Legal Operating Agreement Document for Texas State

Misconceptions

Understanding the Texas Operating Agreement form is crucial for anyone involved in forming a limited liability company (LLC) in Texas. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

-

It is not necessary to have an Operating Agreement.

Many people believe that an Operating Agreement is optional for LLCs in Texas. While it is not legally required, having one is highly recommended. It outlines the management structure and operational procedures, helping to prevent disputes among members.

-

All LLCs must use the same Operating Agreement template.

Some assume that there is a one-size-fits-all template for Operating Agreements. In reality, each LLC has unique needs. Customizing the agreement to reflect the specific goals and structure of the business is important.

-

Operating Agreements are only for multi-member LLCs.

It is a common belief that only LLCs with multiple members need an Operating Agreement. However, single-member LLCs can also benefit from having one. It helps clarify the owner’s intentions and provides legal protection.

-

The Operating Agreement cannot be changed once it is signed.

Some think that an Operating Agreement is set in stone after signing. In fact, it can be amended as needed. Members can modify the agreement to reflect changes in business operations or membership.

-

Operating Agreements are only for legal purposes.

This misconception suggests that the agreement serves no practical purpose beyond legal requirements. In truth, it plays a vital role in day-to-day operations, helping to establish clear expectations and responsibilities.

-

Filing the Operating Agreement with the state is mandatory.

Many believe that they must file their Operating Agreement with the Texas Secretary of State. This is not the case. The agreement is an internal document and does not need to be filed, although keeping it accessible is advisable.

Addressing these misconceptions can help ensure that LLC owners in Texas make informed decisions regarding their Operating Agreements, ultimately leading to smoother operations and fewer disputes.

Documents used along the form

When forming a business entity in Texas, especially a limited liability company (LLC), several documents complement the Texas Operating Agreement. Each of these documents plays a crucial role in establishing the structure, governance, and operational guidelines of the LLC. Below is a list of common forms and documents used alongside the Texas Operating Agreement.

- Certificate of Formation: This document is filed with the Texas Secretary of State to officially create the LLC. It includes basic information like the company name, registered agent, and purpose of the business.

- Bylaws: While not always required for LLCs, bylaws outline the internal rules and procedures for managing the company. They provide clarity on governance and decision-making processes.

- Membership Certificates: These certificates serve as proof of ownership for members of the LLC. They detail the percentage of ownership each member holds.

- Initial Resolutions: This document records the initial decisions made by the members or managers of the LLC, such as appointing officers or approving bank accounts.

- Homeschool Letter of Intent Form: To formally notify the school district of your intention to homeschool, use the mandatory Homeschool Letter of Intent documentation to ensure compliance with state regulations.

- Operating Procedures: This document outlines the day-to-day operations of the LLC, including roles and responsibilities of members and managers, and standard operating practices.

- Member Agreement: This agreement details the rights and responsibilities of each member. It can include provisions on profit sharing, voting rights, and transfer of membership interests.

- Annual Reports: LLCs may be required to file annual reports with the state to maintain good standing. These reports typically include updated information about the business and its members.

- Tax Forms: Depending on the business structure and income, various federal and state tax forms may need to be filed, such as the IRS Form 1065 for partnerships.

- Non-Disclosure Agreement (NDA): If members share sensitive information, an NDA can protect proprietary information and trade secrets from being disclosed to outsiders.

Understanding these documents helps ensure that your LLC operates smoothly and complies with state requirements. Each form plays a distinct role in the overall management and legal standing of the business.

Other State-specific Operating Agreement Forms

Llc Operating Agreement California - This document is beneficial for setting a strong foundation for future growth.

Operating Agreement Llc Florida Template - It facilitates understanding of how business decisions are executed.

The Georgia Bill of Sale form is crucial for anyone engaging in the sale of personal property. It ensures a smooth transfer of ownership, safeguarding both parties involved in the transaction. For more information, you can refer to this helpful Georgia bill of sale form resource.

Nys Llc - It can help prevent conflicts among business owners.

