Legal Loan Agreement Document for Texas State

Misconceptions

Loan agreements are essential documents in Texas, yet several misconceptions persist about their nature and requirements. Understanding these misconceptions can help borrowers and lenders navigate the loan process more effectively.

- Misconception 1: A loan agreement does not need to be in writing.

- Misconception 2: All loan agreements are the same.

- Misconception 3: A signature is the only requirement for a valid loan agreement.

- Misconception 4: Only banks can issue loan agreements.

- Misconception 5: There are no consequences for defaulting on a loan agreement.

- Misconception 6: Loan agreements are only necessary for large sums of money.

- Misconception 7: Once signed, a loan agreement cannot be changed.

While verbal agreements can be legally binding, having a written loan agreement provides clarity and protection for both parties. In Texas, a written document is strongly recommended to avoid misunderstandings.

Loan agreements can vary significantly based on the type of loan, the parties involved, and specific terms negotiated. Each agreement should reflect the unique circumstances of the transaction.

While signatures are crucial, other elements such as the date, loan amount, and repayment terms must also be clearly stated for the agreement to be enforceable.

Individuals and private lenders can also create loan agreements. As long as the terms are legal and agreed upon, any party can enter into a loan agreement.

Defaulting on a loan can lead to serious consequences, including damage to credit scores, legal action, and potential loss of collateral. Understanding the implications of default is essential for borrowers.

Regardless of the amount, a loan agreement is beneficial for any loan transaction. It ensures that both parties understand their obligations and protects their interests.

Loan agreements can be amended if both parties agree to the changes. It is important to document any amendments in writing to maintain clarity and legality.

Documents used along the form

When engaging in a loan agreement in Texas, several other forms and documents may accompany the primary agreement to ensure clarity, legality, and protection for all parties involved. Each of these documents serves a specific purpose and helps outline the terms and conditions of the loan arrangement.

- Promissory Note: This document is a written promise from the borrower to repay the loan amount. It specifies the loan terms, including interest rate, repayment schedule, and consequences of default. It serves as evidence of the debt.

- Room Rental Agreement: This legal document establishes the terms and conditions for renting a room within a housing unit, ensuring clarity and minimizing disputes. More details can be found at https://nyforms.com/room-rental-agreement-template.

- Security Agreement: If the loan is secured by collateral, this agreement outlines the collateral being used to guarantee the loan. It details the rights of the lender in the event of default, allowing them to claim the collateral.

- Loan Disclosure Statement: This statement provides essential information about the loan, including fees, interest rates, and the total cost of the loan. It ensures that borrowers understand the financial implications before signing the loan agreement.

- Personal Guarantee: In some cases, a lender may require a personal guarantee from the borrower or a third party. This document signifies that the individual agrees to be responsible for the loan if the borrower defaults, adding an extra layer of security for the lender.

- Loan Modification Agreement: If changes to the original loan terms are necessary, this agreement modifies the existing loan agreement. It outlines the new terms and conditions and requires the consent of both parties to be valid.

Understanding these documents can significantly enhance the borrowing experience, ensuring that all parties are on the same page regarding their rights and responsibilities. Properly executed, these forms contribute to a transparent and secure lending process.

Other State-specific Loan Agreement Forms

Loan Agreement Template California - Terms and conditions are clearly stated to prevent misunderstandings.

In addition to clearly outlining the details of the sale, utilizing the California Boat Bill of Sale form helps both parties maintain a record of the transaction, which is crucial for legal purposes. For those looking for a convenient way to obtain this form, Fast PDF Templates offers an easy access point to get the necessary documentation for a smooth transfer of ownership.

