Legal Motor Vehicle Bill of Sale Document for Texas State

Misconceptions

There are several misconceptions about the Texas Motor Vehicle Bill of Sale form. Understanding these can help ensure a smoother transaction when buying or selling a vehicle.

- Misconception 1: The Bill of Sale is not necessary for vehicle transfers.

- Misconception 2: A Bill of Sale must be notarized.

- Misconception 3: The Bill of Sale is the only document needed for vehicle registration.

- Misconception 4: A Bill of Sale is only for private sales.

- Misconception 5: The form must be filled out in person.

Many people believe that a Bill of Sale is optional. In Texas, it serves as a crucial document that provides proof of the transaction and protects both the buyer and seller.

Some think that notarization is a requirement for the Bill of Sale to be valid. While notarization can add an extra layer of security, it is not mandatory in Texas.

It’s a common belief that the Bill of Sale is sufficient for registering a vehicle. However, buyers also need to provide other documents, such as the title and proof of insurance.

Some individuals think that this document is only relevant for private transactions. In reality, it can also be used in dealership sales or trades.

Many assume that the Bill of Sale must be completed in person. However, it can be filled out and signed electronically, making it more convenient for both parties.

Documents used along the form

The Texas Motor Vehicle Bill of Sale form is essential for transferring ownership of a vehicle. However, several other documents may also be required or beneficial during this process. Below is a list of commonly used forms and documents that can accompany the Bill of Sale in Texas.

- Title Transfer Application: This document is necessary to officially transfer the vehicle's title from the seller to the buyer. It includes details about the vehicle and both parties involved.

- Vehicle Title: The current title of the vehicle proves ownership. It must be signed over to the buyer by the seller during the transaction.

- Odometer Disclosure Statement: This form records the vehicle's mileage at the time of sale. It helps prevent fraud and is often required for titles issued after 2010.

- Texas Registration Application: This document is used to register the vehicle in the buyer's name. It includes information about the vehicle and the new owner.

- Proof of Insurance: Buyers must provide proof of insurance before registering the vehicle. This document confirms that the vehicle is insured as required by Texas law.

- Sales Tax Receipt: This receipt shows that the buyer has paid the necessary sales tax on the vehicle purchase. It is important for the registration process.

- Emission Inspection Certificate: Some vehicles may need to pass an emissions test before registration. This certificate verifies compliance with environmental regulations.

- Operating Agreement: This important document outlines the management and financial structure of an LLC, providing clarity and reducing potential conflicts among members. For more information, you can visit PDF Documents Hub.

- Notarized Affidavit: In some cases, a notarized affidavit may be required to confirm the legitimacy of the sale, especially if the title is lost or missing.

- Application for Duplicate Title: If the original title is lost, this application allows the owner to request a duplicate title from the Texas Department of Motor Vehicles.

Being aware of these documents can streamline the vehicle transfer process. Ensure that all necessary forms are completed accurately to avoid delays or complications in registration and ownership transfer.

Other State-specific Motor Vehicle Bill of Sale Forms

Mso Dmv - It is critical during a sale of a vehicle that all information is accurate to avoid potential legal issues.

California Dmv Statement of Facts - Conveys the terms for any reciprocal agreements in the sale.

For those seeking clarity on employment documentation, the required Employment Verification details provide indispensable insights that aid both employers and job seekers in understanding this critical process.

Fl Bill of Sale - Includes essential data required by state officials.

Key Details about Texas Motor Vehicle Bill of Sale

What is a Texas Motor Vehicle Bill of Sale?

