Legal Real Estate Purchase Agreement Document for Texas State

Misconceptions

The Texas Real Estate Purchase Agreement is a crucial document in any real estate transaction in Texas. However, several misconceptions surround this form. Understanding these misconceptions can help buyers and sellers navigate the process more effectively.

- Misconception 1: The form is only for residential properties.

- Misconception 2: Once signed, the agreement cannot be changed.

- Misconception 3: The agreement protects only the seller.

- Misconception 4: The agreement is the same as a deed.

- Misconception 5: It is unnecessary to have a real estate agent to use the form.

- Misconception 6: The agreement is a legally binding contract from the moment it is signed.

This is not true. While the form is commonly used for residential real estate transactions, it can also be adapted for commercial properties. Buyers and sellers should ensure that the form meets their specific needs.

Many people believe that a signed agreement is set in stone. However, amendments can be made if both parties agree to the changes. It is essential to document any modifications in writing.

This is a common misunderstanding. The Texas Real Estate Purchase Agreement is designed to protect the interests of both the buyer and the seller. Each party has rights and obligations outlined in the agreement.

While both documents are essential in real estate transactions, they serve different purposes. The purchase agreement outlines the terms of the sale, while a deed transfers ownership of the property.

While it is possible to use the Texas Real Estate Purchase Agreement without an agent, having a real estate professional can provide valuable guidance. They can help ensure that all necessary terms are included and that the process runs smoothly.

This statement is partially true. The agreement becomes legally binding once all parties have signed and any contingencies have been satisfied. Until then, the parties may still have options to withdraw from the agreement.

Documents used along the form

When engaging in a real estate transaction in Texas, several forms and documents accompany the Texas Real Estate Purchase Agreement. These documents help ensure that all parties are protected and that the transaction proceeds smoothly. Below is a list of commonly used forms that you may encounter.

- Seller's Disclosure Notice: This document requires the seller to disclose any known issues with the property, such as structural problems or past flooding. Transparency is key to a successful transaction.

- Property Inspection Report: After an inspection, this report outlines the condition of the property, highlighting any repairs needed. It helps buyers make informed decisions.

- Option Fee Agreement: This agreement allows the buyer to purchase an option to terminate the contract within a specified time frame, usually in exchange for a fee. It provides flexibility for buyers.

- Title Commitment: Issued by a title company, this document outlines the terms of the title insurance policy and confirms the seller's ownership of the property. It protects the buyer from future claims against the title.

- Operating Agreement: An essential document for any limited liability company (LLC), outlining management structure and responsibilities. To create your Operating Agreement, visit PDF Documents Hub.

- Closing Disclosure: This document provides a detailed breakdown of the final costs associated with the transaction, including loan terms and fees. It ensures that buyers understand their financial obligations.

- Deed: This legal document transfers ownership of the property from the seller to the buyer. It must be signed and recorded to be effective.

- Financing Addendum: If the buyer is obtaining a loan, this addendum outlines the terms of financing, including loan type and contingency clauses. It clarifies the buyer's financial commitments.

- Lead-Based Paint Disclosure: Required for homes built before 1978, this form informs buyers about the potential presence of lead-based paint. It’s essential for health and safety reasons.

- Home Warranty Agreement: This document provides coverage for certain repairs and replacements of home systems and appliances, offering peace of mind to the buyer.

Each of these documents plays a crucial role in the real estate transaction process in Texas. Understanding their purpose can help both buyers and sellers navigate the complexities of buying or selling a home more effectively.

Other State-specific Real Estate Purchase Agreement Forms

Buyer Agreement - The document often includes a timeline for fulfilling various conditions of the sale.

To ensure a smooth rental process, consider utilizing a carefully crafted Lease Agreement form that meets your specific needs. This document is essential for establishing clear terms, providing a foundation for successful landlord-tenant relationships. For more information, please visit our in-depth Lease Agreement guide.

Estate Sale Agreement - It usually includes a section for the buyer and seller to sign and date.

