Legal Power of Attorney Document for Texas State

Misconceptions

Many individuals have misunderstandings about the Texas Power of Attorney form. These misconceptions can lead to confusion and potentially impact important decisions. Here are four common misconceptions:

- Misconception 1: A Power of Attorney is only for financial matters.

- Misconception 2: A Power of Attorney is permanent and cannot be revoked.

- Misconception 3: Only lawyers can create a Power of Attorney.

- Misconception 4: A Power of Attorney automatically goes into effect.

This is not true. While many people associate Power of Attorney with financial decisions, it can also cover medical decisions, property management, and more. The form can be tailored to grant specific powers, depending on the needs of the individual.

In reality, a Power of Attorney can be revoked at any time by the person who created it, as long as they are mentally competent. This flexibility allows individuals to change their decisions as circumstances evolve.

This is a common belief, but it is not accurate. While consulting a lawyer can be helpful, individuals can create a Power of Attorney on their own using state-approved forms. However, it's crucial to ensure that the document meets all legal requirements.

This misconception can lead to significant issues. A Power of Attorney may be set to take effect immediately or only under specific conditions, such as the principal's incapacitation. Understanding how and when the document activates is essential for effective planning.

Documents used along the form

A Power of Attorney (POA) is a legal document that allows one person to act on behalf of another in legal or financial matters. In Texas, individuals often utilize additional forms and documents in conjunction with a Power of Attorney to ensure comprehensive management of their affairs. Below is a list of common documents that may accompany a Texas Power of Attorney.

- Advance Directive: This document outlines an individual's preferences for medical treatment in the event they become unable to communicate their wishes. It often includes a living will and a medical power of attorney.

- Living Will: A living will specifies what types of medical treatment a person wishes to receive or forego in end-of-life situations, providing guidance to healthcare providers and loved ones.

- Medical Power of Attorney: This form designates an individual to make healthcare decisions on behalf of the principal when they are unable to do so themselves.

- Hold Harmless Agreement: To protect yourself from potential liabilities, consider utilizing a practical Hold Harmless Agreement template when engaging in activities that may present risks.

- Durable Power of Attorney: This variation of the standard POA remains effective even if the principal becomes incapacitated, allowing the agent to continue managing the principal's affairs.

- Financial Power of Attorney: This document specifically grants authority to an agent to manage financial matters, such as banking, investments, and real estate transactions.

- Trust Document: A trust outlines how assets will be managed and distributed, often used in estate planning to avoid probate and provide for beneficiaries.

- Will: A will is a legal document that specifies how a person's assets should be distributed after their death, naming an executor to manage the estate.

- Beneficiary Designation Forms: These forms are used to designate beneficiaries for accounts such as life insurance policies, retirement plans, and bank accounts, ensuring that assets are transferred directly upon death.

Understanding these documents can help individuals make informed decisions regarding their legal and financial affairs. Each document serves a specific purpose and may be essential for comprehensive planning and management.

Other State-specific Power of Attorney Forms

Free Power of Attorney Form California - This document is valid in all states but may be subject to specific state requirements.

When preparing to sell your motorcycle, it’s crucial to complete the New York Motorcycle Bill of Sale, which can be easily found at PDF Documents Hub. This important document not only acts as proof of ownership transfer but also helps in avoiding any potential disputes between the buyer and seller by clearly stating the terms of the sale.

Power of Attorney Form Florida Pdf - It can cover financial, legal, or health matters.

Key Details about Texas Power of Attorney

What is a Texas Power of Attorney form?

