Legal Last Will and Testament Document for Texas State

Misconceptions

Understanding the Texas Last Will and Testament form is essential for anyone looking to create a will. However, there are several misconceptions that can lead to confusion. Here are ten common misunderstandings about this important legal document:

- Only wealthy individuals need a will. Many people believe that wills are only for the rich. In reality, anyone with assets, no matter how modest, can benefit from having a will to ensure their wishes are honored.

- A will only takes effect after death. While it is true that a will is executed after death, it can also provide guidance for medical decisions or guardianship of children if the person becomes incapacitated.

- Verbal wills are valid in Texas. Some people think that they can simply express their wishes verbally. However, Texas law requires a written document to be considered a valid will.

- All wills must be notarized. While notarization can help validate a will, it is not a requirement in Texas. A will can be valid without a notary, as long as it is properly signed and witnessed.

- Once a will is created, it cannot be changed. Many individuals believe that a will is set in stone. In fact, wills can be amended or revoked at any time, as long as the person is of sound mind.

- Only lawyers can draft a will. While it is advisable to consult with a lawyer, individuals can create their own wills using templates or online resources, provided they follow Texas laws.

- Wills are only for distributing property. A will can also address other matters, such as appointing guardians for minor children and specifying funeral arrangements.

- Having a will avoids probate. A common myth is that having a will allows one to bypass the probate process entirely. In Texas, wills still go through probate, although having one can simplify the process.

- Beneficiaries must be family members. Many people think that only relatives can be named as beneficiaries. In fact, anyone can be designated as a beneficiary in a will, including friends and charities.

- Wills are only necessary for those with dependents. Even individuals without dependents can benefit from having a will to ensure their assets are distributed according to their wishes.

By understanding these misconceptions, individuals can make informed decisions about creating a Last Will and Testament in Texas. It is always wise to seek guidance to ensure that your will meets legal requirements and accurately reflects your wishes.

Documents used along the form

When creating a Texas Last Will and Testament, several additional documents may be necessary to ensure that your wishes are fully honored and that your estate is managed according to your desires. Each of these documents plays a crucial role in the estate planning process, providing clarity and guidance for your loved ones during a difficult time.

- Durable Power of Attorney: This document allows you to appoint someone to make financial decisions on your behalf if you become incapacitated. It ensures that your financial matters are handled according to your wishes, even if you are unable to communicate them yourself.

- Medical Power of Attorney: Similar to the Durable Power of Attorney, this form designates someone to make healthcare decisions for you if you are unable to do so. It is vital for ensuring that your medical treatment aligns with your preferences and values.

- Living Will: A Living Will outlines your wishes regarding medical treatment in situations where you may be unable to express your desires, particularly at the end of life. This document can relieve your family from the burden of making difficult decisions during emotional times.

- New York Lease Agreement: To ensure clarity and protect interests in rental arrangements, consider utilizing the PDF Documents Hub for your lease agreement needs.

- Affidavit of Heirship: This document can help establish the rightful heirs to your estate in cases where there is no will or when the will is contested. It serves as a legal declaration of who your heirs are, which can simplify the probate process.

Incorporating these documents into your estate planning can provide peace of mind, knowing that your wishes will be respected and that your loved ones will have clear guidance in your absence. Taking the time to prepare these forms can significantly ease the burden on your family during a challenging period.

Other State-specific Last Will and Testament Forms

Can You Make a Will Yourself - A necessary foundation for any comprehensive estate plan, ensuring comprehensive organization of affairs.

The Florida Motor Vehicle Power of Attorney form is a legal document that allows someone to appoint another person to handle matters related to their vehicle on their behalf. This can include tasks such as registration, titling, and selling. If you need to authorize someone to manage your vehicle affairs, especially when you're unable to do so yourself, you can see the form to get started.

Template for a Will - Specifies how personal belongings and financial assets should be allocated after one's passing.

Key Details about Texas Last Will and Testament

What is a Last Will and Testament in Texas?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. In Texas, this document allows you to designate beneficiaries for your property, appoint guardians for minor children, and specify your wishes regarding funeral arrangements. It serves as a critical tool for ensuring your wishes are respected and can help avoid disputes among family members.

