Legal Transfer-on-Death Deed Template

State-specific Guides for Transfer-on-Death Deed Templates

Misconceptions

Understanding the Transfer-on-Death (TOD) deed is crucial for effective estate planning. Several misconceptions exist about this legal tool. Below are five common misunderstandings, along with clarifications.

- Misconception 1: A Transfer-on-Death deed avoids probate entirely.

- Misconception 2: The property is immediately transferred to the beneficiary upon signing the deed.

- Misconception 3: A Transfer-on-Death deed can only be used for real estate.

- Misconception 4: Beneficiaries can make decisions about the property before the owner's death.

- Misconception 5: A Transfer-on-Death deed is the same as a will.

While a TOD deed allows for the direct transfer of property upon death, it does not eliminate the probate process for other assets. Only the property specified in the TOD deed bypasses probate.

The transfer only occurs after the property owner passes away. Until that time, the owner retains full control over the property.

While primarily used for real estate, the concept of transfer-on-death can apply to other types of assets, such as bank accounts or securities, depending on state laws.

Beneficiaries have no rights to the property until the owner passes away. The owner can sell, mortgage, or change the deed at any time.

Although both documents deal with asset distribution after death, a TOD deed is specifically for transferring property directly, while a will encompasses a broader range of assets and may require probate.

Documents used along the form

When considering a Transfer-on-Death (TOD) deed, it's important to understand that several other documents often accompany it. These forms help clarify intentions, establish ownership, and ensure a smooth transition of assets upon the owner's passing. Below is a list of common documents that may be used alongside a TOD deed.

- Last Will and Testament: This document outlines how a person's assets should be distributed after their death. It can complement a TOD deed by addressing any assets not covered by the deed.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how they should be distributed after death. It can provide additional control over assets and help avoid probate.

- Beneficiary Designation Forms: These forms specify who will receive certain assets, such as life insurance policies or retirement accounts, upon the owner's death. They work alongside the TOD deed to ensure all assets are accounted for.

- Power of Attorney: This document grants someone the authority to act on behalf of another person in legal or financial matters. It can be important for managing assets during the owner's lifetime, especially if they become incapacitated.

- Property Deed: This legal document provides proof of ownership for real estate. It may be necessary to reference or update the property deed when creating a TOD deed to ensure clarity in ownership transfer.

- Last Will and Testament: This document outlines how a person's assets will be distributed after their death. It can include instructions for care of minor children and specify who will manage the estate, and you can find more details for the form.

- Affidavit of Heirship: This sworn statement establishes the identity of heirs and their relationship to the deceased. It can be useful in clarifying ownership and distribution of assets when no will exists.

Understanding these documents can help ensure that your wishes are honored and that your assets are distributed according to your preferences. By being informed, you can make the process smoother for your loved ones during a challenging time.

More Types of Transfer-on-Death Deed Templates:

Iowa Quit Claim Deed Requirements - This document allows one party to relinquish any interest in a property to another party.

When preparing for a vehicle transaction, it's essential to have a clear understanding of the necessary documentation, including the Vehicle Bill of Sale, which formalizes the sale and protects both the buyer and seller by detailing important vehicle information and terms of the sale.

Corrective Deed California - This form can streamline real estate transactions by ensuring accurate documentation.

Deed in Lieu of Foreclosure Meaning - Understanding the Deed in Lieu mechanics can help homeowners make informed decisions.

Key Details about Transfer-on-Death Deed

What is a Transfer-on-Death Deed?