Key Details about Texas Operating Agreement

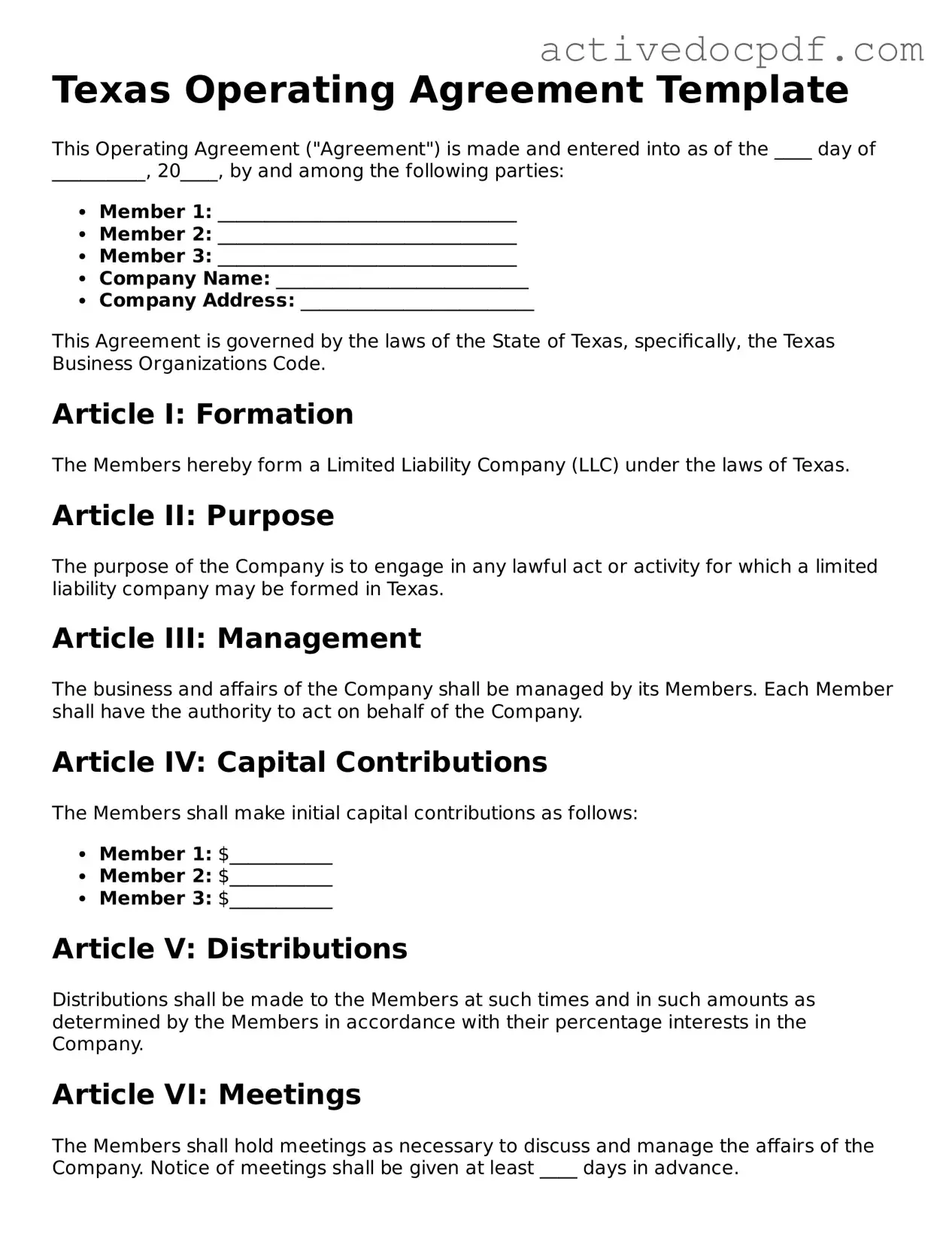

What is a Texas Operating Agreement?

A Texas Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC) in Texas. This agreement serves as an internal guideline for the members of the LLC, detailing their rights, responsibilities, and the distribution of profits and losses.

Is an Operating Agreement required in Texas?

No, Texas does not legally require LLCs to have an Operating Agreement. However, it is highly recommended to create one. An Operating Agreement helps prevent misunderstandings among members and provides a clear framework for resolving disputes. It can also help protect the limited liability status of the LLC.

Who should create the Operating Agreement?

