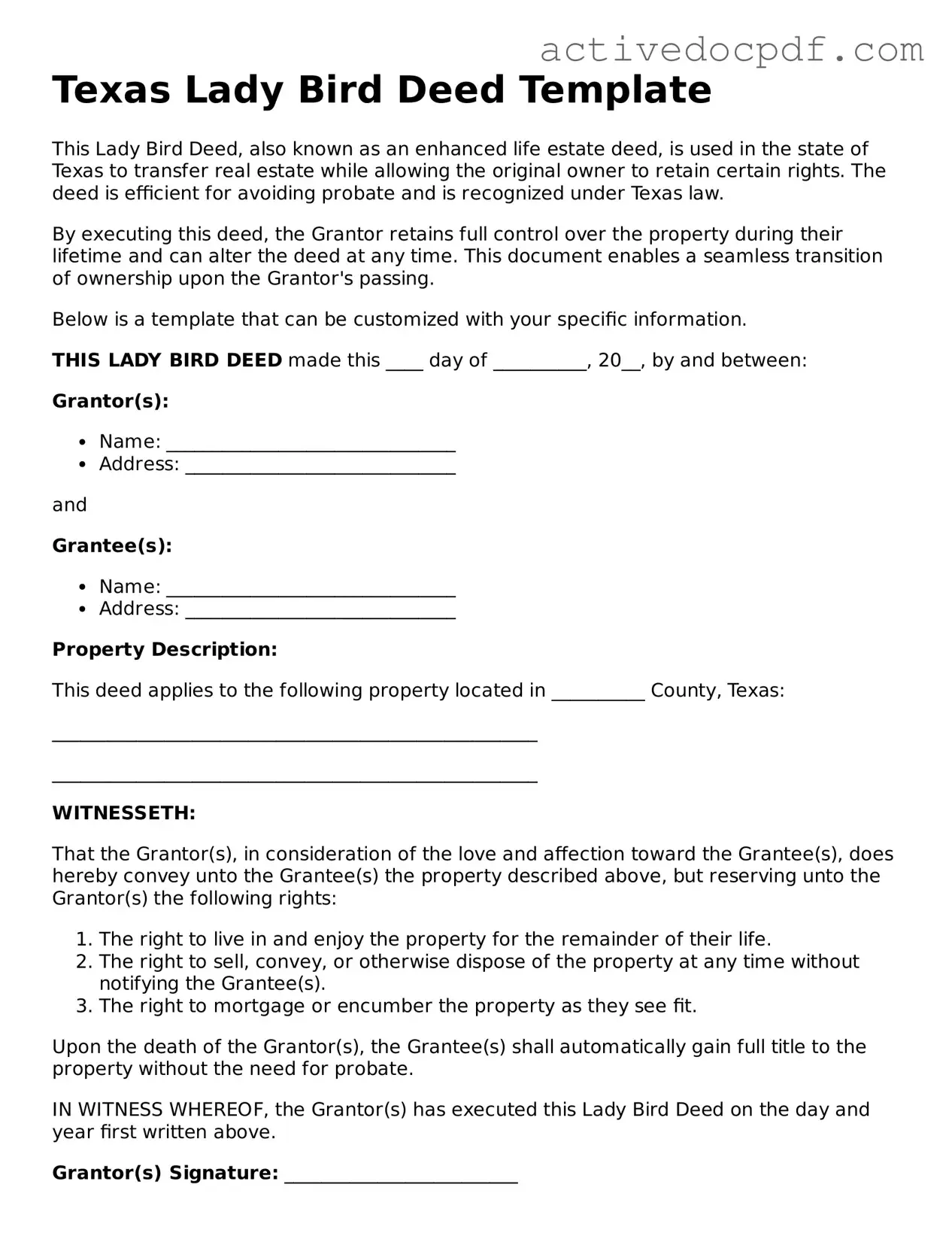

Legal Lady Bird Deed Document for Texas State

Misconceptions

The Texas Lady Bird Deed is a unique tool in estate planning, but several misconceptions surround its use. Here are six common misunderstandings:

- It only benefits married couples. Many believe that the Lady Bird Deed is only for married couples. In reality, it can be used by anyone who wants to transfer property while retaining control during their lifetime.

