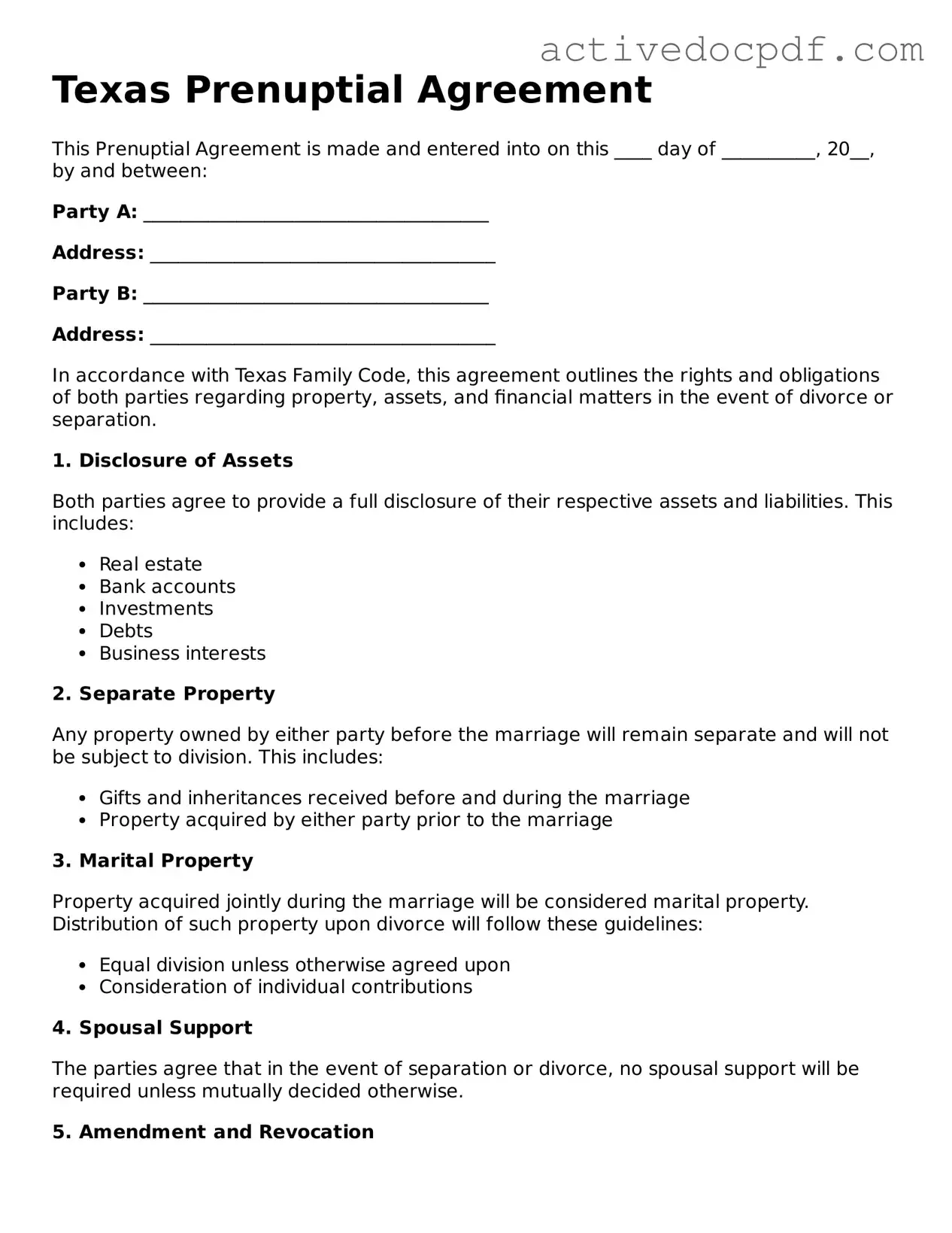

Legal Prenuptial Agreement Document for Texas State

Misconceptions

When it comes to prenuptial agreements in Texas, several misconceptions can lead to confusion and misunderstandings. Here are six common myths clarified:

- Prenuptial agreements are only for the wealthy. Many people believe that these agreements are only necessary for those with significant assets. In reality, anyone entering a marriage can benefit from a prenuptial agreement, regardless of their financial status.

- Prenuptial agreements are not enforceable in Texas. This is false. Prenuptial agreements are legally recognized in Texas as long as they meet specific requirements, such as being in writing and signed by both parties.

- Prenuptial agreements can cover anything. While prenuptial agreements can address many financial matters, they cannot dictate personal matters such as child custody or support. Texas law limits the scope of what can be included.

- Only one party needs a lawyer. It is a common belief that only one spouse needs legal representation when drafting a prenuptial agreement. However, both parties should seek independent legal advice to ensure the agreement is fair and enforceable.

- Prenuptial agreements are only for divorce. Some people think these agreements are only useful in the event of a divorce. However, they can also help clarify financial responsibilities and expectations during the marriage.

- Prenuptial agreements are permanent. Many assume that once a prenuptial agreement is signed, it cannot be changed. In fact, couples can modify or revoke their prenuptial agreements at any time, as long as both parties agree to the changes.

Understanding these misconceptions can help individuals make informed decisions about prenuptial agreements in Texas.

Documents used along the form

A Texas Prenuptial Agreement is an important document for couples planning to marry, as it outlines the financial rights and responsibilities of each spouse in the event of divorce or separation. However, there are other forms and documents that often accompany this agreement to ensure comprehensive legal protection and clarity. Below is a list of additional documents commonly used alongside a Texas Prenuptial Agreement.