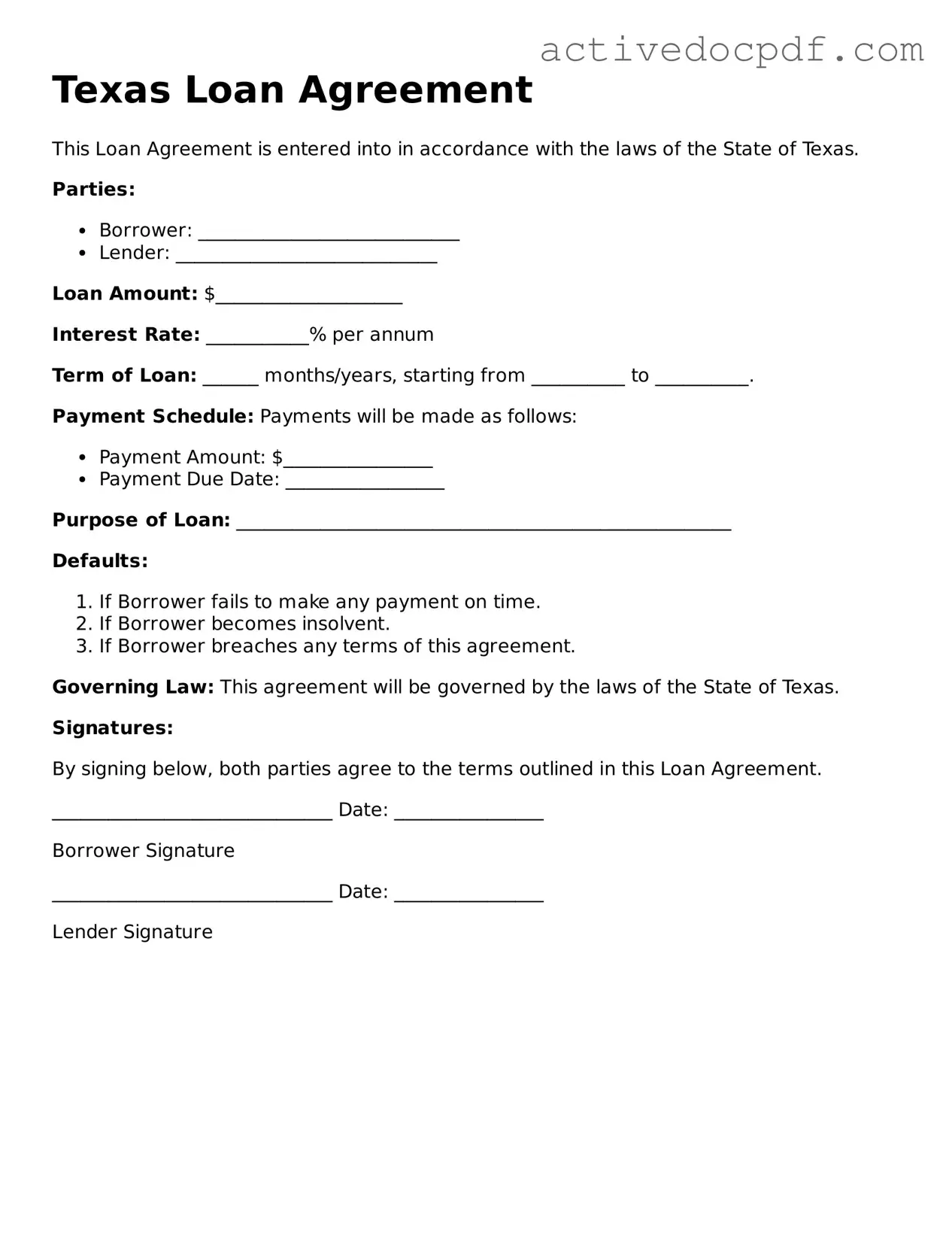

Key Details about Texas Loan Agreement

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document used to outline the terms and conditions of a loan between a lender and a borrower in the state of Texas. This form helps ensure that both parties understand their rights and obligations, providing clarity and protection in the lending process.

Who needs a Texas Loan Agreement?

Anyone involved in a lending transaction in Texas should consider using a Loan Agreement. This includes individuals, businesses, and organizations that either lend money or borrow funds. Having a formal agreement can help prevent misunderstandings and disputes down the line.

What should be included in a Texas Loan Agreement?

A comprehensive Texas Loan Agreement typically includes the following key elements:

- Loan Amount: The total sum being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: A detailed schedule outlining how and when the borrower will repay the loan.

- Default Terms: Conditions that define what happens if the borrower fails to repay the loan as agreed.

- Signatures: Both parties must sign the agreement to make it legally binding.

Is a Texas Loan Agreement legally binding?

Yes, a Texas Loan Agreement is legally binding as long as it meets the necessary legal requirements. This includes mutual consent from both parties, clear terms, and the intention to create a legal obligation. However, it’s always wise to consult with a legal professional to ensure that your agreement is enforceable.

Can I modify a Texas Loan Agreement after it has been signed?

