Legal Promissory Note Document for Texas State

Misconceptions

-

Misconception 1: A Texas Promissory Note must be notarized.

While notarization can add credibility, it is not a legal requirement for a Texas Promissory Note to be valid. The note is enforceable as long as it includes the necessary elements, such as the amount borrowed and repayment terms.

-

Misconception 2: A Promissory Note is the same as a loan agreement.

A Promissory Note is a specific type of document that outlines the borrower's promise to repay a loan. In contrast, a loan agreement often includes additional terms and conditions, such as collateral and default clauses.

-

Misconception 3: Interest rates on Promissory Notes are unlimited.

Texas law does impose limits on interest rates. If the interest rate exceeds certain thresholds, it may be considered usury, which is illegal.

-

Misconception 4: A Promissory Note does not need to specify a repayment schedule.

For clarity and enforceability, it is essential to include a repayment schedule. This ensures both parties understand when payments are due and how much is owed.

-

Misconception 5: A Promissory Note can only be used for personal loans.

Promissory Notes can be used for various types of loans, including business loans, real estate transactions, and even informal loans between friends or family.

-

Misconception 6: Once signed, a Promissory Note cannot be modified.

Parties can modify a Promissory Note if both agree to the changes. It is advisable to document any modifications in writing to avoid confusion later.

-

Misconception 7: A Promissory Note is not enforceable in court.

On the contrary, a properly executed Promissory Note is legally binding and can be enforced in court if the borrower defaults on the loan.

Documents used along the form

When entering into a loan agreement in Texas, the Promissory Note is a crucial document that outlines the borrower's promise to repay the loan. However, several other forms and documents may accompany the Promissory Note to ensure clarity and protection for all parties involved. Here’s a list of some commonly used documents that often work in conjunction with a Texas Promissory Note.

- Loan Agreement: This document details the terms and conditions of the loan, including the interest rate, repayment schedule, and any collateral involved. It serves as a comprehensive contract between the lender and borrower.

- Security Agreement: If the loan is secured by collateral, this document specifies the assets that back the loan. It outlines the rights of the lender in case of default.

- Disclosure Statement: This form provides the borrower with important information about the loan, including total costs, fees, and the annual percentage rate (APR). It ensures transparency in the lending process.

- Last Will and Testament: It is crucial for estate planning, allowing individuals to specify the distribution of their assets and the guardianship of minor children. To create this document, you may refer to the form in pdf.

- Personal Guaranty: In some cases, a third party may agree to guarantee the loan. This document holds the guarantor responsible for repayment if the borrower defaults.

- Amortization Schedule: This schedule breaks down each payment into principal and interest over the life of the loan. It helps borrowers understand how their payments will be applied.

- Default Notice: This document notifies the borrower of any missed payments or breaches of the loan agreement. It typically outlines the consequences of defaulting on the loan.

- Release of Lien: Once the loan is fully repaid, this document is filed to remove any lien placed on the borrower's property as collateral. It serves as proof that the debt has been satisfied.

Understanding these accompanying documents can help borrowers navigate the complexities of loan agreements more effectively. By being aware of what each document entails, both lenders and borrowers can foster a clearer and more secure lending relationship.

Other State-specific Promissory Note Forms

Simple Promissory Note Template California - Usually, promissory notes are simple and easy to understand for both parties.

To facilitate a smooth sales process, it is recommended to use the New York Trailer Bill of Sale form, which can be found at nyforms.com/trailer-bill-of-sale-template. This form provides a clear outline of the transaction details, helping both parties understand their rights and obligations during the sale.