- Financial Disclosure Statement: This document provides a detailed account of each party's assets, liabilities, income, and expenses. Transparency is key, as it helps both parties understand their financial situations before entering into the marriage.

- Incorporation Documents: For businesses looking to establish themselves, having the proper incorporation documents is essential. The PDF Documents Hub offers a streamlined way to obtain the New York Articles of Incorporation form, ensuring compliance and protection under state law.

- Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is created after marriage. It can address changes in circumstances or clarify financial arrangements that may have evolved since the wedding.

- Marital Property Agreement: This document specifically outlines how property acquired during the marriage will be classified and divided. It can help prevent disputes over ownership and ensure both parties agree on what constitutes marital versus separate property.

- Separation Agreement: In the event of a separation, this agreement details how assets, debts, and responsibilities will be managed. It serves as a temporary arrangement until a divorce is finalized, providing clarity and reducing conflict during a difficult time.

Utilizing these documents in conjunction with a Texas Prenuptial Agreement can provide couples with a clearer understanding of their financial landscape and expectations. By addressing these important aspects, both parties can enter into marriage with greater confidence and security.

Other State-specific Prenuptial Agreement Forms

Florida Prenup Contract - The specificity of the terms in a prenup can provide peace of mind for both partners.

To ensure a smooth transfer of ownership, it is essential to have a reliable document such as the California Dog Bill of Sale form, which not only provides a written record of the transaction but also clarifies the terms for both parties involved. For those looking for an easy way to prepare this document, Fast PDF Templates offers a convenient solution that simplifies the process of drafting the necessary paperwork.

California Prenup Contract - A prenuptial agreement can ensure both parties have a fair understanding of their rights.

Key Details about Texas Prenuptial Agreement

What is a prenuptial agreement in Texas?

A prenuptial agreement, often referred to as a prenup, is a legal document created by two individuals before they marry. In Texas, this agreement outlines how assets and debts will be divided in the event of a divorce or separation. It can also address other matters such as spousal support and property rights. By establishing these terms in advance, couples can protect their individual interests and clarify their financial arrangements.

What should be included in a Texas prenuptial agreement?

A comprehensive prenuptial agreement in Texas typically includes the following elements:

- Identification of each party's assets and liabilities.

- Provisions for the division of property acquired during the marriage.

- Terms regarding spousal support or alimony.

- Instructions for handling debts incurred during the marriage.

- Any other specific agreements the couple wishes to include.

It is important for both parties to fully disclose their financial situations to ensure the agreement is fair and enforceable.

How do I create a prenuptial agreement in Texas?

To create a prenuptial agreement in Texas, follow these steps:

- Discuss your intentions and expectations with your partner.

- Gather a complete list of your assets and debts.

- Consult with a qualified attorney to draft the agreement. This ensures that the document complies with Texas laws.

- Review the draft together and make any necessary changes.

- Sign the agreement in the presence of a notary public.

It is advisable for each party to have their own legal representation to avoid any conflicts of interest.

Is a prenuptial agreement enforceable in Texas?

Yes, a prenuptial agreement is enforceable in Texas, provided it meets certain legal requirements. The agreement must be in writing and signed by both parties. Additionally, it should be entered into voluntarily, without coercion or fraud. If the agreement is deemed unconscionable or if one party did not fully disclose their financial situation, a court may choose not to enforce it. Therefore, transparency and fairness are crucial during the drafting process.

Similar forms

Postnuptial Agreement: Similar to a prenuptial agreement, a postnuptial agreement is created after marriage. It outlines how assets and debts will be handled in the event of a divorce. Both documents aim to provide clarity and security regarding financial matters.

Separation Agreement: A separation agreement is used when a couple decides to live apart but not divorce. It details the arrangements for child custody, support, and division of property. Like a prenuptial agreement, it helps avoid disputes by clearly defining expectations.

Divorce Settlement Agreement: This document is reached during the divorce process. It outlines how assets, debts, and responsibilities will be divided. Similar to a prenuptial agreement, it serves to protect both parties’ interests and aims to minimize conflict.

Living Together Agreement: Often used by couples who cohabit without marrying, this agreement addresses property rights and financial responsibilities. Like a prenuptial agreement, it helps establish clear terms to avoid misunderstandings in the future.

- Articles of Incorporation: For those looking to form a corporation in Colorado, the essential Articles of Incorporation form guide outlines the necessary steps and details required for filing.

Will: A will dictates how a person's assets will be distributed after their death. While it serves a different purpose, both a will and a prenuptial agreement provide clarity about the distribution of assets, ensuring that individuals' wishes are respected.

Guide to Filling Out Texas Prenuptial Agreement

Completing the Texas Prenuptial Agreement form requires careful attention to detail. This process involves gathering information about both parties, their assets, and their intentions regarding financial matters during the marriage. Follow these steps to ensure accurate completion of the form.

- Obtain the Form: Download or acquire the Texas Prenuptial Agreement form from a reliable source.

- Identify the Parties: Clearly state the full legal names of both parties entering the agreement.

- Provide Addresses: Include the current residential addresses for both parties.

- List Assets: Itemize all assets owned by each party, including property, bank accounts, investments, and any other relevant financial interests.

- Disclose Debts: List any debts or liabilities for both parties. This includes loans, credit card debts, and mortgages.

- Outline Terms: Specify the terms of the agreement. This may include how assets will be divided in the event of a divorce or separation.

- Include Signatures: Both parties must sign the document in the presence of a notary public to ensure its validity.

- Store Safely: Keep the signed agreement in a safe place, and consider providing copies to both parties and their legal representatives.