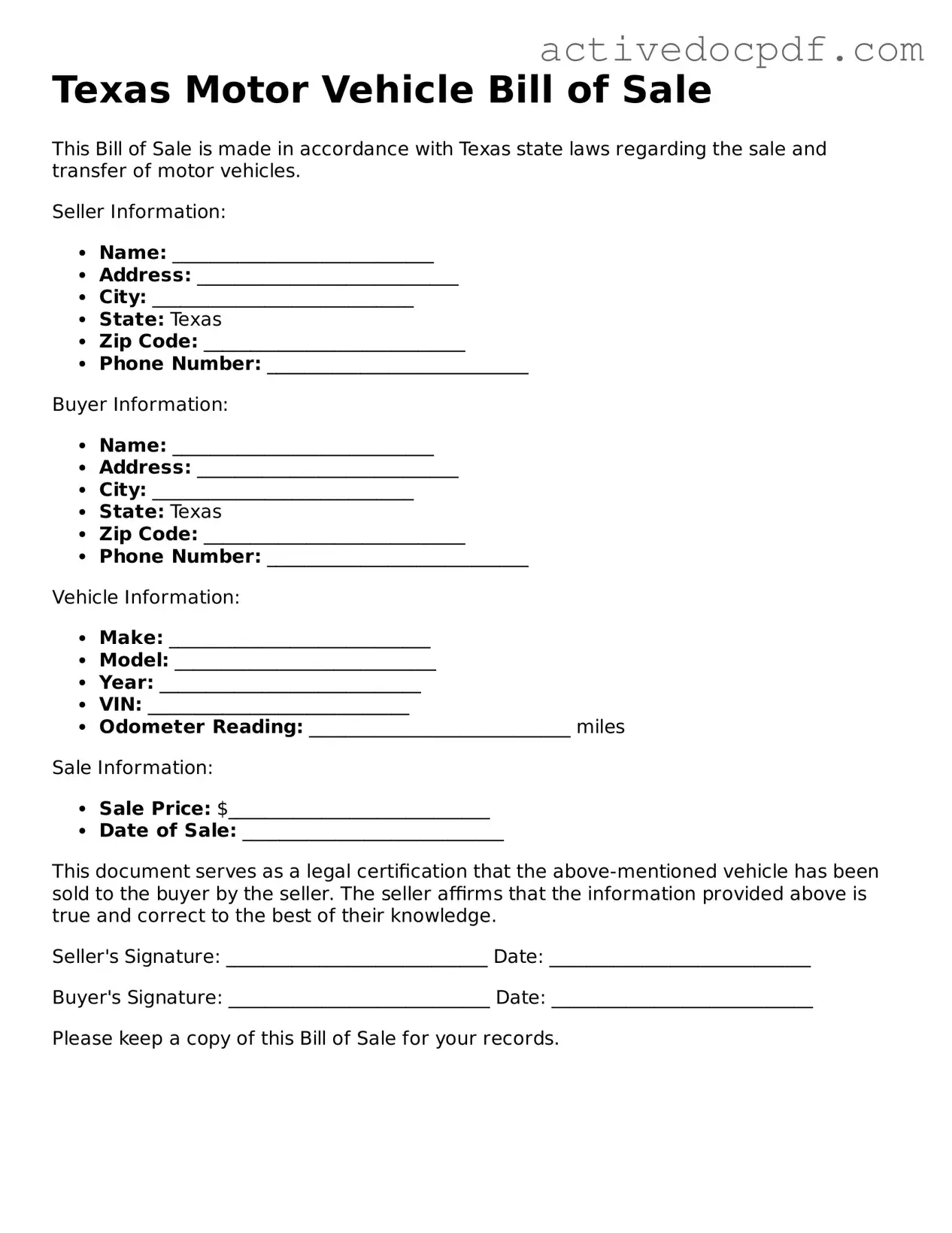

A Texas Motor Vehicle Bill of Sale is a legal document that serves as proof of the sale and transfer of ownership of a motor vehicle. It includes essential details about the vehicle, such as its make, model, year, and Vehicle Identification Number (VIN). This document is crucial for both the seller and the buyer, as it provides a record of the transaction and is often required for vehicle registration and title transfer.

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required in Texas for the sale of a vehicle, it is highly recommended. Having a Bill of Sale protects both parties by documenting the transaction. It can help resolve disputes regarding the sale and serves as proof of ownership transfer, which is particularly important when registering the vehicle with the Texas Department of Motor Vehicles (DMV).

What information should be included in a Texas Motor Vehicle Bill of Sale?

A comprehensive Bill of Sale should include the following information:

- Full names and addresses of both the buyer and the seller.

- The date of the sale.

- Detailed description of the vehicle, including make, model, year, color, and VIN.

- The sale price of the vehicle.

- Odometer reading at the time of sale.

- Any warranties or guarantees provided by the seller.

Including this information helps ensure clarity and reduces the potential for misunderstandings between the parties involved.

How do I complete a Texas Motor Vehicle Bill of Sale?

Completing a Texas Motor Vehicle Bill of Sale involves several straightforward steps:

- Obtain a blank Bill of Sale form, which can be found online or at certain DMV offices.

- Fill in the required details, ensuring accuracy in all entries.

- Both the buyer and seller should sign the document. This signature signifies agreement to the terms of the sale.

Once completed, both parties should retain a copy for their records.

