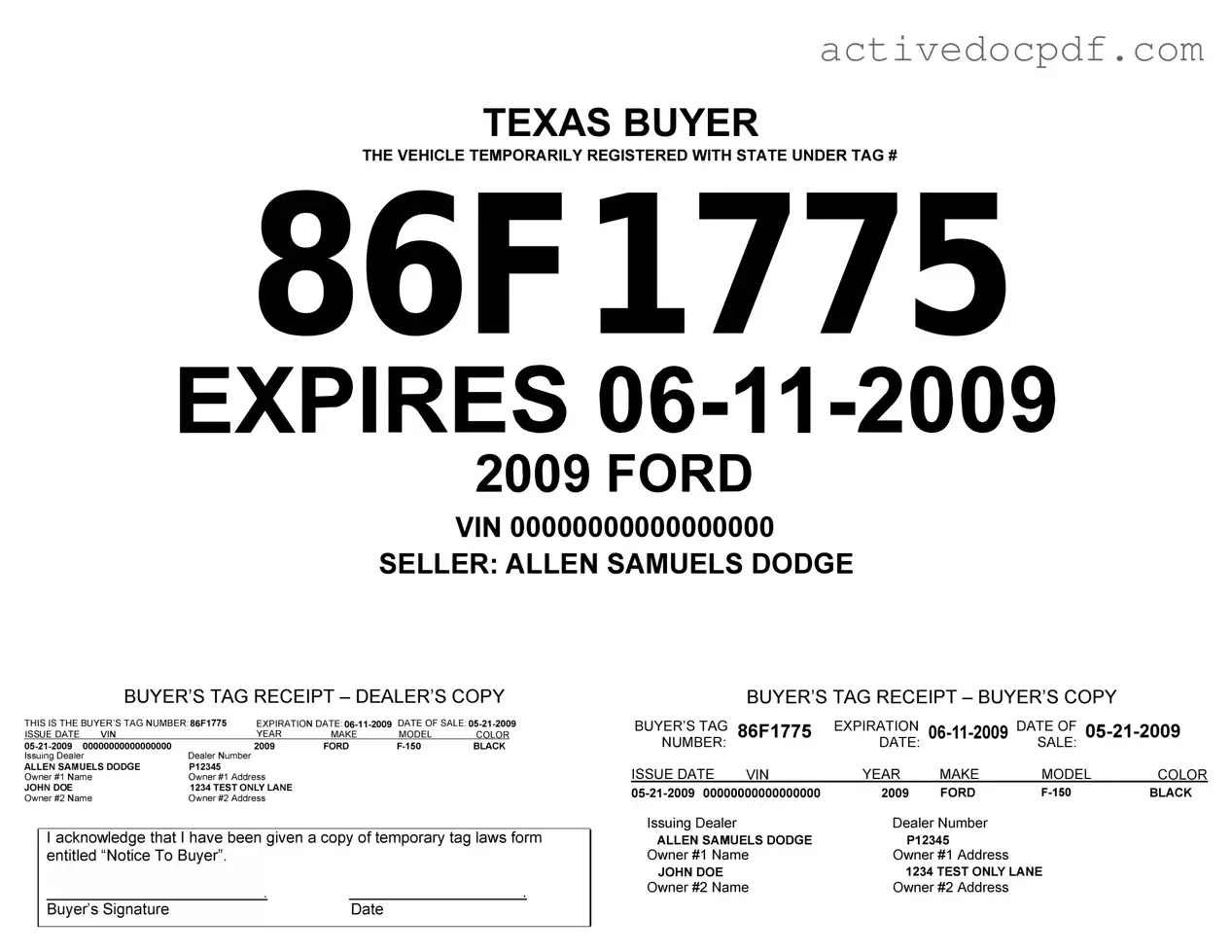

Free Texas Temporary Tag PDF Form

Misconceptions

Understanding the Texas Temporary Tag form can be confusing. Here are six common misconceptions that people often have:

-

Temporary tags are only for new vehicles.

This is not true. Temporary tags can be issued for both new and used vehicles. They allow for legal operation while the permanent registration is processed.

-

You can use a temporary tag indefinitely.

Temporary tags are valid for a limited time, typically 30 days. They are meant to provide a short-term solution while you complete the registration process.

-

Only dealerships can issue temporary tags.

Individuals can also obtain temporary tags. You can apply through the Texas Department of Motor Vehicles if you meet the necessary requirements.

-

There is no fee for temporary tags.

Fees are often associated with issuing temporary tags. Check with your local DMV for the exact amount, as it can vary.

-

Temporary tags are not valid for out-of-state travel.

This is a misconception. Temporary tags are valid for travel across state lines, but it's wise to check the regulations of the destination state.

-

Once you get a temporary tag, you don’t need to worry about registration.

While temporary tags allow you to drive legally, you still need to complete the registration process to obtain your permanent tags. Don't delay in handling this.

Documents used along the form

The Texas Temporary Tag form is an essential document for vehicle registration in Texas. It allows drivers to operate a vehicle legally while waiting for permanent registration. Along with this form, several other documents are often required or recommended to ensure compliance with state regulations. Below is a list of commonly used forms and documents associated with the Texas Temporary Tag form.

- Application for Texas Title and/or Registration (Form 130-U): This form is used to apply for a title and registration for a vehicle. It provides necessary information about the vehicle and the owner.

