Legal Transfer-on-Death Deed Document for Texas State

Misconceptions

The Texas Transfer-on-Death Deed (TODD) is a tool that allows property owners to transfer real estate to beneficiaries upon their death without going through probate. However, several misconceptions exist regarding this form. Below are seven common misconceptions along with clarifications.

- The Transfer-on-Death Deed is the same as a will. This is incorrect. A TODD specifically transfers real estate and operates independently of a will, which covers all assets.

- Using a TODD avoids all taxes. While a TODD can help avoid probate, it does not exempt the property from estate taxes or property taxes that may still apply.

- A TODD can be revoked only in specific circumstances. This is misleading. A property owner can revoke or change a TODD at any time before their death, as long as they follow the proper procedures.

- The beneficiaries automatically take possession of the property upon the owner’s death. Not necessarily. Beneficiaries must still file the TODD with the county clerk to establish their ownership.

- A TODD is only useful for single individuals. This is not true. Married couples can also use a TODD to transfer property to their heirs.

- All types of property can be transferred using a TODD. This is incorrect. A TODD can only be used for real estate and does not apply to personal property or financial accounts.

- The form does not require any witnesses or notarization. This is false. A TODD must be signed in the presence of a notary public and can also require witnesses, depending on the situation.

Understanding these misconceptions can help property owners make informed decisions about their estate planning options in Texas.

Documents used along the form

When utilizing a Texas Transfer-on-Death Deed, several other forms and documents may also be necessary to ensure a smooth transfer of property upon death. These documents help clarify intentions, establish legal authority, and facilitate the probate process if needed. Below is a list of commonly associated forms and documents.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can complement a Transfer-on-Death Deed by addressing any assets not covered by the deed.

- Affidavit of Heirship: This form may be used to establish the heirs of a deceased person when there is no will. It helps clarify ownership of property that may not have a designated beneficiary.

- Durable Power of Attorney: To ensure you have the right representation, consider utilizing the necessary guidance on Durable Power of Attorney options for decision-making needs.

- Power of Attorney: This document grants someone the authority to act on another person's behalf in legal and financial matters. It can be useful for managing property before the transfer occurs.

- Property Deed: This is the legal document that outlines ownership of the property. It is essential to have a clear deed to ensure the Transfer-on-Death Deed is valid and enforceable.

- Notice of Transfer on Death Deed: This document serves to notify interested parties that a Transfer-on-Death Deed has been executed. It can help prevent disputes among potential heirs.

- Probate Documents: If the property transfer is contested or if there are complications, various probate documents may be required to navigate the legal process and validate the transfer.

Having these documents prepared and organized can significantly streamline the transfer process and help avoid potential legal issues. It is advisable to consult with a legal professional to ensure all necessary forms are correctly completed and filed.

Other State-specific Transfer-on-Death Deed Forms

Where Can I Get a Tod Form - Beneficiaries do not gain any rights to the property until the owner's death, ensuring the owner's control during their lifetime.

In understanding the importance of protecting oneself from potential risks, utilizing a Hold Harmless Agreement is essential for ensuring that both parties clearly delineate their responsibilities. This legal instrument mitigates ambiguity in various transactions where liabilities may arise. If you are looking to safeguard your interests effectively, you can conveniently fill out the necessary documentation by visiting texasformspdf.com/fillable-hold-harmless-agreement-online/.

Key Details about Texas Transfer-on-Death Deed

What is a Texas Transfer-on-Death Deed?

A Texas Transfer-on-Death Deed (TODD) allows a property owner to transfer their real estate to a designated beneficiary upon their death. This deed does not take effect until the owner passes away, meaning the owner retains full control of the property during their lifetime.

How does a Transfer-on-Death Deed work?

When the property owner dies, the designated beneficiary can claim the property without going through probate. The TODD must be properly executed and recorded with the county clerk’s office where the property is located. This ensures that the transfer is legally recognized.

Who can be named as a beneficiary?