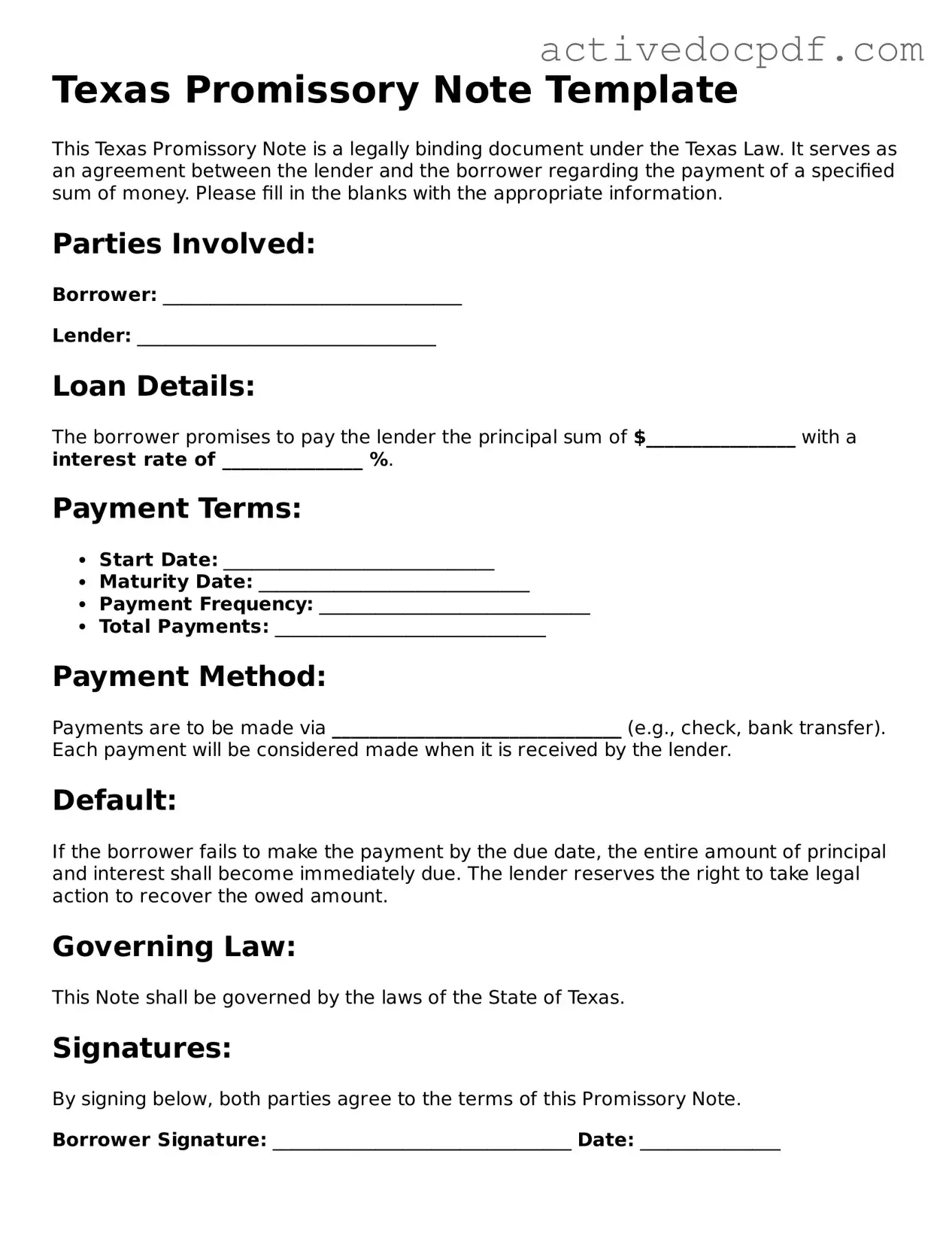

Key Details about Texas Promissory Note

What is a Texas Promissory Note?

A Texas Promissory Note is a written agreement in which one party promises to pay a specific amount of money to another party at a designated time or upon demand. This document outlines the terms of the loan, including the principal amount, interest rate, and payment schedule.

Who can use a Texas Promissory Note?

Any individual or business in Texas can use a Promissory Note. It is commonly used in personal loans, business transactions, or any situation where one party lends money to another. Both lenders and borrowers should ensure they understand the terms before signing.

What information is included in a Texas Promissory Note?