The members of the LLC should collaborate to create the Operating Agreement. Each member's input is valuable, as it ensures that the agreement reflects the collective vision and operational strategies of the business. Consulting with a legal professional can also be beneficial to ensure compliance with state laws.

What key elements should be included in the Operating Agreement?

Key elements of a Texas Operating Agreement typically include:

- Company Information: Name, principal address, and purpose of the LLC.

- Member Details: Names and contributions of all members.

- Management Structure: Whether the LLC will be member-managed or manager-managed.

- Voting Rights: Procedures for decision-making and voting among members.

- Profit and Loss Distribution: How profits and losses will be allocated among members.

- Transfer of Membership Interests: Guidelines for transferring ownership interests.

- Dissolution Procedures: Steps to take if the LLC needs to be dissolved.

How can I amend the Operating Agreement?

Amending the Operating Agreement typically requires a vote among the members, according to the procedures outlined in the original agreement. It is essential to document any changes in writing and have all members sign the amended agreement to ensure clarity and enforceability.

What happens if there is no Operating Agreement?

If an LLC operates without an Operating Agreement, the default rules set by Texas state law will apply. This can lead to unintended consequences regarding management, profit distribution, and member responsibilities. Without a clear agreement, disputes may arise, which can complicate operations and lead to potential legal issues.

Can the Operating Agreement be used in court?

Yes, an Operating Agreement can be used in court as evidence of the members' intentions and agreements regarding the operation of the LLC. It serves as a binding contract among members, and courts generally uphold the terms outlined in the agreement, provided they are lawful and not in violation of public policy.

Similar forms

Bylaws: Similar to an Operating Agreement, bylaws outline the internal rules and procedures for managing a corporation. They specify the roles of directors and officers, meeting protocols, and voting procedures.

- Operating Agreement Form: This is crucial for LLC owners in New York to ensure proper governance. For assistance in creating one, visit PDF Documents Hub.

Partnership Agreement: This document governs the relationship between partners in a business venture. Like an Operating Agreement, it details ownership stakes, profit-sharing arrangements, and decision-making processes.

Shareholder Agreement: This agreement is similar in function, focusing on the rights and obligations of shareholders in a corporation. It addresses issues like transfer of shares, voting rights, and management responsibilities.

Joint Venture Agreement: This document outlines the terms of collaboration between two or more parties. It shares similarities with an Operating Agreement in defining roles, contributions, and profit distribution.

LLC Membership Agreement: This agreement is often used interchangeably with an Operating Agreement for limited liability companies. It specifies the rights and duties of members, as well as the management structure.

Franchise Agreement: This document establishes the relationship between a franchisor and franchisee. It is similar in that it outlines operational guidelines, fees, and responsibilities, ensuring consistency across franchises.

Employment Agreement: While focused on the employer-employee relationship, it shares common elements with an Operating Agreement by defining roles, responsibilities, and compensation structures.

Non-Disclosure Agreement (NDA): This document protects confidential information. Like an Operating Agreement, it can include clauses that dictate how information is shared among parties involved in a business.

Asset Purchase Agreement: This agreement details the terms of purchasing assets from another business. It shares similarities with an Operating Agreement by outlining responsibilities and obligations of the parties involved.

Memorandum of Understanding (MOU): An MOU outlines a mutual agreement between parties, often serving as a precursor to more formal agreements. It can resemble an Operating Agreement by defining roles and expectations.

Guide to Filling Out Texas Operating Agreement

Once you have the Texas Operating Agreement form ready, you will need to fill it out carefully. This document is essential for outlining the management structure and operational guidelines of your business. Follow these steps to complete the form accurately.

- Begin by entering the name of your LLC at the top of the form.

- Provide the principal office address of the LLC. This should be a physical location, not a P.O. Box.

- List the names and addresses of all members involved in the LLC. Ensure that you include each member’s full name and current address.

- Specify the percentage of ownership for each member. This reflects their stake in the LLC.

- Outline the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Detail the voting rights of each member. Clarify how decisions will be made and what percentage is required for approval.

- Include provisions for profit and loss distribution. State how profits and losses will be allocated among members.

- Address any additional clauses that are important for your LLC. This may include buy-sell agreements or procedures for adding new members.

- Review the document for accuracy. Make sure all information is correct and complete.

- Finally, have all members sign and date the agreement. This formalizes the document and makes it legally binding.