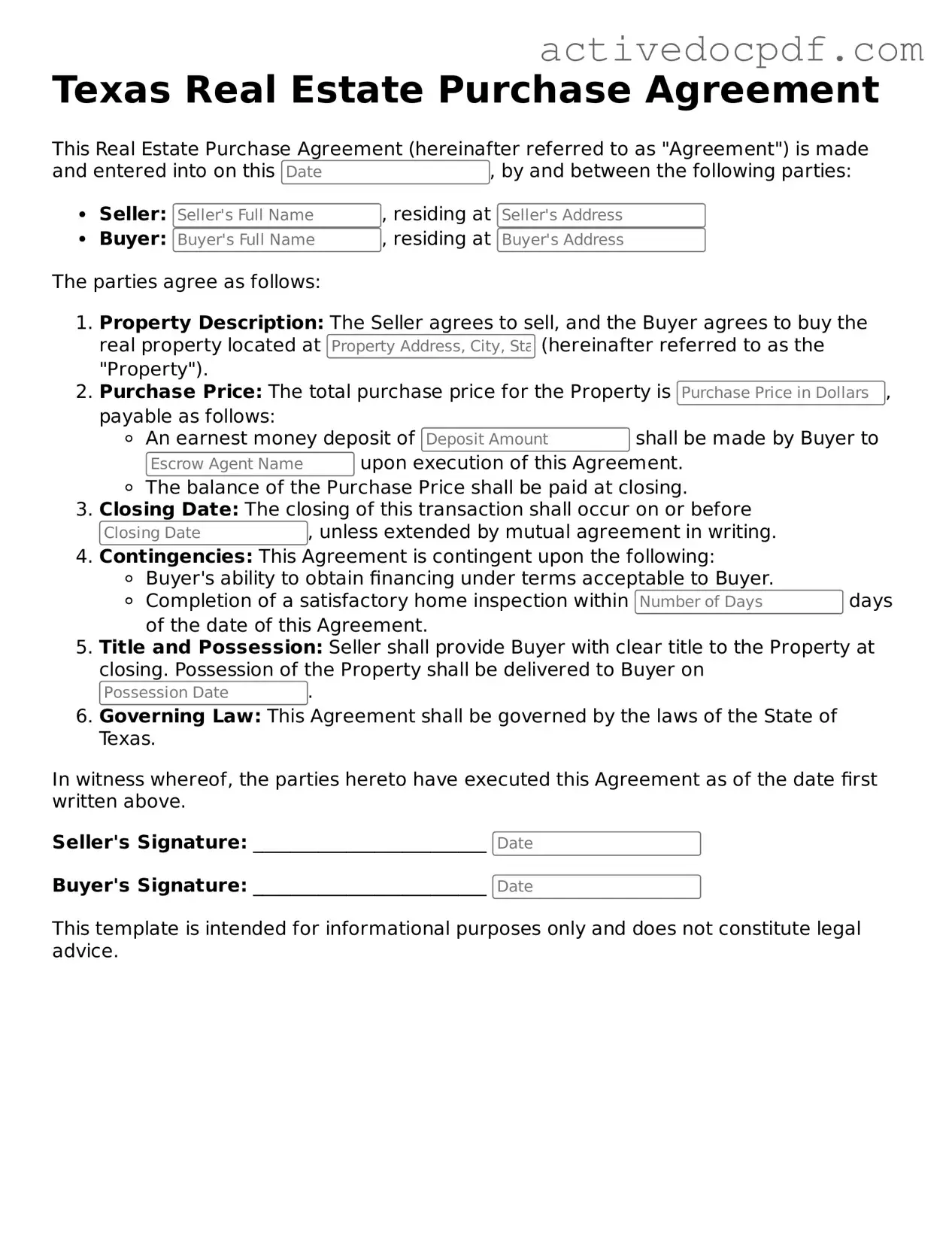

Key Details about Texas Real Estate Purchase Agreement

What is the Texas Real Estate Purchase Agreement form?

The Texas Real Estate Purchase Agreement form is a legally binding document used to outline the terms and conditions of a real estate transaction in Texas. It serves as a contract between the buyer and seller, detailing the property being sold, the purchase price, and other important terms of the sale.

Who typically uses this form?

This form is primarily used by real estate agents, buyers, and sellers involved in residential property transactions in Texas. It ensures that all parties are on the same page regarding the sale and helps to protect their interests.

What key elements are included in the agreement?

The Texas Real Estate Purchase Agreement typically includes:

- Property description

- Purchase price

- Financing details

- Closing date

- Contingencies (such as inspections or financing)

- Earnest money deposit

- Title and possession details

Is the agreement customizable?

Yes, the Texas Real Estate Purchase Agreement can be customized to meet the specific needs of the buyer and seller. Parties can add additional terms or conditions as long as both agree to them and they are compliant with Texas law.