Any individual or entity can be named as a beneficiary in a TODD. This includes family members, friends, or even organizations. However, it’s important to ensure that the beneficiary is someone you trust to manage the property after your passing.

Are there any requirements for creating a Transfer-on-Death Deed?

Yes, there are specific requirements to create a valid TODD in Texas:

- The deed must be in writing.

- The property owner must sign the deed.

- The deed must clearly identify the property and the beneficiary.

- The deed must be recorded in the county where the property is located.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a TODD at any time while you are alive. To do this, you will need to create a new deed that either names a different beneficiary or explicitly revokes the previous deed. It is essential to record the new deed to ensure it is legally effective.

What happens if the beneficiary dies before me?

If the beneficiary named in your TODD passes away before you do, the transfer will not occur. You may want to consider naming an alternate beneficiary in your deed to avoid complications. This ensures that your property will still be transferred according to your wishes.

Is a Transfer-on-Death Deed the right choice for me?

A Transfer-on-Death Deed can be a good option for many property owners, especially if you want to avoid probate and ensure a smooth transfer of property to your loved ones. However, it’s wise to consult with a legal professional to discuss your specific situation and determine if this option aligns with your estate planning goals.

Similar forms

- Will: A will outlines how a person's assets will be distributed after their death. Like a Transfer-on-Death Deed, it allows for the transfer of property but requires probate.

- Mobile Home Bill of Sale: This document is crucial for the transfer of ownership of a mobile home, akin to the transfer mechanisms outlined in a TOD Deed, and can be obtained from PDF Documents Hub.

- Living Trust: A living trust holds a person's assets during their lifetime and specifies how they are to be distributed after death. This document avoids probate, similar to the Transfer-on-Death Deed.

- Beneficiary Designation: Commonly used for retirement accounts and insurance policies, this document allows individuals to name beneficiaries who will receive assets upon death, mirroring the intent of a Transfer-on-Death Deed.

- Joint Tenancy with Right of Survivorship: This form of property ownership allows co-owners to inherit the property directly upon the death of one owner, similar to the automatic transfer in a Transfer-on-Death Deed.

- Payable-on-Death (POD) Accounts: These bank accounts allow the account holder to name a beneficiary who will receive the funds upon the account holder's death, functioning similarly to a Transfer-on-Death Deed.

- Transfer-on-Death Registration: Used for securities, this registration allows for the transfer of ownership upon death without going through probate, akin to the Transfer-on-Death Deed.

- Life Estate Deed: This deed allows a person to retain the right to use property during their lifetime while designating a beneficiary to receive the property after their death, similar to the purpose of a Transfer-on-Death Deed.

- Revocable Trust: Like a living trust, a revocable trust can be altered during the grantor's lifetime and directs how assets are distributed upon death, paralleling the Transfer-on-Death Deed.

- Durable Power of Attorney: While primarily used for financial and medical decisions, this document can include provisions for asset distribution upon death, aligning with the intent of a Transfer-on-Death Deed.