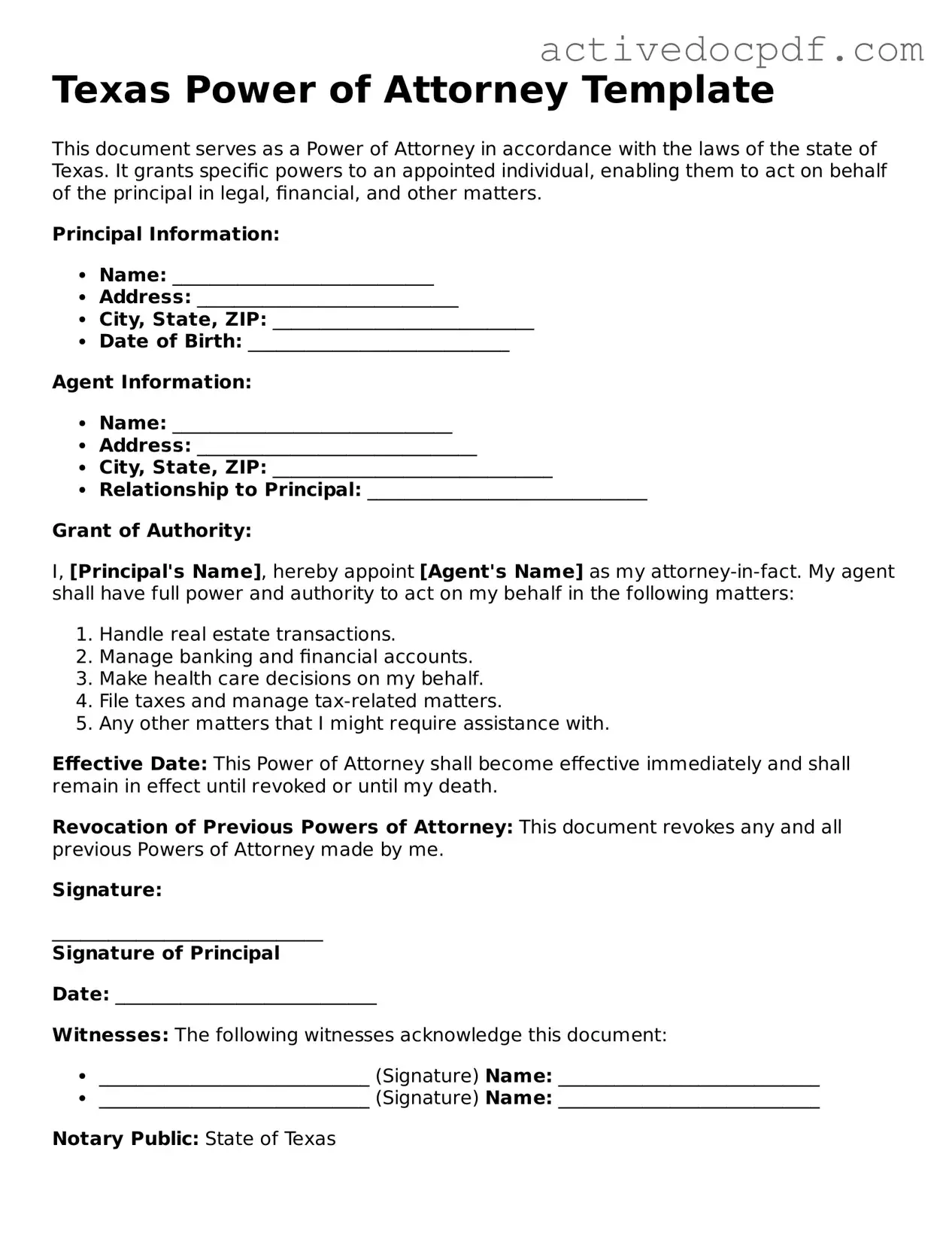

A Texas Power of Attorney form is a legal document that allows one person (the principal) to appoint another person (the agent) to make decisions on their behalf. This can include financial matters, medical decisions, or other personal affairs. It is essential for ensuring that someone you trust can act for you if you are unable to do so yourself.

Why do I need a Power of Attorney?

Having a Power of Attorney in place is crucial for several reasons:

- It provides peace of mind, knowing that someone you trust can handle your affairs if you become incapacitated.

- It can prevent delays in decision-making during emergencies.