- It avoids probate completely. While a Lady Bird Deed can simplify the transfer of property and may help avoid probate for that property, it does not eliminate probate for all assets. Other assets may still go through the probate process.

- It cannot be changed once executed. Some think that once a Lady Bird Deed is signed, it cannot be altered. However, the grantor can revoke or modify the deed at any time while they are alive and competent.

- It affects property taxes negatively. There is a misconception that using a Lady Bird Deed will increase property taxes. In fact, the property tax benefits typically remain unchanged as the grantor retains control over the property.

- It is only for primary residences. Many people believe that Lady Bird Deeds can only be used for primary residences. However, they can also be applied to other types of real estate, such as vacation homes or rental properties.

- It is too complicated for the average person. While legal documents can seem daunting, the Lady Bird Deed is relatively straightforward. With proper guidance, most people can understand and utilize it effectively.

Documents used along the form

The Texas Lady Bird Deed is a unique estate planning tool that allows property owners to transfer their property to beneficiaries while retaining certain rights during their lifetime. However, it is often accompanied by other forms and documents that help clarify intentions, facilitate the transfer process, and ensure compliance with legal requirements. Below is a list of commonly used documents alongside the Texas Lady Bird Deed.

- Will: A legal document that outlines how a person's assets will be distributed upon their death. It can complement the Lady Bird Deed by addressing any remaining assets not covered by the deed.

- Durable Power of Attorney: This document grants someone the authority to make financial and legal decisions on behalf of the property owner if they become incapacitated. It ensures that decisions regarding the property can still be made when necessary.

- Transfer on Death Deed: Similar to the Lady Bird Deed, this document allows property to pass directly to a beneficiary upon the owner's death, without going through probate. It is an alternative that some may consider.

- Employment Application PDF: This standardized document is crucial for employers to gather necessary information from job applicants. For more details, you can refer to documentonline.org.

- Affidavit of Heirship: This document establishes the heirs of a deceased person’s estate. It can be useful in clarifying ownership of property that may not have been formally transferred.

- Property Tax Exemption Application: If the property qualifies, this form can be submitted to claim exemptions that reduce property taxes. It is important for maintaining financial benefits associated with the property.

- Homestead Declaration: This document asserts a property as a primary residence, which can provide certain legal protections and tax benefits. It may be relevant in conjunction with a Lady Bird Deed.

- Deed of Trust: A security instrument that allows a lender to hold a lien on the property until the borrower repays a loan. This document is crucial if the property is financed and needs to be addressed during the transfer process.

These documents serve various purposes and can significantly impact the management and transfer of property. Properly utilizing them alongside the Texas Lady Bird Deed can help ensure a smoother transition of assets and protect the interests of all parties involved.

Other State-specific Lady Bird Deed Forms

Lady Bird Deed Texas Pros and Cons - A Lady Bird Deed can provide peace of mind regarding estate planning and asset transfer.

When buying or selling a trailer in New York, it is crucial to have a proper documentation process in place, and the New York Trailer Bill of Sale form is a key component of this transaction. By completing this form, both parties can ensure they have a clear record of the sale, including all necessary details such as the purchase price and trailer description. For those looking to streamline this process, a useful resource can be found at nyforms.com/trailer-bill-of-sale-template/, which provides a template to facilitate the completion of the bill of sale.

Key Details about Texas Lady Bird Deed

What is a Lady Bird Deed in Texas?

A Lady Bird Deed, also known as an enhanced life estate deed, allows property owners in Texas to transfer real estate to their beneficiaries while retaining control of the property during their lifetime. This type of deed enables the owner to sell, mortgage, or otherwise manage the property without needing consent from the beneficiaries. Upon the owner's death, the property automatically transfers to the named beneficiaries without going through probate.

What are the benefits of using a Lady Bird Deed?

Several advantages come with using a Lady Bird Deed:

- Avoids Probate: The property transfers directly to beneficiaries upon the owner's death, bypassing the probate process.

