Legal Tractor Bill of Sale Document for Texas State

Misconceptions

The Texas Tractor Bill of Sale form is a crucial document for anyone involved in buying or selling tractors in Texas. However, several misconceptions surround this form. Understanding these misconceptions can help ensure a smoother transaction process.

-

It is not necessary to use a Bill of Sale for tractors.

Many people believe that a Bill of Sale is optional for tractor transactions. In reality, it provides essential proof of ownership and can protect both the buyer and seller in case of disputes.

-

Only licensed dealers can use the Bill of Sale.

This is incorrect. Both private individuals and licensed dealers can utilize the Texas Tractor Bill of Sale form to document their transactions legally.

-

The form must be notarized to be valid.

While notarization adds an extra layer of security, it is not a requirement for the Bill of Sale to be legally binding in Texas.

-

All sales require a specific format for the Bill of Sale.

While the form should include certain information, it does not have to follow a rigid format. As long as it contains the necessary details, it is valid.

-

Only new tractors need a Bill of Sale.

This misconception overlooks the fact that used tractors also require documentation. A Bill of Sale is vital for any transfer of ownership, regardless of the tractor's age.

-

Once the Bill of Sale is signed, the transaction is complete.

Signing the Bill of Sale is just one step. The buyer should also ensure that the tractor is properly registered and any necessary taxes are paid.

-

The Bill of Sale does not need to include the tractor's VIN.

Including the Vehicle Identification Number (VIN) is important for clarity and helps avoid any confusion about the specific tractor being sold.

-

All states have the same requirements for a Bill of Sale.

Each state has its own laws regarding Bills of Sale. Texas has specific requirements that may differ from those in other states, making it essential to understand local regulations.

-

A Bill of Sale is only for the buyer's benefit.

This is a common misunderstanding. The Bill of Sale protects both parties by providing a written record of the transaction, which can be useful in case of future disputes.

By dispelling these misconceptions, individuals can approach tractor transactions in Texas with greater confidence and knowledge. Always ensure that the necessary documentation is completed accurately to facilitate a smooth transfer of ownership.

Documents used along the form

When buying or selling a tractor in Texas, it's important to have the right documents in place. In addition to the Texas Tractor Bill of Sale, several other forms and documents can help ensure a smooth transaction. Here’s a list of some commonly used documents.

- Texas Title Application: This form is needed to apply for a new title after the sale. It provides essential information about the tractor and the new owner.

- Vehicle Identification Number (VIN) Inspection: This inspection verifies the tractor's VIN. It helps confirm that the vehicle matches the title and is not stolen.

- Affidavit of Motor Vehicle Gift Transfer: If the tractor is given as a gift, this form can help clarify the transfer of ownership without a sale price.

- Sales Tax Exemption Certificate: If applicable, this document can exempt the buyer from paying sales tax on the transaction.

- Bill of Sale for Equipment: Sometimes, a separate bill of sale for equipment is used to outline the specifics of the tractor's condition and any included attachments.

- IRS W-9 Form: This form is essential for providing your Taxpayer Identification Number (TIN) to the other party involved in the transaction. For more information on how to fill out the form, visit PDF Documents Hub.

- Power of Attorney: This document allows someone to act on behalf of the seller or buyer in the transaction, which can be useful if one party cannot be present.

- Insurance Documentation: Proof of insurance is often required to register the tractor and can protect the buyer from liability after the sale.

Having these documents ready can make the buying or selling process much easier. Always ensure that all forms are filled out correctly and kept in a safe place for future reference.

Other State-specific Tractor Bill of Sale Forms

Florida Bill of Sale Requirements - Makes future sales easier by maintaining a solid record.

To complete the sale process effectively, it is important for both parties to understand the necessary documentation involved. After agreeing on the terms of the sale, you can print and complete the form, ensuring all details about the horse and transaction are accurately recorded, thereby facilitating a smooth transfer of ownership.

Does a Tractor Have a Title - Includes signatures to validate the sale agreement.

Key Details about Texas Tractor Bill of Sale

What is a Texas Tractor Bill of Sale?