Yes, modifications can be made to a Texas Loan Agreement after it has been signed, but both parties must agree to the changes. It’s best to document any modifications in writing and have both parties sign the updated agreement to avoid any confusion in the future.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may have several options, depending on the terms outlined in the Loan Agreement. These options can include:

- Charging late fees or penalties.

- Initiating legal action to recover the owed amount.

- Seizing collateral if the loan was secured.

It’s important to understand these terms before entering into a loan agreement.

Do I need a lawyer to create a Texas Loan Agreement?

While it’s not legally required to have a lawyer draft a Texas Loan Agreement, consulting with one can provide valuable guidance. A lawyer can help ensure that the agreement complies with Texas laws and adequately protects your interests.

Are there any specific Texas laws governing loan agreements?

Yes, Texas has specific laws that govern loan agreements, including regulations on interest rates, lending practices, and consumer protection. Familiarizing yourself with these laws can help you create a compliant and effective loan agreement.

Where can I find a Texas Loan Agreement template?

Many resources are available online for finding Texas Loan Agreement templates. Websites that specialize in legal documents often provide customizable templates. However, always review any template carefully and consider seeking legal advice to ensure it meets your specific needs.

What should I do if I have a dispute regarding a Texas Loan Agreement?

If a dispute arises regarding a Texas Loan Agreement, the first step is to communicate directly with the other party to try and resolve the issue amicably. If that fails, mediation or arbitration may be options to consider. In some cases, legal action may be necessary. Consulting with a lawyer can help you understand your rights and the best course of action.

Similar forms

Promissory Note: This document outlines a borrower's promise to repay a loan, detailing the amount borrowed, interest rate, and repayment schedule. Like a Loan Agreement, it serves as a formal acknowledgment of debt.

Lease Agreement: A lease agreement outlines the rental terms for property. For more information and assistance, you can visit PDF Documents Hub, which provides resources to help you create your own agreement.

Mortgage Agreement: A Mortgage Agreement secures a loan with real property. Similar to a Loan Agreement, it specifies the terms of the loan and the consequences of default.

Security Agreement: This document grants a lender rights to specific collateral in case of default. Both agreements detail the obligations of the borrower and the rights of the lender.

Lease Agreement: A Lease Agreement outlines the terms under which one party rents property from another. It shares similarities with a Loan Agreement in that it establishes terms, conditions, and responsibilities for both parties.

Credit Agreement: This agreement governs the terms of a line of credit. Like a Loan Agreement, it specifies the amount, interest rates, and repayment terms, providing a framework for borrowing.

Personal Loan Agreement: This document is specifically for personal loans between individuals. Similar to a Loan Agreement, it details the loan amount, interest rate, and repayment terms, creating a clear understanding between the parties.

Business Loan Agreement: This is tailored for business financing. Like a Loan Agreement, it outlines the loan amount, purpose, and repayment terms, ensuring both parties are aligned on expectations.

Line of Credit Agreement: This agreement allows borrowers to access funds up to a certain limit. It resembles a Loan Agreement by detailing the borrowing limits, interest rates, and repayment obligations.

Debt Settlement Agreement: This document outlines the terms under which a borrower settles a debt for less than the owed amount. It is similar to a Loan Agreement in that it formalizes the terms and conditions of repayment.

Guide to Filling Out Texas Loan Agreement

Filling out the Texas Loan Agreement form is a straightforward process. It requires accurate information to ensure clarity and legal compliance. Follow these steps carefully to complete the form correctly.

- Gather necessary information: Collect all relevant details, such as the names of the borrower and lender, loan amount, interest rate, and repayment terms.

- Start with the borrower’s information: Enter the full name, address, and contact details of the borrower in the designated fields.

- Provide the lender’s information: Fill in the lender’s name, address, and contact details in the appropriate sections.

- Specify the loan amount: Clearly state the total amount of the loan in numerical and written form.

- Detail the interest rate: Indicate the interest rate applicable to the loan, ensuring it is expressed as a percentage.

- Outline repayment terms: Describe the repayment schedule, including the duration of the loan and the frequency of payments.

- Include any additional terms: If there are specific conditions or clauses that need to be included, write them in the designated area.

- Sign the agreement: Both the borrower and lender should sign and date the form to validate the agreement.

- Make copies: After completing the form, make copies for both parties to keep for their records.