- Retains Control: The property owner maintains full control over the property during their lifetime.

- Tax Benefits: Beneficiaries receive a step-up in basis, potentially reducing capital gains taxes when they sell the property.

- Flexibility: The owner can change beneficiaries or revoke the deed at any time before their death.

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed involves several steps:

- Obtain the appropriate form, which can often be found online or through a legal professional.

- Fill out the form with accurate information, including the property description and the names of the beneficiaries.

- Sign the deed in front of a notary public.

- Record the deed with the county clerk's office in the county where the property is located.

Can anyone use a Lady Bird Deed?

While most property owners can utilize a Lady Bird Deed, certain conditions apply. The property must be real estate located in Texas, and the owner must be of sound mind when creating the deed. Additionally, it is advisable for individuals to consult with a legal professional to ensure that a Lady Bird Deed is suitable for their specific circumstances.

What happens if I want to sell the property after creating a Lady Bird Deed?

If you decide to sell the property after executing a Lady Bird Deed, you have the right to do so without needing to inform the beneficiaries. The deed allows you to retain full control over the property, meaning you can sell, lease, or mortgage it as you see fit. However, it is essential to understand that selling the property will eliminate the benefits of the deed for the beneficiaries.

Is a Lady Bird Deed recognized in other states?

Lady Bird Deeds are specific to Texas and are not recognized in the same form in other states. However, some states have similar instruments, such as life estate deeds or transfer-on-death deeds. It is crucial to consult with a legal professional in your state to explore available options for property transfer and estate planning.

Similar forms

The Lady Bird Deed is a unique estate planning tool, but it shares similarities with several other documents. Here’s a breakdown of six documents that are comparable to the Lady Bird Deed, highlighting their key features:

- Living Trust: Like the Lady Bird Deed, a living trust allows for the transfer of assets without going through probate. It provides flexibility in managing assets during the grantor's lifetime and can specify how assets are distributed after death.

- Transfer on Death Deed (TOD): This document enables property owners to designate beneficiaries who will receive the property upon their death, similar to how a Lady Bird Deed transfers property automatically to the designated heir.

- Will: A will outlines how a person's assets will be distributed after their death. While a will requires probate, the Lady Bird Deed allows for a more straightforward transfer without court involvement.

- Motor Vehicle Bill of Sale: This document records the transfer of ownership of a vehicle and ensures a smooth transaction. To learn more about this essential form, visit PDF Documents Hub.

- Joint Tenancy with Right of Survivorship: This form of ownership allows two or more people to own property together. When one owner passes away, their share automatically transfers to the surviving owner, similar to the automatic transfer feature of a Lady Bird Deed.

- Power of Attorney: While primarily used to designate someone to make decisions on your behalf, a power of attorney can also address property management. The Lady Bird Deed allows for continued control over the property during the grantor's lifetime, which can be a point of similarity.

- Beneficiary Designation Forms: Commonly used for financial accounts and insurance policies, these forms allow individuals to name beneficiaries who will receive assets upon death. This is akin to the beneficiary designation in a Lady Bird Deed.

Guide to Filling Out Texas Lady Bird Deed

After obtaining the Texas Lady Bird Deed form, the next step involves accurately filling it out to ensure it meets legal requirements. This process includes providing necessary information about the property and the parties involved. Follow these steps carefully to complete the form.

- Begin by entering the date at the top of the form.

- Provide the full name and address of the property owner(s) in the designated section.

- Clearly describe the property being transferred. Include the legal description, which can usually be found on the property deed or tax records.

- List the names of the beneficiaries who will receive the property. Ensure that the names are spelled correctly.

- Indicate whether the property owner retains the right to sell or transfer the property during their lifetime.

- Include any specific instructions or conditions for the beneficiaries, if applicable.

- Sign and date the form in the presence of a notary public to validate the deed.

- Ensure that the notary public completes their section by signing and providing their seal.

- Make copies of the completed deed for your records.

- File the original deed with the county clerk's office in the county where the property is located.