Legal Vehicle Repayment Agreement Template

Misconceptions

There are several misconceptions about the Vehicle Repayment Agreement form. Understanding these can help avoid confusion and ensure proper use of the document. Here’s a list of some common misunderstandings:

- It is only for car loans. Many believe this form is exclusive to car loans. In reality, it can apply to various types of vehicle financing.

- It guarantees loan approval. Some think filling out the form guarantees that a loan will be approved. Approval depends on other factors, such as credit history.

- It replaces the original loan agreement. Many assume this form takes the place of the original loan agreement. However, it serves as an additional document outlining repayment terms.

- Only one party needs to sign. Some people think only the borrower needs to sign the form. Both parties involved in the agreement must sign for it to be valid.

- It is a legally binding contract. There is a belief that this form is automatically a legally binding contract. It becomes binding only when all parties agree to the terms.

- It is not necessary if payments are on time. Some believe that if payments are made on time, the form is unnecessary. However, it is essential for documenting repayment terms regardless of payment status.

- It can be altered after signing. Many think they can change the terms after signing the form. Once signed, any changes require a new agreement.

- It is only needed for new loans. Some individuals think this form is only necessary for new loans. In fact, it can be used for refinancing or restructuring existing loans as well.

Clarifying these misconceptions can help ensure that individuals use the Vehicle Repayment Agreement form correctly and understand its purpose.

Documents used along the form

When entering into a Vehicle Repayment Agreement, several other forms and documents may be necessary to ensure a smooth transaction and protect all parties involved. Here is a list of commonly used documents that complement the Vehicle Repayment Agreement.

- Bill of Sale: This document serves as proof of the sale of the vehicle. It outlines the details of the transaction, including the purchase price, vehicle identification number (VIN), and the names of the buyer and seller.

- Title Transfer Form: Required to legally transfer ownership of the vehicle from the seller to the buyer. This form must be completed and submitted to the appropriate state agency to update the vehicle’s title.

- Loan Agreement: If financing is involved, this document outlines the terms of the loan, including the interest rate, repayment schedule, and any collateral agreements related to the vehicle.

- Credit Application: This form collects personal and financial information from the borrower to assess creditworthiness. It is often required by lenders before approving a loan for the vehicle.

- Insurance Verification: Proof of insurance is typically required before finalizing the sale. This document confirms that the buyer has obtained the necessary insurance coverage for the vehicle.

- Odometer Disclosure Statement: This statement verifies the vehicle's mileage at the time of sale. It is important for both parties to ensure transparency regarding the vehicle's condition and value.

- Child Support Texas Form: This official document outlines the obligations of the individual ordered to pay child support and is essential for ensuring children's financial needs are met. For a straightforward guide on how to fill out the form, visit https://texasformspdf.com/fillable-child-support-texas-online.

- Power of Attorney: In some cases, a seller may grant a trusted individual the authority to sign documents on their behalf. This form is essential when the seller cannot be present during the transaction.

Having these documents prepared and organized can facilitate a smoother transaction. Ensure that all parties review and understand each document to avoid potential disputes in the future.

Fill out More Forms

Temporary Lease Agreement - Clarifies whether the property can be sublet or assigned.

This general bill of sale template for various transactions can significantly simplify the transfer process by providing clear guidelines and ensuring all necessary information is documented accurately.

Sample Letter of Intent to Purchase Property - This form expresses the terms and conditions the buyer would like to negotiate.