Who can create a Last Will and Testament in Texas?

In Texas, any person who is at least 18 years old and of sound mind can create a Last Will and Testament. This means you must be able to understand the nature of the document and the consequences of your decisions. Additionally, you must not be under duress or undue influence when creating your will.

What are the requirements for a valid will in Texas?

For a will to be valid in Texas, it must meet several key requirements:

- The will must be in writing.

- The testator (the person making the will) must sign the document.

- The signing must be witnessed by at least two individuals who are at least 14 years old and who are not beneficiaries of the will.

Alternatively, Texas recognizes holographic wills, which are handwritten and do not require witnesses, provided they are signed by the testator.

Can I change or revoke my will in Texas?

Yes, you can change or revoke your will at any time while you are alive and of sound mind. To make changes, you can create a new will that explicitly revokes the previous one or add a codicil, which is an amendment to the original will. If you wish to revoke your will, you can do so by destroying it or stating your intent to revoke in writing.

What happens if I die without a will in Texas?

If you die without a will, you are considered to have died "intestate." In this case, Texas law determines how your assets will be distributed. Generally, your property will go to your closest relatives, such as your spouse, children, or parents, depending on your family situation. Dying intestate can lead to complications and may not reflect your wishes, making it essential to have a will in place.

Can I write my own will in Texas?

Yes, you can write your own will in Texas, but it is crucial to ensure that it meets all legal requirements to be valid. While a handwritten will (holographic will) can be valid, it is often advisable to seek legal assistance to avoid potential issues or ambiguities that could arise. A well-drafted will can provide peace of mind and clarity for your loved ones.

Is it necessary to have an attorney to create a will in Texas?

While it is not legally required to have an attorney to create a will in Texas, consulting with one can be beneficial. An attorney can help ensure that your will complies with state laws, accurately reflects your wishes, and addresses any complex family or financial situations. This can prevent potential disputes and complications in the future.

Similar forms

- Living Will: A living will outlines your preferences for medical treatment in case you become unable to communicate your wishes. Like a Last Will and Testament, it ensures your decisions are respected, but it focuses on health care rather than asset distribution.

- Power of Attorney: This document allows you to appoint someone to make financial or legal decisions on your behalf if you are unable to do so. Similar to a Last Will, it provides clarity and direction regarding your wishes, but it is effective while you are still alive.

- Trust: A trust holds assets for the benefit of specific individuals or purposes. While a Last Will distributes assets after death, a trust can manage and distribute assets both during your lifetime and after your passing, offering more control over how and when beneficiaries receive their inheritance.

- Durable Power of Attorney: For those seeking clarity in financial decision-making, the essential Durable Power of Attorney form guide is invaluable to ensure your interests are upheld if you become incapacitated.

- Advance Directive: An advance directive combines both a living will and a medical power of attorney. It specifies your health care preferences and appoints someone to make decisions on your behalf. Like a Last Will, it ensures your wishes are honored, particularly concerning medical care.