- It allows you to choose who will manage your affairs, rather than leaving it to the courts to decide.

How do I create a Power of Attorney in Texas?

To create a Power of Attorney in Texas, follow these steps:

- Choose a trusted individual to act as your agent.

- Obtain a Texas Power of Attorney form, which can be found online or through legal resources.

- Fill out the form, clearly stating the powers you wish to grant your agent.

- Sign the document in front of a notary public to make it legally binding.

Can I revoke a Power of Attorney?

Yes, you can revoke a Power of Attorney at any time as long as you are mentally competent. To do this, you should create a written revocation document and notify your agent. It’s also a good idea to inform any institutions or individuals that may have relied on the original Power of Attorney.

What happens if I don’t have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, your family may need to go through the court system to obtain guardianship. This process can be lengthy, costly, and may not result in the outcome you desire. Having a Power of Attorney in place helps avoid this situation and ensures your wishes are respected.

Similar forms

- Living Will: A living will outlines an individual's preferences regarding medical treatment in the event they become unable to communicate their wishes. Like a Power of Attorney, it addresses decision-making but focuses specifically on healthcare decisions.

- Health Care Proxy: This document designates someone to make medical decisions on behalf of an individual if they are incapacitated. Similar to a Power of Attorney, it grants authority to another person but is specifically tailored for health-related matters.

- Durable Power of Attorney: This type of Power of Attorney remains effective even if the principal becomes incapacitated. It is similar to the standard Power of Attorney but provides ongoing authority in situations where the individual can no longer make decisions.

- Financial Power of Attorney: This document specifically authorizes someone to manage financial affairs. While a general Power of Attorney can cover various areas, a Financial Power of Attorney focuses solely on financial matters.

- Bill of Sale: The Bill of Sale form is a crucial document for detailing the transfer of ownership of personal property. It ensures clarity in transactions and terms, and you can access the Bill of Sale form to facilitate your sale.

- Trust Agreement: A trust agreement allows a person to transfer assets to a trustee for the benefit of beneficiaries. Both documents involve delegating authority, but a trust manages assets over time rather than just decision-making at a specific moment.

- Will: A will outlines how a person's assets will be distributed after their death. While a Power of Attorney is effective during a person's lifetime, a will takes effect upon death, making it a different type of planning document.

- Guardianship Document: This legal document appoints a guardian for a minor or incapacitated adult. Similar to a Power of Attorney, it involves the appointment of someone to make decisions, but it typically requires court approval and is often more permanent.

- Advance Directive: An advance directive combines a living will and a health care proxy, providing both treatment preferences and designating a decision-maker. It is similar to a Power of Attorney in that it guides healthcare decisions when the individual cannot express their wishes.

- Agent Authorization: This document allows someone to act on behalf of another in specific situations. Like a Power of Attorney, it grants authority to make decisions, but it may be limited to certain tasks or timeframes.

Guide to Filling Out Texas Power of Attorney

Once you have the Texas Power of Attorney form ready, it’s important to complete it accurately to ensure it serves its intended purpose. Follow these steps carefully to fill out the form correctly.

- Begin by clearly writing your name as the principal at the top of the form. This is the person granting the power of attorney.

- Next, provide your address. Include the city, state, and ZIP code to ensure there is no confusion about your location.

- Identify the agent you are appointing. Write the full name of the person who will act on your behalf. This individual is referred to as the agent or attorney-in-fact.

- Include the agent's address, ensuring it is complete with city, state, and ZIP code.

- Specify the powers you wish to grant to your agent. You can either check the boxes for specific powers or write in additional powers if needed.

- Indicate the duration of the power of attorney. You can choose to make it effective immediately or specify a date or condition under which it becomes effective.

- Sign and date the form at the designated area. Your signature must be in your own handwriting.

- Have the form notarized. A notary public will need to witness your signature to validate the document.

After completing the form, ensure you keep a copy for your records. Provide copies to your agent and any relevant institutions or individuals who may need to rely on this document.