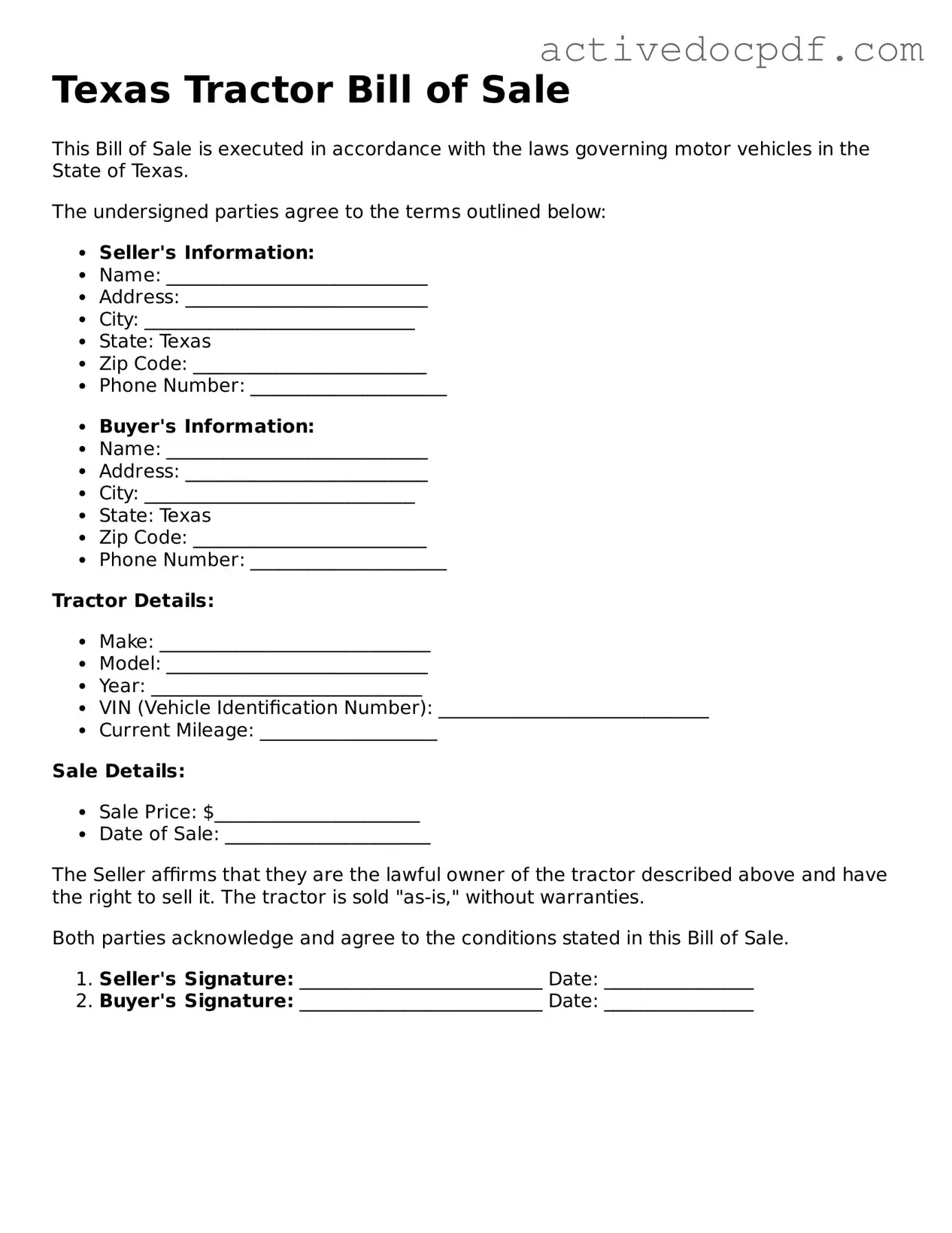

A Texas Tractor Bill of Sale is a legal document that records the sale and transfer of ownership of a tractor from one party to another. This form serves as proof of the transaction and includes important details about the tractor, the buyer, and the seller.

Why do I need a Bill of Sale for a tractor?

Having a Bill of Sale is essential for several reasons:

- It provides legal proof of the transaction.

- It helps establish the new owner’s claim to the tractor.

- It can be useful for tax purposes.