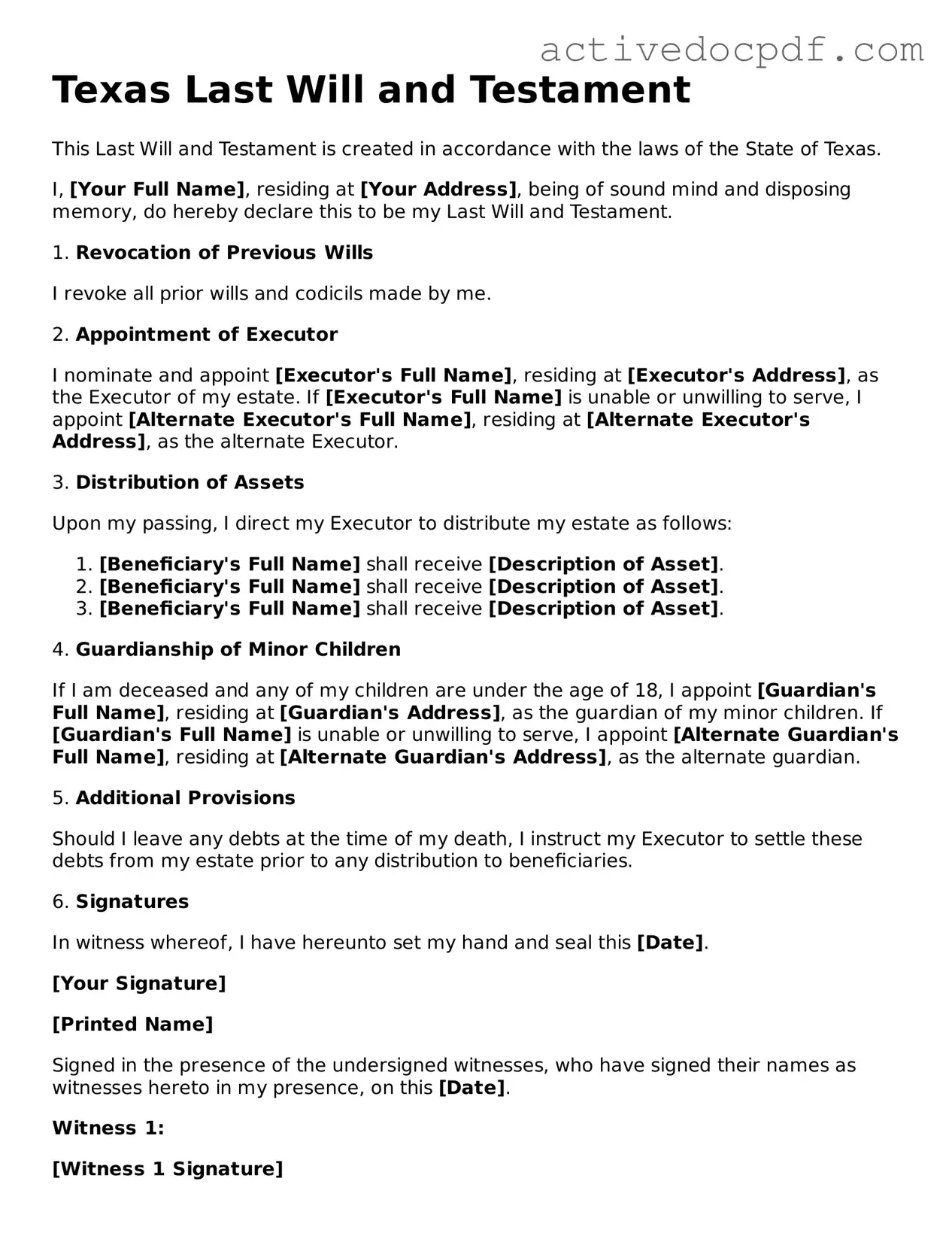

Guide to Filling Out Texas Last Will and Testament

Filling out a Texas Last Will and Testament form is an important step in ensuring your wishes are honored after your passing. This process involves careful consideration and attention to detail. By following these steps, you can create a legally binding document that reflects your intentions regarding the distribution of your assets and care for your loved ones.

- Gather Necessary Information: Before you begin, collect all relevant information, including your full name, address, and the names and addresses of your beneficiaries.

- Title the Document: At the top of the form, write "Last Will and Testament" to clearly indicate the purpose of the document.

- Identify Yourself: State your full name and declare that you are of sound mind and legal age to create a will.

- Revocation of Previous Wills: If applicable, include a statement revoking any previous wills or codicils to avoid confusion.

- Appoint an Executor: Choose a trusted individual to serve as your executor. Include their full name and address.

- Detail Your Assets: Clearly list your assets, including real estate, bank accounts, personal belongings, and any other items of value you wish to distribute.

- Specify Beneficiaries: Indicate who will receive each asset. Include their full names and relationships to you.

- Include Alternate Beneficiaries: Consider naming alternate beneficiaries in case your primary choices are unable to inherit.

- Sign and Date the Document: Sign and date your will in the presence of at least two witnesses. Ensure they also sign the document.

- Store the Will Safely: Keep the original will in a safe place, such as a safe deposit box or with your attorney, and inform your executor of its location.

Once you have completed the form, review it carefully to ensure all information is accurate. This will help prevent any potential disputes or confusion in the future. After finalizing your will, consider discussing your wishes with your family and executor to promote understanding and clarity.