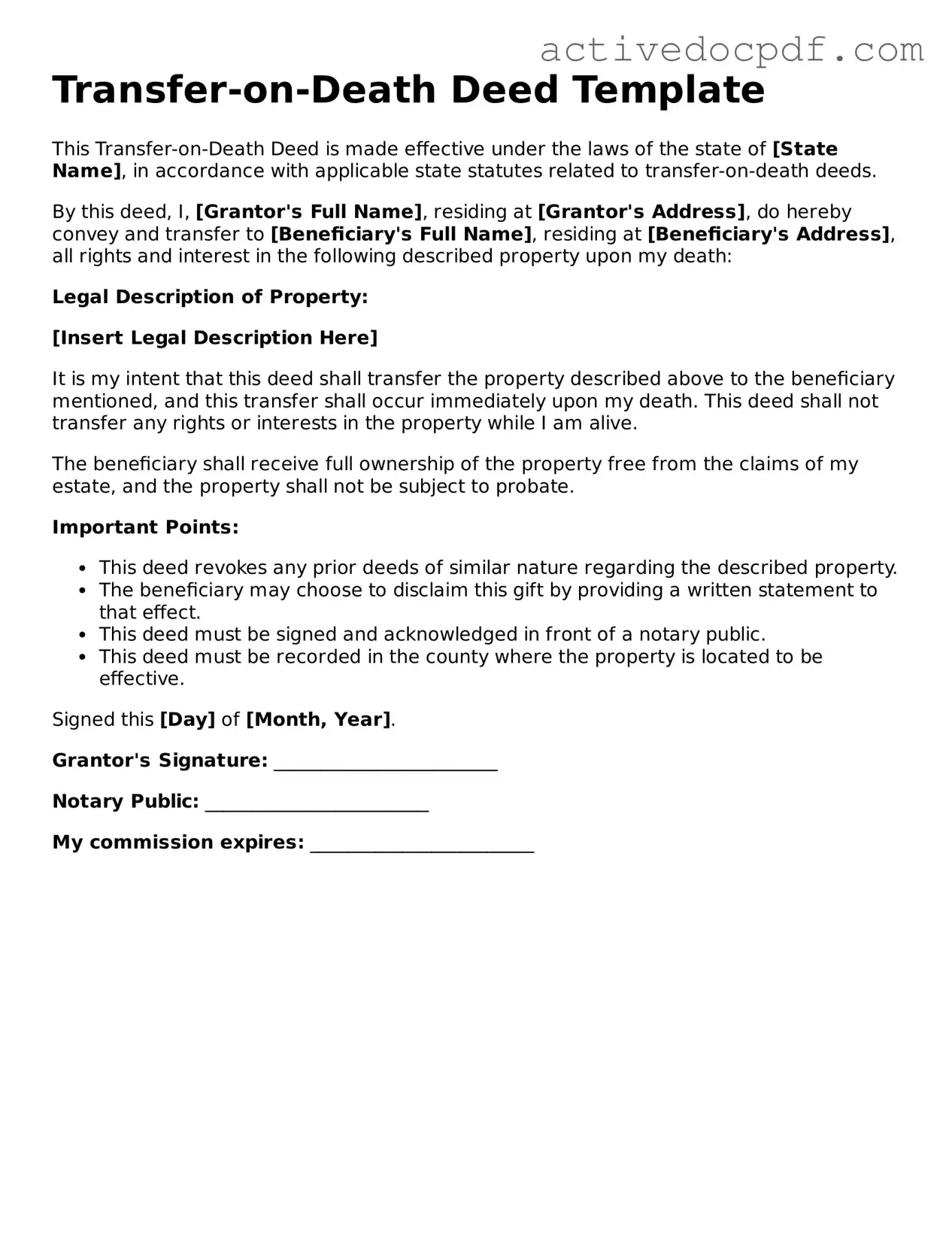

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows a property owner to transfer real estate to a beneficiary upon their death. This deed does not take effect until the owner's death, allowing the owner to retain full control of the property during their lifetime.

How does a Transfer-on-Death Deed work?

When the property owner passes away, the designated beneficiary automatically receives ownership of the property without the need for probate. The process generally involves the following steps:

- The property owner completes the TOD Deed form, naming the beneficiary.

- The deed is signed and notarized.

- The deed is recorded with the appropriate local government office.

Who can be named as a beneficiary in a Transfer-on-Death Deed?

Any individual or entity can be named as a beneficiary in a TOD Deed. This includes family members, friends, or organizations. However, it is important to ensure that the beneficiary is capable of inheriting the property under state law.

Are there any limitations to using a Transfer-on-Death Deed?

Yes, there are limitations to consider:

- The TOD Deed can only be used for real estate, not personal property.

- Some states may have specific rules regarding the use of TOD Deeds.

- If the property is subject to a mortgage, the beneficiary may need to address the mortgage obligations after the owner's death.

Can a Transfer-on-Death Deed be revoked or changed?

Yes, a Transfer-on-Death Deed can be revoked or changed by the property owner at any time before their death. This can be done by executing a new deed or a revocation form, which must also be recorded with the local government office.

What are the tax implications of a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner. However, beneficiaries may be responsible for property taxes after the owner's death. It is advisable to consult a tax professional for specific guidance regarding potential tax liabilities.

Is legal assistance recommended when creating a Transfer-on-Death Deed?

While it is possible to create a Transfer-on-Death Deed without legal assistance, consulting an attorney is recommended. Legal professionals can provide valuable insights, ensure compliance with state laws, and help avoid potential issues that may arise in the future.

Similar forms

- Will: A will specifies how a person's assets should be distributed after their death. Like a Transfer-on-Death Deed, it allows individuals to decide who receives their property, but it requires probate, while a Transfer-on-Death Deed does not.

- Living Trust: A living trust holds assets during a person's lifetime and specifies how those assets are managed and distributed after death. Both documents avoid probate, but a living trust can provide more comprehensive management of assets during life.

- Beneficiary Designation: This document allows individuals to name beneficiaries for certain assets, such as life insurance policies or retirement accounts. Similar to a Transfer-on-Death Deed, it directly transfers assets to beneficiaries without going through probate.

- Payable-on-Death Account: This type of bank account allows the account holder to name a beneficiary who will receive the funds upon their death. Like a Transfer-on-Death Deed, it bypasses probate and provides a straightforward transfer of assets.

- Emotional Support Animal Letter: The https://documentonline.org/ is a crucial document for individuals seeking the companionship of an emotional support animal, as it validates their need and can ease various processes like housing and travel arrangements.

- Joint Tenancy with Right of Survivorship: This ownership arrangement allows two or more people to own property together. When one owner dies, the property automatically transfers to the surviving owner, similar to how a Transfer-on-Death Deed operates.

Guide to Filling Out Transfer-on-Death Deed

After you have gathered all necessary information, you are ready to fill out the Transfer-on-Death Deed form. This document will allow you to designate a beneficiary for your property upon your passing. Ensure that you have all relevant details at hand, as accuracy is crucial for the validity of the deed.

- Begin by entering your full name in the designated space at the top of the form.

- Provide your current address, including city, state, and zip code.

- Identify the property you wish to transfer. Include the legal description, which can typically be found on your property tax statement or deed.

- Clearly state the name of the beneficiary you are designating to receive the property. Make sure to include their full name and current address.

- If you are naming multiple beneficiaries, list them all, ensuring each has their full name and address included.

- Indicate whether the transfer is to be made in equal shares or specify the percentage each beneficiary will receive.

- Sign the form in the presence of a notary public. This step is essential for the deed to be legally binding.

- Have the notary public sign and stamp the document, confirming their acknowledgment of your signature.

- Make copies of the signed and notarized deed for your records and for each beneficiary.

- Finally, file the original deed with the appropriate local government office, usually the county recorder's office, to ensure it is officially recorded.