Key Details about Vehicle Repayment Agreement

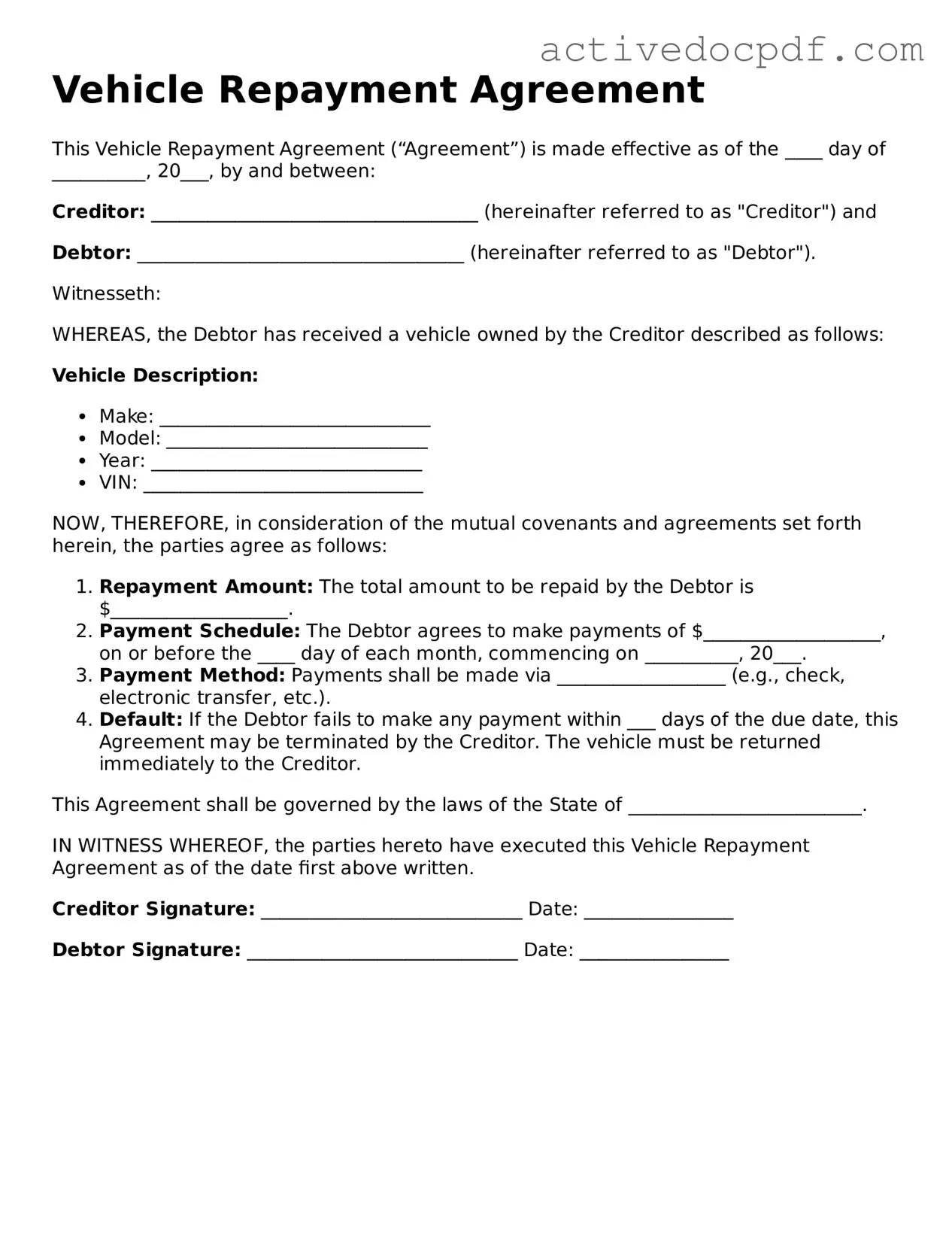

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a legal document that outlines the terms under which a borrower agrees to repay a loan secured by a vehicle. It specifies the repayment schedule, interest rates, and consequences of default. This form is crucial for both lenders and borrowers to ensure clarity and mutual understanding regarding the financial obligation.

Who needs to complete the Vehicle Repayment Agreement form?

Both parties involved in the loan transaction need to complete the form. This includes the borrower, who is receiving the loan, and the lender, who is providing the funds. Completing the form is essential to formalize the agreement and protect the interests of both parties.

What information is required on the form?

The Vehicle Repayment Agreement form typically requires the following information:

- Borrower's full name and contact details

- Lender's full name and contact details

- Details of the vehicle, including make, model, and VIN

- Total loan amount

- Interest rate and repayment terms

- Payment schedule, including due dates

- Consequences of defaulting on the loan

How is the repayment schedule structured?

The repayment schedule is usually structured to specify regular payment intervals, such as weekly, bi-weekly, or monthly. Each payment will typically include both principal and interest. The form should clearly outline the due dates for each payment and the total number of payments required to fully repay the loan.

What happens if a borrower defaults on the agreement?

If a borrower defaults, the lender has the right to take specific actions as outlined in the agreement. This may include:

- Charging late fees

- Repossessing the vehicle

- Reporting the default to credit bureaus

It is crucial for borrowers to understand these consequences before signing the agreement.

Can the terms of the Vehicle Repayment Agreement be modified?

Yes, the terms of the Vehicle Repayment Agreement can be modified, but this requires mutual consent from both the borrower and the lender. Any changes should be documented in writing and signed by both parties to ensure enforceability.

Is legal advice recommended before signing the form?

Yes, it is advisable to seek legal advice before signing the Vehicle Repayment Agreement. Understanding the terms and implications of the agreement can prevent future disputes and ensure that both parties are aware of their rights and responsibilities.

Similar forms

-

Loan Agreement: This document outlines the terms of a loan, including the amount borrowed, interest rates, and repayment schedule. Like the Vehicle Repayment Agreement, it establishes the obligations of both the borrower and lender.

-

Lease Agreement: A lease agreement details the terms under which one party rents property from another. Similar to the Vehicle Repayment Agreement, it specifies payment terms and conditions for use of the vehicle.

-

Boat Bill of Sale: The PDF Documents Hub provides a streamlined process for completing the necessary documentation for transferring ownership of a boat, ensuring both parties fulfill their legal obligations.

-

Promissory Note: This is a written promise to pay a specified amount of money to a designated party. It shares similarities with the Vehicle Repayment Agreement in that it outlines repayment terms and conditions.

-

Security Agreement: A security agreement creates a legal claim over collateral to secure a loan. It is akin to the Vehicle Repayment Agreement as it may involve the vehicle itself as collateral for the repayment of the loan.

-

Installment Sale Agreement: This document outlines the terms under which a buyer agrees to pay for a vehicle in installments. Like the Vehicle Repayment Agreement, it details payment schedules and the consequences of default.

Guide to Filling Out Vehicle Repayment Agreement

Once you have the Vehicle Repayment Agreement form in front of you, it's time to fill it out carefully. Follow these steps to ensure all necessary information is included and accurate. Completing this form correctly will help you move forward smoothly with your repayment process.

- Start by entering your personal information at the top of the form. This includes your full name, address, and contact details.

- Next, provide the details of the vehicle. Include the make, model, year, and Vehicle Identification Number (VIN).

- In the section for repayment terms, specify the total amount owed and the payment schedule. Clearly outline how much you will pay and when.

- Fill in any additional terms or conditions that apply to your repayment agreement. Be specific to avoid confusion later.

- Sign and date the form at the bottom. Ensure your signature matches the name you provided at the top.

- If required, have a witness or co-signer sign the form as well. Make sure they also include the date of their signature.

After completing the form, review it for any errors or missing information. Once everything is correct, you can submit it as instructed.