What is earnest money, and why is it important?

Earnest money is a deposit made by the buyer to demonstrate their commitment to purchasing the property. It is typically held in escrow and applied to the purchase price at closing. This deposit is important because it shows the seller that the buyer is serious and helps to secure the property while the transaction is finalized.

What are contingencies, and how do they work?

Contingencies are conditions that must be met for the sale to proceed. Common contingencies include financing, home inspections, and appraisal requirements. If a contingency is not met, the buyer may have the right to withdraw from the agreement without losing their earnest money.

Can a buyer back out of the agreement?

Yes, a buyer can back out of the agreement under certain circumstances, particularly if there are contingencies that have not been satisfied. However, if the buyer withdraws for reasons not covered by contingencies, they may forfeit their earnest money.

How is the closing process handled?

The closing process involves finalizing the sale of the property. This typically includes the signing of documents, payment of closing costs, and transfer of ownership. A title company or real estate attorney usually facilitates this process to ensure that all legal requirements are met.

What happens if there is a dispute over the agreement?

If a dispute arises, the parties may attempt to resolve it through negotiation or mediation. If these methods fail, legal action may be necessary. It is advisable for parties to consult with a legal professional to understand their rights and options.

Where can I obtain a Texas Real Estate Purchase Agreement form?

The Texas Real Estate Purchase Agreement form can be obtained through various sources, including real estate agents, brokers, or online legal document providers. It is important to ensure that the form is up-to-date and compliant with Texas laws.

Similar forms

- Lease Agreement: This document outlines the terms under which a tenant may occupy a property. Like a purchase agreement, it specifies the parties involved, the property description, and the terms of payment.

- Option to Purchase Agreement: This agreement grants a potential buyer the right to purchase a property within a specified time frame. Similar to a purchase agreement, it includes the purchase price and conditions for the sale.

- Real Estate Listing Agreement: This document is used between a property owner and a real estate agent. It details the agent's authority to sell the property, similar to how a purchase agreement outlines the buyer's intent to buy.

- Sales Contract: Often used in various types of transactions, a sales contract outlines the terms of sale for goods or services. It shares similarities with a real estate purchase agreement in its structure and purpose of formalizing a sale.

- Purchase and Sale Agreement: This document is specifically tailored for real estate transactions. It combines elements of both purchase agreements and sales contracts, detailing the obligations of both parties involved in the sale.

- Title Commitment: This document outlines the state of the title to a property and any liens or encumbrances. It is similar to a purchase agreement in that it is crucial for the transaction and protects the buyer's interests.

- Escrow Agreement: This document establishes the terms under which a neutral third party holds funds or documents until the transaction is complete. It parallels a purchase agreement by ensuring that both parties fulfill their obligations before the transfer of ownership.

- ATV Bill of Sale: This document is essential for recording the sale of an all-terrain vehicle in California, ensuring both parties are protected. For more details, refer to the Four Wheeler Bill of Sale.

- Disclosure Statement: Sellers often provide this document to inform buyers of any known issues with the property. It is similar to a purchase agreement as it seeks to protect both parties by ensuring transparency in the transaction.

- Financing Agreement: This document outlines the terms of financing for the purchase of property. It shares characteristics with a purchase agreement by detailing the financial obligations of the buyer.

Guide to Filling Out Texas Real Estate Purchase Agreement

After obtaining the Texas Real Estate Purchase Agreement form, you’ll need to complete it accurately to ensure a smooth transaction. Follow these steps carefully to fill out the form correctly.

- Enter the date: Write the date when you are filling out the form at the top.

- Identify the parties: Fill in the names of the buyer(s) and seller(s) in the designated spaces.

- Property description: Provide a detailed description of the property, including the address and any relevant legal descriptions.

- Purchase price: Clearly state the agreed purchase price of the property.

- Earnest money: Indicate the amount of earnest money the buyer will provide and the name of the escrow agent or title company.

- Financing details: Specify how the buyer intends to finance the purchase, including any loan information.

- Closing date: Write in the proposed closing date for the transaction.

- Contingencies: List any contingencies that must be met before the sale can proceed, such as inspections or financing approval.

- Signatures: Ensure that all parties sign and date the agreement at the bottom of the form.

Once you have completed the form, review it carefully for accuracy. Both the buyer and seller should keep a copy for their records. The next step is to submit the signed agreement to the appropriate parties, typically the title company or real estate agent, to move forward with the transaction.