- Room Rental Agreement: To ensure a smooth rental experience, it is advisable to have a Room Rental Agreement in place, which can be found at https://nyforms.com/room-rental-agreement-template/.

- Proof of Insurance: A document that verifies the vehicle is insured in accordance with Texas state law. It is required for registration and must be presented during the process.

- Vehicle Inspection Report: This report confirms that the vehicle has passed a safety inspection. It is necessary for registration and must be current.

- Bill of Sale: This document serves as proof of purchase when buying a vehicle. It includes details about the buyer, seller, and vehicle, and may be required for registration.

- Identification Documents: A valid form of identification, such as a driver’s license or state ID, is required to verify the identity of the person registering the vehicle.

- Application for a Temporary Tag: This form may be used in conjunction with the Texas Temporary Tag form to request an extension or additional temporary tags under certain circumstances.

Gathering these documents can streamline the registration process and help avoid delays. Ensure that all forms are filled out accurately and completely to facilitate a smooth transaction.

Check out Popular Documents

Dispute Documents Netspend Email - Incomplete forms may prolong the dispute process.

What Is a General Background Check - Sign and date the form to authorize the release of your information for verification.

If you are looking to ensure a hassle-free transfer of ownership, consider using the Washington Trailer Bill of Sale form, an integral document for this process. To start, you can easily access the necessary template for your needs by visiting this helpful trailer bill of sale document.

Contract for Leased Owner Operators - Owner Operators are encouraged to understand the agreement thoroughly before signing, to ensure compliance with all facets of the contract.

Key Details about Texas Temporary Tag

What is a Texas Temporary Tag?

A Texas Temporary Tag is a short-term vehicle registration issued by the Texas Department of Motor Vehicles (TxDMV). It allows drivers to legally operate a vehicle while waiting for permanent registration and license plates. These tags are typically valid for 30 days.

Who can apply for a Temporary Tag?

Anyone who has purchased a vehicle and needs to drive it before receiving permanent registration can apply for a Temporary Tag. This includes individuals buying from dealerships or private sellers.

How do I obtain a Temporary Tag?

To obtain a Temporary Tag, follow these steps:

- Visit a local county tax office or a TxDMV regional service center.

- Provide proof of vehicle ownership, such as a bill of sale or title.

- Complete the Temporary Tag application form.

- Pay the required fee, which varies by county.

What information do I need to provide?

You will need to provide the following information:

- Your name and address.

- Vehicle identification number (VIN).

- Make, model, and year of the vehicle.

- Proof of insurance.

How much does a Temporary Tag cost?

The cost of a Temporary Tag can vary by county. Typically, the fee ranges from $5 to $25. It is advisable to check with your local county tax office for the exact amount.

How long is a Temporary Tag valid?

A Temporary Tag is valid for 30 days from the date of issuance. If you need more time, you may need to apply for an extension or obtain permanent registration.

Can I use a Temporary Tag on any vehicle?

No, a Temporary Tag is specific to the vehicle for which it was issued. It cannot be transferred to another vehicle. If you purchase a different vehicle, you must apply for a new Temporary Tag.

What should I do if my Temporary Tag expires?

If your Temporary Tag expires, you must refrain from driving the vehicle until you obtain permanent registration or a new Temporary Tag. To avoid penalties, apply for a new Temporary Tag or complete the registration process before the expiration date.

Where can I find more information about Temporary Tags?

For more information, visit the Texas Department of Motor Vehicles website or contact your local county tax office. They can provide specific details and answer any questions you may have.

Similar forms

Vehicle Registration Certificate: Like the Texas Temporary Tag form, this document serves as proof that a vehicle is registered with the state. It includes details such as the vehicle identification number (VIN), owner information, and registration dates.

-

The Lease Agreement is crucial in establishing a clear understanding between landlords and tenants, ensuring both parties are aware of their rights and obligations. For those interested in creating this document, visit PDF Documents Hub to find the necessary forms and resources.

Title Certificate: This document establishes ownership of a vehicle, similar to the temporary tag's role in permitting legal operation. Both documents contain crucial information about the vehicle and its owner.

Bill of Sale: A bill of sale functions as a receipt for the purchase of a vehicle. It provides evidence of the transaction, akin to how the temporary tag allows the vehicle to be driven legally while waiting for permanent registration.

Insurance Card: This document shows that a vehicle is insured, which is a requirement for driving legally. While the temporary tag allows for temporary operation, the insurance card ensures that the vehicle is covered in case of an accident.

Inspection Report: An inspection report verifies that a vehicle meets safety and emissions standards. Similar to the temporary tag, it is essential for ensuring that the vehicle is roadworthy and compliant with state regulations.

Guide to Filling Out Texas Temporary Tag

Filling out the Texas Temporary Tag form is a straightforward process that requires specific information about the vehicle and the owner. Ensure you have all necessary documents ready before starting. Follow the steps below to complete the form accurately.

- Begin with the vehicle information section. Enter the Vehicle Identification Number (VIN) clearly.

- Provide the make, model, and year of the vehicle. This information can usually be found on the vehicle's title or registration documents.

- Fill in the owner's details. Include the full name, address, and contact number of the vehicle owner.

- Indicate the reason for needing a temporary tag. Be specific about the circumstances, such as waiting for a title transfer or pending registration.

- Sign and date the form at the designated area. Ensure that the signature matches the name provided.

- Review the completed form for any errors or missing information. Accuracy is crucial to avoid delays.

- Submit the form along with any required fees to the appropriate Texas Department of Motor Vehicles office.