A typical Texas Promissory Note includes:

- The names and addresses of the borrower and lender

- The principal amount of the loan

- The interest rate

- The payment schedule

- Any late fees or penalties

- Signatures of both parties

Is a Texas Promissory Note legally binding?

Yes, a properly executed Texas Promissory Note is legally binding. Once signed, both parties are obligated to adhere to the terms outlined in the document. If either party fails to comply, the other party may have legal recourse.

Do I need a lawyer to create a Texas Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, consulting with one can be beneficial. A lawyer can help ensure that the document complies with Texas laws and meets the specific needs of both parties.

What happens if the borrower defaults on the loan?

If the borrower defaults, the lender may take several actions, including:

- Contacting the borrower to discuss the missed payments

- Assessing late fees as outlined in the Promissory Note

- Initiating legal proceedings to recover the owed amount

It is important for both parties to understand the consequences of defaulting before entering into the agreement.

Can a Texas Promissory Note be modified?

Yes, a Texas Promissory Note can be modified, but both parties must agree to the changes. It is recommended to document any modifications in writing and have both parties sign the updated agreement to avoid misunderstandings.

How do I enforce a Texas Promissory Note?

To enforce a Texas Promissory Note, the lender may first attempt to resolve the issue directly with the borrower. If that fails, the lender can file a lawsuit in a Texas court. Having a signed Promissory Note serves as evidence of the loan agreement, which can strengthen the lender's case.

Where can I find a Texas Promissory Note template?

Templates for Texas Promissory Notes can be found online through various legal document websites. It is important to choose a reputable source to ensure the template complies with Texas law. Customizing the template to fit the specific terms of the agreement is essential.

Similar forms

Loan Agreement: Similar to a promissory note, a loan agreement outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. Both documents serve as a formal record of the borrower’s commitment to repay the lender.

Mortgage: A mortgage is a specific type of loan agreement used to purchase real estate. Like a promissory note, it includes details about the loan amount and repayment terms, but it also involves collateral—typically the property being purchased.

- Employment Verification Form: This document is essential for confirming an individual's work history and qualifications, which can be crucial during the hiring process. To learn more about how to fill it out, you can visit documentonline.org.

Lease Agreement: A lease agreement may resemble a promissory note in that it establishes a financial obligation. It details the terms under which one party pays another for the use of property, often including payment amounts and due dates.

Installment Agreement: This document outlines a payment plan for a debt, similar to a promissory note. It specifies the total amount owed, the payment schedule, and any interest or fees, ensuring both parties understand their obligations.

Personal Guarantee: A personal guarantee is a promise made by an individual to repay a loan if the primary borrower defaults. It shares similarities with a promissory note in that it creates a personal obligation to pay a debt.

Credit Agreement: This document details the terms of credit extended to a borrower. Like a promissory note, it includes payment terms and conditions but may also encompass other factors like credit limits and fees.

Bond: A bond represents a loan made by an investor to a borrower, typically a corporation or government. It functions similarly to a promissory note by documenting the obligation to pay back the borrowed amount along with interest.

Debt Settlement Agreement: This document outlines the terms under which a debtor agrees to pay a reduced amount to settle a debt. Like a promissory note, it formalizes the agreement between the debtor and creditor regarding repayment.

Guide to Filling Out Texas Promissory Note

Once you have the Texas Promissory Note form ready, it's essential to fill it out accurately. This document outlines the terms of a loan agreement between the lender and the borrower. Ensure you have all necessary information at hand before proceeding.

- Start by entering the date at the top of the form.

- Write the name and address of the borrower in the designated section.

- Provide the name and address of the lender next.

- Specify the principal amount of the loan in the appropriate field.

- Indicate the interest rate, if applicable, clearly stating whether it is fixed or variable.

- Fill in the repayment terms, including the due date for payments and any grace period allowed.

- Outline any late fees or penalties for missed payments.

- Include any collateral information if the loan is secured.

- Sign and date the form in the designated area. Ensure both parties sign if required.

After completing the form, review it carefully for any errors or omissions. Both parties should retain a copy for their records. It’s advisable to consult with a professional if you have any questions about the terms outlined in the note.