Can I use a generic Bill of Sale form in Texas?

Yes, you can use a generic Bill of Sale form in Texas, provided it contains all the necessary information. However, using a state-specific form may simplify the process, as it is designed to meet Texas requirements. Ensure that the form includes all relevant details to avoid complications during the title transfer process.

What should I do with the Bill of Sale after the sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The seller should also provide the buyer with any other necessary documents, such as the vehicle title. The buyer will need the Bill of Sale when registering the vehicle with the Texas DMV. It is advisable for the seller to notify the DMV of the sale, which can help protect against any future liabilities associated with the vehicle.

Is there a fee associated with the Bill of Sale in Texas?

No fee is required specifically for the Bill of Sale itself. However, there may be fees associated with the vehicle title transfer and registration process at the DMV. These fees can vary based on the vehicle's value and other factors. It is important to check with the local DMV for the most current fee schedule.

What if there are issues after the sale?

If issues arise after the sale, such as disputes over the condition of the vehicle or claims of fraud, the Bill of Sale can serve as an important piece of evidence. It is advisable for both parties to communicate openly and attempt to resolve any issues amicably. If necessary, legal action may be considered, but having a well-documented Bill of Sale can significantly strengthen one's position in any dispute.

Similar forms

The Motor Vehicle Bill of Sale form serves as a crucial document in the transfer of ownership for a vehicle. However, it shares similarities with several other important documents. Here’s a look at ten documents that are comparable in nature:

- Real Estate Bill of Sale: Similar to the Motor Vehicle Bill of Sale, this document facilitates the transfer of ownership for personal property associated with real estate transactions, like appliances or fixtures.

- Boat Bill of Sale: Just like the Motor Vehicle Bill of Sale, this form is used to document the sale of a boat, ensuring that ownership is officially transferred from the seller to the buyer.

- Goods Bill of Sale: This document plays a vital role in the transfer of ownership for various goods. It outlines the transaction details, ensuring both parties are protected. You can fill out the Bill of Sale form by clicking the button below.

- Aircraft Bill of Sale: This document serves a similar purpose in the aviation industry, providing proof of ownership transfer for an aircraft, much like vehicles on the road.

- Personal Property Bill of Sale: Used for various types of personal property, this document outlines the sale and transfer of ownership, similar to vehicles and other assets.

- Business Bill of Sale: When a business changes hands, this document formalizes the sale, just as a Motor Vehicle Bill of Sale does for vehicles, ensuring all parties are clear on the transaction.

- Lease Agreement: While primarily a rental document, a lease agreement can also function similarly by outlining the terms of use and ownership rights for a vehicle or property.

- Gift Letter: This document can be akin to a bill of sale when a vehicle is gifted. It serves as proof of the transfer of ownership without a monetary exchange.

- Warranty Deed: In real estate, this document guarantees that the seller has the right to transfer ownership, similar to how a Motor Vehicle Bill of Sale affirms ownership transfer for vehicles.

- Power of Attorney: While not a sale document, it allows someone to act on behalf of another in transactions, including vehicle sales, ensuring the process is legally binding.

- Release of Liability Form: This document is often used alongside a bill of sale to protect the seller from future claims after the vehicle has been sold, similar to how other sales documents function.

Each of these documents plays a vital role in ensuring that ownership is clearly established and protected, just like the Motor Vehicle Bill of Sale does for vehicles.

Guide to Filling Out Texas Motor Vehicle Bill of Sale

Filling out the Texas Motor Vehicle Bill of Sale form is an important step in the process of transferring ownership of a vehicle. Once you have completed the form, you will be ready to submit it to the appropriate authorities and ensure that the transaction is legally recognized.

- Obtain the form: You can find the Texas Motor Vehicle Bill of Sale form online or at your local county tax office.

- Fill in the seller's information: Write the full name, address, and contact information of the seller. Make sure this information is accurate.

- Fill in the buyer's information: Enter the full name, address, and contact information of the buyer. Double-check for any errors.

- Provide vehicle details: Include the vehicle identification number (VIN), make, model, year, and odometer reading. This information is crucial for identifying the vehicle.

- State the sale price: Clearly indicate the amount for which the vehicle is being sold. This should be the agreed-upon price between the buyer and seller.

- Sign and date the form: Both the seller and buyer must sign and date the form. This signifies that both parties agree to the terms of the sale.

- Make copies: After completing the form, make copies for both the buyer and seller. This ensures that both parties have a record of the transaction.