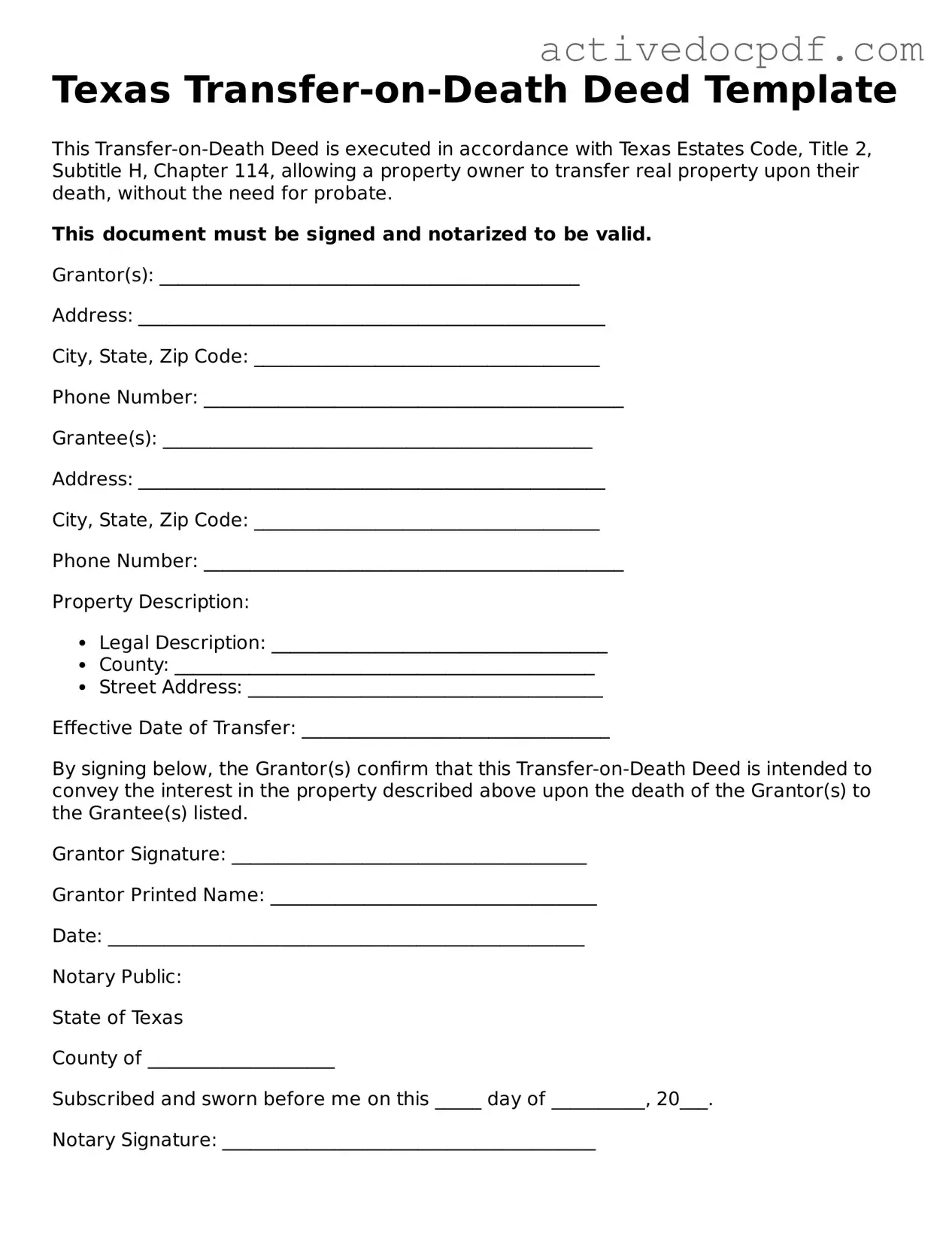

Guide to Filling Out Texas Transfer-on-Death Deed

Once you have the Texas Transfer-on-Death Deed form ready, it’s important to carefully fill it out to ensure that your wishes are clearly documented. This form allows you to designate a beneficiary who will receive your property upon your passing, without the need for probate. Follow these steps to complete the form accurately.

- Obtain the Form: Make sure you have the official Texas Transfer-on-Death Deed form. You can find it online or through a local legal office.

- Property Description: Clearly describe the property you wish to transfer. Include the address, legal description, and any relevant details that identify the property.

- Owner Information: Fill in your name as the current owner of the property. Provide your mailing address and any other required personal information.

- Beneficiary Information: Enter the name of the person or entity you want to inherit the property. Be specific and include their mailing address to avoid any confusion.

- Sign the Document: You must sign the form in the presence of a notary public. Ensure that your signature is clear and matches the name you provided as the owner.

- Notarization: The notary will confirm your identity and witness your signature. They will then complete their section of the form.

- Record the Deed: After notarization, take the completed form to the county clerk’s office where the property is located. Recording the deed ensures it is legally recognized.

Once you have followed these steps and submitted the deed for recording, it will become part of the public record. This means that your intentions regarding the property transfer will be clear and enforceable, providing peace of mind for you and your beneficiary.