- It protects both the buyer and seller by documenting the terms of the sale.

What information is required on the Bill of Sale?

A Texas Tractor Bill of Sale should include the following information:

- The names and addresses of both the buyer and seller.

- The date of the sale.

- A detailed description of the tractor, including make, model, year, and Vehicle Identification Number (VIN).

- The sale price.

- Any warranties or guarantees, if applicable.

Is the Bill of Sale required to register the tractor?

Yes, a Bill of Sale is typically required when registering a tractor in Texas. It provides the necessary documentation to prove ownership and is often needed by the Texas Department of Motor Vehicles (DMV) or local tax office.

Can I create my own Bill of Sale?

Yes, you can create your own Bill of Sale as long as it includes all the necessary information. However, using a template specifically designed for Texas can help ensure that you don’t miss any important details.

Do I need to have the Bill of Sale notarized?

While notarization is not required for a Texas Tractor Bill of Sale, it is often recommended. Having the document notarized can add an extra layer of security and authenticity, which may be beneficial in case of any disputes.

What if I lose the Bill of Sale?

If you lose the Bill of Sale, it can be challenging to prove ownership. It is advisable to keep a copy in a safe place. If necessary, you may be able to create a new Bill of Sale with the original parties involved, or you could seek legal assistance to establish ownership.

Can I use a Bill of Sale for a tractor that I received as a gift?

Yes, you can use a Bill of Sale for a tractor received as a gift. In this case, the document should clearly state that the transfer is a gift, and it should still include all relevant details about the tractor and the parties involved.

Similar forms

- Vehicle Bill of Sale: This document serves a similar purpose by transferring ownership of a vehicle from one party to another. It includes details like the vehicle's make, model, year, and identification number, along with the buyer and seller's information.

- Boat Bill of Sale: Like the Tractor Bill of Sale, this form is used to document the sale of a boat. It captures essential details such as the boat's specifications, registration number, and the parties involved in the transaction.

- Motorcycle Bill of Sale: This document facilitates the transfer of ownership for motorcycles. It outlines the bike's make, model, year, and Vehicle Identification Number (VIN), ensuring that both parties have a record of the transaction.

- CDC U.S. Standard Certificate of Live Birth: This essential document ensures the accurate recording of a child's birth details in the United States, which is crucial for obtaining vital documents; for more information, visit documentonline.org.

- RV Bill of Sale: Similar to the Tractor Bill of Sale, this form is used for recreational vehicles. It details the RV's specifications and includes buyer and seller information, making it a crucial document for ownership transfer.

- Equipment Bill of Sale: This document is utilized for the sale of various types of equipment, including construction or agricultural machinery. It includes specifics about the equipment and the parties involved, ensuring a clear record of the transaction.

- General Bill of Sale: This versatile document can be used for any type of personal property transfer. It captures the essential details of the sale, including a description of the item, the sale price, and the parties' information.

Guide to Filling Out Texas Tractor Bill of Sale

Completing the Texas Tractor Bill of Sale form is a straightforward process that requires attention to detail. Once filled out, this document serves as a legal record of the sale and transfer of ownership of a tractor. It is important to ensure all information is accurate to avoid potential disputes in the future.

- Obtain the Form: Start by downloading or obtaining a physical copy of the Texas Tractor Bill of Sale form.

- Seller Information: Fill in the seller's name, address, and contact information. Ensure that this information is current and accurate.

- Buyer Information: Enter the buyer's name, address, and contact details. Like the seller's information, this must be precise.

- Tractor Details: Provide specific details about the tractor being sold. This includes the make, model, year, and Vehicle Identification Number (VIN).

- Sale Price: Indicate the agreed-upon sale price for the tractor. Be clear and specific about the amount.

- Date of Sale: Write the date on which the sale is taking place. This is important for record-keeping.

- Signatures: Both the seller and buyer must sign the form. This signifies agreement to the terms outlined in the document.

- Witness or Notary (if required): Depending on local regulations, a witness or notary public may need to sign the form to validate the transaction.

After completing the form, both parties should retain a copy for their records. It is advisable to keep this document in a safe place, as it may be required for future reference, such as when registering the tractor or for tax purposes.